Breaking news: Cetus DEX Hacked with $11 Million Loss

In a shocking incident that has rattled the cryptocurrency community, Cetus, the leading decentralized exchange (DEX) and main liquidity provider for the SUI blockchain, has reportedly been hacked. The breach resulted in an estimated loss of approximately $11 million, primarily drained from the SUI/USDC liquidity pool. This alarming event has sent shockwaves through the crypto market, particularly affecting investors and traders involved with the SUI token and its associated liquidity pools.

Details of the Hack

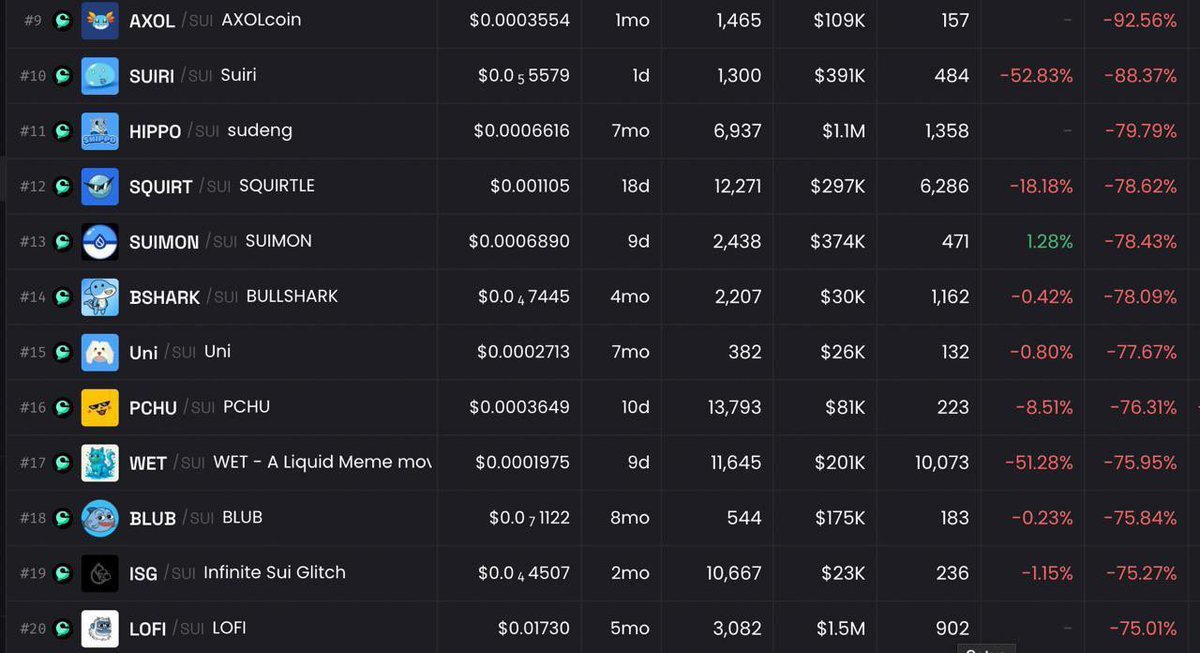

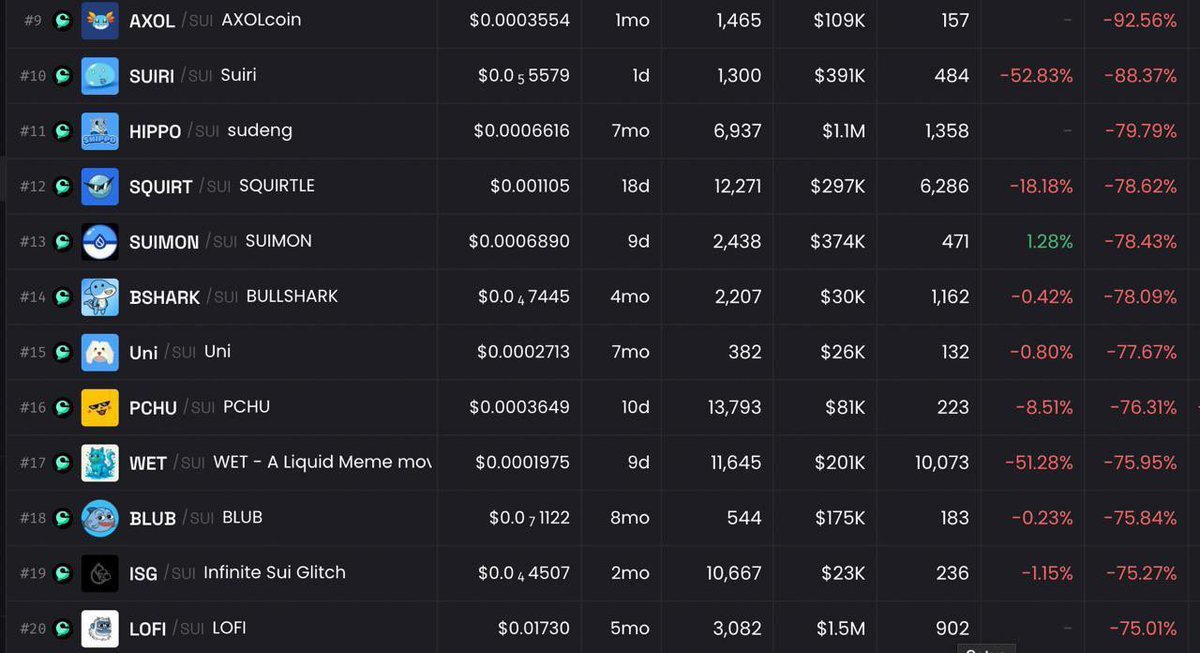

According to reports from Cointelegraph, a respected source in crypto news, the hacking incident occurred on May 22, 2025. The attackers specifically targeted the SUI/USDC liquidity pool, draining a significant amount of funds and causing a dramatic decline in the value of various tokens. Many of these tokens plummeted by over 75%, leaving investors and users in a state of panic as liquidity pools were compromised and emptied.

The implications of this hack extend beyond just financial losses for Cetus; they raise serious concerns about the security measures implemented at decentralized exchanges. The SUI token had been gaining traction as a promising asset within the decentralized finance (DeFi) space, and this breach raises questions about the platform’s security protocols and its ability to protect user investments.

Impact on the SUI Ecosystem

