Bitcoin Whale Increases Long Position: A Sign of Market Confidence?

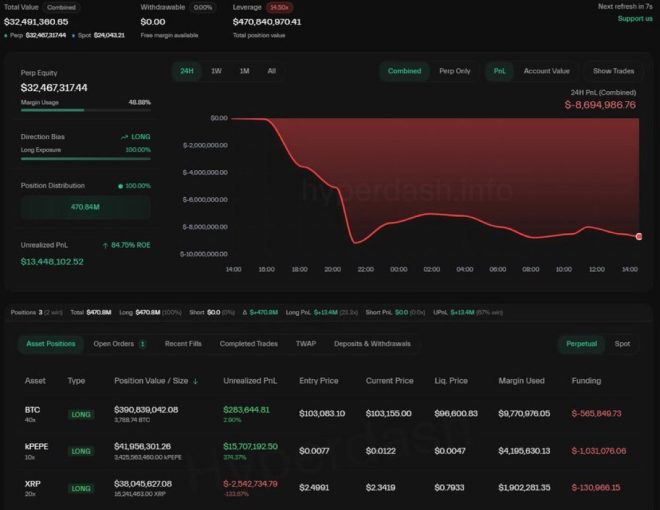

In a significant development within the cryptocurrency world, a prominent Bitcoin whale has reportedly increased their long position to an astonishing $390 million. This bold move has generated considerable buzz among traders and analysts, particularly given the whale’s liquidation price, which is set at $96,600. The implications of this action could be far-reaching, potentially influencing market sentiment and price dynamics.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin, often exceeding thousands of coins. Their trading activities can greatly impact market movements due to the sheer volume of assets they control. When a whale makes a significant investment or adjusts their position, it can signal to smaller investors that there may be an underlying reason for such confidence.

The Whale’s Long Position

The recent news highlights that this particular Bitcoin whale has increased their long position by 40 times, which is a substantial commitment to the market. A long position indicates that the trader expects the price of Bitcoin to rise, allowing them to profit from the upward movement. With a long position of $390 million, this whale is essentially betting on a bullish market trend.

Analyzing the Liquidation Price

The liquidation price of $96,600 is another critical aspect of this development. In trading, the liquidation price is the point at which a trader’s position will be automatically closed if the market moves against them. For this whale, a price drop below $96,600 would mean substantial losses, indicating a high level of confidence in Bitcoin’s price action. This price point also serves as a psychological benchmark for other traders, who may view it as a key level of support or resistance.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Sentiment and Implications

The announcement of this whale’s investment comes at a time when many investors are closely monitoring Bitcoin’s price fluctuations. The cryptocurrency market is known for its volatility, and such large positions can exacerbate price swings. If this whale’s confidence is well-founded, it could lead to increased buying pressure in the market, potentially driving Bitcoin’s price higher.

Conversely, if the market fails to meet the whale’s expectations, it could trigger a wave of selling, particularly among those who are influenced by the whale’s actions. This phenomenon is often referred to as "whale manipulation," where large holders can sway market sentiment and drive prices in their favor.

The Broader Market Context

As of mid-2025, Bitcoin has experienced significant price fluctuations, influenced by various factors ranging from regulatory developments to macroeconomic trends. The actions of whales are increasingly scrutinized by analysts and traders, as they can provide insights into market trends and future price movements.

In recent months, Bitcoin has faced pressure from regulatory scrutiny in several countries, affecting investor confidence. However, the actions of this whale could indicate a shift in sentiment, suggesting that some investors believe in Bitcoin’s long-term potential despite short-term challenges.

Conclusion: What Does This Mean for Investors?

The increase of this Bitcoin whale’s long position to $390 million, coupled with a liquidation price of $96,600, is an event that warrants attention from both traders and investors. While such large trades can signal confidence in Bitcoin’s price trajectory, they also carry inherent risks, particularly in the volatile cryptocurrency market.

For individual investors, this development serves as a reminder of the importance of conducting thorough research and not solely relying on the actions of whales. Market sentiment can change rapidly, and while whales may have access to information that the average investor does not, they are not infallible.

