BlackRock’s Strategic Move: A $8.65 Million Investment in Ethereum

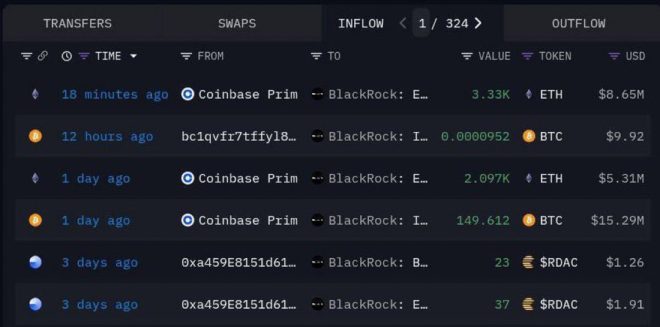

In a significant development within the cryptocurrency landscape, BlackRock, the world’s largest asset manager, has made headlines by acquiring a substantial amount of Ethereum (ETH) valued at $8,650,000. This strategic investment, executed on Coinbase, underscores BlackRock’s increasing interest in digital assets and signals a broader acceptance of cryptocurrencies in mainstream finance.

Understanding the Investment

On May 19, 2025, the news broke via a tweet from Crypto Rover, a prominent figure in the cryptocurrency community. The tweet highlighted BlackRock’s purchase, drawing considerable attention from investors and analysts alike. The acquisition of such a large amount of Ethereum indicates not only BlackRock’s confidence in the cryptocurrency market but also its recognition of Ethereum’s potential as a leading blockchain platform.

Why Ethereum?

Ethereum has established itself as a cornerstone of the decentralized finance (DeFi) movement and is the second-largest cryptocurrency by market capitalization, following Bitcoin. The platform is renowned for its smart contract functionality, enabling developers to create decentralized applications (dApps) that operate without intermediaries. This capability has attracted a diverse range of projects and investments, making Ethereum a focal point in the blockchain ecosystem.

BlackRock’s investment in Ethereum can be interpreted as a strategic move to diversify its portfolio and tap into the growing demand for blockchain-based assets. As institutional interest in cryptocurrencies continues to rise, major financial players like BlackRock are keen to capitalize on the opportunities presented by digital currencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

BlackRock’s entry into the Ethereum market could have far-reaching implications. First, it may encourage other institutional investors to follow suit, leading to increased capital inflow into the cryptocurrency space. This influx of investment could bolster Ethereum’s price and market stability, fostering a more robust environment for both retail and institutional investors.

Moreover, BlackRock’s involvement may enhance the legitimacy of Ethereum and other cryptocurrencies in the eyes of traditional finance. As a trusted name in asset management, BlackRock’s endorsement could pave the way for more regulatory acceptance and integration of cryptocurrencies into mainstream finance.

The Role of Coinbase

BlackRock’s purchase was facilitated through Coinbase, one of the largest and most reputable cryptocurrency exchanges. Coinbase has become a preferred platform for institutional investors due to its robust security measures, regulatory compliance, and user-friendly interface. By choosing Coinbase for this transaction, BlackRock demonstrates its commitment to engaging with established platforms that prioritize security and transparency.

Market Reactions

Following the announcement of BlackRock’s investment, the cryptocurrency market experienced notable volatility. Ethereum’s price saw a surge as traders reacted to the news, reflecting the enthusiasm surrounding institutional investments in digital assets. Market analysts predict that this trend of institutional adoption is likely to continue, further solidifying Ethereum’s position in the cryptocurrency hierarchy.

Future Outlook for Ethereum

Looking ahead, the future of Ethereum appears promising, especially with the backing of major players like BlackRock. As Ethereum continues to evolve, with upcoming upgrades and enhancements aimed at increasing scalability and reducing transaction costs, it is positioned to further capture market share and expand its user base.

The ongoing development of Ethereum 2.0, which aims to transition the network from a proof-of-work to a proof-of-stake consensus mechanism, is also likely to enhance the platform’s appeal. This transition aims to improve energy efficiency and network security, addressing some of the criticisms that have been leveled against Ethereum.

Conclusion

BlackRock’s $8.65 million investment in Ethereum marks a pivotal moment in the intersection of traditional finance and the burgeoning world of cryptocurrencies. As major institutional players take a more active role in the cryptocurrency market, the landscape is poised for significant transformation. This investment not only highlights BlackRock’s strategic vision but also underscores the growing legitimacy of cryptocurrencies like Ethereum in the global financial ecosystem.

For investors and enthusiasts, following BlackRock’s actions and the broader trends in cryptocurrency adoption will be crucial in navigating this dynamic market. As Ethereum continues to innovate and expand its capabilities, it remains at the forefront of the digital asset revolution, attracting attention from both retail and institutional investors alike. The future of Ethereum looks bright, and with continued support from significant players like BlackRock, it is set to play a crucial role in shaping the future of finance.

In summary, the recent investment by BlackRock in Ethereum is a clear signal of the evolving financial landscape, where digital assets are becoming integral to investment strategies. As more institutions recognize the potential of cryptocurrencies, the market is likely to witness further growth and maturation, paving the way for a new era of financial innovation.