The immediate ramifications of the hack are evident in the drastic price drops of the affected tokens. Investors who had previously placed their trust in the Cetus DEX and the SUI token are now facing significant losses. With compromised liquidity pools, traders are left questioning whether they will ever recover their investments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This incident could lead to a loss of faith in the SUI platform and decentralized exchanges overall. Security is a paramount concern for cryptocurrency users, and breaches of this nature highlight vulnerabilities that can undermine confidence in the entire ecosystem. The fallout from this hack may discourage new investors from entering the SUI space, which could have long-term effects on the platform’s growth and development.

Community Response

In the aftermath of the Cetus hack, the cryptocurrency community has reacted swiftly. Social media platforms, particularly Twitter, have become hotbeds of discussion, with traders expressing their concerns and frustrations. The community is calling for enhanced security protocols for decentralized exchanges to prevent similar incidents in the future.

This incident has sparked a broader conversation about the inherent risks associated with investing in DeFi platforms. While these platforms offer unique opportunities for yield farming and trading, they also come with increased security risks. The community is urging developers and platform operators to prioritize security in their operations to protect users’ investments.

Security Measures to Consider

As the dust settles on this unfortunate incident, it’s crucial for both investors and decentralized exchange operators to consider the importance of robust security measures. Here are some strategies that can help mitigate risks:

- Regular Security Audits: DEX operators should conduct frequent security audits on their platforms to identify vulnerabilities and address them proactively.

