Breaking news: Cetus DEX Hacked, $11M in $SUI Drained

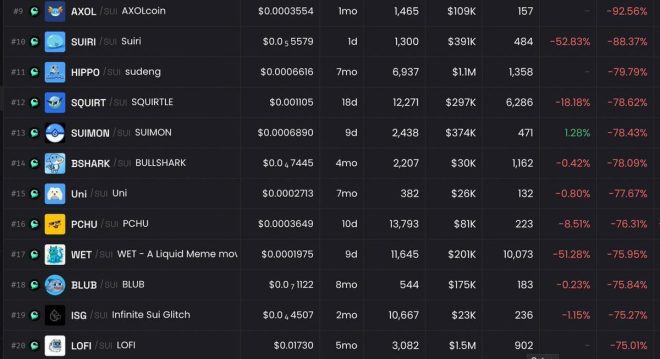

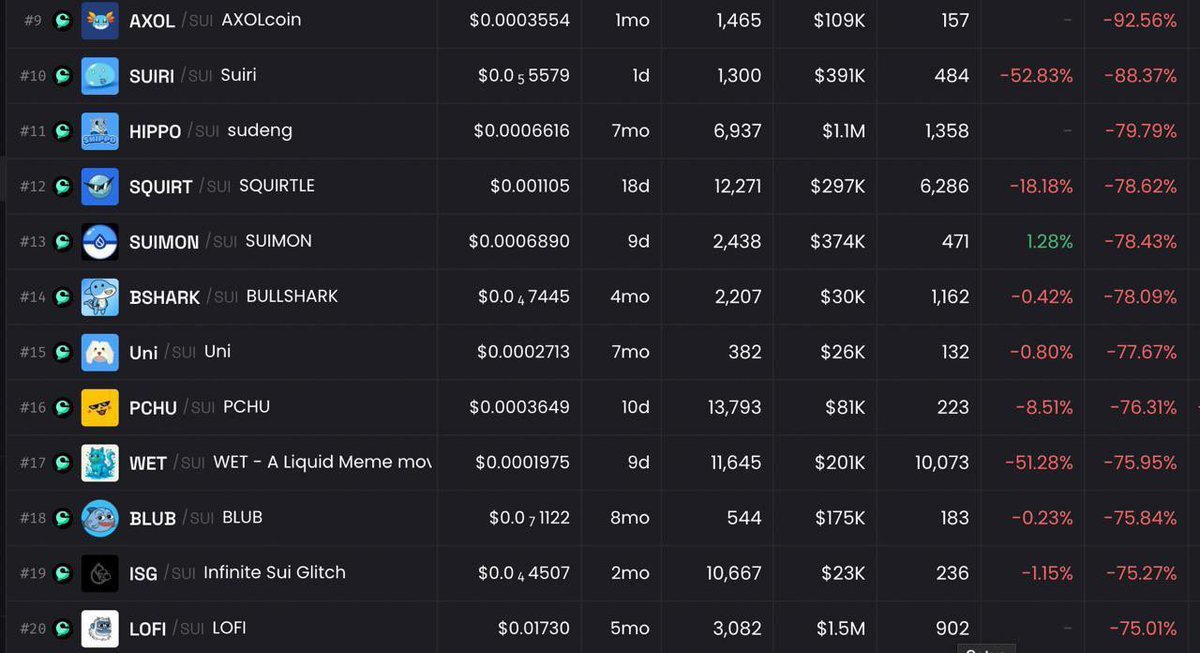

In a shocking development for the cryptocurrency community, Cetus, the primary liquidity provider decentralized exchange (DEX) on the SUI blockchain, has reportedly been hacked. The incident, which has sent ripples through the crypto markets, has resulted in an estimated $11 million being drained from the SUI/USDC liquidity pool. Following the breach, many tokens associated with the SUI ecosystem have experienced significant losses, with values plummeting by over 75% as liquidity pools are rapidly emptied.

What Happened?

According to a tweet from Cointelegraph, the hack was confirmed on May 22, 2025, and has raised alarming concerns over the security of decentralized finance (DeFi) platforms. The breach highlights the vulnerabilities that can exist within DeFi ecosystems, particularly for liquidity pools that serve as major components for trading and decentralized exchanges. As a primary liquidity provider, Cetus plays a crucial role in facilitating transactions and providing market depth for SUI users.

