BlackRock’s Significant Investment in Ethereum: A Game Changer for Crypto

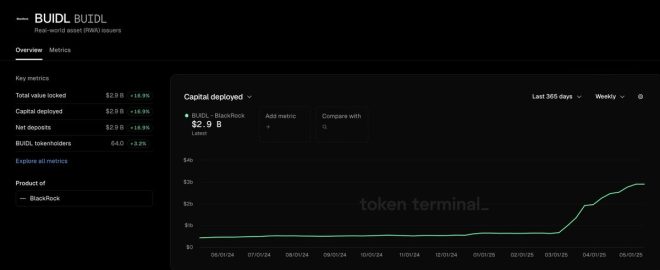

In a groundbreaking revelation, BlackRock has reportedly surpassed $2.9 billion in assets under management (AUM) in Ethereum ($ETH). This surge has ignited conversations across the cryptocurrency community, suggesting that BlackRock, a global investment management titan, is making a serious commitment to Ethereum. The news was shared by prominent crypto influencer Crypto Rover on Twitter, indicating a noteworthy shift in institutional interest towards cryptocurrency assets.

Understanding BlackRock’s Role in Cryptocurrency

BlackRock is one of the largest asset management firms globally, overseeing trillions in assets. Its foray into the cryptocurrency space signals a pivotal moment for the entire industry. Traditionally seen as a conservative player in finance, BlackRock’s increasing investment in Ethereum suggests a growing acceptance of digital assets among institutional investors. This trend could lead to more mainstream adoption of cryptocurrencies, which has the potential to further legitimize the sector in the eyes of traditional investors.

The Implications of $2.9 Billion in Ethereum

The surpassing of $2.9 billion in AUM for Ethereum by BlackRock carries several implications:

- Increased Credibility for Ethereum: Institutional investment often enhances the credibility of an asset. With BlackRock’s backing, Ethereum could see an increase in its perceived stability and long-term viability.

- Potential Price Surge: Historically, significant investments from large firms have led to price increases. As BlackRock continues to accumulate Ethereum, demand may outstrip supply, leading to higher prices.

- Market Dynamics: BlackRock’s entry into Ethereum could change the dynamics of the cryptocurrency market. As a major player, BlackRock’s trading strategies and decisions will significantly influence market trends.

- Catalyst for Other Institutions: BlackRock’s bold investment may encourage other institutional investors to explore cryptocurrency assets. This could lead to a domino effect, bringing more capital into the crypto market.

The Growing Acceptance of Ethereum

Ethereum has emerged as a leading platform for decentralized applications (dApps) and smart contracts. Its versatile technology has attracted developers and businesses alike, establishing it as more than just a cryptocurrency. BlackRock’s investment reinforces the narrative that Ethereum is not merely a speculative asset but a foundational technology for the future of finance and beyond.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Future of Ethereum and Institutional Investments

As we look ahead, the future of Ethereum appears promising, particularly in light of substantial institutional investments. BlackRock’s involvement could pave the way for increased regulatory clarity and infrastructure development, making it easier for other institutions to invest in digital assets.

Conclusion

BlackRock’s surpassing $2.9 billion in Ethereum AUM is a significant milestone that underscores the growing acceptance and legitimacy of cryptocurrency in traditional finance. As institutional investors like BlackRock step into the crypto arena, the landscape is poised for transformative changes. The developments surrounding Ethereum could lead to increased adoption, price appreciation, and a broader acceptance of digital assets in the financial ecosystem. For crypto enthusiasts and investors, this moment marks an exciting chapter in the evolution of cryptocurrency, and all eyes will be on how BlackRock’s strategies unfold in this dynamic market.

BREAKING:

BLACKROCK’S $ETH ASSETS UNDER MANAGEMENT SURPASS $2,900,000,000.

THEY 100% KNOW SOMETHING pic.twitter.com/H0MxFMnxX0

— Crypto Rover (@rovercrc) May 19, 2025

BREAKING: BLACKROCK’S $ETH ASSETS UNDER MANAGEMENT SURPASS $2,900,000,000

When news breaks that a major financial player is diving deep into cryptocurrency, it grabs everyone’s attention, and rightly so. Recently, Crypto Rover shared a pivotal update: BlackRock’s assets under management (AUM) in Ethereum have surged past a staggering $2.9 billion. This isn’t just another figure; it’s a testament to BlackRock’s confidence in the future of Ethereum and the broader cryptocurrency landscape.

But what does this mean for you, the everyday investor? Let’s break it down!

THEY 100% KNOW SOMETHING

You might be wondering why BlackRock’s move is so significant. The truth is, when a giant like BlackRock makes such a bold investment, it often signals that they see potential where others might not. With trillions in assets under management, BlackRock’s decisions can sway markets and influence investor sentiment. Their belief in Ethereum suggests that they foresee substantial growth ahead.