- Insurance Protocols: Implementing insurance mechanisms can help protect users’ funds against unforeseen hacks and breaches.

- User Education: Educating users about safe practices and the risks associated with DeFi investments can empower them to make informed decisions.

- Multi-Signature Wallets: Utilizing multi-signature wallets can add an extra layer of security, requiring multiple approvals for transactions and withdrawals.

- Real-Time Monitoring: Employing real-time monitoring tools can help detect unusual activities on the platform, allowing for swift action to be taken in case of potential threats.

The Future of Cetus and SUI

Looking forward, the future of Cetus and the SUI token will depend on how effectively the platform can recover from this incident. Transparency will be key; the Cetus team must communicate openly with its users about the steps being taken to rectify the situation and enhance security measures.

For the SUI blockchain, this incident may serve as a crucial learning experience. As the DeFi landscape continues to evolve, the importance of security cannot be overstated. The hacking incident could lead to an industry-wide reassessment of security protocols and best practices, ultimately fostering a more secure environment for all users.

Conclusion

The hacking of Cetus, a primary DEX for the SUI blockchain, serves as a stark reminder of the vulnerabilities that exist within the DeFi space. With $11 million drained from the SUI/USDC liquidity pool and significant price drops across the board, the implications of this event are far-reaching.

As the community grapples with the fallout, there is an urgent need for enhanced security measures across decentralized exchanges. This incident not only highlights the risks associated with DeFi investments but also underscores the importance of community vigilance, education, and proactive measures to protect user funds.

Investors and operators alike must learn from this experience to foster a more secure and resilient cryptocurrency ecosystem. The journey ahead will undoubtedly be challenging, but through collaboration and innovation, the DeFi space can emerge stronger and more secure in the wake of this crisis.

Final Thoughts

The hack of Cetus, the main LP provider DEX on $SUI, has sent shockwaves through the crypto community. With $11 million drained from the SUI/USDC pool and most tokens suffering major losses, the implications are significant. As the community navigates the aftermath, it is clear that security must be a top priority moving forward. The lessons learned from this incident will be crucial for the future of the SUI ecosystem and the broader DeFi landscape.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied.

—————–

Breaking News: Cetus DEX Hacked with $11 Million Loss

In a shocking development for the cryptocurrency community, Cetus, a leading decentralized exchange (DEX) and the main liquidity provider for the SUI blockchain, was reportedly hacked, resulting in a staggering loss of approximately $11 million. This incident has sent shockwaves throughout the crypto market, especially among investors and traders involved with the SUI token and its associated liquidity pools.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Details of the Hack

According to a tweet from Cointelegraph, a reputable source in the crypto news sector, the hack occurred on May 22, 2025. The assailants targeted the SUI/USDC liquidity pool, draining a significant amount of funds. The aftermath has seen a dramatic decline in the value of most tokens, with many plummeting by over 75% as liquidity pools were emptied.

The implications of this hack are profound, not just for Cetus but for the broader SUI ecosystem. The SUI token has been gaining traction as a promising asset in the decentralized finance (DeFi) space, and this breach raises questions about the security measures in place at decentralized exchanges.

Impact on the SUI Ecosystem

The immediate impact of the hack is evident in the drastic price drops of affected tokens. Investors who had placed their trust in the Cetus DEX and the SUI token are now facing significant losses. With the liquidity pools compromised, many traders are left wondering if they can recover their investments.

The incident could lead to a loss of faith in the SUI platform and decentralized exchanges in general. Security is a paramount concern for cryptocurrency users, and breaches like these highlight vulnerabilities that can undermine confidence in the entire ecosystem.

Community Response

In the wake of this event, the cryptocurrency community has reacted swiftly. Discussions are rife on social media platforms, with traders expressing their concerns and frustrations. Many are calling for enhanced security protocols for decentralized exchanges to prevent such incidents in the future.

