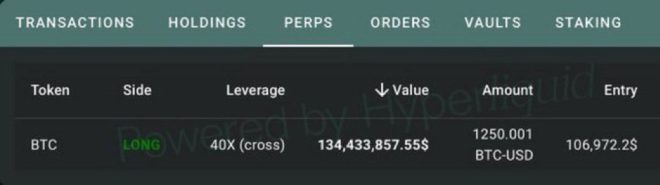

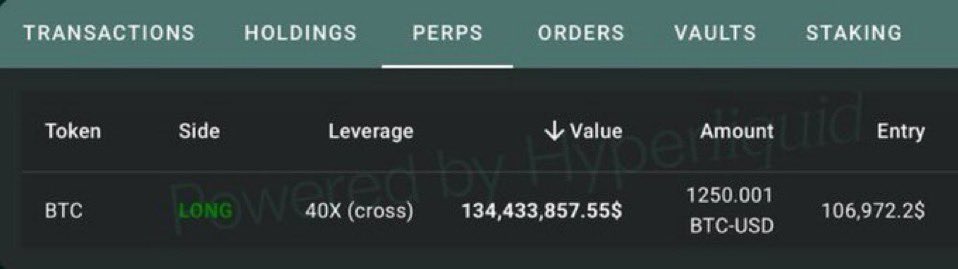

Whale Activity in Bitcoin: A $134 Million Long Position

In a significant development in the cryptocurrency market, a prominent whale has just opened a staggering $134 million long position on Bitcoin. This event, reported by popular cryptocurrency influencer That Martini Guy on Twitter, has sent ripples through the Bitcoin community and sparked conversations about the potential implications for the market. As the cryptocurrency landscape continues to evolve, understanding the impact of large players, or "whales," is crucial for investors and enthusiasts alike.

Understanding the Whale Phenomenon

Whales are individuals or entities that hold large quantities of cryptocurrencies. Their trading activities can significantly influence market prices due to the sheer volume of assets they control. When a whale makes a move, such as opening a substantial long position, it often signals confidence in the asset’s future performance. In this case, the $134 million long position on Bitcoin suggests that the whale anticipates a bullish trend for the cryptocurrency.

What Does a Long Position Mean?

A long position in trading refers to the purchase of an asset with the expectation that its price will rise. Traders who take long positions profit from the difference between the purchase price and the selling price when they eventually liquidate their position. In the context of Bitcoin, a long position indicates that the whale believes the current price is undervalued and expects it to increase in the near future.

The Current state of Bitcoin

As of May 2025, Bitcoin has been experiencing considerable volatility, a characteristic feature of the cryptocurrency market. The price of Bitcoin has seen both significant rallies and sharp corrections, making it a highly speculative investment. However, with institutional interest growing and adoption increasing, many analysts believe that Bitcoin could reach new all-time highs in the coming months.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions to Whale Movements

The cryptocurrency market is known for its sensitivity to large trades. When news of a whale opening a long position breaks, it often leads to increased trading volume and can influence the price direction. Traders and investors frequently look to whale activity as a barometer of market sentiment. A large long position can instill confidence in retail investors, potentially leading to a bullish trend.

Implications of the $134 Million Position

The announcement of a $134 million long position on Bitcoin raises several questions regarding market dynamics:

- Increased Interest: The whale’s investment may attract attention from other traders and investors. As more individuals become aware of the position, they may feel compelled to follow suit, leading to increased buying pressure.

- Market Stability: Large positions can provide a degree of stability in uncertain markets. If the whale is a well-known entity or institution, their involvement can lend credibility to Bitcoin, encouraging others to invest.

- Potential Price Movement: Should the whale’s prediction materialize, Bitcoin could see a significant upward movement. Conversely, if the market does not react as expected, the whale could face substantial losses, which may also affect market sentiment negatively.

The Importance of Market Analysis

For investors, understanding the motivations behind whale activity is essential for making informed decisions. Analyzing market trends, trading volumes, and the behavior of large players can provide valuable insights into potential price movements. Tools such as on-chain analysis can help track whale transactions, allowing investors to gauge market sentiment more accurately.

Staying Informed

In the fast-paced world of cryptocurrency, staying updated on significant events is crucial. Following influential figures, such as That Martini Guy, and monitoring platforms that provide real-time updates can help investors navigate the complexities of the market. Engaging with the community through social media platforms like Twitter can also offer diverse perspectives on market trends.

