Bitcoin Whale Increases Long Position: What It Means for the Market

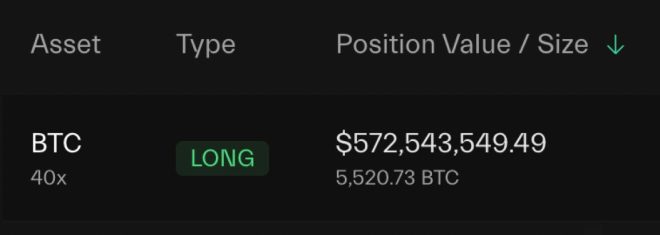

In a striking development within the cryptocurrency landscape, a notable Bitcoin whale has significantly increased their long position, now totaling over $570 million. This move has stirred conversation among crypto enthusiasts and analysts alike, raising questions about the motivations behind such a substantial investment. Is this individual a mere gambler, or do they possess insider information that could influence market trends? This article delves into the implications of this significant financial maneuver and its potential impact on the Bitcoin market.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large quantities of Bitcoin, often amounting to thousands or even millions of dollars. Their actions can substantially influence market prices due to the sheer volume of their holdings. When a whale makes a significant investment, as seen in this case, it often triggers reactions throughout the entire cryptocurrency market, creating ripples that can lead to increased volatility.

The Context of the Investment

The whale in question has reportedly increased their long position by 40 times, indicating a high level of confidence in the future value of Bitcoin. A long position is an investment strategy where the investor anticipates that the price of an asset will rise. By leveraging their investment, this whale is betting on a bullish trend for Bitcoin, which could suggest a favorable outlook for the cryptocurrency in the near term.

Market Reactions

The announcement of this massive investment has caused a flurry of activity within the crypto community. Social media platforms, particularly Twitter, have become hotbeds of speculation regarding the motivations behind this move. Some believe that this whale may have access to insider information, prompting them to make such a bold investment. Others argue that it could simply be a calculated risk based on market trends and technical analysis.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Technical Analysis

Technical analysis plays a crucial role in understanding market movements and predicting future price trends. Analysts often look at various indicators, such as moving averages and trading volumes, to gauge the market’s direction. In this case, the whale’s decision to increase their long position may align with bullish signals observed in Bitcoin’s price trends. Therefore, while insider information cannot be ruled out, the investment could also be a strategic decision based on sound technical analysis.

The Impact of Whale Activity on Bitcoin Pricing

Historically, significant movements by Bitcoin whales have led to increased volatility in the market. When a whale buys or sells a considerable amount of Bitcoin, it can cause the price to surge or plummet, depending on the direction of the trade. This latest long position could lead to a bullish sentiment, encouraging other investors to follow suit and further drive up the price of Bitcoin.

Speculation and Market Sentiment

Speculation is a powerful force in the cryptocurrency market. As news of the whale’s investment spreads, it can create a sense of FOMO (fear of missing out) among retail investors. This psychological aspect often leads to increased buying activity, potentially pushing the price of Bitcoin even higher. Conversely, if the market perceives the whale’s move as risky or unwarranted, it could lead to panic selling, resulting in a price drop.

The Broader Implications for Bitcoin

The actions of Bitcoin whales can also have broader implications for the cryptocurrency ecosystem. A significant investment in Bitcoin may signal growing institutional interest in cryptocurrency as a legitimate asset class. As more institutional investors enter the market, it could enhance Bitcoin’s legitimacy and stability, leading to increased adoption and acceptance.

Conclusion: What Lies Ahead for Bitcoin?

The recent increase in a Bitcoin whale’s long position to over $570 million is a noteworthy event that has captured the attention of the crypto community. Whether this individual is acting on insider information or making a calculated bet based on market trends remains to be seen. However, one thing is clear: the implications of this investment could ripple through the cryptocurrency market, influencing price movements and investor sentiment in the coming days and weeks.

As the cryptocurrency landscape continues to evolve, it’s essential for investors to stay informed and analyze market trends carefully. While the actions of whales can provide valuable insights, it’s crucial to approach the market with a balanced perspective, considering both the potential risks and rewards associated with investing in Bitcoin.

In summary, the Bitcoin whale’s recent investment has opened up discussions about the dynamics of whale activity, market speculation, and the future trajectory of Bitcoin. As we observe how the market reacts to this significant financial move, investors should remain vigilant and prepared for the potential volatility that lies ahead.

BREAKING:

BITCOIN WHALE JUST INCREASED HIS 40x #BITCOIN LONG TO OVER $570 MILLION

GAMBLER OR INSIDER ??? pic.twitter.com/pt5PUju0Ps

— Crypto Rover (@rovercrc) May 19, 2025

BREAKING:

Bitcoin has taken the financial world by storm, and nothing seems to get people talking more than the actions of a Bitcoin whale. Recently, a whale significantly increased their investment in Bitcoin, pushing their long to over $570 million with a staggering 40x leverage. This dramatic move raises intriguing questions: is this investor a gambler or an insider? Let’s dive into the details.