Moreover, this incident has sparked a broader conversation about the inherent risks of investing in DeFi platforms. While these platforms offer unique opportunities for yield farming and trading, they also come with increased security risks. The community is urging developers and platform operators to prioritize security in their operations.

Security Measures to Consider

As the dust settles on this unfortunate incident, it’s crucial for both investors and decentralized exchange operators to consider the importance of robust security measures. Here are some strategies that can help mitigate risks:

- Regular Security Audits: DEX operators should conduct regular security audits on their platforms to identify vulnerabilities and address them proactively.

- Insurance Protocols: Implementing insurance mechanisms can help protect users’ funds against unforeseen hacks and breaches.

- User Education: Educating users about safe practices and the risks associated with DeFi investments can empower them to make informed decisions.

- Multi-Signature Wallets: Utilizing multi-signature wallets can add an extra layer of security, requiring multiple approvals for transactions and withdrawals.

- Real-Time Monitoring: Employing real-time monitoring tools can help detect unusual activities on the platform, allowing for swift action to be taken in case of potential threats.

The Future of Cetus and SUI

Moving forward, the future of Cetus and the SUI token may hinge on how effectively the platform can recover from this incident. Transparency will be key; the Cetus team must communicate openly with its users about the steps being taken to rectify the situation and enhance security.

For the SUI blockchain, this incident may serve as a crucial learning experience. As the DeFi landscape continues to evolve, the importance of security cannot be overstated. The incident could lead to an industry-wide reassessment of security protocols and best practices.

Conclusion

The hacking of Cetus, a primary DEX for the SUI blockchain, serves as a stark reminder of the vulnerabilities that exist within the DeFi space. With $11 million drained from the SUI/USDC liquidity pool and significant price drops across the board, the implications of this event are far-reaching.

As the community grapples with the fallout, there is an urgent need for enhanced security measures across decentralized exchanges. This incident not only highlights the risks associated with DeFi investments but also underscores the importance of community vigilance, education, and proactive measures to protect user funds.

Investors and operators alike must learn from this experience to foster a more secure and resilient cryptocurrency ecosystem. The journey ahead will undoubtedly be challenging, but through collaboration and innovation, the DeFi space can emerge stronger and more secure in the wake of this crisis.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied. pic.twitter.com/sWKwsZGjaM

— Cointelegraph (@Cointelegraph) May 22, 2025

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

In the ever-evolving world of decentralized finance (DeFi), news travels fast. Recently, a major incident shook the community: Cetus, the primary liquidity provider decentralized exchange (DEX) on the $SUI network, has allegedly been hacked. This shocking turn of events has sent ripples through the crypto market, particularly affecting the price and availability of tokens associated with the SUI ecosystem.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied.

The details of the hack are still emerging, but reports indicate that approximately $11 million in $SUI tokens have been drained from the SUI/USDC liquidity pool. This significant loss has triggered a domino effect, leading to a massive downturn in the value of many tokens within the ecosystem. Some tokens have plummeted by over 75%, leaving investors and users in shock as they watch their assets lose value right before their eyes.

The implications of this hack extend beyond just financial losses. For many users who have invested in the SUI ecosystem, this incident raises questions about the security measures in place at platforms like Cetus. In a space that prides itself on decentralization and security, such breaches can shake trust and confidence, which are paramount for any blockchain-based project.

The Impact on the SUI Ecosystem

As the news spreads, the SUI ecosystem is facing a critical moment. The hack has not only drained funds but has also led to a sense of uncertainty among users and investors. Many are left wondering if it’s safe to continue using DEXs like Cetus or if they should withdraw their funds and look for alternatives. The liquidity pools that were once bustling with activity are now in a state of chaos, and users are feeling the repercussions.

Moreover, the market’s reaction has been swift. With the value of SUI tokens dropping drastically, many investors are experiencing significant losses. This situation is a stark reminder of the volatility that comes with investing in cryptocurrency and DeFi. The rise and fall of tokens can happen in the blink of an eye, and incidents like this are a sobering reminder of the risks involved.

