Solana Engagements Set to Surpass Bitcoin Engagements: A Game-Changer in the Crypto Space

In the ever-evolving landscape of cryptocurrency, recent developments indicate a significant shift in engagement metrics between two leading platforms: Solana and Bitcoin. An eye-catching tweet from Solana Sensei has sparked conversations in the crypto community, highlighting that Solana’s engagements are poised to outpace those of Bitcoin. This announcement has drawn attention due to Bitcoin’s historical dominance and the rising prominence of Solana as a formidable player in the market.

Understanding Engagement Metrics in Cryptocurrency

Engagement metrics are vital indicators of a cryptocurrency’s popularity and user interaction. These metrics include social media engagement, transaction volume, active user counts, and developer activity. As the crypto space becomes increasingly competitive, understanding these metrics can provide insight into which platforms are gaining traction and why.

The Rise of Solana

Solana has emerged as a significant contender in the cryptocurrency market, known for its high-speed transactions and low fees. Since its inception, Solana has positioned itself as a blockchain solution for scalability, aiming to provide a platform for decentralized applications (dApps) and non-fungible tokens (NFTs). With an impressive transaction throughput, Solana’s network can handle thousands of transactions per second, making it an attractive choice for developers and users alike.

Bitcoin’s Historical Context

Bitcoin, the first and most well-known cryptocurrency, has long held the title of the dominant player in the market. Its engagement metrics have traditionally been the benchmark against which other cryptocurrencies are measured. However, as the market matures and diversifies, newer platforms like Solana are beginning to challenge Bitcoin’s supremacy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Surpassing Engagements

If Solana’s engagements do indeed surpass those of Bitcoin, the implications could be far-reaching. This shift might indicate a broader acceptance of alternative cryptocurrencies, particularly those that offer enhanced scalability and lower transaction costs. Investors, developers, and users may begin to pivot towards Solana, leading to increased investment, innovation, and community growth.

Factors Contributing to Solana’s Rising Engagement

Several factors are contributing to Solana’s surge in engagement:

- Scalability and Speed: Solana’s architecture allows for rapid transaction processing, making it suitable for high-demand applications like gaming and decentralized finance (DeFi).

- Developer Ecosystem: The growing developer community around Solana is creating a plethora of dApps and projects, further boosting its visibility and user engagement.

- Lower Fees: Compared to Bitcoin, transaction fees on Solana are significantly lower, attracting users who are deterred by Bitcoin’s often high fees.

- NFT Marketplace: Solana has become a popular choice for NFT projects, which has spurred engagement among artists and collectors.

- Strong Marketing and Community Support: Solana has effectively utilized social media and community initiatives to build a robust and engaged user base.

The Future of Cryptocurrency Engagement

As Solana continues to rise in popularity, the cryptocurrency landscape may witness a shift in user preferences and investments. The potential for Solana to surpass Bitcoin in engagements could signify a new era where multiple cryptocurrencies coexist and compete on various fronts, including technological innovation, user experience, and community engagement.

Conclusion

The announcement regarding Solana’s potential to flip Bitcoin’s engagements is a noteworthy development in the cryptocurrency sector. It reflects the growing diversification of the market and highlights the capabilities of newer blockchain technologies. As the crypto community watches closely, the outcome of this engagement battle could shape the future of cryptocurrency interactions and influence investment strategies moving forward.

The implications of Solana potentially surpassing Bitcoin in engagements are profound, signaling a shift in how users and investors view the cryptocurrency landscape. As we continue to monitor these developments, it is clear that innovation and adaptability will be crucial for all players in this dynamic market. The competition between Solana and Bitcoin exemplifies the evolving nature of cryptocurrency and the importance of engagement metrics in understanding market trends. As the landscape continues to change, the rise of Solana could redefine user expectations and interactions in the ever-expanding world of digital currencies.

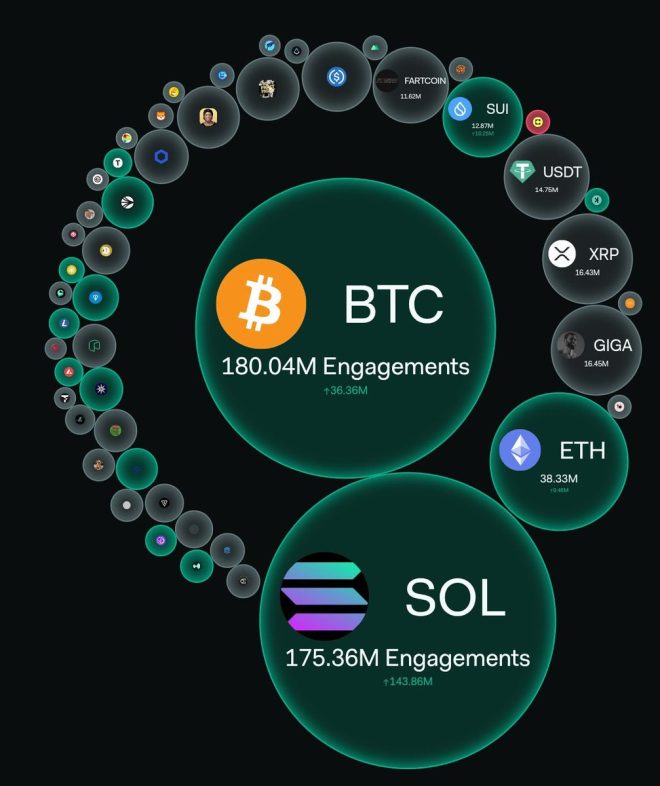

BREAKING: Solana engagements are about to flip Bitcoin engagements pic.twitter.com/jhKRZU7CQn

— Solana Sensei (@SolanaSensei) May 23, 2025

BREAKING: Solana engagements are about to flip Bitcoin engagements

In the rapidly evolving world of cryptocurrencies, the buzz around Solana (SOL) has reached a fever pitch. A recent tweet from Solana Sensei has sent shockwaves through the community, announcing that Solana engagements are on the verge of surpassing Bitcoin engagements. This news has stirred up excitement and speculation about what it means for both Solana and Bitcoin in the ever-competitive crypto landscape.

