Breaking news: $1 Billion USDT Minted at Tether Treasury

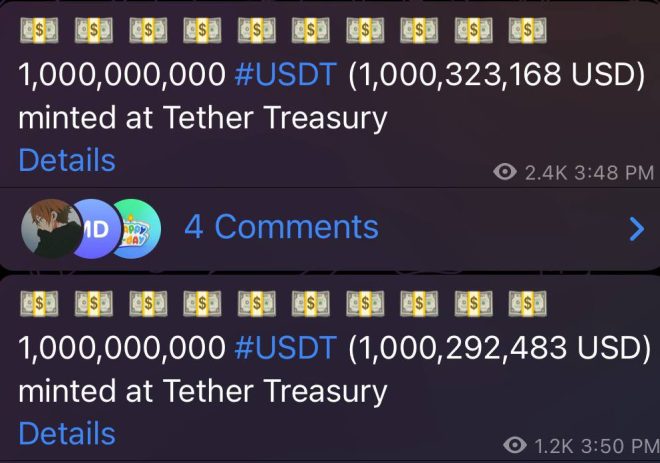

In a significant development for the cryptocurrency market, Tether has minted an additional $1 billion USDT (Tether’s USD-pegged stablecoin) at its treasury, bringing the total minted amount to a staggering $2 billion. This news, shared by crypto influencer Ash Crypto on Twitter, has sparked discussions and speculation within the crypto community.

Understanding Tether and USDT

Tether (USDT) is one of the most widely used stablecoins in the cryptocurrency ecosystem. Its value is pegged to the US dollar, meaning that 1 USDT is designed to equal 1 USD. This stability makes it a popular choice for traders and investors looking to navigate the volatile cryptocurrency market. By minting new USDT, Tether increases the supply of its stablecoin, which can impact market liquidity and trading dynamics.

The Impact of Minting $1 Billion USDT

The decision to mint an additional $1 billion USDT raises several questions and potential implications for the cryptocurrency market:

- Market Liquidity: Increasing the supply of USDT can enhance liquidity in the crypto markets. More USDT in circulation allows traders to execute larger trades without significantly impacting prices, potentially leading to more stable price movements.

- Price Stability: As more USDT is minted, it can contribute to the overall stability of cryptocurrency prices. Traders often use USDT as a safe haven during periods of market volatility. The influx of new USDT allows investors to quickly convert their assets into a stable currency, mitigating risks.

- Speculation and Trading Volume: The minting of $1 billion USDT is likely to fuel speculation in the market. Traders may anticipate price movements based on increased liquidity, leading to heightened trading volume. This can create opportunities for both short-term traders and long-term investors.

- Trust and Transparency: Tether has faced scrutiny in the past regarding its reserves and transparency practices. The minting of a significant amount of USDT raises questions about whether Tether has sufficient reserves to back the newly minted coins. Trust in the stability of USDT is crucial for its continued adoption.

Tether’s Role in the Crypto Ecosystem

Tether plays a crucial role in the broader cryptocurrency ecosystem. It serves as a bridge between traditional fiat currencies and digital assets, enabling seamless transactions and conversions. The minting of USDT can also influence the trading dynamics of various cryptocurrencies, as many exchanges offer USDT trading pairs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions

The reaction from the cryptocurrency community to Tether’s recent minting news has been mixed. Some traders view it as a positive development, believing that increased liquidity will lead to more robust trading opportunities. Others express caution, citing potential risks associated with Tether’s transparency and reserve practices.

Conclusion

The minting of an additional $1 billion USDT at the Tether treasury is a significant event that could have far-reaching implications for the cryptocurrency market. As liquidity increases and trading dynamics shift, traders and investors must remain vigilant and informed. The ongoing developments surrounding Tether’s minting practices will continue to be a focal point of discussion within the crypto community.

For those interested in the cryptocurrency market, keeping an eye on stablecoins like USDT is essential. They play a vital role in maintaining price stability and facilitating trading activities. As the market evolves, Tether’s actions will undoubtedly influence the broader landscape of digital assets.

In summary, Tether’s recent minting of $2 billion USDT highlights the importance of stablecoins in the cryptocurrency ecosystem. As liquidity increases and trading opportunities arise, traders and investors must navigate the complexities of the market with caution and a keen understanding of the implications of such developments.