Conclusion

The opening of a $134 million long position on Bitcoin by a whale is a noteworthy event that underscores the ongoing evolution of the cryptocurrency market. As investors and traders react to this development, the potential implications for Bitcoin’s price and market sentiment will be closely observed. Understanding the influence of whale activity, market dynamics, and broader economic factors will be essential for anyone looking to navigate the world of cryptocurrency successfully.

In summary, the cryptocurrency landscape is shaped by various factors, and whale movements play a significant role in influencing market trends. As we move forward, the impact of large positions like this one will continue to be a topic of interest among investors, analysts, and enthusiasts alike.

BREAKING A WHALE JUST OPENED A $134M LONG POSITION ON #BITCOIN pic.twitter.com/8VYTw5DFpn

— That Martini Guy ₿ (@MartiniGuyYT) May 21, 2025

BREAKING A WHALE JUST OPENED A $134M LONG POSITION ON #BITCOIN

When it comes to the world of cryptocurrency, few events generate as much buzz as a significant investment by a whale. If you’re scratching your head and wondering what a whale is, let me fill you in. In crypto lingo, a whale refers to an individual or entity that holds a large amount of cryptocurrency, often enough to influence market dynamics. Recently, a whale made waves by opening a staggering $134 million long position on Bitcoin. This development has sent ripples through the market, raising questions about what it means for Bitcoin’s future and the broader crypto landscape.

Understanding Long Positions in Bitcoin

Now, before we dive deeper, let’s clarify what a long position is. When a trader opens a long position, they are essentially betting that the price of Bitcoin will rise. If their prediction comes true, they stand to make a profit. However, if the price drops, they could face significant losses. The fact that a whale has taken such a bold stance indicates a strong belief in Bitcoin’s upward potential. But why now?

Many analysts point to a combination of market factors, including growing institutional interest and recent regulatory developments that have positively impacted the crypto space. The whale’s decision could reflect a broader sentiment that Bitcoin is poised for a rally.

Market Reactions to the Whale’s Move

Investors are always on high alert when a whale makes a move, and this situation is no exception. Social media is buzzing with speculation and analysis. Some traders are interpreting this long position as a bullish signal, suggesting that the whale has insider knowledge or a solid analysis backing their decision. Meanwhile, skeptics argue that this could also be a strategic move to manipulate market sentiment.

For those trying to read the tea leaves, it’s essential to monitor Bitcoin’s price action over the coming days and weeks. Will this long position catalyze a market upswing? Or will it result in increased volatility as other traders react to the whale’s bold bet?

What Does This Mean for Retail Investors?

As a retail investor, you might be wondering how this whale’s long position impacts your own investment strategy. While it’s easy to get caught up in the hype, it’s crucial to maintain a level head. The actions of whales can influence market sentiment significantly, but they shouldn’t dictate your investment decisions.

Instead of reacting impulsively, take a moment to assess the broader market conditions. Are there fundamental changes happening that could affect Bitcoin’s price? Do you have a clear investment strategy based on your financial goals? Remember that while following the big players can offer insights, your unique situation should guide your decisions.

The Role of Institutional Investors in Bitcoin

The recent whale activity highlights the growing role of institutional investors in the cryptocurrency market. Institutions have been steadily entering the crypto space over the past few years, bringing with them increased legitimacy and stability. Their involvement often leads to more significant price movements and can trigger changes across the board.

Institutional interest in Bitcoin has surged, with companies like MicroStrategy and Tesla making headlines for their substantial Bitcoin purchases. This shift has contributed to Bitcoin’s price resilience and has attracted more retail investors eager to get in on the action.

Bitcoin’s Future: Bullish or Bearish?

So, what does the future hold for Bitcoin in light of this $134 million long position? While it’s impossible to predict with certainty, several indicators suggest a bullish outlook. Increased adoption, ongoing technological advancements, and growing mainstream acceptance all point to a favorable environment for Bitcoin.

However, potential pitfalls remain. Regulatory scrutiny, market volatility, and macroeconomic factors can all influence Bitcoin’s price trajectory. As an investor, it’s essential to stay informed about these developments and be prepared for any eventuality.

Conclusion: Staying Informed and Cautious

The recent whale activity in the Bitcoin market serves as a reminder of the dynamic nature of cryptocurrency investing. While it’s exciting to see such significant investments, it’s vital to approach the market with caution. Keep abreast of the latest news, understand the fundamentals behind Bitcoin, and develop a strategy that aligns with your risk tolerance and investment goals.

In the ever-evolving world of cryptocurrency, knowledge is power. Stay curious, do your research, and remember that while whales may influence the tides, your investment journey is uniquely your own.

BREAKING A WHALE JUST OPENED A $134M LONG POSITION ON #BITCOIN