Impact on the SUI Ecosystem

The immediate fallout from the hack has been severe. The $11 million drained from the SUI/USDC pool not only represents a significant financial loss but also raises questions about the integrity and security of the SUI platform. With the price of many tokens linked to SUI dropping sharply, investors are understandably concerned about the future viability of projects within the SUI ecosystem. The fact that most tokens have seen declines of 75% or more indicates a broader panic among traders and investors.

Why Security Matters in DeFi

The incident at Cetus underscores the importance of security in the DeFi space. Unlike traditional financial systems, where regulatory bodies oversee and protect user funds, DeFi projects often operate without centralized oversight. This lack of regulation can leave users vulnerable to hacks, exploits, and other malicious activities. The hack at Cetus serves as a stark reminder that investors must conduct thorough due diligence before engaging with DeFi platforms.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Lessons Learned from the Cetus Hack

- Importance of Security Audits: One of the key takeaways from the Cetus hack is the necessity of rigorous security audits. DeFi projects must prioritize the implementation of robust security measures and undergo regular audits to identify and mitigate potential vulnerabilities.

- Community Awareness: The incident emphasizes the need for increased awareness within the crypto community. Users must stay informed about the risks associated with DeFi and be vigilant in monitoring their investments.

- Diversification: Investors should consider diversifying their crypto portfolios to mitigate risk. Relying heavily on a single token or platform can expose users to significant financial loss, as evidenced by the SUI ecosystem’s response to the Cetus hack.

- Implementation of Insurance Protocols: DeFi projects may need to explore insurance protocols that can provide a safety net for users in the event of hacks or exploits. This could help restore confidence among investors and encourage participation in DeFi platforms.

The Future of SUI and Cetus

As the dust settles from the hack, the future of both SUI and Cetus remains uncertain. The SUI community will need to address the fallout and rebuild trust among its users. This may involve implementing new security measures, enhancing transparency, and providing regular updates to stakeholders about the steps being taken to prevent future incidents.

For Cetus, recovery will depend on its ability to communicate effectively with its user base and demonstrate a commitment to improving security protocols. Engaging with the community and being transparent about the measures taken to secure the platform will be critical for its long-term viability.

Conclusion

The hack at Cetus serves as a crucial reminder of the inherent risks associated with decentralized finance. While the potential for high returns in DeFi is alluring, users must remain cautious and informed. As the SUI ecosystem grapples with the aftermath of this incident, the broader crypto community will undoubtedly be watching closely to see how these events unfold. Enhanced security measures, community engagement, and a focus on transparency will be essential for rebuilding trust and ensuring the future success of SUI and its associated platforms.

In a rapidly evolving landscape where digital assets are becoming increasingly mainstream, the lessons learned from the Cetus hack will be invaluable for future developments in the DeFi space. As we move forward, the importance of security and community awareness cannot be overstated. It’s imperative for all stakeholders to remain vigilant and proactive in addressing the challenges that lie ahead in the world of cryptocurrency and decentralized finance.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied. pic.twitter.com/sWKwsZGjaM

— Cointelegraph (@Cointelegraph) May 22, 2025

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked

When it comes to decentralized exchanges (DEXs), security is a primary concern for users. Recently, a significant incident has shaken the crypto community: Cetus, a major liquidity provider DEX on the SUI network, has reportedly been hacked. This is a serious issue that has caught the attention of traders and investors alike, and it raises critical questions about the safety of decentralized finance (DeFi).

As stated in a [tweet from Cointelegraph](https://twitter.com/Cointelegraph/status/1925509145366503486?ref_src=twsrc%5Etfw), the hack resulted in the draining of a staggering $11 million in $SUI tokens from the SUI/USDC liquidity pool. This breach has not only affected the value of $SUI but has also sent shockwaves through the broader crypto market. Many tokens have plummeted, with reports indicating that several are down by more than 75% as pools are emptied.

$11M in $SUI drained from SUI/USDC pool

Let’s break down what happened. Cetus was providing liquidity for the SUI/USDC trading pair when it fell victim to an exploit. This kind of hack isn’t just a minor setback; it’s a painful reminder of the vulnerabilities that exist in the DeFi space. With $11 million siphoned off, the implications are huge. Liquidity pools are essential for the functioning of any DEX, as they provide the necessary capital for trades to occur. When a significant portion of that liquidity vanishes, it can lead to severe market disruptions.

