Bitcoin Surpasses Taiwan Dollar: A Historic Milestone

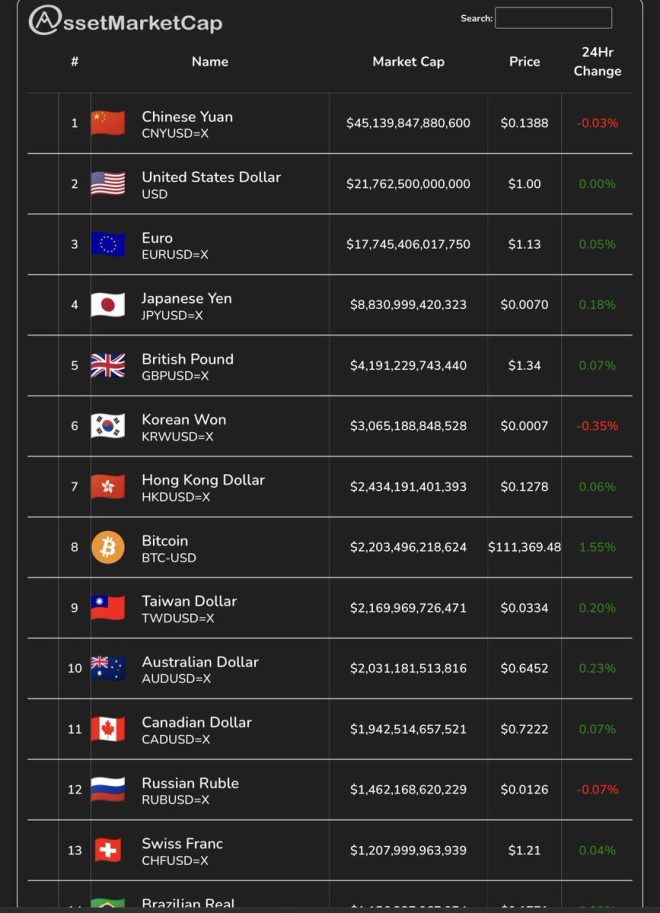

In a groundbreaking development for the cryptocurrency world, Bitcoin has officially claimed its spot as the eighth largest currency globally, surpassing the Taiwan Dollar and rapidly closing in on the Hong Kong Dollar. As of May 22, 2025, Bitcoin’s market capitalization has soared to an impressive $2.2 trillion, marking a significant milestone in its journey toward becoming a mainstream financial asset.

The Rise of Bitcoin

Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, has undergone a remarkable transformation from a niche digital currency to a formidable player in the global financial landscape. Initially dismissed by many as a speculative investment, Bitcoin has proven its resilience and adaptability, evolving into a widely accepted form of currency and a store of value.

The rise in Bitcoin’s market cap can be attributed to several factors, including increased adoption by institutional investors, growing interest from retail investors, and a surge in demand for decentralized finance (DeFi) solutions. As traditional financial systems face challenges, Bitcoin’s decentralized nature has made it an attractive alternative, leading to its rapid ascendance in the global currency rankings.

Bitcoin’s Market Capitalization: A Closer Look

With a current market capitalization of $2.2 trillion, Bitcoin now stands alongside some of the world’s most significant fiat currencies. This achievement underscores the growing recognition of Bitcoin as a legitimate asset class. The surge in Bitcoin’s value can be linked to several key developments:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Institutional Adoption: Major corporations and investment firms have begun to allocate portions of their portfolios to Bitcoin as a hedge against inflation and economic uncertainty. This institutional interest has provided a significant boost to Bitcoin’s credibility and market value.

- Increased Retail Participation: As more individuals become aware of the benefits of owning Bitcoin, retail investment has surged. User-friendly platforms and exchanges have made it easier for everyday investors to buy and hold Bitcoin, contributing to its growing market cap.

- Global Economic Factors: The ongoing economic challenges faced by many countries have led to increased interest in alternative currencies. Bitcoin’s decentralized nature offers a level of security and independence from traditional financial systems, making it an attractive option for those seeking stability.

- Technological Advancements: Improvements in blockchain technology and the development of the Lightning Network have enhanced Bitcoin’s scalability and transaction speed. These advancements have made Bitcoin more practical for everyday use, further driving its adoption.

