Saylor’s Bold Move: $2.1 Billion Preferred Stock Offering

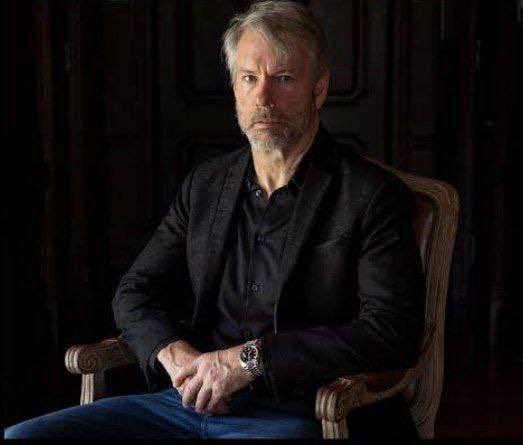

In a significant announcement that has captivated the financial community, Michael Saylor, the co-founder and executive chairman of MicroStrategy, revealed a plan to sell up to $2.1 billion in 10% preferred stock. This strategic decision aims to raise capital and further bolster his company’s position in the rapidly evolving cryptocurrency landscape.

Understanding Saylor’s Strategy

Michael Saylor’s approach to business has often been characterized by bold moves and innovative strategies. His latest plan to issue preferred stock at a 10% yield demonstrates a clear intent to attract investors looking for lucrative opportunities. Preferred stock, which offers dividends before common stock and usually comes with less volatility, is an attractive option for many investors.

By raising funds through this preferred stock offering, Saylor aims to enhance MicroStrategy’s financial flexibility, enabling the company to invest further in Bitcoin and other digital assets. This move aligns with Saylor’s long-term vision of positioning MicroStrategy as a leader in the cryptocurrency market.

The Implications for Investors

The decision to offer preferred stock can have several implications for investors:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Attractive Yield: The 10% yield on preferred stock is considerably higher than many traditional investment options, making it an appealing choice for income-seeking investors.

- Potential for Growth: With the raised capital, MicroStrategy is likely to pursue aggressive growth strategies, particularly in Bitcoin acquisition. This could potentially lead to significant appreciation in the company’s stock value.

- Risk Considerations: While preferred stocks are generally less risky than common stocks, they still carry inherent risks. Investors should consider the volatility of cryptocurrencies and the potential impact on MicroStrategy’s financial performance.

The Broader Impact on Cryptocurrency Market

Saylor’s bold move is not just about MicroStrategy; it has broader implications for the cryptocurrency market. By continuing to invest heavily in Bitcoin, Saylor reinforces the narrative that major corporations can successfully integrate cryptocurrencies into their business models. This could encourage other firms to follow suit, paving the way for further institutional adoption of digital assets.

Moreover, the significant capital raised from this preferred stock offering may lead to increased liquidity in the cryptocurrency markets. As large corporations like MicroStrategy continue to make substantial investments in Bitcoin, it may stabilize prices and enhance market confidence.

Saylor’s Ongoing Commitment to Bitcoin

Michael Saylor has been a vocal proponent of Bitcoin, advocating its potential as a store of value and a hedge against inflation. His commitment to Bitcoin is evident in MicroStrategy’s substantial holdings, which have often been highlighted as a key component of the company’s growth strategy. With this latest capital raising initiative, Saylor is signaling that his faith in Bitcoin remains unwavering.

Conclusion

Michael Saylor’s announcement of a $2.1 billion preferred stock offering at a 10% yield marks a bold and strategic move in the financial world. This initiative not only aims to strengthen MicroStrategy’s position in the cryptocurrency market but also highlights the growing acceptance of digital assets among institutional investors.

As Saylor continues to champion Bitcoin and its potential, this latest development could have far-reaching implications for both MicroStrategy and the broader cryptocurrency market. Investors and stakeholders alike will be watching closely as Saylor executes this strategy and navigates the ever-evolving landscape of digital finance.

In summary, Saylor’s decision to sell preferred stock is a clear indication of his commitment to driving MicroStrategy’s growth through innovative financial strategies. Investors should remain alert to the opportunities and risks associated with this move, as it could set a precedent for other companies looking to capitalize on the burgeoning cryptocurrency space.

BREAKING:

SAYLOR’D STRATEGY TO SELL UP TO

$2.1 BILLION OF 10% PREFERRED STOCK.SAYLOR ISN’T STOPPING !! pic.twitter.com/UZk7DalaYM

— Ash Crypto (@Ashcryptoreal) May 22, 2025

BREAKING:

In the fast-paced world of finance, news can hit like a bolt out of the blue. Recently, a significant announcement has made waves in the investment community: SAYLOR’S STRATEGY TO SELL UP TO $2.1 BILLION OF 10% PREFERRED STOCK. This bold move by a prominent figure in the crypto space has generated a lot of buzz, indicating that the game is far from over. The excitement is palpable, and it’s crucial to unpack what this means for investors, the market, and the future of cryptocurrency.

SAYLOR’S STRATEGY TO SELL UP TO $2.1 BILLION OF 10% PREFERRED STOCK

Michael Saylor, a name synonymous with Bitcoin advocacy, is once again making headlines. His strategy involves the sale of up to $2.1 billion in preferred stock, offering a 10% return. This kind of financial maneuvering is not for the faint of heart, and it highlights Saylor’s aggressive approach to expanding his financial empire. But what does this really mean for the market and investors?

