Bitcoin Market Analysis: Trends and Insights from Swissblock’s Fundamental Index

In the ever-evolving world of cryptocurrency, particularly Bitcoin (BTC), traders and investors are constantly analyzing market trends and indicators to make informed decisions. A recent tweet from a prominent figure in the crypto community highlighted the ongoing discussion around a potential double top formation at $107,000 for Bitcoin. However, contrary to popular belief, the data from Swissblock’s Bitcoin Fundamental Index suggests that the market trend remains intact, with no signs of breakdown in key on-chain signals.

Understanding the Double Top Concept

A double top is a technical analysis pattern that typically indicates a reversal in trend. It occurs when the price reaches a certain high point (in this case, $107,000) twice, without breaking through that resistance level. Many analysts see this as a bearish signal, predicting that the price may decline after failing to surpass this key level. However, it’s essential to consider various factors, including the broader market dynamics and underlying data, to draw accurate conclusions.

Swissblock’s Bitcoin Fundamental Index: A Deeper Look

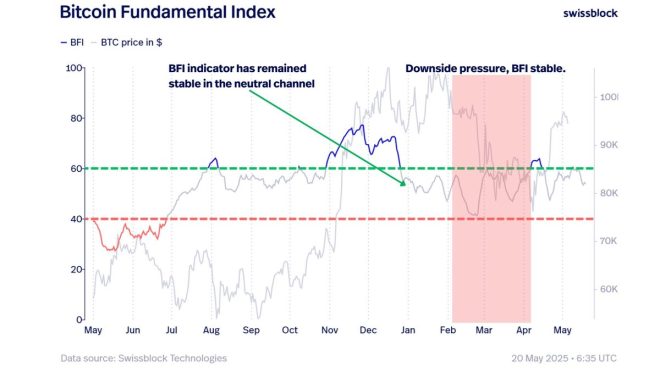

Swissblock’s Bitcoin Fundamental Index provides a comprehensive analysis of Bitcoin’s fundamental health, taking into account various indicators such as on-chain metrics, market sentiment, and macroeconomic factors. According to the recent data, the index indicates that the trend strength for Bitcoin is still intact, suggesting that the market may continue to push higher despite the apprehensions surrounding the double top formation.

On-Chain Signals Remain Strong

One of the critical aspects of the Swissblock analysis is the evaluation of on-chain signals. These signals track the behavior of Bitcoin transactions on the blockchain, providing insights into market activity, investor sentiment, and network health. Currently, on-chain signals are not showing signs of deterioration, which is a positive indicator for Bitcoin’s price trajectory.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

For instance, metrics such as transaction volume, active addresses, and miner activity are crucial in gauging the overall health of the Bitcoin network. High transaction volumes and increasing active addresses indicate growing interest and adoption, which can bolster price movements. Similarly, miner activity is essential; if miners are actively participating in the network, it suggests confidence in Bitcoin’s future value.

Historical Context: Price Discovery and All-Time Highs

Historically, when Bitcoin approaches within 10% of its all-time high (ATH), price discovery typically follows. The data indicates that in approximately 98% of such instances, Bitcoin has managed to break through previous resistance levels and establish new highs. This historical trend provides a compelling argument against the bearish sentiment surrounding the double top pattern.

In the context of the current market, Bitcoin’s recent price movement indicates it is nearing its ATH. If past performance is any indication, the likelihood of a bullish breakout remains high, despite the skepticism expressed by some analysts.

Market Sentiment and External Factors

It’s crucial to consider that market sentiment plays a significant role in driving Bitcoin’s price. As more investors become aware of the potential for upward momentum, buying pressure can intensify, leading to further price increases. Positive news, institutional adoption, and macroeconomic factors such as inflation or regulatory clarity can also contribute to a bullish outlook.

Conclusion: Staying Informed in a Volatile Market

In conclusion, while the discussion around a double top at $107,000 for Bitcoin raises valid concerns, the data from Swissblock’s Bitcoin Fundamental Index paints a different picture. The trend strength appears to be intact, and on-chain signals remain robust, suggesting that Bitcoin is positioned for potential price discovery.

As always, investors and traders must stay informed and consider various factors before making decisions. The cryptocurrency market is notoriously volatile, and conditions can change rapidly. By analyzing fundamental data, historical patterns, and market sentiment, participants can make more informed choices and navigate the complexities of the Bitcoin market with greater confidence.

In summary, while skepticism around the double top formation may exist, the evidence suggests that Bitcoin is still very much in a bullish phase. Keeping an eye on Swissblock’s Fundamental Index and its implications will be crucial for anyone looking to capitalize on the ongoing developments in the Bitcoin ecosystem.

With the potential for Bitcoin to break through previous resistance levels and establish new all-time highs, now is an exciting time for investors and enthusiasts alike to engage with this dynamic market.

Plenty of talk about a double top at $107K but the data says otherwise.

Swissblock’s Bitcoin Fundamental Index is still showing trend strength intact, and on-chain signals aren’t breaking down.

Historically, when $BTC gets within 10% of ATH, price discovery follows 98% of the… pic.twitter.com/ZedTZnRkej

— Senior (@SeniorDeFi) May 21, 2025

Plenty of Talk About a Double Top at $107K But the Data Says Otherwise

The cryptocurrency market is buzzing with chatter about Bitcoin’s potential price movements, particularly the notion of a double top forming at $107K. Many traders and investors are scratching their heads, wondering if this historical pattern will repeat itself or if there’s more to the story. Let’s dive into the data and see why some analysts believe that the current situation is much more complex than merely pointing to a double top.

