Overview of the No Tax on Tips Act Passed by the US senate

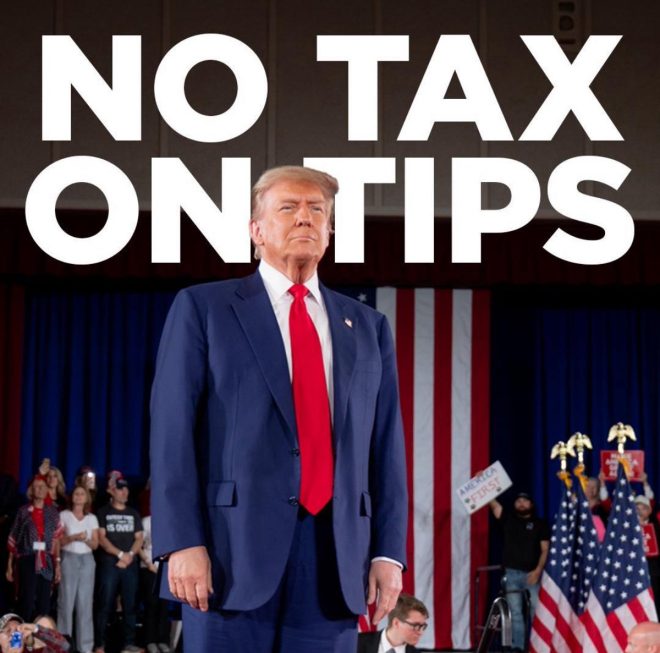

On May 20, 2025, a significant development emerged in the realm of U.S. labor policy as the Senate unanimously passed President trump‘s "No Tax on Tips Act." This landmark legislation aims to provide essential relief to tipped workers across the nation, fulfilling a pivotal promise made by the Trump administration. The unanimous support from the Senate underscores a rare moment of bipartisan agreement on an issue that directly affects millions of Americans.

Understanding the No Tax on Tips Act

The No Tax on Tips Act is designed to ensure that tips received by service workers are not subject to federal taxation. This legislation is particularly beneficial for sectors such as hospitality, food service, and personal care, where tipping is a customary practice. By removing tax burdens associated with tips, the act aims to increase the take-home pay for those in tipped positions, allowing them to better support themselves and their families.

Impact on Tipped Workers

The passage of the No Tax on Tips Act is expected to significantly impact the lives of tipped workers. These individuals often rely heavily on tips as a primary source of income. By eliminating taxes on these tips, workers can retain more of their earnings, which can lead to improved financial stability. This relief is particularly crucial in light of the economic challenges that service workers have faced, especially during and after the COVID-19 pandemic.

Bipartisan Support and Legislative Process

The unanimous passage of the No Tax on Tips Act indicates a rare moment of cooperation in a politically divided landscape. Senators from both parties recognized the importance of supporting tipped workers, who have been disproportionately affected by economic downturns and crises. The swift movement through the legislative process highlights the urgency of addressing the needs of these workers, many of whom are women and people of color.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Implications

The economic implications of this legislation extend beyond the immediate benefits for tipped workers. By increasing disposable income among service workers, the No Tax on Tips Act has the potential to stimulate local economies. When tipped workers retain more of their earnings, they are likely to spend that money in their communities, supporting local businesses and services. This ripple effect can contribute to a more robust economic recovery, especially in areas heavily reliant on the hospitality and service sectors.

A Promise Fulfilled

President Trump’s commitment to supporting tipped workers has been a cornerstone of his administration’s labor policies. The passage of the No Tax on Tips Act represents a fulfillment of that promise, resonating with both workers and advocates who have long argued for better protections and support for those in the service industry. This legislation is seen as a step in the right direction, addressing long-standing issues related to income inequality and financial instability for tipped workers.

Conclusion

In summary, the unanimous passage of the No Tax on Tips Act by the U.S. Senate marks a significant milestone for tipped workers across the country. By eliminating federal taxes on tips, the legislation aims to enhance the financial well-being of millions of service employees, providing much-needed relief in a challenging economic landscape. The bipartisan support for this act illustrates a collective recognition of the value and importance of tipped workers and their contributions to the economy. As the implementation of the No Tax on Tips Act unfolds, it will be crucial to monitor its effects on both workers and the broader economic landscape in the United States.

#BREAKING: The US Senate has UNANIMOUSLY passed President Trump’s No Tax on Tips Act

Tipped workers: Trump is KEEPING HIS PROMISE!