The Competition: Hong Kong Dollar and Other Currencies

As Bitcoin edges closer to the Hong Kong Dollar in market capitalization, the competition among global currencies has intensified. The Hong Kong Dollar, known for its stability and strong ties to the global financial market, is a formidable opponent. However, Bitcoin’s unique attributes—such as its limited supply and decentralized nature—set it apart from traditional currencies.

The implications of Bitcoin’s rise extend beyond mere market rankings. As Bitcoin continues to gain traction, it challenges the dominance of established fiat currencies and raises questions about the future of money itself. The growing acceptance of Bitcoin and other cryptocurrencies may lead to a shift in how individuals and businesses perceive value and conduct transactions.

The Future of Bitcoin

Looking ahead, Bitcoin’s trajectory appears promising, with several trends likely to shape its future:

- Regulatory Developments: As Bitcoin’s popularity grows, regulatory bodies worldwide are beginning to take notice. While some regulations may pose challenges, a clear regulatory framework could enhance Bitcoin’s legitimacy and attract further investment.

- Integration with Traditional Finance: The integration of Bitcoin into traditional financial systems is already underway, with various financial institutions offering Bitcoin-related products and services. This trend is expected to continue, further bridging the gap between cryptocurrencies and traditional finance.

- Sustainability Concerns: As Bitcoin’s popularity rises, so do concerns about its environmental impact, particularly regarding energy consumption associated with mining. The industry is actively exploring solutions to address these concerns, such as transitioning to renewable energy sources.

- Market Volatility: While Bitcoin has shown resilience, it remains susceptible to market volatility. Investors should remain vigilant and conduct thorough research before entering the market, understanding both the potential rewards and risks associated with cryptocurrency investments.

Conclusion

Bitcoin’s ascent to the rank of the eighth largest currency globally marks a pivotal moment in the history of finance. With a market capitalization of $2.2 trillion and increasing adoption by both institutions and individuals, Bitcoin is solidifying its position as a key player in the financial landscape. As the world continues to navigate economic uncertainties, Bitcoin’s decentralized nature and innovative technology make it a compelling alternative to traditional fiat currencies.

Investors and enthusiasts alike should keep a close eye on Bitcoin’s developments, as its impact on the global economy and financial systems is only just beginning to unfold. Whether you are a seasoned investor or new to the world of cryptocurrency, understanding Bitcoin’s significance and potential will be crucial in the rapidly evolving financial landscape.

BREAKING

BITCOIN NOW RANKS AS THE 8TH BIGGEST CURRENCY GLOBALLY, SURPASSING THE TAIWAN DOLLAR AND CLOSING IN ON THE HONG KONG DOLLAR!

$2.2T MARKET CAP AND CLIMBING FAST! pic.twitter.com/nT3SnCLT3X

— DustyBC Crypto (@TheDustyBC) May 22, 2025

BREAKING

Bitcoin is making waves in the financial world once again! It has just achieved a remarkable milestone by ranking as the 8th biggest currency globally. This is no small feat, as it has surpassed the Taiwan Dollar and is now closing in on the Hong Kong Dollar. With a staggering market cap of $2.2 trillion, Bitcoin is climbing fast and capturing the attention of investors and enthusiasts alike.

BITCOIN NOW RANKS AS THE 8TH BIGGEST CURRENCY GLOBALLY

So, what does it mean for Bitcoin to rank as the 8th biggest currency globally? This ranking isn’t just a number; it signifies the growing acceptance and adoption of Bitcoin as a legitimate form of currency. As countries and institutions begin to recognize Bitcoin’s potential, it steadily gains a foothold in the global financial system.

It’s fascinating to see how Bitcoin has evolved since its inception. Initially dismissed as a digital novelty, Bitcoin has matured into a serious contender in the currency market. Investors are now looking at it not just as a speculative asset, but as a viable alternative to traditional currencies.

SURPASSING THE TAIWAN DOLLAR

Bitcoin’s ability to surpass the Taiwan Dollar is an impressive milestone. The Taiwan Dollar has long been a stable currency in the Asian market, but Bitcoin’s surge reflects a shift in how people perceive value. As more individuals and businesses adopt Bitcoin for transactions, its market cap continues to grow, leaving traditional currencies in its wake.

For many, this transition is indicative of a larger trend—people are becoming increasingly comfortable with digital currencies. This comfort comes from the advancements in technology, which make it easier to buy, sell, and use Bitcoin in everyday transactions.

