Bitcoin Surpasses Amazon and Google: A Historic Milestone

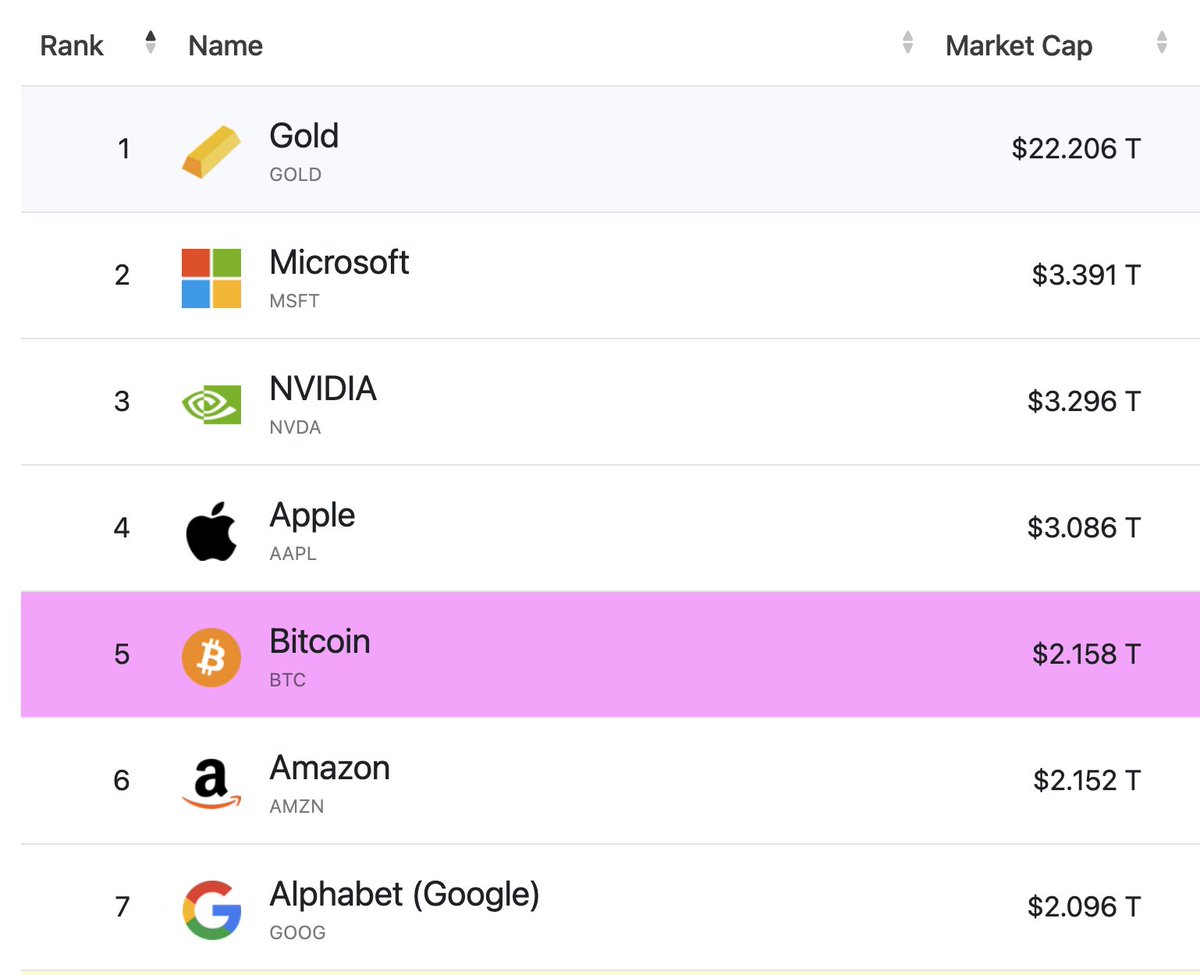

In a groundbreaking development in the financial world, Bitcoin has officially surpassed both Amazon and Google to become the fifth largest asset globally. This remarkable achievement signifies a pivotal moment for cryptocurrency, illustrating its increasing acceptance and integration into mainstream finance. As of May 21, 2025, Bitcoin’s market capitalization has positioned it alongside traditional giants, fundamentally changing the perception of digital currencies.

The Rise of Bitcoin

Bitcoin, created in 2009 by an anonymous figure known as Satoshi Nakamoto, has undergone significant evolution since its inception. Initially dismissed as a niche digital currency used primarily for online transactions, Bitcoin has matured into a legitimate asset class. Its meteoric rise can be attributed to various factors, including growing institutional adoption, inflation hedging, and a shift in investor sentiment towards decentralized finance.

The journey of Bitcoin from an obscure digital currency to the fifth largest asset in the world is a testament to its resilience and innovation. The cryptocurrency market has experienced extreme volatility, yet Bitcoin has emerged as a leader, consistently outperforming traditional assets such as stocks and gold in certain periods.

