Bitcoin Surges to 8th Largest Currency by Market Cap

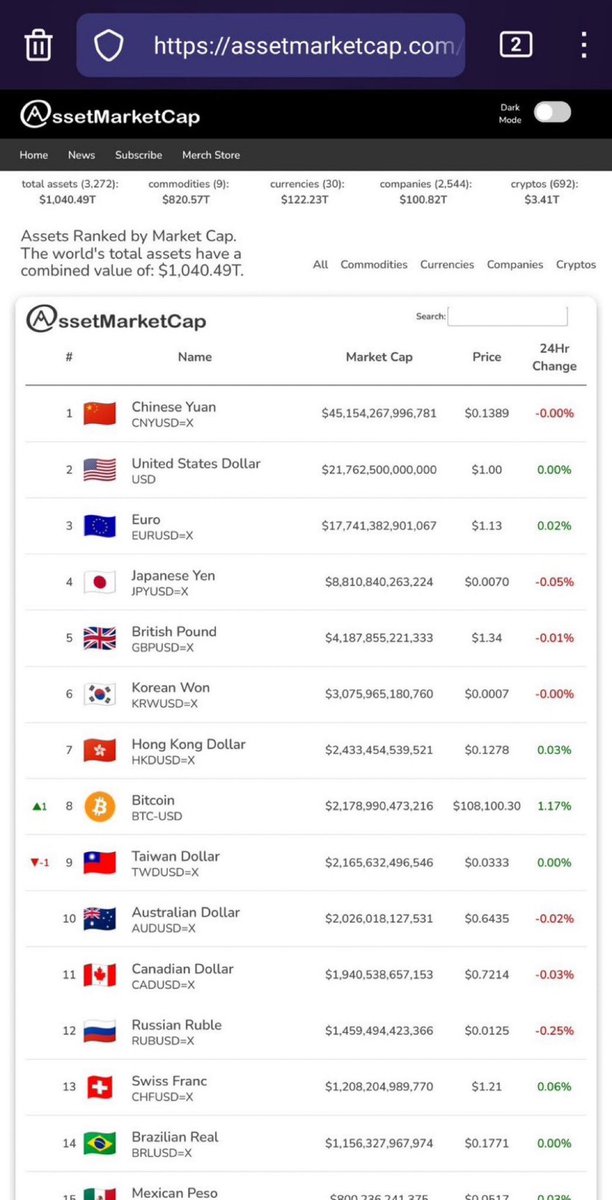

In a significant milestone for the cryptocurrency market, Bitcoin has officially become the 8th largest currency in the world by market capitalization. This breakthrough was announced through a tweet by Crypto Beast on May 22, 2025, indicating a notable shift in the financial landscape as Bitcoin continues to gain traction among investors, institutions, and the general public.

Understanding Bitcoin’s Rise

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency to introduce blockchain technology. This decentralized digital currency allows for peer-to-peer transactions without the need for intermediaries like banks. Over the years, Bitcoin has evolved from a niche asset to a major player in global finance, leading to its recent rise in market capitalization.

The Significance of Market Capitalization

Market capitalization is a crucial indicator of a currency’s value and stature in the global economy. It is calculated by multiplying the current price of the asset by its circulating supply. As Bitcoin climbs the ranks to become the 8th largest currency, this achievement demonstrates its growing acceptance and trust among users and investors alike. The surge in market cap reflects increased investment, a growing user base, and the overall health of the cryptocurrency market.

Factors Contributing to Bitcoin’s Growth

Several factors have contributed to Bitcoin’s rapid ascent in the financial world:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Institutional Adoption: Large corporations and institutional investors have begun to recognize Bitcoin as a legitimate asset class. Companies like Tesla and MicroStrategy have invested heavily in Bitcoin, encouraging others to follow suit.

- Increased Public Awareness: As more individuals learn about Bitcoin and its benefits, the demand has surged. The mainstream media’s coverage and social media discussions have raised awareness, leading to a growing interest in cryptocurrency.

- Market Dynamics: The supply of Bitcoin is capped at 21 million coins, which creates scarcity. As demand rises, so does the price, leading to an increase in market capitalization.

