Bitcoin Reaches All-Time High Amidst Retail Apathy: A Sign of the Super Cycle

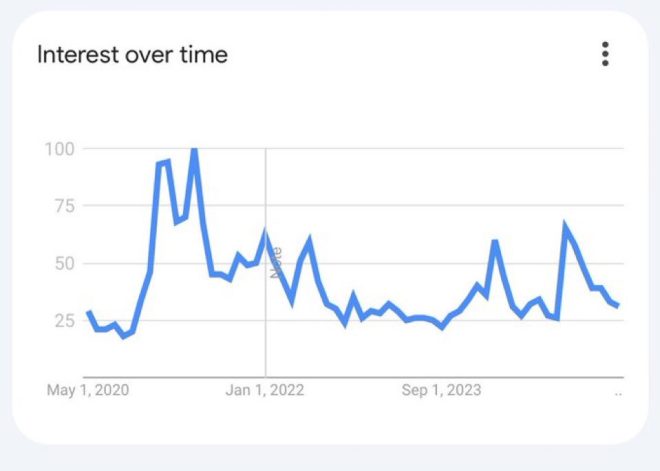

In a recent tweet that has captured the attention of the cryptocurrency community, prominent crypto influencer That Martini Guy (@MartiniGuyYT) announced that Bitcoin has reached an all-time high (ATH). What’s intriguing, however, is his observation that retail investors are largely disengaged from the crypto market during this significant milestone. This phenomenon raises questions about market dynamics, investor sentiment, and the potential for a so-called "super cycle" in the cryptocurrency landscape.

Understanding Bitcoin’s All-Time High

Bitcoin, often referred to as digital gold, has experienced a rollercoaster of price fluctuations since its inception in 2009. The cryptocurrency has been known for its volatility, but reaching an ATH signifies a new level of market interest and investment. An ATH is a critical benchmark that often entices new investors to enter the market, hoping to capitalize on the upward momentum.

The recent surge in Bitcoin’s price to an ATH has been attributed to a confluence of factors, including increased institutional adoption, favorable regulatory developments, and macroeconomic conditions that have made traditional assets less appealing. As Bitcoin continues to solidify its position as a legitimate asset class, discussions around its value and future prospects become increasingly relevant.

Retail Investor Apathy: A Contradictory Trend

One of the most striking aspects of this situation is the apparent apathy among retail investors. Traditionally, when Bitcoin reaches new heights, retail investors rush to participate, driven by fear of missing out (FOMO) and the allure of potential profits. However, this time, the lack of enthusiasm from the retail sector is noticeable.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Several factors could explain this phenomenon. Firstly, the crypto market has matured significantly, with a greater number of participants, including institutional investors who may have more influence on price movements than retail traders. Secondly, the overwhelming media coverage and the volatility of past bull runs may have led to a sense of skepticism among retail investors, making them more cautious about entering the market at this stage.

The Concept of a Super Cycle

The term "super cycle" refers to an extended period of significant growth in an asset or market, characterized by strong demand and limited supply. In the context of Bitcoin, a super cycle suggests that the cryptocurrency could experience sustained growth over an extended period, fueled by increasing adoption and a shift in the perception of digital assets.

Proponents of the super cycle theory argue that the current conditions in the market—such as increasing institutional interest, the rise of decentralized finance (DeFi), and the growing acceptance of cryptocurrencies in mainstream finance—could lead to a prolonged upward trajectory for Bitcoin. This contrasts sharply with previous cycles, which often saw rapid price increases followed by sharp corrections.

Implications for Investors

For investors, the current landscape presents a unique set of opportunities and challenges. Understanding the dynamics between institutional and retail investors is crucial for making informed decisions. The lack of retail interest during Bitcoin’s ATH could indicate a shift in market behavior, where institutional players increasingly dominate trading volumes and price movements.

Moreover, as Bitcoin continues to establish itself as a store of value and a hedge against inflation, investors must consider how external economic factors might influence the cryptocurrency market. Events such as changes in monetary policy, geopolitical tensions, and advancements in blockchain technology could all play significant roles in shaping Bitcoin’s future trajectory.

