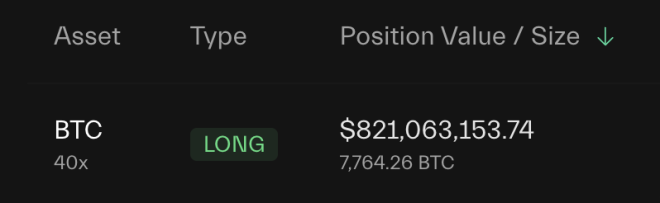

James Wynn’s Bold Bitcoin Bet: $820 Million Long Position

In a striking move that has captured the attention of the cryptocurrency community, James Wynn has reportedly increased his long position in Bitcoin to an astounding $820 million. This significant investment reflects Wynn’s bullish stance on Bitcoin’s future, as he places nearly $1 billion on the line, betting that the cryptocurrency will continue to rise. The announcement, made public via a tweet from The Bitcoin Historian on May 20, 2025, has stirred discussions among investors, analysts, and enthusiasts alike, highlighting the volatile yet potentially lucrative nature of the cryptocurrency market.

The Context of Wynn’s Investment

Bitcoin, the first and most well-known cryptocurrency, has seen its value fluctuate dramatically over the years. From its humble beginnings to reaching all-time highs, Bitcoin’s price is influenced by various factors, including market demand, regulatory news, technological advancements, and macroeconomic conditions. Wynn’s decision to increase his investment to such a high figure signals a strong belief in Bitcoin’s future potential, especially as the digital asset continues to gain traction among institutional investors and mainstream financial platforms.

The Implications of a $820 Million Long Position

Investing $820 million in a long position indicates that Wynn anticipates Bitcoin’s price will rise. This type of investment strategy is commonly employed by traders looking to capitalize on upward price movements. By betting on Bitcoin’s ascent, Wynn is aligning himself with a growing trend where more investors are embracing cryptocurrencies as a viable asset class.

Factors Driving Bitcoin’s Popularity

Several factors contribute to Bitcoin’s increasing popularity and its appeal as an investment:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Institutional Adoption: Over recent years, major corporations and institutional investors have begun to recognize Bitcoin as a legitimate asset. Companies have started adding Bitcoin to their balance sheets, and investment firms have launched Bitcoin-focused funds.

- Decentralization and Scarcity: Bitcoin operates on a decentralized network, and its supply is capped at 21 million coins, which creates a sense of scarcity. This limited supply can drive demand, especially as more people and institutions seek to acquire Bitcoin.

- Inflation Hedge: In light of inflation concerns and economic uncertainty, many investors view Bitcoin as a hedge against fiat currency devaluation. Its decentralized nature and fixed supply make it an attractive alternative for preserving wealth.

- Technological Advancements: Innovations in blockchain technology, including improvements in transaction speed and security, have bolstered confidence in Bitcoin and other cryptocurrencies. These advancements make Bitcoin more user-friendly and accessible to a broader audience.

The Risks Involved

While Wynn’s investment is bold, it is essential to acknowledge the inherent risks associated with cryptocurrency investments. Bitcoin’s volatility can lead to significant price swings, which can result in substantial gains or losses. Factors such as regulatory changes, market sentiment, and macroeconomic trends can greatly influence Bitcoin’s price, making it a high-risk investment.

Additionally, the cryptocurrency market is still relatively young, and its regulatory landscape is evolving. Changes in government policies or regulations could impact the market significantly, adding another layer of risk for investors like Wynn.

Analyzing Market Reactions

Wynn’s announcement has sparked conversations among traders and analysts about the potential implications for the Bitcoin market. Many view his substantial investment as a sign of confidence in Bitcoin’s future performance, which could attract more investors to the space. The fear of missing out (FOMO) may drive some traders to consider entering the market, which could further propel Bitcoin’s price upward.

However, it is crucial to approach such investments with caution. While large bets can sometimes indicate bullish sentiment, they can also lead to increased volatility. If Bitcoin’s price does not move in the anticipated direction, it could lead to significant losses for investors who follow suit without conducting their due diligence.

Conclusion

James Wynn’s decision to increase his long position in Bitcoin to $820 million is a bold bet that underscores the ongoing evolution of the cryptocurrency market. As Bitcoin continues to gain traction among institutional investors and mainstream audiences, Wynn’s investment serves as a reminder of the potential rewards and risks associated with this digital asset. While the future of Bitcoin remains uncertain, Wynn’s confidence reflects a growing belief in the cryptocurrency’s ability to thrive in an increasingly digital financial landscape.

Investors should remain vigilant and conduct thorough research before entering the market, as the volatility and unpredictability of cryptocurrencies can lead to both significant gains and losses. As the cryptocurrency landscape continues to evolve, Wynn’s investment may serve as a pivotal moment in Bitcoin’s journey, influencing the decisions of investors and shaping the future of digital assets.

JUST IN: JAMES WYNN JUST INCREASED HIS #BITCOIN LONG TO $820,000,000

HE’S BETTING ALMOST $1 BILLION THAT BTC IS GOING HIGHER. WILD pic.twitter.com/zIns1FvPHj

— The Bitcoin Historian (@pete_rizzo_) May 20, 2025

JUST IN: JAMES WYNN JUST INCREASED HIS #BITCOIN LONG TO $820,000,000

When it comes to the world of cryptocurrency, few events can shake the market quite like a massive investment from a notable figure. Recently, James Wynn made headlines by increasing his Bitcoin long position to an astonishing $820,000,000. This move has stirred up conversations and speculation all over social media and investment circles alike. As a prominent figure in the crypto community, Wynn’s actions often signal trends and shifts in the market, and this latest gamble is no exception.