Security Measures in DeFi: What Went Wrong?

One of the most pressing questions following the Cetus hack is: what went wrong? How could a platform that is supposed to provide security for users’ funds fall victim to such a significant breach? While the full details of the hack are still being investigated, several factors could contribute to vulnerabilities in DeFi platforms.

Firstly, the rapid pace of innovation in DeFi means that security measures can sometimes lag behind the advancements in technology. Developers are constantly creating new protocols and features, but if security is not prioritized, it can leave the door open for malicious actors. Regular audits and rigorous testing are essential to identify and mitigate potential vulnerabilities.

Additionally, the decentralized nature of many DeFi platforms can create challenges in accountability. Unlike traditional financial institutions, which have centralized oversight and regulations, DEXs often operate in a less regulated environment. This can make it difficult to trace the origins of hacks or hold individuals accountable for their actions.

Community Response and Recovery Efforts

In the wake of the hack, the community’s response has been crucial. Many users are turning to social media platforms like Twitter to voice their concerns and share updates about the situation. It’s a reminder of how interconnected the crypto community is, as individuals come together to support one another during times of crisis.

Recovery efforts are also underway. Developers and security teams are working tirelessly to investigate the breach and assess the damage. Communication from the Cetus team will be vital during this time, as transparency can help rebuild trust within the community. Users need to know what steps are being taken to secure the platform and prevent similar incidents in the future.

Lessons Learned from the Incident

Every crisis presents an opportunity for growth and improvement. The Cetus hack serves as a critical lesson for the entire DeFi space. It highlights the importance of prioritizing security and implementing robust safeguards to protect users’ funds. As the industry continues to grow, developers and projects must take proactive measures to ensure that their platforms are secure and resilient.

Moreover, this incident underscores the need for users to remain vigilant. While DeFi offers exciting opportunities for investment and innovation, it also comes with inherent risks. Users should take the time to research platforms thoroughly, understand the risks involved, and consider diversifying their investments to mitigate potential losses.

The Future of Cetus and the SUI Ecosystem

Looking ahead, the future of Cetus and the SUI ecosystem will depend on how effectively they can navigate this crisis. The community’s response and the team’s commitment to transparency and security will play a significant role in rebuilding trust. If handled well, this situation could ultimately lead to a stronger and more secure platform.

Investors will be watching closely to see how the situation unfolds. If Cetus can demonstrate its resilience and implement effective security measures, it may emerge from this crisis even stronger. However, if the response is lacking, it could lead to long-lasting damage to the platform’s reputation and user base.

Final Thoughts

The hack of Cetus, the main LP provider DEX on $SUI, is a significant event that has sent shockwaves through the crypto community. With $11 million drained from the SUI/USDC pool and most tokens suffering major losses, the implications are far-reaching. As the community grapples with the fallout, it’s clear that security in DeFi must be a top priority. The lessons learned from this incident will be crucial for the future of the SUI ecosystem and the broader DeFi landscape.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied.

—————–

Breaking News: Cetus DEX Hacked with $11 Million Loss

In a recent incident that has sent shockwaves through the cryptocurrency community, Cetus, a prominent decentralized exchange (DEX) and the primary liquidity provider for the SUI blockchain, has reportedly been hacked. This security breach resulted in an enormous loss of approximately $11 million, significantly impacting traders and investors involved with the SUI token and its associated liquidity pools.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experiences from Healthcare Workers

Details of the Hack

According to a [tweet from Cointelegraph](https://cointelegraph.com/news/cetus-hacked-11m-drained-from-sui-usdc-pool), the hack took place on May 22, 2025. The attackers specifically targeted the SUI/USDC liquidity pool, draining a significant sum of funds. The aftermath has seen a shocking decline in the value of many tokens, with some experiencing drops of over 75% as liquidity pools were emptied.

