President trump‘s Announcement on Fannie Mae and Freddie Mac

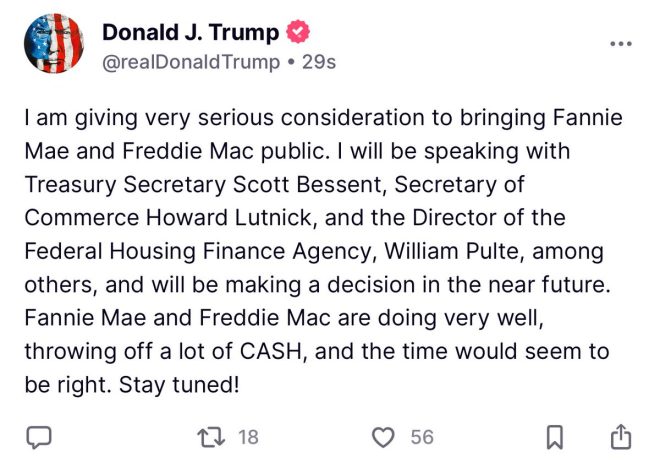

In a recent announcement that has sent shockwaves through the political and financial landscape, President Trump revealed his intention to discuss the potential public offering of Fannie Mae and Freddie Mac with Treasury Secretary Scott Bessent. This announcement, made on May 21, 2025, has garnered significant attention, particularly among political commentators and financial analysts. The implications of such a move are vast and could reshape the housing finance system in the United States.

The Context of Fannie Mae and Freddie Mac

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) are government-sponsored enterprises (GSEs) that play a crucial role in the U.S. housing market. Established to enhance liquidity in the mortgage market, these entities buy mortgages from lenders, pooling them into securities that are then sold to investors. This process helps ensure that mortgage credit is available to a wide range of borrowers, thus facilitating homeownership and stabilizing the housing market.

However, following the financial crisis of 2008, both Fannie Mae and Freddie Mac were placed under conservatorship by the Federal Housing Finance Agency (FHFA). Since then, discussions about their future have been contentious, with various stakeholders advocating for different approaches, ranging from continued government control to a complete privatization of the enterprises.

Implications of Going Public

The prospect of taking Fannie Mae and Freddie Mac public raises several important questions. If these entities were to be privatized, it would fundamentally alter their operational structures and objectives. Proponents argue that bringing Fannie Mae and Freddie Mac to the public market could enhance their efficiency and accountability by subjecting them to the rigors of the free market. This could potentially lead to better service for consumers and a more resilient housing finance system.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

However, critics warn that privatization could jeopardize the mission of these enterprises, which is to promote affordable housing and ensure access to mortgage credit for all Americans. The fear is that profit motives could overshadow the public interest, leading to higher costs for consumers and reduced access to loans for lower-income families.

Political Reactions

The announcement has elicited strong reactions from various political factions. Many conservatives and supporters of President Trump view this move as a necessary step toward reducing government involvement in the housing market. They believe that privatization could lead to increased competition and innovation in the mortgage sector, ultimately benefiting consumers.

On the other hand, liberal commentators and housing advocates are expressing alarm at the potential consequences of such a change. They argue that removing government oversight could lead to a repeat of the reckless lending practices that contributed to the 2008 financial crisis. The mention of Secretary Bessent’s involvement in these discussions adds another layer of complexity, as he is known for his cautious approach to financial regulation.

The Importance of Strategic Planning

As discussions progress, it will be essential for the government to engage in thorough strategic planning. Any move to privatize Fannie Mae and Freddie Mac must consider the long-term implications for the housing market and the overall economy. Policymakers will need to weigh the benefits of increased efficiency against the potential risks to housing affordability and access.

Moreover, transparency in the process will be crucial to maintaining public trust. Stakeholders from various sectors, including financial institutions, housing advocates, and the general public, should be included in discussions to ensure that diverse perspectives are considered.

The Path Forward

President Trump’s initiative to engage with Treasury Secretary Bessent on this matter could mark a pivotal moment in the future of housing finance in America. As the administration moves forward, it will be essential to monitor developments closely. The outcome of these discussions could have far-reaching consequences, not only for Fannie Mae and Freddie Mac but also for the millions of Americans who rely on them for affordable mortgage options.

In conclusion, the potential public offering of Fannie Mae and Freddie Mac represents a significant shift in U.S. housing finance policy. The discussions led by President Trump and Secretary Bessent will undoubtedly shape the future of these institutions and the housing market as a whole. As the nation grapples with the implications of this announcement, one thing is clear: the stakes are high, and the path ahead will require careful consideration and strategic foresight.

Key Takeaways

- Fannie Mae and Freddie Mac’s Role: These GSEs are pivotal in providing liquidity to the mortgage market and supporting affordable housing.

- Privatization Risks: While privatization could enhance efficiency, it may also threaten the mission of promoting accessible housing.

- Political Divide: The announcement has polarized opinions, with conservatives advocating for reduced government involvement and liberals cautioning against potential risks.

- Importance of Strategic Planning: Any changes must be carefully planned and consider the long-term effects on consumers and the housing market.

- Monitoring Developments: Stakeholders should keep a close eye on discussions and decisions, as these will shape the future of housing finance in the U.S.

By understanding these facets, stakeholders can better prepare for the changes that may lie ahead in the housing finance system.