BREAKING

ANOTHER $1 BILLION USDT JUST

MINTED AT THE TETHER TREASURY.TOTAL $2 BILLION MINTED pic.twitter.com/yR7N6RAREx

— Ash Crypto (@Ashcryptoreal) May 21, 2025

BREAKING

In the ever-evolving world of cryptocurrency, news travels fast, especially when it involves significant financial movements. Recently, the crypto community was abuzz with the announcement that another $1 billion USDT was minted at the Tether Treasury. This brings the total minted to a staggering $2 billion! This surge in USDT minting raises a multitude of questions about what it means for the market, the stability of stablecoins, and the ongoing narrative surrounding Tether.

ANOTHER $1 BILLION USDT JUST

The news of the latest minting comes from a tweet by Ash Crypto, a well-known figure in the crypto space. This tweet has caught the attention of both seasoned traders and newcomers alike. But what does it mean to mint such a large amount of USDT? Simply put, minting USDT involves creating new tokens that can be used for transactions, trading, and other financial activities. The process is backed by Tether’s reserves, which are meant to ensure that each USDT is always redeemable for one US dollar.

MINTED AT THE TETHER TREASURY

The Tether Treasury is essentially the central hub for all activities related to USDT minting and burning. Minting occurs when there is high demand for USDT, and Tether believes that issuing more tokens will help facilitate trading and liquidity in the market. This move can be seen as a response to the growing demand for stablecoins, particularly as investors look for safe havens amidst market volatility. But it also raises questions about the long-term implications of such large-scale minting. Will it affect the peg of USDT to the dollar? How will it influence market sentiment? These are all important considerations for anyone involved in the crypto space.

TOTAL $2 BILLION MINTED

The fact that Tether has minted a total of $2 billion in a short span has sparked conversations around the stability and transparency of the USDT. Critics have often pointed out the lack of clarity regarding Tether’s reserves, which has led to skepticism about the actual backing of their tokens. This latest minting episode only amplifies those concerns. Some argue that such a large minting could lead to inflationary pressures within the stablecoin market, while others see it as a necessary move to meet the increasing demand for liquidity.

WHAT DOES THIS MEAN FOR INVESTORS?

For investors, the minting of another $1 billion USDT could be seen as a double-edged sword. On one hand, it offers more liquidity in the market, which can be beneficial during times of high trading volume. On the other hand, it raises questions about the sustainability of Tether’s model and whether the company can maintain the 1:1 peg with the US dollar. If you’re holding USDT or considering investing in it, it’s essential to stay informed about these developments and understand the implications they may have on your investments.

THE ROLE OF STABLECOINS IN THE CRYPTO LANDSCAPE

Stablecoins like USDT play a crucial role in the cryptocurrency ecosystem. They serve as a bridge between volatile cryptocurrencies and fiat currencies, allowing traders to move in and out of positions without converting back to traditional money. With the recent minting, it’s clear that Tether aims to maintain its dominance in this space. However, the competition is heating up with other stablecoins like USDC and BUSD gaining traction. As an investor, it’s worth considering how these developments might impact your trading strategies.

THE FUTURE OF USDT

Looking ahead, the future of USDT will likely depend on several factors, including market demand and regulatory scrutiny. The recent minting highlights Tether’s ability to respond to market needs quickly, but it also puts them under the microscope. Investors should keep an eye out for any changes in regulatory policies surrounding stablecoins, as these could significantly impact Tether’s operations and trust within the community.

CONCLUDING THOUGHTS

This recent minting of $1 billion USDT at the Tether Treasury is a pivotal moment in the cryptocurrency landscape. It underscores the importance of stablecoins in providing liquidity and facilitating transactions. However, it also raises essential questions about transparency and the long-term viability of Tether’s operations. As the crypto market continues to evolve, staying informed about these developments will be crucial for anyone looking to navigate the complexities of cryptocurrency investing.

“`

This article is designed to engage readers with an informal tone while maintaining a focus on important developments in the cryptocurrency world, specifically regarding Tether and USDT. It incorporates SEO-friendly keywords and phrases relevant to the topic while providing a comprehensive overview of the implications of the recent minting announcement.

ANOTHER $1 BILLION USDT JUST

MINTED AT THE TETHER TREASURY.

TOTAL $2 BILLION MINTED