The Impact of Bitcoin Whale Activity on the Market

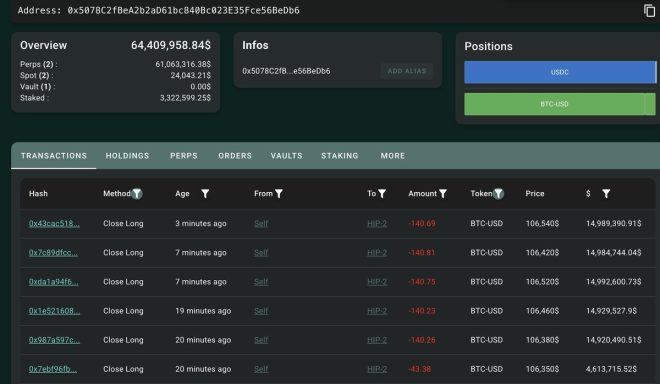

In the dynamic world of cryptocurrency, the actions of significant holders, often referred to as "whales," can have profound effects on market trends and sentiments. Recently, a notable event occurred when a Bitcoin whale, holding approximately $820 million in Bitcoin, began to close their long position. This event has caught the attention of traders, investors, and analysts alike, raising questions about its potential implications for the broader crypto market.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin, often enough to influence the market when they decide to buy or sell. These whales can include early adopters of Bitcoin, institutional investors, and hedge funds. Given their substantial holdings, their trading activities can lead to significant price fluctuations, as their decisions can sway market confidence.

The Whale’s Long Position

A long position in trading means that an investor has bought an asset with the expectation that its price will rise. In the case of the $820 million Bitcoin whale, their decision to close this position suggests a strategic move that could indicate a shift in market sentiment. These positions can be closed either to secure profits or to minimize potential losses, depending on the market’s current trajectory.

Market Reactions

The announcement of the whale closing their long position prompted immediate reactions across social media platforms, particularly Twitter, where users quickly speculated about the potential outcomes of this action. Traders often monitor whale activity as it can serve as a bellwether for market movements. The fear or excitement generated by such news can result in increased trading volume and volatility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Potential Implications for Bitcoin Prices

The closure of a significant long position can lead to various outcomes in the Bitcoin market:

- Short-Term Volatility: The immediate aftermath of such news often results in short-term price volatility. Traders may react by either selling their positions in fear of a downturn or buying in anticipation of a rebound, leading to rapid price swings.

- Market Sentiment: The actions of whales can heavily influence market sentiment. The closing of a long position by a whale may lead to bearish sentiment, causing other traders to reconsider their positions. Conversely, if the whale is closing their position to reinvest at a lower price, it could signal a potential buying opportunity for others.

- Technical Analysis: Many traders rely on technical analysis to predict price movements. The closure of a long position can lead to technical indicators showing bearish signals, which may trigger further selling from other traders.

Long-Term Effects

While the immediate impact of the whale’s actions is noteworthy, the long-term effects are equally important. If the whale’s closure of their long position leads to a sustained decline in Bitcoin prices, it could signal a larger trend of profit-taking among investors. This could indicate that the market may be reaching a local top, prompting further analysis of market fundamentals.

The Role of News and Social Media

In the age of digital communication, news travels fast, and social media platforms play a crucial role in shaping market perceptions. The tweet from Crypto Beast, which highlighted the whale’s actions, serves as an illustration of how quickly information can spread and influence trader behavior. Social media platforms are now essential tools for traders to gauge market sentiment and react to unfolding events.

Conclusion

The closure of a long position by a Bitcoin whale, especially one with a substantial holding like $820 million, is an event that cannot be overlooked in the cryptocurrency market. It serves as a reminder of the influence that large holders have on market dynamics and the importance of monitoring their actions.

As the market continues to evolve, traders and investors must remain vigilant and informed. Understanding the implications of whale activity is crucial for making informed trading decisions. The cryptocurrency landscape is characterized by its volatility and rapid changes, and staying ahead of the curve is essential for success in this dynamic environment.

In summary, the recent actions of the Bitcoin whale signify not only a critical moment in the market but also the broader trends that may shape the future of cryptocurrency trading. By staying informed about these developments, traders can better navigate the complexities of the crypto market, making strategic decisions based on both current events and historical patterns. The interplay between whale activity and market sentiment is a fascinating aspect of cryptocurrency trading that continues to intrigue and challenge participants in the space.

BREAKING

The $820M bitcoin whale started closing his long position https://t.co/ftAJ7JcDPc pic.twitter.com/mQixMnWr0Q

— Crypto Beast (@cryptobeastreal) May 21, 2025

BREAKING

When it comes to the world of cryptocurrency, few stories capture attention as much as the movements of major players, particularly when it involves significant sums like an $820 million bitcoin whale. Recently, a tweet from Crypto Beast stirred the crypto community, announcing that this whale had begun to close his long position. This development sent ripples through the market, raising questions and speculation among traders and investors alike. Let’s break down what this means and why it matters.