Why is Ethereum particularly interesting? Unlike Bitcoin, which primarily serves as a digital currency, Ethereum is a robust platform that supports decentralized applications (dApps) and smart contracts. This versatility has captured the attention of developers and investors alike, positioning Ethereum as a cornerstone of the decentralized finance (DeFi) movement.

The Implications of BlackRock’s Confidence in Ethereum

So, what does this mean for the average Joe or Jane looking to invest in crypto? For starters, increased institutional interest often leads to higher prices. When big players like BlackRock enter the scene, it can create a ripple effect, attracting more investors to the space. This can drive up demand for Ethereum, potentially increasing its value.

Additionally, BlackRock’s involvement lends legitimacy to Ethereum. While crypto has faced skepticism from traditional finance sectors, BlackRock’s backing can help bridge that gap. This could encourage more conservative investors to dip their toes into the crypto waters.

Understanding BlackRock’s Strategy

You might be curious about BlackRock’s strategy and how they approach investing in cryptocurrencies. Their investment philosophy typically involves extensive research and a long-term perspective. They’re known for analyzing macroeconomic trends and identifying opportunities that align with their investment goals.

For Ethereum, this might involve looking at factors like network upgrades (like the recent transition to Ethereum 2.0), the growing adoption of decentralized finance (DeFi), and the increasing interest from developers in building on the Ethereum blockchain. All these factors play into BlackRock’s decision to invest heavily in ETH.

What This Means for the Future of Ethereum

The surge in BlackRock’s Ethereum assets is a strong indicator of what’s to come. As more institutional players enter the crypto space, we can expect Ethereum to gain traction as a leading platform. This could lead to more innovations, increased usage, and, ultimately, a more robust ecosystem.

Moreover, this kind of institutional support might pave the way for regulatory clarity in the crypto space. As more established financial institutions engage with cryptocurrencies, regulators may feel pressured to provide clear guidelines, which could further legitimize the industry.

How Should You Approach Investing in Ethereum?

If you’re considering investing in Ethereum, here are a few tips to keep in mind:

1. **Do Your Research**: Just as BlackRock conducts thorough research before investing, you should too. Understand the fundamentals of Ethereum, its technology, and the market dynamics.

2. **Consider Dollar-Cost Averaging**: Rather than trying to time the market, consider a dollar-cost averaging approach. This means investing a fixed amount of money at regular intervals, regardless of the price. This strategy can help mitigate the effects of volatility.

3. **Diversify Your Portfolio**: While Ethereum is an exciting investment, it’s essential to diversify your holdings. Don’t put all your eggs in one basket. Consider including other cryptocurrencies or traditional assets in your portfolio.

4. **Stay Informed**: Keep an eye on developments in the crypto space. News, regulatory changes, and market trends can significantly impact Ethereum’s performance. Follow credible sources and stay updated.

5. **Be Prepared for Volatility**: The crypto market is known for its price swings. Be prepared for ups and downs and don’t let emotions dictate your investment decisions.

The Broader Impact of Institutional Investment in Crypto

BlackRock’s embrace of Ethereum is part of a larger trend that sees institutional investors increasingly entering the cryptocurrency market. Companies like Tesla, MicroStrategy, and Square have already made headlines for their Bitcoin investments, while other financial institutions have launched crypto-focused funds.

This trend is essential for several reasons:

– **Legitimacy**: Institutional investment adds a layer of legitimacy to the crypto space. When well-known, trusted institutions invest, it helps to dispel some of the skepticism surrounding cryptocurrencies.

– **Increased Adoption**: As institutions invest in cryptocurrencies, they also pave the way for more individuals to become interested in investing in digital assets. This can create a more extensive user base and further drive demand.

– **Innovation in Financial Products**: The interest from institutions is also leading to the development of new financial products, like futures and ETFs based on cryptocurrencies. This innovation can provide investors with more options and help them navigate the complex crypto landscape.

What’s Next for BlackRock and Ethereum?

Looking ahead, it will be fascinating to watch how BlackRock continues to engage with Ethereum and the broader crypto market. Will they expand their investment even further? Will they introduce new products that leverage Ethereum’s capabilities?

As Ethereum continues to evolve—especially with upcoming updates and improvements—the potential for growth remains significant. BlackRock’s substantial investment may just be the tip of the iceberg.

In Summary

The news that BlackRock’s assets under management in Ethereum have surpassed $2.9 billion is a critical moment in the cryptocurrency landscape. It reflects a growing acceptance of digital assets in traditional finance and highlights the potential for Ethereum’s future.

For investors, this development signals an opportunity. Understanding the implications of BlackRock’s investment can help you make informed decisions and navigate the ever-evolving world of cryptocurrencies. Stay curious, keep learning, and who knows—you might just find yourself riding the wave of the next big investment opportunity!

BLACKROCK’S $ETH ASSETS UNDER MANAGEMENT SURPASS $2,900,000,000.

THEY 100% KNOW SOMETHING