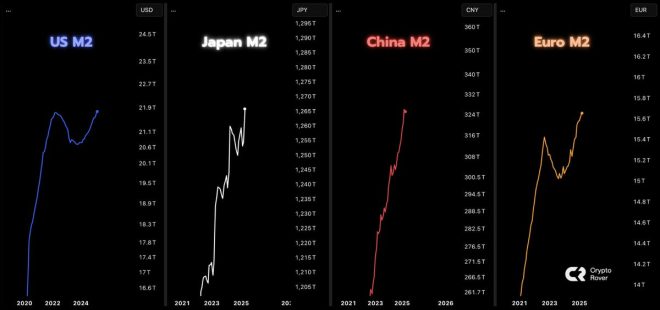

Global Money Supplies Approach All-Time Highs

In recent times, global money supplies have been breaking all-time highs (ATHs) or are on the verge of doing so. This significant increase in liquidity is poised to have profound implications for the financial markets, particularly in the realms of cryptocurrency and traditional investments. As governments and central banks around the world continue to inject trillions of dollars into their economies to combat economic slowdowns and support recovery, the impact on asset prices is becoming increasingly apparent.

Trillions of Fresh Liquidity Entering the Market

The influx of trillions in fresh liquidity can be attributed to various monetary policies designed to stimulate economic growth. Central banks are implementing low-interest rates, quantitative easing, and other measures to ensure that businesses and consumers have access to capital. This trend is not only limited to traditional fiat currencies but is also affecting the cryptocurrency markets. The ample availability of capital is likely to lead to increased investment in various asset classes, including Bitcoin and altcoins.

The Implications for Bitcoin

As global money supplies continue to swell, Bitcoin is expected to experience significant upward momentum. Historically, Bitcoin has demonstrated a strong correlation with increases in liquidity. When more money is available in the system, more investors tend to flock to alternative assets like Bitcoin, which is often seen as a hedge against inflation and a store of value. With the current trends indicating an influx of capital, it is reasonable to anticipate a substantial price increase for Bitcoin in the coming months.

Altcoins Set to Explode

In addition to Bitcoin, altcoins are also likely to see considerable price increases as the market experiences this liquidity boom. Altcoins, which include a wide range of cryptocurrencies beyond Bitcoin, have the potential for explosive growth, especially when the overall market sentiment is positive. Investors are likely to diversify their portfolios, seeking opportunities in various altcoins that exhibit strong fundamentals and growth potential. As liquidity increases, more capital will flow into these projects, further driving their prices up.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Preparing for Market Movements

Given the current economic climate and the impending influx of liquidity, it is crucial for investors to prepare accordingly. Here are a few strategies that can help individuals navigate the evolving market landscape:

1. **Diversify Investments**: Investors should consider diversifying their portfolios to include a mix of Bitcoin, altcoins, and traditional assets. This strategy can help mitigate risk while also positioning investors to capitalize on growth opportunities across different markets.

2. **Stay Informed**: Keeping abreast of market trends, economic indicators, and regulatory developments is essential for making informed investment decisions. Knowledge of market dynamics can give investors a competitive edge and help them anticipate changes in asset prices.

3. **Set Clear Goals**: Establishing clear investment goals and risk tolerance levels is vital. Understanding one’s investment objectives can guide decision-making and help investors remain focused during periods of volatility.

4. **Utilize Technical Analysis**: Learning how to read charts and utilize technical indicators can aid investors in identifying potential entry and exit points for their trades. Technical analysis can provide valuable insights into market trends and price movements.

5. **Be Cautious of FOMO**: The fear of missing out (FOMO) is a common emotional response in rapidly moving markets. Investors should be cautious not to make impulsive decisions based on hype or speculation. Instead, they should stick to their investment strategy and make decisions grounded in research.

Conclusion

As global money supplies approach all-time highs, the financial landscape is poised for significant changes. The anticipated influx of trillions of dollars in liquidity will likely drive Bitcoin and altcoins to new heights. Investors should prepare for these market movements by diversifying their portfolios, staying informed, and employing sound investment strategies. By being proactive and making informed decisions, investors can position themselves to take advantage of the opportunities that arise in this dynamic and evolving market.

Global money supplies are breaking ATHs, or are close to doing so.

Trillions of fresh liquidity will enter the market.

Bitcoin will pump, and altcoins will explode.