Market Dynamics and Implications

With Bitcoin now ranking fifth among global assets, trailing only behind gold, the U.S. dollar, and other significant assets, the implications for investors and the financial landscape are profound. This shift suggests an increasing recognition of Bitcoin as a “store of value,” a characteristic long attributed to gold. Investors are beginning to view Bitcoin not just as a speculative investment, but as a hedge against economic instability and inflation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The recent surge in Bitcoin’s value can also be linked to macroeconomic factors such as rising inflation rates and economic uncertainty. As traditional fiat currencies face depreciation, many investors are turning to Bitcoin as a safe haven. This trend is reflected in the growing interest and investment from institutional players, including hedge funds, corporations, and even sovereign wealth funds.

The Role of Institutional Investors

Institutional investors have played a crucial role in Bitcoin’s ascent. Companies like MicroStrategy and Tesla have made significant investments in Bitcoin, further legitimizing its status as a viable asset. The entry of institutional players into the cryptocurrency space has not only boosted Bitcoin’s price but has also increased its credibility among retail investors.

Moreover, the introduction of Bitcoin-related financial products, such as ETFs (Exchange-Traded Funds) and futures contracts, has made it easier for institutional and retail investors to gain exposure to this digital asset. The growing infrastructure supporting Bitcoin, including exchanges, custodians, and regulatory frameworks, has also contributed to its rising status in the financial world.

Challenges and Considerations

Despite Bitcoin’s impressive growth, numerous challenges remain. Regulatory scrutiny is one of the most significant hurdles facing the cryptocurrency market. Governments around the world are grappling with how to regulate Bitcoin and other cryptocurrencies, which could impact their adoption and use. Regulatory clarity is essential for institutional investors to feel secure in their investments.

Additionally, Bitcoin’s environmental impact has come under fire due to the energy-intensive process of mining. Critics argue that Bitcoin mining contributes to carbon emissions and climate change, raising questions about the sustainability of the cryptocurrency. The industry is aware of these concerns and is exploring solutions, such as transitioning to renewable energy sources for mining operations.

The Future of Bitcoin and Cryptocurrency

Looking ahead, the future of Bitcoin appears promising. As more individuals and institutions adopt cryptocurrency, we can expect continued growth in market capitalization and acceptance. The introduction of new technologies, such as the Lightning Network, aims to enhance Bitcoin’s scalability and transaction speed, making it more practical for everyday use.

Moreover, the ongoing development of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) indicates that the cryptocurrency ecosystem is expanding beyond just Bitcoin. These innovations are attracting a new wave of users and investors, further solidifying the place of cryptocurrency in the global financial landscape.

As Bitcoin continues to gain traction, its impact on traditional financial systems will be a critical area to watch. The potential for Bitcoin to challenge the status quo of banking and finance is significant. The rise of Bitcoin may lead to a future where cryptocurrencies play a central role in global commerce and finance.

Conclusion

Bitcoin’s recent achievement of becoming the fifth largest asset in the world is a landmark event in the history of finance. Its rise signifies a shift in how we view and interact with money, investment, and value. As Bitcoin continues to gain acceptance and legitimacy, it is essential for investors to stay informed about market trends, regulatory developments, and the broader implications of this digital asset.

In summary, Bitcoin’s journey from a niche digital currency to a leading global asset highlights its transformative potential. As we move forward, the cryptocurrency landscape will continue to evolve, presenting both opportunities and challenges for investors and financial institutions alike. The future of Bitcoin and cryptocurrencies is bright, and their role in reshaping the financial world is undeniable.

JUST IN: Bitcoin overtakes Amazon and Google to become the 5th biggest asset in the world. pic.twitter.com/dYqKvTTAEK

— Bitcoin Archive (@BTC_Archive) May 21, 2025

JUST IN: Bitcoin overtakes Amazon and Google to become the 5th biggest asset in the world.

In a groundbreaking moment for the cryptocurrency landscape, Bitcoin has officially surpassed both Amazon and Google, emerging as the fifth largest asset globally. This incredible achievement is a testament to Bitcoin’s ongoing evolution and increasing acceptance as a legitimate store of value. As we dive into this exciting news, let’s explore what this means for the future of Bitcoin and the broader financial ecosystem.

The Rise of Bitcoin: A Brief Overview

Since its inception in 2009, Bitcoin has been on a rollercoaster ride. Initially dismissed as a fad, it has steadily gained traction over the years, fueled by growing interest from both retail and institutional investors. The digital currency gained its first major spotlight during the 2017 bull run when it reached almost $20,000. However, it was the subsequent years that established Bitcoin as a more stable and respected asset.

Fast forward to today, and Bitcoin’s market capitalization has surged, leading it to dethrone giants like Amazon and Google. This transition marks a significant shift in how we perceive traditional assets versus digital currencies. Not only is Bitcoin now positioned among the top assets, but it also signals a growing acceptance of digital currencies in mainstream finance.

What Does This Mean for Investors?

