BlackRock’s Bitcoin ETF Surges: A Bullish Sign for Investors

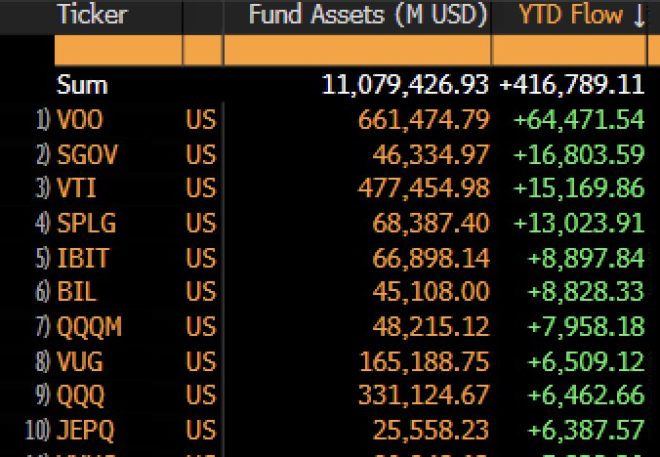

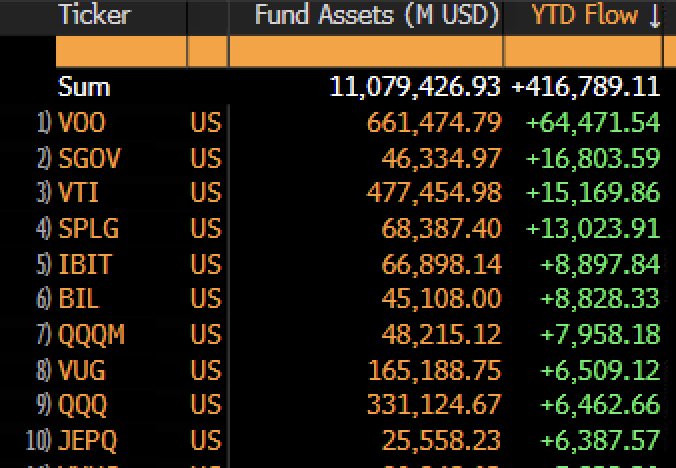

In recent financial news, BlackRock’s Bitcoin Exchange-Traded Fund (ETF) has made headlines by landing among the top five ETFs in year-to-date (YTD) flows. This announcement, shared by Bitcoin Magazine on May 21, 2025, underscores a significant resurgence in the cryptocurrency market, particularly for Bitcoin. As the bulls return to the market, investors are keenly observing the implications of this development.

Understanding BlackRock’s Bitcoin ETF

BlackRock, one of the largest asset management firms globally, has been instrumental in the growing acceptance of cryptocurrencies within mainstream finance. The launch of its Bitcoin ETF has attracted considerable attention, as it allows traditional investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency. Instead, the ETF tracks the performance of Bitcoin, making it a more accessible option for institutional and retail investors alike.

The Significance of YTD Flows

The term "YTD flows" refers to the net inflows or outflows of capital into an investment vehicle from the beginning of the year to the present date. Being in the top five ETFs for YTD flows is a strong indicator of investor confidence and interest. This surge can be attributed to several factors:

- Increased Institutional Interest: Institutional investors have been progressively warming to Bitcoin as a legitimate asset class. The introduction of BlackRock’s Bitcoin ETF has further legitimized this perspective, leading to increased investments.

- Market Recovery: After periods of volatility, the crypto market often experiences cycles of recovery. This latest bullish trend signals a potential rebound, drawing in both new and returning investors.

- Regulatory Clarity: As regulatory frameworks around cryptocurrencies become clearer, investors feel more secure in their investment choices. This clarity has been a driving force behind the renewed interest in Bitcoin and related investment products.

The Role of Bitcoin in a Diversified Portfolio

For many investors, Bitcoin represents a unique opportunity for diversification. Traditionally, investors have relied on stocks and bonds, but the emergence of cryptocurrencies has opened new avenues for portfolio enhancement. Bitcoin, often referred to as "digital gold," is considered a hedge against inflation and economic uncertainty.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Bulls Are Back?

The resurgence of bullish sentiment in the Bitcoin market can be attributed to several key factors:

- Price Momentum: Bitcoin has shown signs of increasing price momentum, leading traders and investors to believe that the upward trend will continue. This positive price action often breeds further buying activity, creating a self-reinforcing cycle.

- Technological Advancements: Innovations in blockchain technology and the growing acceptance of crypto transactions in various sectors contribute to increased optimism about Bitcoin’s future.

- Global Economic Factors: Economic uncertainty, including inflationary pressures and geopolitical tensions, often drives investors toward alternative assets like Bitcoin. As traditional markets fluctuate, Bitcoin’s appeal as a store of value grows.

The Broader Impact on the Cryptocurrency Market

BlackRock’s Bitcoin ETF is not just significant for the firm itself but also for the broader cryptocurrency ecosystem. As major financial institutions like BlackRock enter the space, it signals to other investors and companies that cryptocurrencies are becoming a standard part of the financial landscape. This trend could inspire more ETFs and investment products focused on cryptocurrencies, further legitimizing the market.

The Future of Bitcoin ETFs

The growing success of BlackRock’s Bitcoin ETF may pave the way for more cryptocurrency ETFs in the future. As more firms look to capitalize on the popularity of digital assets, investors can expect a wider array of options to choose from. This diversification could lead to more competitive pricing and better performance for investors.