BREAKING President Trump said he will speak with Treasury Sec. Scott Bessent to bring Fannie Mae and Freddie Mac Public

HOLY SH*T Liberals are going to lose their minds pic.twitter.com/aeEnRS8dEu

— MAGA Voice (@MAGAVoice) May 21, 2025

BREAKING President Trump said he will speak with Treasury Sec. Scott Bessent to bring Fannie Mae and Freddie Mac Public

The news has just broken, and it’s already creating quite the buzz! President Trump has announced plans to engage with Treasury Secretary Scott Bessent about taking Fannie Mae and Freddie Mac public. If you haven’t been following the housing finance market, these two entities have played a crucial role in the U.S. housing industry since their inception. The announcement is stirring up a whirlwind of reactions, especially among liberals who are likely to have strong feelings about this move. So, what does this mean for the American economy and the housing market?

Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that were placed under federal conservatorship during the 2008 financial crisis. Their role has been to provide liquidity, stability, and affordability in the housing market. By bringing them public, President Trump is essentially suggesting a shift in the way these institutions operate, potentially leading to more private sector involvement and less government oversight.

HOLY SH*T Liberals are going to lose their minds

You can already imagine the reactions flooding social media! Liberals have historically been opposed to privatization efforts that could jeopardize the affordability of housing for many Americans. The idea of making Fannie Mae and Freddie Mac public may trigger fears of increased costs for homebuyers, as private investors typically seek profits.

So, what’s the rationale behind this bold move? For one, Trump and his administration could argue that this is a step toward reducing the federal government’s footprint in the housing sector. Additionally, it could be seen as a push for innovation and efficiency in the way mortgage financing is handled. However, the implications are far-reaching, and not everyone is on board with the idea.

Some critics are likely to argue that taking these entities public could lead to a repeat of the issues that caused the 2008 financial crisis. After all, the housing market is incredibly sensitive to changes in policy and economic conditions. If Fannie Mae and Freddie Mac were to operate like traditional public companies, the potential for reckless behavior might increase, leading to a new set of challenges for regulators and consumers alike.

What This Means for Homeowners and Future Buyers

If the plan to take Fannie Mae and Freddie Mac public goes through, it could have a significant impact on homeowners and potential buyers. For one, interest rates on mortgages might rise as investors seek higher returns on their investments. This could make home buying less affordable for many Americans, especially younger generations who are already grappling with student debt and rising living costs.

Moreover, with private investors more involved, the focus might shift from providing affordable loans to maximizing profits. This shift could lead to stricter lending practices and fewer options for those with less-than-perfect credit scores. The very foundation of what Fannie Mae and Freddie Mac were intended to do—offer accessible financing—could be at risk.

Reactions from the Political Arena

It’s no surprise that political reactions are pouring in. Democrats are likely to voice strong opposition to this proposal, framing it as a threat to the stability of the housing market and a step backward for middle-class families. On the other hand, some Republicans may view this as a necessary step toward restoring free-market principles in the housing sector.

Social media is already buzzing with opinions from both sides. Liberals are expressing their outrage, while conservatives are celebrating what they see as a bold move toward economic freedom. This discourse will likely continue to escalate as more details about the plan emerge.

The Implications for the Housing Market

The implications of this announcement could ripple through the housing market in various ways. If Fannie Mae and Freddie Mac are brought public, we could see changes in how mortgages are underwritten and structured. Lenders might become more cautious, resulting in stricter lending requirements. First-time homebuyers could find themselves facing higher down payment requirements and interest rates, making it even more challenging to enter the housing market.

Furthermore, if private investors take a more significant role in funding mortgages, the risk of housing bubbles could increase. With profit as the primary motive, investors might focus on high-demand areas, driving up prices and potentially leading to a scenario where affordable housing becomes even scarcer.

What Experts Are Saying

Economic analysts are keeping a close eye on this breaking news. Some experts argue that bringing Fannie Mae and Freddie Mac public could lead to greater efficiency in the housing finance market. They believe that private investment could drive innovation and improve services for consumers. However, others caution that this move could be detrimental to the very consumers it aims to serve, particularly those who rely on affordable housing options.

For instance, a recent [article from The Wall Street Journal](https://www.wsj.com/) discusses the potential consequences of privatizing these GSEs and highlights the concerns surrounding increased mortgage rates and stricter lending practices. It’s essential to consider both sides of the argument and weigh the potential benefits against the risks.

Potential Outcomes: A Look Ahead

As the conversation continues, it’s crucial to consider what the future might hold if this proposal moves forward. Would we see a wave of new policies aimed at protecting consumers, or would the focus shift entirely toward profitability? The answer lies in how lawmakers and regulators respond to this change.

If Fannie Mae and Freddie Mac go public, it could set a precedent for other government agencies and programs. This might lead to a broader shift in how the government interacts with markets, potentially reshaping the landscape of American finance.

Moreover, the public’s reaction could influence future elections and policy decisions. If voters feel that their housing options are being compromised, it could lead to significant shifts in political power. The 2026 elections could see housing policy becoming a central issue, with both parties vying for the support of frustrated homeowners and renters alike.

Conclusion

As we digest this breaking news, one thing is clear: the announcement from President Trump about bringing Fannie Mae and Freddie Mac public will have far-reaching implications for the housing market and the economy at large. The reactions from both sides of the political spectrum will undoubtedly shape the conversation around this topic in the coming days.

It’s a time for homeowners, potential buyers, and policymakers to stay informed and engaged. The future of housing finance is at a crossroads, and how we navigate these changes will determine the landscape of homeownership in America for years to come. Buckle up; it’s going to be an exciting ride!

Breaking News, Cause of death, Obituary, Today