- Technological Advancements: Innovations in blockchain technology and improvements in Bitcoin’s scalability have made it more attractive to users. Solutions like the Lightning Network, which enhances transaction speeds, have further bolstered its appeal.

- Global Economic Conditions: Economic uncertainty and inflation in traditional currencies have propelled investors towards Bitcoin as a hedge against economic instability. Its decentralized nature appeals to those seeking financial security outside of government control.

What Does This Mean for the Future?

Bitcoin’s positioning as the 8th largest currency signifies a turning point in how cryptocurrencies are perceived. It legitimizes Bitcoin in the eyes of traditional investors and financial institutions, paving the way for future growth. As Bitcoin continues to establish itself, this could lead to a domino effect where more currencies and digital assets gain recognition and adoption.

The Implications for Regulators

As Bitcoin gains prominence, regulators around the world are under increasing pressure to establish frameworks that govern the cryptocurrency market. Striking a balance between fostering innovation and protecting investors is paramount. Clear regulations could facilitate further adoption and integration of Bitcoin into the financial system while mitigating risks associated with fraud and market manipulation.

Potential Challenges Ahead

Despite its impressive growth, Bitcoin faces several challenges that could impact its future trajectory:

- Volatility: Bitcoin is known for its price volatility, which can deter some investors. While volatility can present opportunities for profit, it also poses risks.

- Regulatory Scrutiny: Increased regulatory attention can lead to uncertainty. How governments choose to regulate cryptocurrencies will significantly influence Bitcoin’s future.

- Environmental Concerns: Bitcoin mining consumes a considerable amount of energy, raising concerns about its environmental impact. The industry is under pressure to adopt more sustainable practices.

- Competition: The rise of alternative cryptocurrencies (altcoins) and blockchain technologies presents competition. These assets could potentially overshadow Bitcoin if they offer superior functionalities or advantages.

The Broader Impact on Financial Markets

The rise of Bitcoin as a leading currency has broader implications for global financial markets. It encourages diversification in investment portfolios, as more investors seek exposure to alternative assets. Additionally, Bitcoin’s rise challenges traditional financial systems, pushing banks and financial institutions to innovate and adapt to a changing landscape.

Conclusion

Bitcoin’s ascent to become the 8th largest currency by market cap is a landmark achievement that underscores its growing acceptance and significance in the global economy. The factors driving this growth, such as institutional adoption, increased public awareness, and technological advancements, highlight the shifting dynamics of the financial landscape. However, challenges remain, and the future of Bitcoin will depend on its ability to navigate regulatory hurdles, address environmental concerns, and maintain its competitive edge among emerging digital assets. As Bitcoin continues to evolve, it will be fascinating to observe how it shapes the future of finance and investment.

This development serves as a reminder of the rapidly changing nature of money and the potential for cryptocurrencies to redefine our understanding of value and exchange. The journey of Bitcoin is far from over, and its continued success may pave the way for a new era in the world of finance.

BREAKING

Bitcoin becomes the 8th largest “currency” in the world by market cap pic.twitter.com/tkn7mYhvHV

— Crypto Beast (@cryptobeastreal) May 22, 2025

BREAKING

Bitcoin has officially become the 8th largest “currency” in the world by market cap. This is a monumental milestone for cryptocurrencies, and it’s got everyone buzzing. If you’re not already in the loop, let’s dive into what this means for Bitcoin and the broader financial landscape.

Bitcoin Becomes the 8th Largest “Currency” in the World by Market Cap

As of May 22, 2025, Bitcoin’s market cap has skyrocketed, placing it firmly in the top tier of global currencies. This isn’t just a casual achievement; it’s a testament to how far Bitcoin has come since its inception. Once dismissed as a fad or a speculative bubble, Bitcoin is now being taken seriously by investors, businesses, and even governments around the world. This shift is crucial, as it signals a growing acceptance of cryptocurrencies in the mainstream economy.

