Understanding the Potential Credit Downgrade of the United States

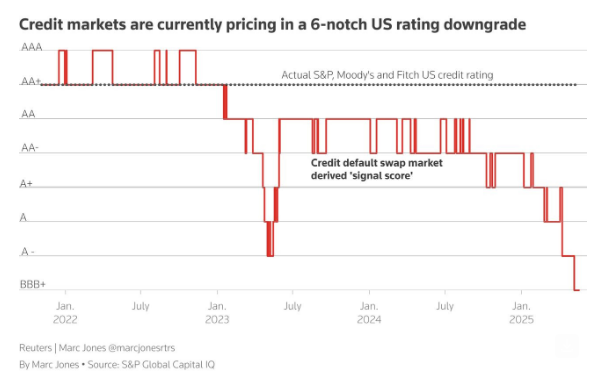

In a significant development that has sent ripples through financial markets, a recent report from Barchart highlighted that credit markets are currently pricing in a potential six-level credit downgrade for the United States. This downgrade could reduce the country’s credit rating to BBB, which is just above the investment-grade threshold. This alarming prediction raises questions about the implications for the U.S. economy, investors, and global markets.

What Does a Credit Downgrade Mean?

A credit downgrade occurs when a credit rating agency assesses that an entity, such as a country or corporation, has a higher risk of defaulting on its debts. In the case of the United States, a downgrade to a BBB rating would signify a decline in confidence regarding its ability to meet its financial obligations. This could lead to higher borrowing costs for the government, as investors demand a higher yield for taking on additional risk.

The Importance of Credit Ratings

Credit ratings play a crucial role in the financial ecosystem. They influence the cost of borrowing for governments and corporations, affect investment decisions, and impact the overall economic environment. A downgrade can lead to increased costs for the government, which may result in reduced spending on public services and infrastructure. Additionally, it can dampen investor sentiment, leading to volatility in the stock and bond markets.

The Current Financial Landscape

As of May 2025, the economic landscape in the United States is characterized by several factors that could contribute to a potential credit downgrade. These include rising national debt levels, inflationary pressures, and uncertain economic growth. The COVID-19 pandemic has exacerbated existing fiscal challenges, leading to increased government spending and deficits.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investor Reactions to the Downgrade Prediction

Investors are closely monitoring the situation as the potential for a credit downgrade looms. A downgrade to BBB could trigger sell-offs in U.S. Treasury securities, which are traditionally seen as safe-haven assets. This could lead to increased yields on government bonds, making borrowing more expensive for the federal government. Higher interest rates may also trickle down to consumers, impacting mortgages, auto loans, and credit cards.

Implications for the Global Economy

The implications of a U.S. credit downgrade extend beyond domestic borders. The United States holds a pivotal role in the global economy, and any significant changes in its credit rating can lead to global market instability. Investors around the world rely on U.S. Treasuries as a benchmark for risk-free assets. A downgrade could lead to a re-evaluation of risk across global markets, affecting currencies, commodities, and other asset classes.

The Path Forward

As the situation develops, it is crucial for policymakers to address the underlying issues contributing to the potential credit downgrade. This may involve implementing fiscal policies aimed at reducing the national debt and promoting sustainable economic growth. Additionally, engaging in constructive dialogue with credit rating agencies can help restore confidence in the U.S. creditworthiness.

Conclusion

The prediction of a six-level credit downgrade for the United States to a BBB rating raises serious concerns about the country’s financial stability and economic future. As investors grapple with the potential consequences, it is essential to monitor the evolving situation closely. Understanding the implications of a credit downgrade and taking proactive measures can help mitigate risks for both the U.S. economy and global markets.

In conclusion, the financial community must remain vigilant as developments unfold surrounding the potential credit downgrade of the United States. The interplay of economic factors, government policies, and investor sentiment will ultimately shape the outcome of this critical issue.

Key Takeaways

- Credit Downgrade Significance: A potential six-level downgrade would place the U.S. credit rating at BBB, just above investment grade, signaling increased risk of default.

- Impact on Borrowing Costs: A downgrade could lead to higher borrowing costs for the U.S. government, impacting public spending and economic growth.

- Investor Sentiment: Concerns over a credit downgrade may trigger volatility in financial markets, affecting both domestic and international investors.

- Global Economic Effects: The U.S. plays a crucial role in the global economy, and changes in its credit rating could have widespread ramifications for global financial stability.

- Policy Response: Addressing fiscal challenges and engaging with credit rating agencies will be essential for restoring confidence in U.S. creditworthiness.

As the potential for a credit downgrade unfolds, it is important for stakeholders to stay informed and prepared for the implications that may arise from this critical issue.

