Breaking news: Bitcoin Whale Sees Massive Profit

In the fast-paced world of cryptocurrency trading, significant movements often catch the attention of investors and enthusiasts alike. One such noteworthy event occurred recently when a prominent Bitcoin whale, an investor holding a substantial amount of Bitcoin, announced a remarkable profit of $39 million on a long position worth $1 billion. This development has sent ripples through the crypto community, prompting discussions about market trends, investment strategies, and the future of Bitcoin.

What Is a Bitcoin Whale?

A Bitcoin whale refers to an individual or entity that holds a large amount of Bitcoin, typically enough to influence market prices with their trading activities. These whales can be early adopters, large investors, or institutions that have amassed significant Bitcoin holdings. Their trading decisions often create volatility in the market, making them a focal point for traders and analysts.

The $1 Billion Long Position

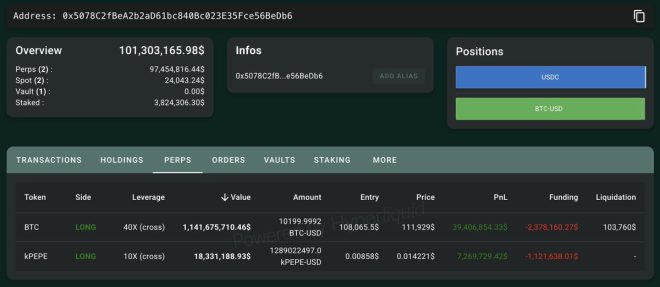

The announcement from the Twitter account Crypto Beast revealed that this particular whale had taken a long position in Bitcoin valued at $1 billion. A long position means that the investor anticipates the price of Bitcoin will rise, allowing them to profit from the increase. The current profit of $39 million indicates that the price of Bitcoin has appreciated significantly since the whale entered the position.

This substantial profit margin highlights the potential for high returns in the cryptocurrency market, particularly for those who can effectively time their trades. However, it also underscores the risks involved, as the volatility of Bitcoin can lead to significant losses just as quickly as it can lead to gains.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reaction and Implications

The revelation of such a large profit from a Bitcoin whale has sparked widespread interest and speculation within the cryptocurrency community. Many traders and investors are closely monitoring the market for signs of future movements, particularly to see if this whale will take any actions that could impact Bitcoin’s price.

When a whale makes a profit, there are two potential outcomes: they may choose to sell some or all of their holdings to realize those gains, or they might hold onto their position, believing that further price increases are imminent. The decision made by this whale could set the tone for short-term market trends, influencing other traders’ behaviors and potentially leading to increased volatility.

Analyzing Bitcoin’s Recent Performance

To understand the context of this whale’s profitable position, it is essential to analyze Bitcoin’s recent performance. Throughout 2025, Bitcoin has experienced significant price fluctuations, driven by various factors such as market sentiment, regulatory developments, and macroeconomic trends.

As of now, Bitcoin’s price has rallied, leading to increased interest from both retail and institutional investors. This resurgence can be attributed to several factors, including growing acceptance of cryptocurrency as a legitimate asset class, advancements in blockchain technology, and the ongoing integration of digital currencies into traditional financial systems.

The Role of Institutional Investors

The participation of institutional investors, such as hedge funds and publicly traded companies, has played a crucial role in the recent growth of Bitcoin’s market capitalization. These entities often have substantial resources and are capable of making significant investments, which can drive prices higher.

The presence of institutional investors also adds a layer of legitimacy to the cryptocurrency space, attracting more mainstream attention and investment. As more large players enter the market, the dynamics of trading and price movements may change, leading to new opportunities and challenges for individual traders.

The Future of Bitcoin

As the cryptocurrency market evolves, the future of Bitcoin remains a topic of great interest and speculation. While some analysts predict continued growth, others caution about the potential for market corrections and downturns. The recent profit reported by the Bitcoin whale serves as a reminder of the inherent volatility in crypto trading.

Investors are advised to conduct thorough research and consider their risk tolerance before entering the market. Strategies such as dollar-cost averaging, diversification, and risk management can help mitigate potential losses while still allowing for participation in the market’s upside.

Conclusion

The announcement of a $39 million profit from a Bitcoin whale’s $1 billion long position has ignited excitement and speculation within the cryptocurrency community. As Bitcoin’s price continues to fluctuate, the actions of large investors like this whale may significantly influence market trends and investor sentiment.

For those interested in cryptocurrency, staying informed about market developments and institutional movements is crucial. The dynamic nature of the crypto market offers both opportunities and risks, making it essential for investors to remain vigilant and adaptable.

As we continue to witness the evolution of Bitcoin and the broader cryptocurrency landscape, one thing remains clear: cryptocurrency trading is not just about numbers—it’s about understanding market psychology, trends, and the underlying technologies that drive this revolutionary financial ecosystem. Whether you are a seasoned trader or a newcomer to the world of crypto, the story of the Bitcoin whale serves as a compelling reminder of the potential rewards—and risks—of investing in digital assets.