The $820M Bitcoin Whale: Who Are They?

Before diving into the implications of closing a long position, it’s essential to understand who these bitcoin whales are. In the crypto world, whales are individuals or organizations that hold large amounts of cryptocurrency. With such a significant investment, their actions can sway market trends. The $820 million whale mentioned in the tweet is a prime example of how big players can influence the market dynamics.

The identity of this whale is often shrouded in mystery. It could be a hedge fund, a venture capitalist, or even an individual investor who amassed their wealth in bitcoin over the years. Regardless of who they are, their investment strategies can provide insight into market sentiment. When a whale decides to close a long position, it usually signals a shift in confidence regarding the market’s current trajectory.

What Does Closing a Long Position Mean?

In trading terms, a long position refers to buying an asset with the expectation that its price will rise. Investors profit from the difference between the purchase price and the selling price once the asset appreciates. However, when a whale like this $820 million investor starts closing their long position, it can indicate several things.

For one, it may suggest that they believe the market has peaked and that it’s time to take profits before a potential downturn. Alternatively, it could signify a change in strategy, perhaps moving funds into other assets or into fiat currency. Whatever the reason, the action of closing a long position can create a domino effect, prompting other investors to reevaluate their own positions and strategies.

Market Reactions to the Closure of Long Positions

The reaction from the market can be swift and dramatic. When news broke about this whale closing their long position, many traders quickly took to social media to express their concerns. Some feared a market correction, while others saw it as an opportunity to buy in at a lower price. The volatility in the crypto market often leads to mixed reactions; one person’s panic can be another person’s opportunity.

History shows that when whales make significant moves, the market often follows suit. For example, when a notable whale sold off a large chunk of their bitcoin holdings in the past, it triggered a sell-off among smaller investors, leading to a sharp price drop. This time, many are watching closely to see if the same pattern will emerge or if the market will stabilize despite the whale’s actions.

The Bigger Picture: Understanding Market Sentiment

The actions of this $820 million bitcoin whale also speak to the broader market sentiment. In a rapidly changing environment, understanding trends and signals from major players can help investors make informed decisions. When whales move, it can reflect a lack of confidence in the market, particularly if they are closing long positions.

For example, if this whale is closing their long position due to fears of a downturn, it could indicate that other major players might follow suit. Conversely, if the market remains stable or even continues to rise after the closure, it may suggest that the whale’s actions were an isolated decision rather than a reflection of broader market trends.

Why Should Investors Pay Attention?

Investors should pay attention to movements like this for several reasons. First, it offers insight into the mindset of major players in the market. Understanding why a whale is closing a long position can provide valuable information for making personal investment decisions.

Moreover, tracking the behavior of whales can help investors identify potential market trends. If more whales start closing their positions, it could signal a broader shift in market sentiment, prompting a reevaluation of investment strategies across the board.

On the flip side, if the market holds steady or rebounds despite this whale’s actions, it may indicate resilience among smaller investors. In an environment as volatile as cryptocurrency, discerning these signals can be crucial for navigating the landscape successfully.

Potential Outcomes of This Development

The closing of a long position by a significant player like the $820 million bitcoin whale can lead to several potential outcomes. In the short term, the market may experience increased volatility as traders react to the news. If other whales join in and start closing their positions, it could lead to a downward spiral in prices.

However, it’s also possible that the market will stabilize. If the broader investor base remains optimistic about bitcoin and cryptocurrency’s long-term prospects, they may seize the opportunity to buy at lower prices, counteracting any downward pressure from the whales.

It’s also worth noting that the actions of one whale do not dictate the fate of the entire market. Cryptocurrency is influenced by a myriad of factors, including regulatory developments, technological advancements, and macroeconomic trends. Thus, while the closure of this long position is significant, it’s essential to consider it in the context of the larger market landscape.

Keeping an Eye on Future Developments

As the dust settles from the announcement of the $820 million bitcoin whale closing their long position, it’s crucial for investors and traders to keep an eye on future developments. Will this whale continue to offload their holdings, or will they reverse course and accumulate again?

Monitoring the behavior of this whale and others will provide valuable insights into market sentiment and potential price movements. Additionally, staying informed about broader market trends, regulatory changes, and technological advancements will help investors navigate the often tumultuous waters of cryptocurrency trading.

In the fast-paced world of crypto, being proactive and informed can make all the difference. While it’s easy to get caught up in the fear and excitement surrounding major announcements, maintaining a level-headed approach is key to successful investing.

In summary, the act of a significant player like the $820 million bitcoin whale closing their long position is a critical event in the cryptocurrency market, drawing attention and speculation. As the market reacts, understanding the implications of such moves will help investors make informed decisions moving forward. Keep your eyes peeled, folks; the world of cryptocurrency is always evolving!

The $820M bitcoin whale started closing his long position