HE’S BETTING ALMOST $1 BILLION THAT BTC IS GOING HIGHER. WILD

It’s not every day you hear about someone betting nearly a billion dollars on Bitcoin. This bold move has left many investors wondering what Wynn sees that they might not. Is he privy to insider information, or is he simply riding the wave of optimism that has characterized the crypto market in recent months? Regardless of the reasons behind this decision, one thing is clear: Wynn’s faith in Bitcoin’s future is unwavering.

Let’s break down what this could mean for both the crypto community and for individual investors.

Understanding Bitcoin’s Volatile Nature

Bitcoin is known for its volatility, and Wynn’s massive investment exemplifies the risks and rewards that come with investing in cryptocurrencies. In recent years, we’ve seen Bitcoin reach heights that seemed unimaginable, only to experience sharp declines shortly after. However, many investors, including Wynn, believe that the long-term trend for Bitcoin remains upward.

For those considering investing in Bitcoin, it’s crucial to understand this volatility. While the potential for significant gains exists, so too does the risk of substantial losses. In Wynn’s case, he appears to be betting on a bullish trend, indicating that he believes Bitcoin will continue to appreciate in value over time.

The Influence of High-Profile Investors

The impact of high-profile investors like Wynn cannot be understated. When someone with a significant financial background makes such a large investment in Bitcoin, it often encourages others to follow suit. This can lead to increased demand and, in turn, drive the price of Bitcoin even higher.

Wynn’s recent decision has already sparked discussions among analysts and investors alike. Many are speculating on the potential for Bitcoin to reach new all-time highs, especially if more investors are encouraged by Wynn’s bold move. The psychology of investing plays a critical role here—seeing a respected figure make a substantial investment can lead others to feel more confident in their own investment decisions.

What Drives Bitcoin Prices?

Several factors contribute to the rise and fall of Bitcoin prices. These can include market demand, regulatory news, technological advancements, and macroeconomic trends. Recently, news of institutional investors entering the market has helped fuel optimism. When large entities, such as hedge funds and publicly traded companies, begin to invest in Bitcoin, it signals a growing acceptance of cryptocurrency as a legitimate asset class.

Wynn’s investment comes at a time when Bitcoin is gaining increased attention from both retail and institutional investors. As more people recognize the potential for Bitcoin to serve as a hedge against inflation and a store of value, the demand for it may continue to rise.

How to Approach Bitcoin Investment

If you’re considering investing in Bitcoin, it’s essential to approach it thoughtfully. Here are some tips to help you navigate this volatile market:

1. **Do Your Research**: Understanding the fundamentals of Bitcoin and the broader cryptocurrency market is crucial. Familiarize yourself with how blockchain technology works and the factors that influence Bitcoin’s price.

2. **Invest What You Can Afford to Lose**: Given Bitcoin’s volatility, it’s wise to only invest money that you can afford to lose. This way, you can mitigate the emotional impact of potential losses.

3. **Diversify Your Portfolio**: While Bitcoin may seem like an attractive investment, it’s essential to diversify your portfolio. Consider investing in a mix of assets to spread risk.

4. **Stay Updated**: The cryptocurrency market is fast-moving. Staying informed about news and developments can help you make better investment decisions.

5. **Seek Professional Guidance**: If you’re unsure about how to invest in Bitcoin or whether it’s the right choice for you, consider consulting with a financial advisor who understands cryptocurrencies.

The Future of Bitcoin and Cryptocurrency

James Wynn’s significant investment in Bitcoin is a testament to the growing belief in the cryptocurrency’s future. Many experts believe that Bitcoin could continue to rise in value, especially as more institutions and individuals recognize its potential.

As the world becomes increasingly digital, the role of cryptocurrencies like Bitcoin may expand. Innovations in blockchain technology could lead to new applications that further integrate Bitcoin into everyday transactions.

In the coming years, we may see Bitcoin achieve mainstream acceptance, transitioning from a speculative investment to a widely used currency. Wynn’s investment may just be the beginning of a broader trend where more investors are willing to place their bets on Bitcoin’s future.

Community Reactions to Wynn’s Investment

As news of James Wynn’s massive investment spread, the cryptocurrency community had plenty to say. Many expressed excitement and optimism, viewing Wynn’s decision as a validation of Bitcoin’s potential. Others voiced caution, reminding investors to remain vigilant amid the volatility of the crypto market.

Social media platforms like Twitter have been buzzing with reactions. Influencers and analysts are dissecting the implications of Wynn’s bet, and the conversation is only expected to grow. The community’s overall response reflects a mix of enthusiasm and skepticism, highlighting the dual nature of investing in cryptocurrencies.

Conclusion: A Bold Bet on the Future

James Wynn’s decision to increase his Bitcoin long position to $820,000,000 is a bold statement about his confidence in the cryptocurrency’s future. His investment could serve as a catalyst for further interest in Bitcoin, encouraging more people to explore the potential of this digital asset.

As the market evolves, it will be fascinating to see how Wynn’s bet plays out. Whether it leads to new all-time highs or serves as a cautionary tale, one thing is certain: the world of cryptocurrency is as dynamic and unpredictable as ever.

With Bitcoin continuing to attract attention from both retail and institutional investors, it’s an exciting time to be involved in the crypto space. Whether you’re a seasoned investor or just starting out, understanding the implications of major investments like Wynn’s can help you navigate the thrilling world of cryptocurrency.