The Role of Media and Public Perception

Media coverage plays a crucial role in shaping public perception of cryptocurrencies. The narrative surrounding Bitcoin’s ATH and the apparent disengagement of retail investors could influence future market behavior. Positive coverage can attract new investors, while negative sentiment can deter participation.

As the cryptocurrency space evolves, it is essential for media outlets and influencers to provide balanced perspectives, highlighting both the opportunities and risks associated with investing in cryptocurrencies. This approach can help educate prospective investors and foster a more informed and engaged community.

Conclusion: A Pivotal Moment in Cryptocurrency

In summary, Bitcoin’s recent achievement of an all-time high amidst retail investor apathy raises intriguing questions about the current state of the cryptocurrency market. As institutional adoption accelerates and perceptions of digital assets evolve, the potential for a super cycle becomes more plausible. However, the lack of retail participation at this critical juncture suggests a shift in market dynamics that both current and prospective investors should closely monitor.

As we move forward, understanding the interplay between institutional and retail investors will be essential for navigating the complexities of the cryptocurrency market. Whether this marks the beginning of a super cycle or a period of consolidation remains to be seen, but one thing is clear: the landscape of digital assets is continually evolving, presenting both challenges and opportunities for all market participants.

In conclusion, Bitcoin’s current ATH and the notable absence of retail enthusiasm underscore the importance of ongoing dialogue within the cryptocurrency community. By fostering informed discussions and promoting awareness of market trends, investors can better position themselves for success in this dynamically shifting environment. Whether you are a seasoned investor or new to the crypto space, staying informed and adaptable will be key to navigating the exciting world of cryptocurrencies in the coming years.

BREAKING BITCOIN IS AT ATH AND RETAIL IS NOT EVEN TALKING ABOUT CRYPTO

THIS IS THE SUPER CYCLE pic.twitter.com/sog1mR6g90

— That Martini Guy ₿ (@MartiniGuyYT) May 22, 2025

BREAKING BITCOIN IS AT ATH AND RETAIL IS NOT EVEN TALKING ABOUT CRYPTO

The cryptocurrency world is buzzing with excitement as Bitcoin reaches an all-time high (ATH)! If you haven’t been paying attention, you might be surprised to learn that retail investors are not even talking about crypto right now, despite this monumental achievement. This phenomenon begs the question: Are we witnessing the dawn of a super cycle in the crypto market? Let’s unpack this intriguing development and what it could mean for investors.

Understanding Bitcoin’s All-Time High

When Bitcoin hits an ATH, it’s not just a number. It represents a significant moment in the cryptocurrency’s history, showcasing its potential to break barriers and redefine financial systems. The excitement is palpable among long-time investors and enthusiasts, as it marks another milestone in Bitcoin’s journey since its inception in 2009.

But what does it mean for the average investor? For many, the ATH indicates that institutional and retail interest might be shifting. [CoinDesk](https://www.coindesk.com/) reported that Bitcoin’s price surges often correlate with broader market trends and investor sentiment. However, the current scenario is peculiar—retail investors seem to be sitting this one out.

Retail’s Silence Amidst the Hype

You might find it odd that while Bitcoin is making headlines, retail investors are seemingly not engaged. This could be attributed to several factors. One significant reason is the overwhelming information overload. With so much noise in the market, many retail investors might feel paralyzed, unsure of where to place their bets.

Additionally, the recent surge in popularity of alternative cryptocurrencies (altcoins) might have diverted attention from Bitcoin. As platforms like [Ethereum](https://www.ethereum.org/) and others continue to innovate, retail investors may be more interested in exploring the plethora of options available to them rather than sticking solely with Bitcoin.

What Is a Super Cycle?

The term “super cycle” refers to a prolonged period of growth in the market, significantly longer and more robust than typical cycles. In the context of Bitcoin, a super cycle suggests that the cryptocurrency could experience sustained upward momentum, driven by increasing institutional adoption, technological advancements, and greater public awareness.

Historically, Bitcoin has gone through cycles of bull and bear markets, but a super cycle could mean we’re entering a phase where Bitcoin becomes more entrenched in mainstream finance. According to [Forbes](https://www.forbes.com/), this could lead to more significant price increases, driven by demand from both retail and institutional investors.