One of the most notable indicators in this discussion is the [Swissblock’s Bitcoin Fundamental Index](https://swissblock.io/), which remains robust. This index is not just some arbitrary number; it’s a comprehensive measure that takes into account various on-chain signals and market dynamics. The index is showing that the trend strength for Bitcoin is still intact, indicating that the bulls are not ready to throw in the towel yet.

Swissblock’s Bitcoin Fundamental Index Is Still Showing Trend Strength Intact

It’s important to understand what the Swissblock’s Bitcoin Fundamental Index really signifies. This index provides traders with insights into Bitcoin’s underlying strength, factoring in elements such as network activity, transaction volume, and overall market sentiment. When the index shows positive signals, it typically suggests that the market is healthy and that Bitcoin is poised for potential growth.

So, why should you care? Well, many traders often rely on market sentiment and price charts alone, but these can be misleading. The Swissblock index offers a more nuanced view, helping to filter out the noise that often clouds decision-making in the crypto space. When this index indicates stability, it’s a signal that the price may not be as vulnerable to drastic corrections as some might believe.

On-Chain Signals Aren’t Breaking Down

Another crucial aspect to consider is that on-chain signals are holding up well. What does this mean in layman’s terms? Essentially, it means that the fundamental data supporting Bitcoin—like network transactions and wallets’ activity—is still strong. This is vital because it underlines the fact that there’s genuine interest and participation in the network, which is a good sign for long-term investors.

For example, when Bitcoin experiences a surge in active addresses or transaction volumes, it usually indicates that more people are entering the market. This can lead to price appreciation as demand outstrips supply. Conversely, if the on-chain metrics were to show signs of deterioration, it could indicate that a price correction is imminent. But right now, that’s not the case.

Historically, When $BTC Gets Within 10% of ATH, Price Discovery Follows 98% of the Time

Let’s take a moment to look at Bitcoin’s historical performance. There’s a compelling trend that many traders are keeping an eye on: whenever Bitcoin gets within 10% of its All-Time High (ATH), price discovery usually follows, and it has occurred 98% of the time. This means that in the vast majority of instances, when Bitcoin approaches its previous peak, the market tends to push the price higher.

This historical trend is crucial for anyone looking to understand Bitcoin’s price behavior. It provides a framework for making educated predictions about future price movements. So, if Bitcoin is hovering around that $107K mark, the data suggests that a significant price movement could be on the horizon.

But why does this happen? When Bitcoin nears its ATH, it creates a sense of urgency among traders and investors. FOMO (Fear of Missing Out) kicks in, leading to increased buying pressure, which can drive prices even higher. So, while the talk about a double top is prominent, the underlying data suggests that we might be on the brink of another price discovery phase instead.

Analyzing the FOMO Factor

Let’s break it down a bit more. FOMO is a powerful psychological driver in the crypto market. When people see Bitcoin nearing its ATH, they start to wonder if they should jump in before it skyrockets beyond reach. This kind of sentiment can create a self-fulfilling prophecy, where the mere anticipation of price increases leads to actual price increases.

This is why understanding market psychology is just as important as looking at technical indicators. The crypto market is often driven by emotions, and FOMO is a potent force that can lead to rapid price movements. As more and more traders enter the market, the demand for Bitcoin increases, and with that, the price tends to follow suit.

The Role of Institutional Investors

In recent years, institutional investors have increasingly entered the Bitcoin space. This is a game-changer for the market. When large institutions buy Bitcoin, they bring a level of legitimacy and stability that retail investors often lack. Their involvement can lead to increased demand and, consequently, higher prices.

Institutions typically have longer investment horizons than retail traders. They’re less likely to panic sell during market fluctuations, which can help stabilize prices. This institutional support is another reason why many analysts believe that the current market dynamics favor upward price movement rather than a double top scenario.

The Importance of Diversifying Your Research Sources

When navigating the crypto market, it’s easy to get lost in the noise. There are countless opinions and forecasts out there, but not all of them are based on solid data. That’s why it’s essential to diversify the sources from which you gather information. Relying solely on social media chatter or sensational headlines can lead to poor decision-making.

Platforms like [Swissblock](https://swissblock.io/) provide valuable insights based on data rather than speculation. When you back your trading decisions with solid data, you’re more likely to make informed choices that align with market trends.

Conclusion: The Bigger Picture

In summary, while there’s plenty of talk about a double top at $107K, the underlying data suggests that the market may be poised for another round of price discovery. With the Swissblock’s Bitcoin Fundamental Index showing trend strength intact and on-chain signals holding firm, there’s a strong case to be made for optimism.

Additionally, historical trends indicate that Bitcoin often experiences price increases when it gets close to its ATH. So, instead of getting caught up in the noise surrounding potential price patterns, it’s crucial to focus on what the data is telling us.

As you navigate the ever-changing landscape of the crypto market, remember to stay informed, consider multiple perspectives, and make decisions based on solid data. It’s a thrilling time to be involved in Bitcoin, and understanding the nuances of the market can help you make the most of this opportunity.

Plenty of talk about a double top at $107K but the data says otherwise.

Swissblock’s Bitcoin Fundamental Index is still showing trend strength intact, and on-chain signals aren’t breaking down.

Historically, when $BTC gets within 10% of ATH, price discovery follows 98% of the