Conclusion

The news about BlackRock’s Bitcoin ETF entering the top five ETFs in YTD flows is a testament to the resilience and potential of the cryptocurrency market. As the bulls return, investors are presented with new opportunities for growth and diversification. With institutional interest peaking and regulatory clarity improving, the future looks promising for Bitcoin and other cryptocurrencies.

As we move forward, staying informed about market trends and developments will be crucial for investors looking to navigate this dynamic landscape. Whether you are a seasoned investor or new to the world of cryptocurrencies, the rise of Bitcoin ETFs like BlackRock’s offers a compelling case for inclusion in a diversified investment portfolio.

JUST IN: Blackrock’s #Bitcoin ETF is now in the top 5 ETFs in YTD flows.

Bulls are back pic.twitter.com/w4MwkAhnol

— Bitcoin Magazine (@BitcoinMagazine) May 21, 2025

JUST IN: Blackrock’s Bitcoin ETF is Now in the Top 5 ETFs in YTD Flows

If you’ve been keeping an eye on the cryptocurrency scene, you probably heard the latest buzz: Blackrock’s Bitcoin ETF has officially made its mark by landing in the top 5 ETFs for year-to-date (YTD) flows. This is a big deal, not just for Blackrock but for the entire market. The resurgence of bullish sentiment surrounding Bitcoin is palpable, and investors are starting to feel that excitement again. So, what does this mean for the future of Bitcoin investments and the broader ETF market?

The Rise of Bitcoin ETFs

Bitcoin ETFs have been gaining traction over the past few years, and they represent a significant step toward mainstream acceptance of cryptocurrency. An ETF, or exchange-traded fund, allows investors to buy shares that track the performance of an asset—in this case, Bitcoin—without needing to directly purchase the cryptocurrency itself. This makes investing in Bitcoin more accessible to the average investor who may not want to deal with wallets, exchanges, and the complexities of safeguarding their digital assets.

With Blackrock’s Bitcoin ETF now ranking among the top 5 ETFs based on YTD flows, it signals that institutional interest in Bitcoin is growing. Blackrock, being one of the largest asset management firms globally, brings a level of credibility to the Bitcoin space. This endorsement from a financial giant opens doors for more traditional investors to dip their toes into the cryptocurrency market.

Bulls Are Back

The phrase “Bulls are back” perfectly captures the current mood among cryptocurrency enthusiasts. After a prolonged period of uncertainty and price dips, Bitcoin is showing signs of life again. As more institutional players enter the market, the demand for Bitcoin is likely to rise, pushing prices higher.

Investors are catching wind of this momentum, and many are jumping back into the market, eager to capitalize on what they hope will be the next big price surge. The psychological aspect of investing cannot be understated, and as confidence grows in Bitcoin, more people are expected to invest, which could create a positive feedback loop.

The Implications for Retail Investors

So, what does Blackrock’s Bitcoin ETF mean for retail investors? For starters, it provides an easier pathway for those who want exposure to Bitcoin without the hassles that come with directly buying and storing the cryptocurrency. Retail investors might find that investing in an ETF is less intimidating and more aligned with traditional investment strategies.

Additionally, the success of Blackrock’s ETF could pave the way for even more Bitcoin-related financial products. If other asset managers see the inflows that Blackrock is experiencing, they may follow suit and launch their own Bitcoin ETFs. This could lead to more competition and innovation in the space, ultimately benefiting investors.

Understanding Bitcoin’s Market Dynamics

To truly appreciate the significance of Blackrock’s Bitcoin ETF, it’s essential to understand the overall dynamics of the cryptocurrency market. Bitcoin has been known for its volatility, with prices fluctuating dramatically over short periods. This can be both a risk and an opportunity for investors.

When institutional investors enter the market, they often bring stability and liquidity, which can help dampen the wild price swings that retail investors typically experience. As more institutional capital flows into Bitcoin through ETFs, it could lead to a more mature market, making it easier for both institutional and retail investors to navigate.

Future Outlook for Bitcoin and ETFs

Looking ahead, the future for Bitcoin and ETFs seems bright. The entry of major players like Blackrock indicates a shift in how cryptocurrencies are perceived in the financial world. As more financial institutions recognize the potential of Bitcoin, we can expect a broader acceptance of not just Bitcoin but other cryptocurrencies as well.

Furthermore, regulatory clarity around cryptocurrencies is improving, which could encourage even more traditional investors to explore digital assets. As the landscape continues to evolve, Bitcoin ETFs will likely become a more integral part of investment portfolios.

Why You Should Care

You might be wondering why all this matters. If you’re an investor or someone interested in the financial markets, the developments in Bitcoin ETFs could impact your investment strategies. Understanding these changes can help you make informed decisions about where to allocate your resources.

Moreover, as Bitcoin continues to gain traction, it has the potential to reshape financial systems and investment paradigms. It’s not just a passing trend; it represents a fundamental shift in how we think about money and assets.

Final Thoughts on Blackrock’s Bitcoin ETF

Blackrock’s Bitcoin ETF entering the top 5 ETFs in YTD flows is a significant milestone, and it’s not just about numbers; it symbolizes a broader acceptance of Bitcoin as a legitimate investment. The bullish sentiment surrounding this development is a clear indication that the market is ready for a resurgence.

As we move forward, keep an eye on how Bitcoin and its ETFs perform, the regulatory environment, and the overall sentiment in the cryptocurrency community. Whether you’re a seasoned investor or a newcomer, understanding these dynamics can help you navigate the exciting world of cryptocurrency investments.

If you want to stay updated on the latest developments in Bitcoin and ETFs, check out [Bitcoin Magazine](https://bitcoinmagazine.com/) for continuous insights and analysis. The world of cryptocurrency is evolving rapidly, and you won’t want to miss out on what comes next!