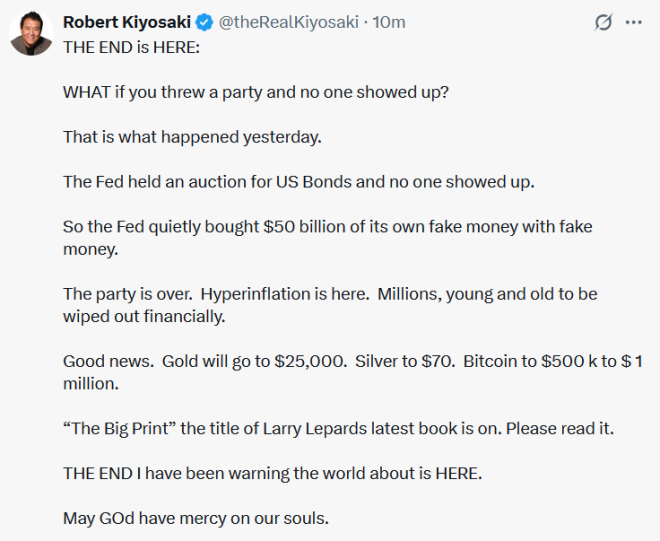

In a recent tweet that has garnered significant attention, the author of the popular financial book “Rich Dad Poor Dad,” Robert Kiyosaki, raised eyebrows with alarming predictions regarding the U.S. economy and the future of Bitcoin. His statement, “FED HELD A BOND AUCTION AND NO ONE SHOWED UP,” suggests a troubling lack of interest in U.S. government bonds, which could indicate deeper financial instability. Kiyosaki’s bold prediction foresees Bitcoin soaring to extraordinary heights, with estimates ranging from $500,000 to $1 million per coin.

### The Implications of a Failed Bond Auction

A bond auction is a critical mechanism through which the government raises funds. When Kiyosaki asserts that no one attended a recent auction, it suggests a significant lack of confidence among investors in U.S. debt. This absence can imply that bond yields may rise, leading to increased borrowing costs for the government and, by extension, the economy. Such a scenario could drive investors toward alternative assets, including cryptocurrencies like Bitcoin.

### The Bitcoin Surge Prediction

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Kiyosaki’s prediction of Bitcoin reaching between $500,000 and $1 million is not just sensationalism; it reflects a growing sentiment among many investors who see cryptocurrencies as a hedge against inflation and economic uncertainty. Bitcoin’s limited supply, capped at 21 million coins, positions it as a deflationary asset, contrasting sharply with fiat currencies that can be printed without limit. As people lose faith in traditional markets, Bitcoin’s appeal as a store of value may become even more pronounced.

### The Role of Inflation and Economic Instability

The financial landscape in the U.S. has been tumultuous, with rising inflation and economic uncertainty exacerbated by various global events, including geopolitical tensions and the ongoing impacts of the COVID-19 pandemic. Kiyosaki’s warnings resonate with those who believe that traditional financial systems are under threat. As inflation erodes purchasing power, more individuals may turn to Bitcoin and other cryptocurrencies as a means of preserving their wealth.

### The Growing Interest in Alternatives to Traditional Investments

As traditional investments face challenges, the interest in Bitcoin and other cryptocurrencies has surged. Kiyosaki’s prediction aligns with a broader trend where investors are seeking alternative assets to diversify and protect their portfolios. Bitcoin, often referred to as “digital gold,” is increasingly viewed as a viable investment option, especially during times of economic uncertainty.

### The Community’s Response

The reaction to Kiyosaki’s tweet has been a mix of intrigue and skepticism. While some investors and crypto enthusiasts are excited about the potential for Bitcoin to reach unprecedented values, others remain cautious, noting the volatility and risks associated with cryptocurrencies. The conversation around Bitcoin’s future is vibrant, with various analysts and influencers contributing differing perspectives.

### The Importance of Staying Informed

For those considering investing in Bitcoin or other cryptocurrencies, it’s crucial to stay informed about market trends and economic indicators. Kiyosaki’s predictions serve as a reminder of the potential for significant shifts in the financial landscape. Investors should conduct thorough research and consider their risk tolerance before diving into the cryptocurrency market.

### Conclusion

Robert Kiyosaki’s recent remarks regarding a failed bond auction and his bullish Bitcoin prediction have sparked widespread discussion about the future of finance. With economic instability on the rise, many are looking to Bitcoin as a potential safe haven. As the financial landscape continues to evolve, keeping an eye on alternative investments like cryptocurrencies will be essential for both seasoned investors and newcomers alike. Whether Kiyosaki’s predictions come to fruition remains to be seen, but one thing is clear: the conversation around Bitcoin and its potential role in the global economy is far from over.

Investors should remain vigilant, informed, and ready to adapt to the ever-changing market dynamics as they navigate these uncertain times.

JUST IN: RICH DAD AUTHOR SAYS “FED HELD A BOND AUCTION AND NO ONE SHOWED UP”

PREDICTS #BITCOIN TO HIT $500K–$1M pic.twitter.com/V99UdHA1Wv

— The Moon Show (@TheMoonShow) May 21, 2025

JUST IN: RICH DAD AUTHOR SAYS “FED HELD A BOND AUCTION AND NO ONE SHOWED UP”

Have you heard the latest buzz in the financial world? Renowned author and entrepreneur Robert Kiyosaki, famously known for his book “Rich Dad Poor Dad,” recently dropped a bombshell. He stated that during a recent bond auction held by the Federal Reserve, there was virtually no participation. That’s right—no one showed up! This has raised eyebrows and sparked discussions about the current state of the economy and the future of investing.