Imagine waking up to find that a significant part of your investments has been compromised. That’s the reality for many users who trusted Cetus with their assets. When pools are drained, it doesn’t just impact those directly involved; it sends ripples throughout the ecosystem, affecting traders who might not even know what’s going on until they try to make a trade and find that prices have skyrocketed or collapsed.

Most tokens down 75%+ as pools are emptied

The aftermath of this hack has been devastating. As liquidity pools are emptied, the prices of most tokens associated with the SUI ecosystem have taken a nosedive. Reports suggest that many tokens are down by over 75%. This kind of plummet can lead to panic selling, further exacerbating the situation. Traders are left wondering if they should hold on or cut their losses, and that uncertainty can lead to a downward spiral of market sentiment.

What does this mean for the average investor? Well, it’s a stark reminder of the importance of due diligence and the inherent risks involved in trading on decentralized platforms. While the allure of high returns in DeFi can be tempting, incidents like this remind us that the volatility and risks are very real.

What led to the hack?

Understanding how such a breach occurred is crucial for the future of decentralized finance. Security vulnerabilities can often be traced back to smart contract flaws, poor security protocols, or even human error. In this case, experts are likely combing through the code to identify the specific exploit that was used to drain the funds.

Cetus, like many other DEXs, relies on smart contracts to facilitate transactions and manage liquidity. If there’s a flaw in the code, it can be exploited by malicious actors. This incident serves as a wake-up call for developers and users alike to prioritize security measures and ensure that thorough audits are conducted before launching any platform.

The community’s response

The crypto community has rallied in response to the news of the hack. Many users are expressing their outrage on social media platforms, while others are calling for increased security measures and transparency from DEX providers. The sentiment is clear: trust has been broken, and it’s going to take time and effort to rebuild it.

In the wake of the hack, discussions are heating up about the need for better regulatory frameworks in the DeFi space. While decentralization offers many advantages, it also leaves users vulnerable to these types of attacks. Striking a balance between innovation and security is crucial for the future of decentralized finance.

Lessons learned from the Cetus hack

Every incident like this offers valuable lessons for both users and developers. Firstly, it highlights the importance of conducting thorough research before investing in any DeFi platform. Users should be aware of the risks involved and should never invest more than they can afford to lose.

Secondly, this incident reinforces the need for robust security protocols. Developers must prioritize security in their projects, conducting regular audits and stress tests to identify vulnerabilities before they can be exploited. The community must also advocate for transparency and accountability in the DeFi space, pushing for standards that protect users.

Lastly, this hack serves as a reminder of the ever-evolving landscape of cryptocurrency. As technology advances, so do the tactics of malicious actors. Staying informed and vigilant is essential for anyone involved in the crypto market.

Looking ahead: The future of DEX security

As we reflect on the Cetus hack, it’s clear that the future of decentralized exchanges depends on how well the community can respond to these challenges. While the incident has been damaging, it also presents an opportunity for growth and improvement in the DeFi space.

The demand for secure trading platforms will only increase as more users enter the market. Developers will need to adapt and innovate to meet these demands, creating more secure environments for trading and liquidity provision. This could involve employing advanced security measures, such as multi-signature wallets, insurance protocols, and improved smart contract auditing processes.

Final thoughts on the Cetus hack

The hack of Cetus, the main LP provider DEX on $SUI, serves as a cautionary tale for the entire crypto community. With $11 million in $SUI drained from the SUI/USDC pool and most tokens experiencing significant losses, the repercussions of this incident will be felt for some time.

It’s essential for both users and developers to learn from the mistakes of the past and work collectively towards a safer, more secure DeFi environment. As we navigate the complexities of decentralized finance, let’s prioritize security, transparency, and community engagement to build a better future for all participants. The journey ahead will undoubtedly be challenging, but with the right approach, we can overcome these hurdles and continue to innovate in the world of cryptocurrency.

BREAKING: Cetus, main LP provider DEX on $SUI, allegedly hacked.

$11M in $SUI drained from SUI/USDC pool, with most tokens down 75%+ as pools are emptied.