Prepare accordingly! https://t.co/tqhwTbI9UL

Global Money Supplies Are Breaking ATHs, or Are Close to Doing So

The financial landscape is undergoing a significant transformation, and if you’ve been keeping an eye on global money supplies, you know what I’m talking about. It seems like we’re on the brink of something monumental, as these money supplies are breaking all-time highs (ATHs) or are close to doing so. With trillions of fresh liquidity poised to enter the market, it’s a time for excitement—and a bit of caution.

So, what does this mean for everyday investors and crypto enthusiasts alike? Buckle up, because the implications are massive, especially for Bitcoin and altcoins.

Trillions of Fresh Liquidity Will Enter the Market

Let’s break it down. The central banks around the world have been engaging in expansive monetary policies, printing money like it’s going out of style. This is mainly to stimulate economies that have been hit hard by various global events, such as the pandemic. The result? Trillions of dollars, euros, and other currencies are flooding into the market.

This surge in liquidity creates an environment ripe for investment. When there’s more money available, investors often turn to assets that can potentially offer higher returns, like cryptocurrencies. The influx of cash into the crypto space could lead to a significant price increase for Bitcoin and altcoins.

According to a [recent report by the Federal Reserve](https://www.federalreserve.gov), the total money supply has increased dramatically over the past few years. This trend is not just limited to the United States; countries around the globe are following suit. So, it’s safe to say that we’re not just looking at a localized phenomenon—this is a global movement.

Bitcoin Will Pump

With all this fresh liquidity entering the market, it’s almost a given that Bitcoin will see a significant price surge. Historically, Bitcoin has acted as a bellwether for the entire cryptocurrency market. When Bitcoin pumps, altcoins usually follow suit.

Why is Bitcoin so special? Well, it’s the first cryptocurrency and has established itself as a digital gold of sorts. Investors see it as a hedge against inflation and a way to preserve wealth. As more institutional investors and retail traders come into the market, the demand for Bitcoin is likely to skyrocket.

Just take a look at what happened in previous bull runs. Each time there’s an increase in money supply, Bitcoin experiences a significant price rise. Many analysts are predicting a similar outcome this time around. If you’re holding Bitcoin, now might be the time to sit tight and watch your investment grow.

Altcoins Will Explode

While Bitcoin often takes the spotlight, we can’t forget about altcoins. With trillions in fresh liquidity, altcoins are also poised for explosive growth. Many altcoins have been underperforming compared to Bitcoin, but that could change rapidly as liquidity flows into the market.

Some altcoins have incredible use cases and communities that support them. Think of Ethereum, which is the backbone for decentralized applications (dApps), or Cardano, which is gaining traction for its focus on sustainability. As investors look for more than just Bitcoin, these altcoins could see a massive surge in interest and price.

The key here is to do your research. Some altcoins are more speculative than others, and while the potential for high returns is exciting, the risks can be equally high. Make sure to analyze the fundamentals of each altcoin before investing.

Prepare Accordingly!

So, what should you do with all this information? Preparation is key. The market can be volatile, and while there’s a lot of optimism around this liquidity surge, it’s essential to approach the situation with a level head.

First off, make sure your crypto holdings are secure. With the potential for a massive influx of cash, we could see a lot of volatility. Consider using hardware wallets for long-term storage and exchange wallets for trading.

Next, think about diversifying your portfolio. While Bitcoin is often considered a safe bet, don’t overlook the potential of altcoins. Research different projects and find ones that resonate with you.

Finally, keep an eye on market trends. Follow reputable news sources and analysts to stay updated on price movements and market sentiment. The more informed you are, the better your chances of making savvy investment decisions.

As we look toward a future filled with possibilities, the current state of global money supplies presents a unique opportunity. Whether you’re a seasoned investor or just starting, understanding these dynamics can help you navigate the exciting—and sometimes daunting—world of cryptocurrencies.

In this ever-changing financial landscape, being prepared is half the battle. So, gear up and get ready for what could be one of the most thrilling times in the crypto market. The floodgates are open, and the possibilities are endless. Remember to stay informed, stay secure, and most importantly, enjoy the ride!

Global money supplies are breaking ATHs, or are close to doing so.

Trillions of fresh liquidity will enter the market.

Bitcoin will pump, and altcoins will explode.

Prepare accordingly!