Factors Fueling the Super Cycle

There are several critical factors that could potentially propel Bitcoin into a super cycle:

1. **Institutional Adoption**: Companies like Tesla and Square have added Bitcoin to their balance sheets, signaling strong institutional interest. As more companies consider Bitcoin as a legitimate asset, the market could see unprecedented growth.

2. **Regulatory Clarity**: As governments around the world start to provide clearer regulations regarding cryptocurrencies, more investors might feel comfortable diving into the market. Regulatory backing can lend Bitcoin legitimacy, attracting more retail investors.

3. **Technological Innovations**: Advancements in blockchain technology can improve Bitcoin’s scalability and usability, making it more attractive to everyday users. For instance, the implementation of the Lightning Network is designed to make Bitcoin transactions faster and cheaper.

4. **Economic Factors**: In times of economic uncertainty, many investors turn to Bitcoin as a hedge against inflation. With global economies facing various challenges, Bitcoin could become a safe haven asset for retail investors.

Will Retail Investors Re-engage?

The big question is whether retail investors will eventually re-engage with Bitcoin as it reaches its ATH. Many are waiting to see how the market behaves before committing their hard-earned money. The fear of missing out (FOMO) is a powerful motivator, and as Bitcoin continues to gain attention, we may see a wave of retail investors jumping back into the market.

Platforms like [Coinbase](https://www.coinbase.com/) and [Binance](https://www.binance.com/) are making it easier for new investors to enter the crypto space. With user-friendly interfaces and educational resources, these platforms are helping demystify cryptocurrencies for the average person.

The Role of Social Media in Crypto Trends

Social media plays a vital role in shaping the narrative around cryptocurrencies. Platforms like Twitter and Reddit are hotbeds for crypto discussions, often fueling trends and influencing investor behavior. The tweet from That Martini Guy highlights the disconnect between Bitcoin’s current success and retail’s apparent disengagement.

As discussions around Bitcoin evolve, social media can become a powerful tool for reinvigorating interest among retail investors. Influencers and thought leaders can sway public perception, making Bitcoin seem more accessible and less intimidating.

How to Navigate the Current Crypto Landscape

If you’re considering diving into Bitcoin or any cryptocurrency, it’s essential to do your research. Here are some tips to navigate the current landscape:

1. **Stay Informed**: Follow reliable sources like [CoinDesk](https://www.coindesk.com/) and [CoinTelegraph](https://cointelegraph.com/) for the latest news and developments. Understanding market trends can help you make informed decisions.

2. **Invest Wisely**: Only invest what you can afford to lose. Cryptocurrency markets can be extremely volatile, and it’s crucial to have a risk management strategy in place.

3. **Engage with the Community**: Join forums and social media groups to connect with other investors. Engaging in discussions can provide valuable insights and help you stay updated on market sentiments.

4. **Diversify Your Portfolio**: While Bitcoin may be a solid investment, consider exploring altcoins as well. Diversifying your investments can reduce risk and potentially increase your profits.

5. **Be Cautious of FOMO**: As Bitcoin reaches new heights, it’s easy to get swept up in excitement. Remember to keep a level head and avoid making impulsive decisions based on market hype.

The Future of Bitcoin and Crypto Investment

As we look ahead, Bitcoin’s ATH could be just the beginning of a larger trend. The potential for a super cycle is real, and if retail investors start to re-engage, we could see the market reach new heights.

The unpredictable nature of the cryptocurrency market means that anything can happen, but one thing is for sure: Bitcoin remains a topic of conversation—whether at its ATH or not. So, keep an eye on the market, stay informed, and make your investment decisions wisely.

In this exciting time for Bitcoin, the true test will be whether retail investors recognize the opportunity before them or remain silent. Only time will tell how this story unfolds, but one thing’s for sure: the cryptocurrency landscape is continuously evolving.

BREAKING BITCOIN IS AT ATH AND RETAIL IS NOT EVEN TALKING ABOUT CRYPTO

THIS IS THE SUPER CYCLE