CLOSING IN ON THE HONG KONG DOLLAR

As Bitcoin inches closer to the Hong Kong Dollar, the implications are significant. The Hong Kong Dollar is a major currency in Asia, known for its stability and widespread use. Bitcoin’s proximity to this currency suggests that it is on the brink of becoming a mainstream currency in the global economy.

This also raises questions about the future of traditional currencies. Will Bitcoin eventually overtake more established currencies? While it’s still too early to predict, Bitcoin’s trajectory indicates that it’s not just a fad—it’s here to stay.

$2.2T MARKET CAP AND CLIMBING FAST!

With a market cap of $2.2 trillion, Bitcoin is not just a cryptocurrency; it’s a financial powerhouse. This substantial market cap indicates a growing trust in Bitcoin as a store of value. Investors are increasingly viewing Bitcoin as a hedge against inflation and economic instability, much like gold.

The rising market cap can also be attributed to several factors, including institutional investments and increased retail participation. Major companies are now integrating Bitcoin into their financial strategies, further legitimizing its role in the economy. For instance, companies like Tesla and MicroStrategy have made significant investments in Bitcoin, which has contributed to its rising value.

Additionally, the global interest in decentralized finance (DeFi) is helping to propel Bitcoin’s popularity. As more people seek alternatives to traditional banking systems, Bitcoin offers a decentralized solution that appeals to those who prioritize financial independence.

THE FUTURE OF BITCOIN

Looking ahead, the future of Bitcoin appears bright. As it continues to gain traction, we can expect to see more innovations in the cryptocurrency space, including advancements in blockchain technology and enhancements to Bitcoin’s scalability. The more efficient and user-friendly Bitcoin becomes, the more likely it will be adopted by the masses.

But it’s essential to remember that with great growth comes volatility. Bitcoin is known for its wild price swings, and while its value may be climbing now, it’s crucial for investors to stay informed and cautious. Watching market trends and understanding the factors that influence Bitcoin’s price can help investors make more informed decisions.

INVESTING IN BITCOIN

If you’re considering investing in Bitcoin, start by doing your research. Understand the risks and rewards associated with cryptocurrency investments. There are various platforms where you can buy Bitcoin, each offering different features, fees, and security measures.

Don’t rush into investing all at once. Consider dollar-cost averaging, where you invest a fixed amount of money at regular intervals. This strategy can help mitigate some of the risks associated with Bitcoin’s price volatility.

BITCOIN AND THE GLOBAL ECONOMY

Bitcoin’s rise is not just a matter of individual investment; it’s a phenomenon that has the potential to reshape the global economy. As Bitcoin becomes more integrated into the financial system, we may see shifts in how currencies are valued and traded. Central banks may need to adapt their policies in response to the growing influence of cryptocurrencies.

Moreover, Bitcoin’s decentralized nature challenges traditional financial institutions. As more people turn to Bitcoin for transactions, banks may have to rethink their roles in facilitating payments and managing currency exchanges.

COMMUNITY AND CULTURE OF BITCOIN

The Bitcoin community is vibrant and diverse, filled with enthusiasts from all walks of life. Whether you’re a developer, investor, or simply someone interested in the technology, there’s a place for you in this community. Engaging with others who share your interests can provide valuable insights and support as you navigate the world of cryptocurrency.

Online forums, social media groups, and local meetups can be great ways to connect with other Bitcoin enthusiasts. Sharing knowledge and experiences can help you stay informed about the latest trends and developments in the space.

CONCLUSION

Bitcoin’s achievement of becoming the 8th biggest currency globally is a powerful indicator of its rising influence. Surpassing the Taiwan Dollar and closing in on the Hong Kong Dollar showcases its growing acceptance. With a market cap of $2.2 trillion and climbing fast, Bitcoin is not just a passing trend; it’s a fundamental shift in how we view currency.

As we continue to watch Bitcoin’s journey, it’s clear that its impact on the financial landscape will be felt for years to come. Whether you’re an investor, enthusiast, or just curious about what Bitcoin has to offer, now is the time to pay attention. The world of cryptocurrency is evolving rapidly, and Bitcoin is leading the charge.

“`

This article is designed to be engaging and informative while adhering to SEO best practices and incorporating the specified keywords.

BITCOIN NOW RANKS AS THE 8TH BIGGEST CURRENCY GLOBALLY, SURPASSING THE TAIWAN DOLLAR AND CLOSING IN ON THE HONG KONG DOLLAR!

$2.2T MARKET CAP AND CLIMBING FAST!