The Rise of Solana

Solana has made significant strides since its inception in 2020. With its high throughput and low transaction fees, it has attracted a growing number of developers and projects. Unlike Bitcoin, which primarily serves as a store of value, Solana’s robust blockchain supports a variety of decentralized applications (dApps), making it a versatile platform for developers and users alike. Its ability to handle thousands of transactions per second has positioned it as a strong contender among blockchain platforms.

When we talk about engagements in the crypto space, we’re referring to the interactions and activities that users have with a particular blockchain or token. This can include everything from trading volume to social media interactions and developer activity. Solana’s recent popularity surge suggests that it is capturing the attention of not just investors, but also developers and everyday users who are looking for alternatives to Ethereum and Bitcoin.

What Does It Mean for Bitcoin?

Bitcoin has long held the crown as the king of cryptocurrencies, dominating market capitalization and engagement levels. However, as new technologies emerge and the landscape shifts, even Bitcoin is not immune to competition. The potential flipping of engagements by Solana signifies a shift in user interest and may suggest that Bitcoin is facing challenges in maintaining its dominance.

For Bitcoin enthusiasts, this news could be alarming. However, it’s essential to realize that Bitcoin’s value proposition as a digital gold still holds strong. Its established network and brand recognition give it a resilience that newer projects may not yet possess. The rise of Solana highlights the dynamic nature of the crypto market, where even the most established players must adapt to new trends and technologies.

The Impact of Engagement Metrics

Engagement metrics are crucial in understanding the health and viability of a cryptocurrency. When Solana engagements are said to be flipping Bitcoin engagements, it indicates a growing community and a more active user base. This shift can lead to increased investment and development, further solidifying Solana’s position in the market.

As more developers flock to Solana to build their projects, the ecosystem becomes richer and more diverse. This can create a positive feedback loop: increased usage leads to more visibility, attracting even more users and developers. In contrast, if Bitcoin’s engagement begins to dwindle, it could slow down its own ecosystem’s growth and innovation.

Solana’s Unique Features

To understand why Solana is gaining traction, we need to look at its unique features. Solana’s proof-of-history (PoH) consensus mechanism allows for high-speed transactions and scalability. This is a game-changer for decentralized finance (DeFi) applications, where speed and efficiency are paramount. Moreover, Solana’s low transaction costs make it feasible for users to engage in microtransactions, something that Bitcoin struggles with due to its higher fees.

Additionally, Solana has been gaining traction in the NFT space. The low fees and fast transaction times make it an attractive option for artists and creators looking to mint and sell their digital art. As the NFT market continues to grow, Solana’s ability to cater to this demand could further enhance its engagement metrics.

Community and Ecosystem Growth

One of the most compelling aspects of Solana’s rise is its community. The enthusiasm and support from its users have been vital in propelling its growth. Social media platforms, especially Twitter, have become hotbeds for discussions, updates, and collaborations within the Solana community. The recent tweet from Solana Sensei is just one example of how community engagement is driving interest and investment.

Moreover, Solana’s ecosystem is expanding rapidly, with numerous projects launching on its platform. From DeFi protocols to NFT marketplaces, the variety of applications being developed on Solana is attracting more users. This diversification not only stimulates engagement but also creates a more robust and resilient ecosystem.

Challenges Ahead

Despite its rapid growth, Solana faces several challenges. Scalability concerns still linger, especially as more users join the platform. Network outages have occurred in the past, raising questions about its reliability. For Solana to truly flip Bitcoin engagements, it needs to demonstrate that it can handle increased demand without compromising performance.

Moreover, as Solana gains popularity, it will likely attract the attention of regulators. The crypto space is still navigating a complex regulatory landscape, and any changes could impact Solana’s operations and user engagement. Staying ahead of regulatory challenges will be crucial for Solana as it aims to solidify its position in the market.

The Future of Solana and Bitcoin

The competition between Solana and Bitcoin is indicative of a broader trend in the cryptocurrency market. As new technologies emerge, the landscape will continue to evolve, and user preferences will shift. The idea that Solana engagements could flip Bitcoin engagements is a testament to the innovation happening in the space.

Bitcoin will always hold a significant place in the crypto ecosystem, but it must remain vigilant and adaptable. Meanwhile, Solana’s rise is a promising signal for the future of blockchain technology, showcasing the potential for innovation and community-driven growth.

Final Thoughts

As the crypto world watches closely, the developments surrounding Solana and Bitcoin will be pivotal in shaping the future of this space. Whether you are a Bitcoin maximalist or a Solana supporter, one thing is clear: the competition is heating up, and the landscape is more exciting than ever. Engaging with these platforms, whether through trading, development, or community participation, will be crucial as we navigate this dynamic environment.

For those looking to stay informed, keeping an eye on social media channels and community discussions will be essential. The rapid pace of change means that the next big development could be just around the corner.

BREAKING: Solana engagements are about to flip Bitcoin engagements