This breach raises serious concerns not just for Cetus, but for the larger SUI ecosystem. The SUI token was gaining traction as a promising asset within the decentralized finance (DeFi) space, and this incident puts a spotlight on the security measures— or lack thereof— at decentralized exchanges.

Impact on the SUI Ecosystem

The immediate effects of the hack are evident. Investors who put their faith in the Cetus DEX and the SUI token are facing significant losses. With liquidity pools compromised, many traders are left in limbo, questioning if and when they can recover their investments.

This incident may lead to a broader loss of confidence in the SUI platform and decentralized exchanges as a whole. Security is a top priority for cryptocurrency users, and breaches like these can undermine the trust that is essential for the entire ecosystem to thrive.

Community Response

In the wake of this event, the cryptocurrency community has responded quickly and vocally. Discussions are rampant on social media platforms, with traders sharing their concerns and frustrations. Many are advocating for stronger security protocols for decentralized exchanges to prevent such incidents in the future.

The hack has also ignited a larger conversation about the inherent risks of investing in DeFi platforms. While these platforms provide unique opportunities for yield farming and trading, they also come with heightened security risks. The community is urging developers and platform operators to prioritize security in their operations.

Security Measures to Consider

As the dust settles after this unfortunate incident, it’s essential for both investors and decentralized exchange operators to understand the importance of robust security measures. Here are some strategies that can help mitigate risks:

- Regular Security Audits: DEX operators should perform regular security audits to identify vulnerabilities and address them proactively.

- Insurance Protocols: Implementing insurance mechanisms can help protect users’ funds against unforeseen hacks and breaches.

- User Education: Educating users about safe practices and the risks associated with DeFi investments can empower them to make informed decisions.

- Multi-Signature Wallets: Utilizing multi-signature wallets can add an extra layer of security, requiring multiple approvals for transactions and withdrawals.

- Real-Time Monitoring: Employing real-time monitoring tools can help detect unusual activities on the platform, allowing for swift action to be taken in case of potential threats.

The Future of Cetus and SUI

Looking ahead, the future of Cetus and the SUI token may hinge on how effectively the platform can recover from this incident. Transparency will be key; the Cetus team must communicate openly with its users about the steps being taken to rectify the situation and enhance security.

For the SUI blockchain, this incident may act as a crucial learning experience. As the DeFi landscape evolves, the importance of security cannot be overstated. This incident could lead to an industry-wide reassessment of security protocols and best practices.

Conclusion

The hacking of Cetus, a primary DEX for the SUI blockchain, serves as a stark reminder of the vulnerabilities that exist within the DeFi space. With $11 million drained from the SUI/USDC liquidity pool and significant price drops across the board, the implications of this event are extensive.

As the community navigates the fallout, there is an urgent need for enhanced security measures across decentralized exchanges. This incident not only highlights the risks associated with DeFi investments but also emphasizes the importance of community vigilance, education, and proactive measures to safeguard user funds.

Investors and operators alike must learn from this experience to foster a more secure and resilient cryptocurrency ecosystem. The journey ahead may be challenging, but through collaboration and innovation, the DeFi space can emerge stronger and more secure in the wake of this crisis.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied. pic.twitter.com/sWKwsZGjaM

— Cointelegraph (@Cointelegraph) May 22, 2025

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

In the fast-paced world of decentralized finance (DeFi), news travels quickly. Recently, a significant incident shook the community: Cetus, the primary liquidity provider decentralized exchange (DEX) on the $SUI network, has allegedly been hacked. This shocking revelation has sent ripples through the crypto market, particularly impacting the price and availability of tokens associated with the SUI ecosystem.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied.

The details of the hack are still emerging, but reports indicate that approximately $11 million in $SUI tokens have been drained from the SUI/USDC liquidity pool. This significant loss has triggered a domino effect, leading to a massive downturn in the value of many tokens within the ecosystem. Some tokens have plummeted by over 75%, leaving investors and users in disbelief as they watch their assets lose value right before their eyes.