Preferred stock is an attractive option for many investors. It typically offers a higher yield than common stock and comes with priority over common shares when it comes to dividends. By offering a 10% return, Saylor is positioning this stock as an appealing option for those looking to secure a reliable income stream. This move could potentially attract a significant amount of capital, which could further bolster Saylor’s ventures in the crypto space.

SAYLOR ISN’T STOPPING !!

The phrase “SAYLOR ISN’T STOPPING !!” resonates throughout the investment community. This declaration isn’t just a catchy tagline; it embodies Saylor’s relentless pursuit of growth and innovation. His willingness to take risks has made him a polarizing figure. Some hail him as a visionary, while others criticize his aggressive tactics. Regardless of where you stand, one thing is clear: Saylor is not backing down.

His determination to push boundaries is evident in his strategic decisions. With Bitcoin’s fluctuating prices and the ever-changing landscape of cryptocurrencies, Saylor’s approach is both bold and calculated. By leveraging preferred stock, he is not just looking to raise funds; he is also reinforcing his position in the market and asserting his influence.

The Implications of Selling Preferred Stock

When a company decides to sell preferred stock, it opens up a variety of implications for the business and its investors. For Saylor, the influx of capital can be used to fund new projects, invest in technology, or even stabilize his existing assets in a volatile market. This is particularly important in the crypto space, where innovation is key to success.

Moreover, selling preferred stock can also be a strategic move to avoid diluting existing shareholders’ equity. By issuing preferred shares, Saylor can raise funds without affecting the voting power of common shareholders. This could be seen as a win-win situation for both Saylor and his investors.

Understanding Preferred Stock

For those unfamiliar with the concept, preferred stock is a type of equity that typically offers fixed dividends. These dividends are paid out before any dividends on common stock are distributed. This means that if a company faces financial difficulties, preferred shareholders have a better chance of receiving their payouts. In this light, Saylor’s offer of 10% preferred stock could be very appealing, especially in the current economic climate.

Investors looking for steady income might find this offering particularly attractive. The fixed return can provide a sense of security, especially for those wary of the volatility associated with cryptocurrencies. Additionally, preferred shares often come with less risk than common shares, making them an appealing option for conservative investors.

The Role of Saylor in the Cryptocurrency Market

Michael Saylor has become a significant figure in the cryptocurrency market, largely due to his outspoken support of Bitcoin. His company, MicroStrategy, has made substantial investments in Bitcoin, solidifying its position as a leader in corporate crypto adoption. Saylor’s strategy of using preferred stock to fund further investments in cryptocurrency aligns with his vision of making Bitcoin a mainstream asset.

His approach has not only attracted attention but also sparked discussions about the future of cryptocurrencies and their role in the financial system. As traditional financial institutions begin to recognize the value of digital currencies, Saylor’s strategies may serve as a blueprint for others looking to navigate this new landscape.

What Does This Mean for Investors?

For investors, this announcement presents both opportunities and challenges. On one hand, the chance to invest in a high-yield preferred stock could be a lucrative opportunity. On the other hand, it also raises questions about the long-term stability of Saylor’s investments and the overall health of the cryptocurrency market.

Investors should conduct thorough research before diving into this offering. Understanding the risks associated with preferred stock, as well as the potential volatility of the cryptocurrency market, is essential. Saylor’s bold moves may inspire confidence, but the inherent risks in the crypto space cannot be overlooked.

The Future of Saylor and Cryptocurrency

As we look ahead, one thing is certain: Michael Saylor’s influence on the cryptocurrency market is likely to grow. His willingness to innovate and adapt to changing market conditions sets him apart from many traditional investors. The sale of preferred stock is just one of the many strategies he employs to secure his position and expand his influence.

The cryptocurrency landscape is evolving rapidly, and Saylor’s moves will undoubtedly shape its future. As more institutional investors enter the space, the strategies employed by pioneers like Saylor will be closely watched. Investors will be eager to see whether this latest venture pays off and how it could impact the broader market.

Final Thoughts

In a world where financial news can shift the tides in an instant, Michael Saylor’s announcement about selling $2.1 billion in preferred stock has certainly caught the attention of many. The strategy behind this move reflects a broader trend in the investment community, one that favors innovation and adaptability over traditional approaches.

As Saylor continues to make waves, investors must stay informed and vigilant. The world of cryptocurrency is exciting but fraught with challenges. Understanding the implications of moves like Saylor’s can provide valuable insights and help investors make informed decisions. Keep an eye on this space, as it promises to be a thrilling ride.

For more insights on this topic, you can read more about Michael Saylor’s journey in cryptocurrency.

“`

This article provides a comprehensive overview of the recent announcement regarding Saylor’s strategy, discussing implications, benefits, and the broader impact on the cryptocurrency market. It uses a conversational tone and engages readers while incorporating SEO best practices.

SAYLOR’D STRATEGY TO SELL UP TO

$2.1 BILLION OF 10% PREFERRED STOCK.

SAYLOR ISN'T STOPPING !!