BITCOIN WHALE JUST INCREASED HIS 40x LONG TO OVER $570 MILLION

On May 19, 2025, the cryptocurrency community was abuzz with news that a prominent Bitcoin whale had amplified their long position to a jaw-dropping $570 million. This massive increase in investment caught the attention of traders and investors alike, leading to wild speculation about the motivations behind such a bold move. In the world of crypto, a whale is defined as an individual or entity that holds a significant amount of a particular cryptocurrency. When they make a move, it can have substantial implications for the market and can influence the decisions of other traders.

With the rise of Bitcoin, many have begun to wonder what drives these whales to make such high-stakes bets. Is it sheer confidence in Bitcoin’s future, or could it be a well-calculated strategy based on insider knowledge? The cryptocurrency space is notorious for its volatility, and leveraging positions can lead to significant profits—or catastrophic losses. In this case, the whale’s decision to use a 40x leverage suggests an aggressive approach, which is not for the faint-hearted.

GAMBLER OR INSIDER ???

The question that everyone is asking: is this whale a gambler taking a reckless risk, or do they have access to insider information that the average investor does not? The nature of cryptocurrency trading often blurs these lines. Some investors operate on gut feelings and market trends, while others claim to have insights that guide their decisions. This particular whale’s move is reminiscent of actions taken in traditional stock markets by those who have access to non-public information. However, the decentralized nature of cryptocurrencies complicates the idea of insider trading.

For many, the notion of a “whale” conjures images of a savvy investor playing the market with a strategic advantage. In a market as unpredictable as cryptocurrency, understanding the motivations of these large holders can provide valuable insights into future price movements. Traders often analyze whale activity to gauge market sentiment and potential shifts in price dynamics.

Some analysts argue that whales can manipulate the market by making large trades that influence price action, creating liquidity for themselves while leaving smaller traders scrambling to keep up. This phenomenon raises ethical questions about market fairness and transparency in the cryptocurrency space. So, is this whale simply a savvy investor capitalizing on market trends, or are they leveraging insider knowledge to gain an unfair advantage?

The Impact of Whales on Bitcoin Price

Bitcoin’s price is notoriously volatile, influenced by various factors, including market sentiment, regulatory news, and the actions of large holders. When a whale increases their position dramatically, it can lead to significant price fluctuations. Traders often react to such moves, leading to cascading effects on the market. For instance, a surge in buying pressure from a whale can create a bullish sentiment, prompting other investors to enter the market, pushing prices even higher.

However, it’s essential to consider the flip side. If a whale decides to sell off a significant portion of their holdings, it can lead to panic selling among smaller investors, causing prices to plummet. This dynamic creates a fascinating yet treacherous environment for traders. Understanding the impact of whales on Bitcoin price movements is crucial for anyone looking to navigate the crypto landscape successfully.

Market Reactions and Sentiment

When news broke about the whale increasing their long position, the crypto community reacted with a mix of excitement and skepticism. Social media platforms, especially Twitter, were flooded with opinions ranging from bullish predictions to cautious warnings. Some traders viewed the whale’s actions as a bullish indicator, suggesting that they are betting heavily on Bitcoin’s future price appreciation. This optimism can be contagious, leading to increased buying activity across the board.

Conversely, others expressed concerns about the sustainability of such high-leverage positions. The fear of a potential market correction looms large in the minds of many, especially given the historical volatility of Bitcoin. The sentiment often swings between extreme optimism and skepticism, creating a rollercoaster of emotions for those involved in trading.

What Can We Learn from This Incident?

For individual investors and traders, the actions of whales can serve as valuable lessons. Monitoring whale activity can provide insights into market trends and sentiment shifts. However, it’s crucial to approach these insights with caution. Following the actions of a whale blindly can lead to significant losses, especially in a market as unpredictable as cryptocurrency.

Understanding risk management and developing a robust trading strategy is essential for anyone looking to navigate this space. Whether you are a seasoned trader or a newcomer, learning to analyze market trends, price action, and whale behavior can enhance your trading experience.

The Future of Bitcoin Trading

As Bitcoin continues to evolve and gain mainstream acceptance, the influence of whales is likely to remain a significant factor in market dynamics. The cryptocurrency landscape is still maturing, with regulatory frameworks and institutional participation shaping its future. Investors should keep a close eye on the activities of large holders, as their decisions can lead to both opportunities and risks.

Moreover, as Bitcoin adoption increases and the market becomes more institutionalized, the role of whales may shift. Traditional financial principles may come into play, leading to more stability and predictability in price movements. However, the inherent volatility of cryptocurrencies will likely persist, keeping the thrill of trading alive.

Conclusion

The recent move by a Bitcoin whale to increase their long position to over $570 million has sparked discussions about the motives behind such a bold investment. Whether viewed as a gambler or an insider, the implications of their actions are far-reaching. As the cryptocurrency market continues to develop, understanding the behavior of whales will remain a crucial aspect of trading strategy. Stay informed, be cautious, and remember that in the world of Bitcoin, anything can happen.

BITCOIN WHALE JUST INCREASED HIS 40x #BITCOIN LONG TO OVER $570 MILLION

GAMBLER OR INSIDER ???