BREAKING:

BLACKROCK JUST BOUGHT $8,650,000 WORTH OF $ETH ON COINBASE. pic.twitter.com/22VrTle7TG

— Crypto Rover (@rovercrc) May 19, 2025

BREAKING:

BLACKROCK JUST BOUGHT $8,650,000 WORTH OF $ETH ON COINBASE.

If you’ve been keeping an eye on the cryptocurrency world, you probably heard the buzz about BlackRock’s latest investment. The financial giant recently made headlines by purchasing a whopping $8,650,000 worth of Ethereum (ETH) on Coinbase, and the implications of this move are nothing short of exciting. So, let’s break down what this means for investors, the crypto market, and the future of Ethereum.

What Does This Investment Mean?

BlackRock’s decision to invest in Ethereum is a big deal for several reasons. First, BlackRock is one of the largest asset management firms globally, overseeing trillions in assets. When they make a move in the cryptocurrency space, it sends waves throughout the financial markets. This investment isn’t just a random purchase; it signifies a growing acceptance of cryptocurrencies among traditional financial institutions.

The fact that BlackRock chose Ethereum, specifically, indicates a recognition of the platform’s potential. Ethereum isn’t just a cryptocurrency; it’s a decentralized platform that allows developers to build smart contracts and decentralized applications (dApps). This versatility makes ETH an attractive asset for investment.

Why Ethereum?

Ethereum has been gaining traction as a leading blockchain platform, and it’s not hard to see why. With its smart contract capabilities, Ethereum enables a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs). The rise of DeFi has been particularly noteworthy, as platforms built on Ethereum have been revolutionizing the way we think about finance, lending, and trading.

By investing in Ethereum, BlackRock is likely betting on the continued growth of these sectors. As the DeFi market expands, the value of ETH could increase significantly. Investors are starting to view Ethereum not just as a cryptocurrency but as a key player in the future of finance.

The Impact on the Crypto Market

When a giant like BlackRock enters the crypto space, it often leads to increased interest from other institutional investors. This could result in a surge in demand for Ethereum and other cryptocurrencies, potentially driving prices up. We may already be seeing this effect as news of BlackRock’s investment spreads across social media and financial news outlets.

Moreover, institutional investment can help legitimize the cryptocurrency market. It signals to retail investors that cryptocurrencies are becoming a more accepted form of investment. As more institutions get involved, the market may become more stable, reducing volatility and attracting even more investors.

The Role of Coinbase

Coinbase played a crucial role in this transaction. As one of the leading cryptocurrency exchanges, Coinbase provides a platform for buying, selling, and trading cryptocurrencies. The fact that BlackRock chose Coinbase for this purchase adds to the exchange’s credibility, showing that even large financial institutions trust its services.

Coinbase has been making strides to improve its offerings and attract institutional investors. This includes providing advanced trading tools, custody services, and other features tailored to the needs of large investors. BlackRock’s investment could further enhance Coinbase’s reputation in the market, potentially driving more institutional interest in the platform.

What’s Next for Ethereum?

So, what does the future hold for Ethereum following this significant investment? Analysts and enthusiasts are optimistic. Many believe that BlackRock’s involvement could lead to increased adoption of Ethereum and its associated technologies. As more companies and individuals become aware of the benefits of decentralized finance and smart contracts, the demand for ETH may continue to rise.

Additionally, Ethereum is undergoing significant upgrades aimed at improving its scalability and reducing transaction fees. The transition to Ethereum 2.0, which involves moving from a proof-of-work to a proof-of-stake consensus mechanism, is expected to enhance the network’s efficiency. These improvements could make Ethereum even more attractive to investors and developers alike.

Investing in Ethereum: Opportunities and Risks

While the news of BlackRock’s investment in Ethereum is certainly exciting, it’s essential to approach cryptocurrency investments with caution. Like any investment, there are risks involved. The crypto market is known for its volatility, and prices can fluctuate dramatically in a short period.

If you’re considering investing in Ethereum, take the time to research and understand the market. Look at the technology behind Ethereum, the team involved, and the broader trends in the crypto space. It’s crucial to make informed decisions and not just follow the hype.

Community and Ecosystem Development

The Ethereum community is vibrant and active, with developers constantly working on new projects and applications. This community-driven approach is one of the reasons Ethereum has remained at the forefront of the cryptocurrency space. The ongoing development and innovation within the ecosystem can lead to new use cases and increased demand for ETH.

Furthermore, Ethereum has a strong network effect. As more developers build on the platform, it attracts more users, creating a positive feedback loop. This dynamic can contribute to Ethereum’s long-term growth and stability.

Conclusion

The news about BlackRock buying $8,650,000 worth of Ethereum on Coinbase is a significant milestone for both BlackRock and the cryptocurrency market. It highlights the growing acceptance of digital assets in traditional finance and signals a bright future for Ethereum. As an investor or enthusiast, staying informed and engaged with the developments in this space will be key to navigating the exciting yet unpredictable world of cryptocurrency.

In summary, BlackRock’s investment in Ethereum could be a game-changer for both the asset and the broader market. With potential for growth and innovation, now might be the perfect time to dive deeper into Ethereum and explore what it has to offer.

BLACKROCK JUST BOUGHT $8,650,000 WORTH OF $ETH ON COINBASE.