The implications of this hack extend beyond just financial losses. For many users who have invested in the SUI ecosystem, this incident raises serious questions about the security measures in place at platforms like Cetus. In a space that prides itself on decentralization and security, such breaches can shake trust and confidence, which are vital for any blockchain-based project.

The Impact on the SUI Ecosystem

As the news spreads, the SUI ecosystem is facing a critical moment. The hack has not only drained funds but has also led to a sense of uncertainty among users and investors. Many are left wondering if it’s safe to continue using DEXs like Cetus or if they should withdraw their funds and look for alternatives. The liquidity pools that were once bustling with activity are now in a state of chaos, and users are feeling the repercussions.

Moreover, the market’s reaction has been swift. With the value of SUI tokens dropping drastically, many investors are experiencing significant losses. This situation serves as a stark reminder of the volatility that comes with investing in cryptocurrency and DeFi. The rise and fall of tokens can happen in the blink of an eye, and incidents like this are a sobering reminder of the risks involved.

Security Measures in DeFi: What Went Wrong?

One of the most pressing questions following the Cetus hack is: what went wrong? How could a platform that is supposed to provide security for users’ funds fall victim to such a significant breach? While the full details of the hack are still being investigated, several factors could contribute to vulnerabilities in DeFi platforms.

Firstly, the rapid pace of innovation in DeFi means that security measures can sometimes lag behind the advancements in technology. Developers are constantly creating new protocols and features, but if security is not prioritized, it can leave the door open for malicious actors. Regular audits and rigorous testing are essential to identify and mitigate potential vulnerabilities.

Additionally, the decentralized nature of many DeFi platforms can create challenges in accountability. Unlike traditional financial institutions, which have centralized oversight and regulations, DEXs often operate in a less regulated environment. This can make it difficult to trace the origins of hacks or hold individuals accountable for their actions.

Community Response and Recovery Efforts

In the wake of the hack, the community’s response has been crucial. Many users are turning to social media platforms like Twitter to voice their concerns and share updates about the situation. It’s a reminder of how interconnected the crypto community is, as individuals come together to support one another during times of crisis.

Recovery efforts are also underway. Developers and security teams are working tirelessly to investigate the breach and assess the damage. Communication from the Cetus team will be vital during this time, as transparency can help rebuild trust within the community. Users need to know what steps are being taken to secure the platform and prevent similar incidents in the future.

Lessons Learned from the Incident

Every crisis presents an opportunity for growth and improvement. The Cetus hack serves as a critical lesson for the entire DeFi space. It highlights the importance of prioritizing security and implementing robust safeguards to protect users’ funds. As the industry continues to grow, developers and projects must take proactive measures to ensure that their platforms are secure and resilient.

Moreover, this incident underscores the need for users to remain vigilant. While DeFi offers exciting opportunities for investment and innovation, it also comes with inherent risks. Users should take the time to research platforms thoroughly, understand the risks involved, and consider diversifying their investments to mitigate potential losses.

The Future of Cetus and the SUI Ecosystem

Looking ahead, the future of Cetus and the SUI ecosystem will depend on how effectively they can navigate this crisis. The community’s response and the team’s commitment to transparency and security will play a significant role in rebuilding trust. If handled well, this situation could ultimately lead to a stronger and more secure platform.

Investors will be watching closely to see how the situation unfolds. If Cetus can demonstrate its resilience and implement effective security measures, it may emerge from this crisis even stronger. However, if the response is lacking, it could lead to long-lasting damage to the platform’s reputation and user base.

Final Thoughts

The hack of Cetus, the main LP provider DEX on $SUI, is a significant event that has sent shockwaves through the crypto community. With $11 million drained from the SUI/USDC pool and most tokens suffering major losses, the implications are far-reaching. As the community grapples with the fallout, it’s clear that security in DeFi must be a top priority. The lessons learned from this incident will be crucial for the future of the SUI ecosystem and the broader DeFi landscape.