For investors, Bitcoin’s ascension to the fifth-largest asset is both exciting and indicative of the changing tides in investment strategies. Many are now re-evaluating traditional asset classes and considering Bitcoin as a viable alternative. If you think about it, the rise of Bitcoin means that more people are recognizing the potential for long-term value in cryptocurrency as a hedge against inflation and economic instability.

Moreover, this milestone may encourage more institutional investment. Companies and financial institutions that were once hesitant to invest in cryptocurrencies might now feel more inclined to allocate a portion of their portfolios to Bitcoin. As the narrative shifts and Bitcoin continues to prove its resilience, we could see a broader acceptance that propels the cryptocurrency market to new heights.

The Role of Technology in Bitcoin’s Growth

Bitcoin’s growth can be attributed to several technological advancements. The underlying blockchain technology provides a decentralized and secure method of recording transactions. This transparency has helped build trust in Bitcoin as a financial asset. Furthermore, improvements in wallets and exchanges have made it much easier for people to buy, sell, and store Bitcoin securely.

Additionally, the rise of decentralized finance (DeFi) has played a significant role in boosting Bitcoin’s visibility and utility. DeFi platforms allow users to lend, borrow, and trade cryptocurrencies without intermediaries, thus amplifying Bitcoin’s appeal. As these technologies evolve, so does the opportunity for Bitcoin to integrate further into our financial systems.

Global Economic Factors Influencing Bitcoin’s Surge

The current global economic climate has also played a pivotal role in Bitcoin’s rise. With inflation rates climbing in various countries, many investors are turning to Bitcoin as a safeguard against currency devaluation. The limited supply of Bitcoin, capped at 21 million coins, makes it an attractive option for those looking to preserve their wealth.

Moreover, ongoing geopolitical tensions and economic uncertainty have compelled many to seek alternative investments. Bitcoin has emerged as a digital gold in this context; a store of value that isn’t tied to any single country’s economic policies. This shift in perspective is driving more individuals to invest in Bitcoin, contributing to its market capitalization growth.

Bitcoin vs. Traditional Assets: The New Paradigm

As Bitcoin continues to climb the ranks, it raises an important question: how does it compare to traditional assets? Bitcoin is often likened to gold due to its scarcity and value proposition. However, unlike gold, Bitcoin is highly liquid, can be easily transferred, and operates 24/7, making it a more dynamic asset.

Additionally, the volatility of Bitcoin can be both a blessing and a curse. While it presents opportunities for significant gains, it also poses risks that traditional assets like stocks or bonds do not. Investors need to weigh these factors carefully, understanding that while Bitcoin can be a lucrative investment, it also carries a higher level of risk.

The Future of Bitcoin: What Lies Ahead?

So, what does the future hold for Bitcoin? With its recent achievement of becoming the fifth largest asset in the world, the potential for further growth is immense. As more people begin to understand and embrace the concept of digital currencies, Bitcoin stands to benefit from increased adoption.

Regulatory clarity will also play a crucial role in shaping Bitcoin’s future. Governments around the world are beginning to recognize the importance of cryptocurrency regulation. Clear guidelines can provide a safety net for investors while fostering innovation in the blockchain space. If done right, this could lead to even greater participation in the cryptocurrency market.

Community and Culture: The Heart of Bitcoin

Beyond the numbers and market cap, Bitcoin represents a community and culture that is passionate about financial freedom and decentralization. The ethos of Bitcoin advocates for a system where individuals have control over their finances, free from the constraints of traditional banking systems. This ideology is what continues to draw people to Bitcoin, creating a loyal following that supports its growth.

Engagement within the community is also essential. From forums to social media, the conversations surrounding Bitcoin are vibrant and dynamic. This engagement fosters a sense of belonging and empowerment among users, further solidifying Bitcoin’s position in the financial landscape.

How to Get Involved in Bitcoin

If you’re interested in getting involved in Bitcoin, there are several ways to do so. You can start by researching reputable exchanges where you can buy Bitcoin. Make sure to choose secure platforms with positive reviews. Once you acquire Bitcoin, consider using a hardware wallet to store it safely.

Additionally, stay informed by following credible news sources and joining community discussions. The more you engage with the Bitcoin ecosystem, the better equipped you will be to navigate its complexities and opportunities.

Final Thoughts on Bitcoin’s Historic Achievement

Bitcoin’s recent milestone of overtaking Amazon and Google to become the fifth biggest asset in the world is a remarkable achievement that underscores its growing legitimacy in the financial world. As we witness this evolution, it’s essential to remain informed and engaged, whether you’re an investor, enthusiast, or simply curious about the future of money.

This shift is not just about numbers; it’s about a revolution in how we think about value, investment, and financial autonomy. So, whether you’re a seasoned investor or just starting your journey, keep an eye on Bitcoin. The future of finance is undoubtedly exciting, and Bitcoin is at the forefront of this transformation.

For more insights and updates, you can follow the Bitcoin Archive on Twitter, as they continue to provide invaluable information about Bitcoin and its journey in the financial landscape. Stay tuned!