BREAKING

$1 billion bitcoin long whale is now sitting at $39 million profit on his position pic.twitter.com/Cuf8Gh7M13

— Crypto Beast (@cryptobeastreal) May 22, 2025

BREAKING

In the ever-evolving world of cryptocurrency, news travels fast. Today, we’ve got a monumental update that’s catching everyone’s attention. A whale—yes, that’s right, a massive investor—has taken a long position in Bitcoin worth an astounding $1 billion. And get this: this whale is currently sitting on a whopping $39 million profit! If you’re wondering what this means and how it impacts the crypto market, keep reading.

$1 Billion Bitcoin Long Whale

First off, let’s break down what a “whale” is in the crypto world. Essentially, it refers to individuals or entities that hold large quantities of cryptocurrency. Their significant holdings mean that their trading activities can influence market prices. This particular whale, with a long position in Bitcoin valued at $1 billion, has made a bold move that’s likely to send ripples through the market.

The decision to take such a substantial long position isn’t made lightly. It indicates a strong belief in Bitcoin’s future performance. Given Bitcoin’s history of volatility, this whale is either extremely confident or has a high tolerance for risk. Many traders are now watching closely to see if this whale’s faith in Bitcoin will pay off.

Current Market Trends and Implications

The crypto market is notoriously unpredictable, but trends can be observed. Bitcoin recently has had its ups and downs, often influenced by macroeconomic factors, regulatory news, and market sentiment. So, what does this $39 million profit mean for the broader market?

When a whale profits, it can create a sense of optimism among smaller investors. As more people hear news like this, they might feel encouraged to enter the market. This could lead to increased buying pressure, potentially pushing Bitcoin prices even higher. However, we should also consider the flip side. If the whale decides to cash out, it could trigger a sell-off, leading to a price drop. The result? A classic dance of fear and greed in the market.

Understanding Long Positions in Bitcoin

For those new to trading, a long position means that the investor is betting on the price of Bitcoin to rise. When you enter a long position, you’re essentially buying Bitcoin with the expectation that its value will increase over time. The strategy can be rewarding but also risky, especially in a market as volatile as cryptocurrency. With Bitcoin, the price can fluctuate dramatically, causing both profits and losses to swing widely.

In this case, the whale’s bet has certainly paid off so far, with a $39 million profit under their belt. It’s important to remember that not every long position leads to such success. Many factors can influence market dynamics, including regulatory changes, technological advancements, and broader economic shifts.

What This Means for Retail Investors

So, how should retail investors respond to news like this? Well, first off, it’s crucial to do your own research. A $1 billion long position might seem enticing, but it’s essential to understand the risks involved. Just because a whale is profiting doesn’t guarantee the same outcome for smaller investors.

Investing in cryptocurrencies should always be approached with caution. Consider your risk tolerance, investment goals, and whether you’re ready for the rollercoaster ride that comes with crypto markets. Furthermore, diversifying your investments can help mitigate risks associated with individual assets.

Following the Whale’s Moves

Many traders and investors keep a close eye on whale activity, as it can provide insights into market trends. Some platforms even track large transactions, giving you a heads-up on potential market movements. Tools like Whale Alert are essential for keeping tabs on significant transactions, and they can be invaluable for making informed trading decisions.

However, while following whale movements can be beneficial, it’s essential not to base your trading strategy solely on these observations. Remember, whales operate with different strategies and timeframes than retail investors. They have the capital to weather market storms that individual investors may not.

The Future of Bitcoin and Crypto Investments

As we look ahead, the future of Bitcoin and the cryptocurrency market remains uncertain. Factors like regulatory developments, technological advancements, and macroeconomic trends will continue to shape the market. For now, the news of this whale making a significant profit is a reminder of the potential rewards that can come with investing in cryptocurrencies.

Many analysts are optimistic about Bitcoin’s long-term value, believing that it could continue to rise as more institutional investors enter the space. However, caution is advised, as the market remains highly speculative.

Community Reactions and Speculations

The news of this whale’s profit has sparked a wave of reactions across social media and trading forums. Many enthusiasts are speculating about the potential impact on Bitcoin’s future price movements. Some believe this could be a sign of a bullish trend, while others warn of the risks involved with such volatile assets.

Overall, the crypto community thrives on these discussions, sharing insights, predictions, and strategies. Engaging with fellow investors can provide different perspectives and help you refine your investment approach.

Final Thoughts on the Whale’s Position

In the end, the story of this $1 billion Bitcoin long whale and their $39 million profit serves as a fascinating chapter in the ongoing saga of cryptocurrency investing. While it’s essential to recognize the potential for significant gains, it’s equally crucial to understand the risks involved. As you navigate the world of crypto, stay informed, be cautious, and don’t hesitate to seek advice from trusted sources.

Whether you’re a seasoned investor or just dipping your toes into the crypto waters, remember that knowledge is power. Keep your eyes peeled for updates, and who knows? You might find yourself riding the next wave of profit just like this whale!

$1 billion bitcoin long whale is now sitting at $39 million profit on his position