Breaking news in the Cryptocurrency Market: Hyperliquid Whale Takes Profits

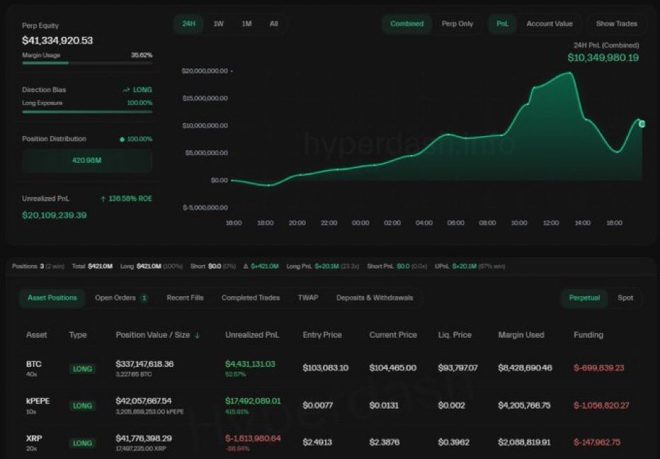

In a startling development within the cryptocurrency market, a hyperliquid whale has reportedly cashed in on a staggering $10 million in profits within just 24 hours. This event has captured the attention of crypto enthusiasts and investors alike, especially considering the whale’s continued strong position on Bitcoin (BTC) with a massive $337 million long position still in play.

Understanding the Impact of Whales in Cryptocurrency

Whales are individuals or entities that hold large amounts of cryptocurrency, capable of influencing market trends with their buying or selling activities. The actions of these whales can create ripples across the market, impacting prices, investor sentiment, and trading strategies. The recent profit-taking by this hyperliquid whale serves as a reminder of the volatility and potential for rapid profit in the crypto space.

The Significance of the $10 Million Profit

Earning $10 million in a single day is no small feat, and it underscores the lucrative opportunities available in the cryptocurrency market, especially during bullish trends. Such profits can be indicative of the whale’s successful trading strategies, market timing, and possibly an in-depth understanding of market signals.

The decision to take profits after a rapid gain also reflects a prudent risk management strategy. In the ever-fluctuating world of cryptocurrencies, locking in profits can protect against sudden downturns, which are common in this volatile market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin’s Role in the Whale’s Strategy

The whale’s substantial long position on Bitcoin, valued at $337 million, signifies a strong belief in BTC’s potential for further appreciation. Bitcoin, being the flagship cryptocurrency, often serves as a barometer for the entire market. Its performance can heavily influence altcoins and the broader crypto ecosystem.

Given the whale’s hefty financial commitment to Bitcoin, it is crucial to analyze the factors that might have contributed to this bullish sentiment. Market trends, institutional adoption, regulatory developments, and macroeconomic conditions often play significant roles in shaping investor confidence in Bitcoin.

Market Reactions and Implications

The news of this whale’s profit-taking has stirred conversations within the crypto community. Many investors are keenly watching for potential market movements that could arise from such significant actions. The immediate effects could include increased volatility as other traders react to the news, potentially leading to either bullish or bearish trends based on market sentiment.

Additionally, this event may encourage other investors to evaluate their own positions and strategies. Those who have been hesitant about entering the market might see the whale’s success as a signal of potential profitability, while more cautious investors may reconsider their exposure to Bitcoin and other cryptocurrencies.

The Future of Cryptocurrency Investments

As we delve into the future of cryptocurrency investments, it is essential to recognize the dynamic nature of this market. The activities of whales like the one highlighted in this news can serve as a barometer for broader market trends. Investors should stay informed and agile, ready to adapt to the ever-changing landscape.

Conclusion

The recent breaking news of a hyperliquid whale taking $10 million in profits while maintaining a massive long position in Bitcoin is a testament to the potential for significant gains in the cryptocurrency market. As investors navigate the complexities and volatility of this space, staying updated on the actions and strategies of influential players like whales can provide valuable insights.

Whether you’re a seasoned trader or a newcomer to the crypto world, understanding the implications of these high-stakes decisions can help inform your investment strategies. In the fast-paced realm of cryptocurrency, knowledge is power, and keeping an eye on market movements is crucial for capitalizing on opportunities as they arise.

BREAKING:

HYPERLIQUID WHALE BEGINS TAKING PROFITS AFTER EARNING $10M IN 24 HOURS

STILL HOLDING A MASSIVE $337M LONG POSITION ON $BTC pic.twitter.com/QS9iDbl5R1

— Crypto Rover (@rovercrc) May 19, 2025

BREAKING:

In the ever-volatile world of cryptocurrency, every day brings with it thrilling news and significant movements. Recently, a noteworthy event caught the attention of traders and enthusiasts alike: a hyperliquid whale has begun taking profits after earning a staggering $10 million in just 24 hours. This kind of profit-taking is not just standard practice; it’s a significant indicator of market sentiment and potential future movements.