BREAKING : United States

Credit markets are currently pricing in a 6-level credit downgrade for the United States, which would give it a rating of BBB, just a smidge above investment grade pic.twitter.com/WlwiP5IN6p

— Barchart (@Barchart) May 21, 2025

BREAKING : United States

In a surprising twist, the U.S. credit markets are currently pricing in a six-level credit downgrade for the United States. This downgrade would result in a rating of BBB, which is just a smidge above investment grade. That’s quite a shift from the traditionally high ratings that the U.S. has enjoyed for years. But what does this actually mean, and how does it impact the economy? Let’s dive into the details.

Understanding Credit Ratings

Credit ratings are like report cards for countries, corporations, and municipalities. They indicate the creditworthiness of an entity and are crucial for investors when making decisions about where to put their money. The ratings are typically assigned by agencies like Moody’s, S&P, and Fitch. The scale ranges from AAA, which indicates the highest level of creditworthiness, to D, which signifies default.

A BBB rating means that while the U.S. is still considered a relatively safe investment, it’s closer to the riskier end of the scale. This change in perception could lead to increased borrowing costs for the government and, subsequently, for consumers and businesses. It’s essential to understand what factors contribute to these ratings.

What’s Causing the Downgrade?

Several factors play into the decision to downgrade a country’s credit rating. For the United States, these might include rising national debt, political instability, and economic indicators that suggest a slowdown. Investors pay close attention to the fiscal policies enacted by the government, as these policies can either inspire confidence or raise red flags.

For instance, if the government continues to run high deficits without a clear plan for repayment, credit agencies might view this as a sign of financial irresponsibility. According to a recent report from Barchart, current market sentiments suggest that investors are becoming increasingly wary of the U.S. government’s ability to manage its debt.

The Impact of a BBB Rating

So, what happens if the United States really does receive a BBB rating? For one, it could lead to higher interest rates on government bonds. When investors perceive a higher risk, they demand higher returns to compensate for that risk. This can trickle down to consumers, impacting everything from mortgage rates to credit card interest rates.

A downgrade can also undermine confidence in the U.S. dollar as a global reserve currency. Many countries hold U.S. dollars to stabilize their own economies, and if the perception of the U.S. economy weakens, they may start looking for alternatives. This could lead to a decline in demand for the dollar, affecting its value.

Market Reactions and Investor Sentiment

The news of a potential credit downgrade can create ripples in the financial markets. Investors often react quickly to such news, adjusting their portfolios based on the perceived risks. If markets react negatively, we could see stock prices fall and volatility increase.

Moreover, consumer confidence might take a hit. If the average citizen hears that their country is being downgraded, it could lead to uncertainty about job security and economic stability. This change in sentiment can have a significant impact on spending habits, which in turn affects economic growth.

What Can Be Done?

So, what can the government do to mitigate the damage of a potential credit downgrade? Implementing responsible fiscal policies is crucial. This means balancing the budget and ensuring that spending doesn’t outpace revenue. Additionally, increasing transparency and accountability in financial dealings can boost investor confidence.

Another critical factor is bipartisan cooperation. Political stability is vital for fostering an environment where investors feel secure. If lawmakers can come together to address issues like the national debt and economic growth, it could help restore faith in the U.S. credit rating.

The Bigger Picture

The potential downgrade of the U.S. credit rating is not just a financial issue—it’s a reflection of broader economic and political challenges. It highlights the importance of sound governance and fiscal responsibility. While the immediate effects may be concerning, this situation can serve as a wake-up call for policymakers to address underlying issues before they escalate.

In an interconnected global economy, the implications of a downgrade extend beyond the borders of the United States. Countries around the world keep a close eye on U.S. economic health, and any signs of weakness can cause global market shifts. It’s a reminder of how intertwined our economies are and how actions taken in one country can have far-reaching consequences.

Final Thoughts

The possibility of a six-level credit downgrade for the United States is a topic that deserves attention and discussion. It serves as a crucial reminder of the importance of maintaining sound economic policies and governance. As the landscape of global finance continues to evolve, staying informed and proactive will be key in navigating these challenges.

Whether you’re an investor, a business owner, or just someone trying to make sense of the economy, understanding these dynamics is vital. Keep an eye on the news, and don’t hesitate to engage in conversations about how these changes could affect your financial future.

“`

This article provides a detailed look at the recent developments in U.S. credit ratings while maintaining an engaging and conversational tone. It includes relevant links and utilizes HTML headings to structure the content effectively for SEO.

Breaking News, Cause of death, Obituary, Today