Kiyosaki’s alarming statement about the bond auction reflects a growing concern about the reliability of traditional financial instruments. With trust in government-issued bonds waning, many investors are left pondering their next moves. If even the Federal Reserve can’t attract buyers, what does that mean for the future of the economy?

PREDICTS #BITCOIN TO HIT $500K–$1M

Now, here’s the kicker: Kiyosaki believes that this situation could lead to an explosive surge in Bitcoin’s value, predicting it could skyrocket to between $500,000 and $1 million! It’s a bold claim that’s sure to ignite the cryptocurrency community.

So, what’s behind this prediction? Let’s break it down. With traditional investments like bonds losing their appeal, more people may start looking for alternatives. Bitcoin, with its decentralized nature and finite supply, has long been touted as a hedge against inflation and a safe haven during economic uncertainty. Kiyosaki’s assertion seems to resonate with that idea, suggesting that as confidence in the dollar and bonds declines, more investors might flock to cryptocurrencies like Bitcoin.

The Impact of the Federal Reserve’s Bond Auction

The Federal Reserve’s bond auction is a crucial mechanism for controlling the money supply and interest rates. When it holds an auction, it’s essentially trying to sell government debt to raise funds for various initiatives. But if no one shows up, it paints a dire picture of investor confidence.

This lack of interest in bonds could be indicative of a broader trend where investors are shifting their focus from traditional assets to more innovative options. It’s a wake-up call for those who still cling to the old financial norms, suggesting that a paradigm shift is underway.

What Does This Mean for Investors?

For everyday investors, Kiyosaki’s predictions about Bitcoin might seem like a gamble. However, they also present an opportunity for those willing to take the plunge. The cryptocurrency market has proven to be incredibly volatile, but it has also offered substantial returns for those who entered at the right time.

Investors need to evaluate their risk tolerance carefully. The potential of Bitcoin reaching $500,000 to $1 million is enticing, but it’s imperative to remember that investing in cryptocurrencies carries its own set of risks. Market fluctuations can be extreme, and without proper research and caution, it’s easy to lose money.

Why Bitcoin?

You might be wondering, why Bitcoin? Well, Bitcoin is often viewed as digital gold. Its limited supply—only 21 million coins will ever exist—makes it a scarce asset in a world where traditional currencies can be printed at will.

Moreover, Bitcoin operates on a decentralized network, meaning it isn’t controlled by any single entity or government. This independence appeals to many investors, especially in times when trust in traditional financial systems is faltering. As Kiyosaki highlights, if the Fed can’t attract bidders for bonds, it might just signal that more people are looking for alternatives, like Bitcoin.

Understanding the Future of Money

The conversation sparked by Kiyosaki’s remarks goes beyond just Bitcoin. It challenges us to rethink what money is and how we perceive value. As we navigate an increasingly digital world, the notion of currency is evolving. Cryptocurrencies are at the forefront of this evolution, providing an alternative to traditional banking systems.

Many are beginning to see Bitcoin and other cryptocurrencies not only as investments but as a form of currency that could potentially replace or complement fiat money. Could we be looking at a future where digital currencies dominate, leaving traditional assets in the dust?

Preparing for the Shift

If you’re considering diving into the world of cryptocurrency, it’s essential to equip yourself with the right knowledge. Start by educating yourself about how Bitcoin works, the underlying blockchain technology, and the factors that influence its price.

Additionally, look into securing your investments. Given that the cryptocurrency market is rife with scams and hacks, ensuring your assets are protected should be a top priority. Use reputable exchanges, enable two-factor authentication, and consider using hardware wallets for storing your Bitcoin.

The Role of Education in Cryptocurrency Investment

Education is key. Kiyosaki’s insights should encourage people to seek knowledge about their financial options. The more you know, the better equipped you are to make informed decisions. There are numerous resources available, from online courses to forums and podcasts, that can help you understand the intricacies of cryptocurrency investing.

As you learn, keep an eye on market trends, regulatory changes, and technological advancements in the crypto space. Staying informed will help you navigate the ever-changing landscape of digital currencies and make strategic investment choices.

Community and Networking

Joining a community of like-minded individuals can also be beneficial. Whether it’s through online forums, local meetups, or social media groups, connecting with other crypto enthusiasts can provide support, insights, and valuable resources. Sharing experiences and knowledge can help you refine your investment strategies and stay updated on the latest developments in the crypto world.

Conclusion: Embracing Change in the Financial Landscape

Kiyosaki’s assertion that “the Fed held a bond auction and no one showed up” serves as a pivotal reminder of the shifting financial landscape. His prediction of Bitcoin soaring to unprecedented heights challenges us to consider the future of money and our role within it.

As we explore the implications of these developments, it’s crucial to remain proactive in our financial education and investment strategies. The world of cryptocurrency is full of potential, but it requires a careful and informed approach. Will you take the leap into the future of finance? The choice is yours!