HYPERLIQUID WHALE BEGINS TAKING PROFITS AFTER EARNING $10M IN 24 HOURS

So, what exactly is a hyperliquid whale? In the crypto world, a whale refers to an individual or entity that holds a large amount of cryptocurrency. These players can move the market with their buying or selling actions. A hyperliquid whale is one that operates in a highly liquid market, meaning they can execute large trades without significantly impacting the price. Their decisions often provide insights into market trends.

The recent profit-taking action by this whale is noteworthy not just for its size but also for the timing. The market can be quite reactive, and when a significant player decides to cash in on their gains, it often prompts other traders to reconsider their positions. This can lead to increased volatility as smaller traders react to the whale’s moves. If you’re keeping an eye on the market, this could be a sign to adjust your strategies.

STILL HOLDING A MASSIVE $337M LONG POSITION ON $BTC

What makes this situation even more intriguing is that the whale is still holding a massive long position on Bitcoin (BTC), valued at $337 million. Holding a long position means they are betting that the price of Bitcoin will continue to rise. This dual strategy of taking profits while maintaining a significant position indicates a level of confidence in Bitcoin’s future price movements. It suggests that despite recent gains, the whale anticipates further upside.

Bitcoin, being the leading cryptocurrency, often sets the tone for the entire market. When a whale maintains a long position at this magnitude, it can instill confidence among other investors. This may lead to increased buying activity, potentially pushing the price higher. The interplay between profit-taking and maintaining long positions is a fascinating aspect of trading psychology. It highlights the balance between securing profits and holding out for potentially greater gains.

The Implications for the Market

For the average trader, understanding the actions of these whales can provide valuable insights into market dynamics. When a whale takes profits, it can be interpreted in several ways. Some traders might see it as a signal to sell, fearing a price drop. Others might take it as a chance to buy, believing that the whale’s ongoing long position suggests confidence in the price recovery. This dual perspective creates an interesting dynamic in trading decisions.

Additionally, the impact of a hyperliquid whale’s trading activity extends beyond just the immediate price action. It can influence market sentiment, which is a crucial factor in the cryptocurrency space. Traders often react not just to prices but to the perceived confidence of large holders. As news of this whale’s actions spreads, it can create a ripple effect, influencing trends and possibly leading to increased trading volumes.

What Can Traders Learn?

For traders looking to navigate the crypto waters, there are several takeaways from this event. First, monitoring whale activity can be a strategic advantage. Tools and platforms that track large transactions can help you stay ahead of market movements. Understanding that whales often have a significant impact on price can help you anticipate potential shifts in the market.

Moreover, considering the psychological aspects of trading can aid in decision-making. When a whale takes profits, it’s a reminder that securing gains is essential in trading. However, it’s equally important to assess the broader market context. Holding onto positions, particularly in a volatile environment, requires a balance between fear and confidence.

Staying Ahead of the Game

As the crypto market continues to evolve, staying informed about significant players and their actions is key. The recent activity of this hyperliquid whale serves as a powerful reminder of the intertwined nature of profit-taking and market sentiment. Keeping an eye on such developments can equip you with the knowledge needed to make informed trading decisions.

Additionally, participating in communities and discussions about crypto trading can provide further insights. Engaging with others who are also analyzing market behaviors can uncover trends that you might not have noticed on your own. Platforms like Twitter and Reddit often have real-time discussions about market movements and whale activities that can be invaluable.

The Bigger Picture

In the grand scheme of the cryptocurrency landscape, the actions of a single whale, while significant, are part of a larger narrative. The market is driven by various factors, including technology advancements, regulatory news, and macroeconomic trends. It’s crucial to consider these elements alongside whale activities to get a comprehensive view of potential market movements.

For instance, as Bitcoin continues to gain acceptance among institutional investors, its price movements might reflect broader economic trends. The interplay between traditional finance and crypto markets can lead to new opportunities and risks for traders. Keeping an eye on these developments will help you stay ahead in this rapidly changing environment.

Conclusion

The recent news about a hyperliquid whale taking profits after earning $10 million in 24 hours, while still holding a substantial long position on Bitcoin, serves as a fascinating case study in market dynamics. For traders, the lesson is clear: pay attention to the actions of the whales. Their movements can provide critical insights into market sentiment and potential future price trends. By staying informed and engaged, you can navigate the thrilling world of cryptocurrency trading with greater confidence and insight.

HYPERLIQUID WHALE BEGINS TAKING PROFITS AFTER EARNING $10M IN 24 HOURS

STILL HOLDING A MASSIVE $337M LONG POSITION ON $BTC