The Significance of Bitcoin’s Market Cap

Market capitalization is a key indicator in the finance world. It gives us a glimpse into the overall value of an asset and how it stands compared to others. Bitcoin’s recent ascension to the 8th largest “currency” signifies not just its value but also the confidence people are placing in it. Many are starting to view Bitcoin as a viable alternative to traditional fiat currencies, particularly in times of economic uncertainty.

Why Has Bitcoin Gained Such Traction?

Several factors contribute to Bitcoin’s increasing popularity. First off, the rise of digital finance has made cryptocurrencies more accessible to the average person. With platforms like Coinbase and Binance, buying Bitcoin is as easy as ordering a pizza. Additionally, the growing trend of institutional investment has lent Bitcoin a certain legitimacy that it once lacked. Companies like Tesla and Square have invested heavily in Bitcoin, encouraging others to follow suit.

Moreover, global economic conditions, such as inflation and currency devaluation, have led many to seek alternatives like Bitcoin. The narrative surrounding Bitcoin as “digital gold” has gained traction, making it an attractive hedge against traditional market fluctuations.

What This Means for the Future of Bitcoin

Reaching the status of the 8th largest currency in the world is just the beginning for Bitcoin. This achievement could pave the way for even more significant developments in the crypto space. As Bitcoin continues to gain acceptance, we might see more businesses starting to accept it as a form of payment. Imagine walking into your favorite coffee shop and paying for your latte with Bitcoin. It’s not as far-fetched as it once seemed!

Furthermore, Bitcoin’s growth could inspire more innovation within the cryptocurrency sector, leading to the development of new technologies and use cases. As more people get involved, the ecosystem surrounding Bitcoin will likely expand, creating opportunities for both investors and entrepreneurs alike.

Challenges Ahead for Bitcoin

Despite this impressive milestone, Bitcoin is not without its challenges. Regulatory scrutiny is a significant hurdle that could impact its growth. Governments are still figuring out how to regulate cryptocurrencies, and any missteps could lead to market volatility. For instance, China’s crackdown on crypto mining sent shockwaves through the market, illustrating how external factors can dramatically influence prices.

Additionally, the environmental impact of Bitcoin mining has come under fire. Critics argue that the energy consumption required to mine Bitcoin is unsustainable. As the world becomes more focused on climate change, Bitcoin may face increasing pressure to adopt more eco-friendly practices.

The Broader Impact of Bitcoin’s Rise

Bitcoin’s rise to the 8th largest currency is not just about the numbers; it’s about a cultural shift. We’re witnessing a paradigm shift in how people view money and value. Many younger generations are more open to the idea of decentralized currencies and digital assets, which could redefine financial literacy and investment strategies for years to come.

This shift can also foster greater financial inclusion. With Bitcoin, individuals who have been traditionally underserved by the banking system can access financial services. This could empower millions around the globe to take control of their financial futures.

How to Get Involved with Bitcoin

So, how can you get involved with Bitcoin? If you’re new to the crypto world, it’s essential to educate yourself. Plenty of resources are available online to help you understand the fundamentals of Bitcoin and blockchain technology. Websites like [CoinDesk](https://www.coindesk.com) and [CoinTelegraph](https://cointelegraph.com) provide in-depth articles, news, and analysis.

Once you feel ready, consider opening an account on a cryptocurrency exchange. Start small, and remember to only invest what you can afford to lose. As with any investment, doing your research is crucial. Look into various wallets, security protocols, and market trends before diving in.

Community and Support

Joining the Bitcoin community can also be a great way to learn and stay informed. Platforms like Reddit and Twitter have active discussions where users share insights and experiences. Engaging with the community can offer valuable perspectives and help you navigate the often-complex world of cryptocurrencies.

Final Thoughts on Bitcoin

Bitcoin’s rise to become the 8th largest currency in the world by market cap is a significant milestone that reflects a shift in how we perceive money and investment. While challenges loom, the potential for growth and innovation in the crypto space is immense. Whether you’re a seasoned investor or just getting started, keeping an eye on Bitcoin’s journey will be fascinating.

As we move forward, remember that investing in Bitcoin is not just about financial gain; it’s about being part of a revolutionary movement that could shape the future of finance. So, buckle up and enjoy the ride!

Bitcoin becomes the 8th largest "currency" in the world by market cap