Relief is coming soon! pic.twitter.com/yrwcFHt8S9

— Nick Sortor (@nicksortor) May 20, 2025

BREAKING: The US Senate has UNANIMOUSLY passed President Trump’s No Tax on Tips Act

In a significant move that has caught the attention of many, the US Senate has unanimously passed the No Tax on Tips Act, a piece of legislation that President Trump promised during his campaign. This act is designed to provide much-needed relief to tipped workers across the country. If you’re in the service industry or rely on tips, this news is likely music to your ears!

Tipped workers: Trump is KEEPING HIS PROMISE!

For years, tipped workers have faced a unique set of challenges, often living paycheck to paycheck despite their hard work. With fluctuating income from tips, many have struggled to make ends meet. The passage of the No Tax on Tips Act is a reflection of Trump’s commitment to support these workers. By eliminating taxes on tips, the legislation aims to enhance the financial stability of those reliant on gratuities.

This act is a win for workers in various sectors, including restaurant staff, bartenders, and other service professionals. It acknowledges the hard work they put in daily and the importance of tips in their overall income. The sentiment is clear: the government is listening to the needs of its workers and responding positively. As reported by NBC News, this act not only fulfills a promise but also sets a precedent for future legislation aimed at worker welfare.

Relief is coming soon!

The unanimous support in the Senate signifies a bipartisan agreement on the importance of this issue. It’s not just about politics; it’s about people. Tipped workers have long been overlooked, and the approval of this act is a step towards ensuring they receive fair compensation for their labor. The relief is coming soon, and many are eager to see how this will change the landscape for service workers.

As we look forward to the implementation of this act, it’s crucial to understand the potential impact it could have. With more take-home pay, tipped workers can better support themselves and their families, leading to a healthier economy overall. It’s a domino effect: when tipped workers thrive, local businesses thrive as well. Increased disposable income means more spending in the community, which is beneficial for everyone.

What Does This Mean for Tipped Workers?

The implications of the No Tax on Tips Act are vast. First off, workers can expect to see a slight increase in their earnings. Without the burden of taxes on their tips, they’ll be able to keep more of what they earn. This is particularly important for those who rely heavily on tips as a significant part of their income. For many, this legislation could mean the difference between financial stability and ongoing struggle.

Moreover, the act encourages a fairer system where workers are rewarded for their efforts without fear of losing a chunk of their income to taxes. It also sets a tone for future legislative efforts aimed at improving working conditions and compensation for all workers, not just those in the service industry. It demonstrates that the government is willing to take steps to protect and support those in vulnerable positions.

Potential Challenges Ahead

While the passing of the No Tax on Tips Act is indeed a victory, it’s essential to remain cautious about potential challenges that may arise. Implementation is key. How swiftly and effectively will this legislation be put into action? That’s something we’ll need to keep an eye on. Additionally, there may be pushback from certain sectors that feel threatened by this change. It’s vital for advocates and supporters of the act to remain vigilant and ensure that the benefits promised are delivered.

There’s also the question of how this will affect the broader taxation system. Will other forms of taxation need to be adjusted to account for this change? These are complex questions that policymakers will need to tackle as they move forward.

Community Response and Public Sentiment

The news of the Senate’s unanimous decision has been met with overwhelming support from various communities. Social media has lit up with reactions, with many service workers expressing their gratitude and relief. The sentiment is clear: this act is a much-needed lifeline. As one bartender tweeted, “Finally, I can keep what I earn! Thank you for listening to us!”

Public support for this legislation reflects a growing recognition of the importance of fair wages and working conditions. It’s a testament to the power of advocacy and the impact that collective voices can have in shaping policy. This is an encouraging sign that when people come together, they can effect change.

What’s Next?

Looking ahead, it will be crucial to monitor how the No Tax on Tips Act unfolds in the coming months. Will it truly deliver the relief that many are hoping for? Will it inspire further legislative action aimed at supporting workers across all industries? As we await these answers, one thing is certain: the conversation about workers’ rights and fair compensation is far from over.

As we celebrate this important legislative victory, let’s also remember the ongoing challenges faced by workers in various sectors. The No Tax on Tips Act is just one piece of the puzzle, but it’s a significant step in the right direction. The momentum is there, and it’s essential to keep pushing for more reforms that benefit all workers, ensuring that they receive the respect and compensation they deserve.

Final Thoughts

The unanimous passing of the No Tax on Tips Act is a clear indication that change is possible. It’s a reminder that the voices of workers matter and that their struggles are being acknowledged. As we move forward, let’s continue to advocate for fair treatment and compensation for all workers, ensuring that the momentum gained from this victory leads to more positive changes in the future.

Breaking News, Cause of death, Obituary, Today