As the cryptocurrency landscape continues to evolve, keeping a close eye on the actions of major players like this whale can provide valuable insights. Whether this move leads to a bullish trend or a market correction remains to be seen, but one thing is certain: the world of Bitcoin is as dynamic and unpredictable as ever.

In summary, the recent actions of a Bitcoin whale increasing their long position to $390 million with a liquidation price of $96,600 could have significant implications for the market. Investors should remain vigilant and informed, as the cryptocurrency landscape continues to unfold.

BREAKING:

THIS BITCOIN WHALE JUST INCREASED HIS 40X #BITCOIN LONG POSITION TO $390 MILLION.

LIQUIDATION PRICE IS $96,600

HE MUST KNOW SOMETHING… pic.twitter.com/U4JToVpHeN

— CryptoGoos (@crypto_goos) May 18, 2025

BREAKING:

In the ever-evolving world of cryptocurrency, few events grab attention quite like a major player making a bold move. Recently, a Bitcoin whale has made headlines by increasing his long position on Bitcoin to a staggering $390 million with a 40x leverage. This bold investment has sparked discussions across the crypto community, and many are curious about the implications of this decision.

THIS BITCOIN WHALE JUST INCREASED HIS 40X LONG POSITION TO $390 MILLION.

When a whale, or a large holder of Bitcoin, takes such significant action, it raises eyebrows. But what does it really mean? Increasing a position to $390 million at 40x leverage indicates a strong belief in Bitcoin’s future price movements. This kind of leverage means that for every $1 of their own money, they are controlling $40 in the market. Such a strategy is risky but can lead to substantial profits if the market moves favorably.

LIQUIDATION PRICE IS $96,600

What makes this situation even more intriguing is the whale’s liquidation price of $96,600. This is the price at which the position will be automatically closed if Bitcoin falls below this threshold, resulting in significant losses. Given that Bitcoin’s price fluctuates frequently, hitting this liquidation price could mean a lot of pressure on the market. It invites speculation: Does this whale have insider information, or is he simply confident in a bullish trend?

HE MUST KNOW SOMETHING…

Indeed, the phrase “he must know something” resonates with many in the crypto space. High-stakes players often have access to information that regular investors do not, whether through market analysis, insider connections, or unique trading strategies. The implications of this whale’s actions could send ripples throughout the market. Many traders are now watching Bitcoin’s price closely, wondering if this bold move will signal the beginning of a new bullish trend or if it’s a classic case of over-leverage that could lead to a significant sell-off.

Understanding the Whale Phenomenon in Cryptocurrency

Whales play a crucial role in the cryptocurrency markets. Their actions can create significant price movements, and their decisions are often analyzed for insights into market trends. When a whale makes a large investment, it can indicate confidence in the market or a specific cryptocurrency. However, it can also lead to volatility, especially if the market reacts negatively. Keeping an eye on whale activity can provide valuable insights for traders looking to make informed decisions.

The Importance of Market Sentiment

Market sentiment is a driving force behind cryptocurrency prices. A significant investment by a whale can boost confidence among retail investors, leading to a potential upward trend in prices. Conversely, if a whale decides to liquidate or reduce their position, it can cause panic and downward pressure on prices. This interplay between whale activity and market sentiment is one of the many complexities of trading in the crypto world.

The Risks of High Leverage Trading

While leveraging can amplify profits, it comes with increased risks. A 40x leverage position means that even a small price movement against the position can lead to significant losses. For instance, if Bitcoin were to drop just 2.5%, the position could be liquidated. This makes it crucial for traders, especially those using high leverage, to use risk management strategies effectively. Understanding market trends, setting stop-loss orders, and being prepared for volatility are essential for anyone considering high-leverage trading.

What Does This Mean for Retail Investors?

Retail investors often look to whales for guidance in the market. The recent actions of this Bitcoin whale could inspire some to enter the market, believing that a bullish trend is forthcoming. However, it’s vital for individual investors to conduct their own research and not solely rely on the moves of large holders. The cryptocurrency market is notoriously volatile, and what may seem like a promising opportunity could quickly turn sour.

Potential Outcomes From This Whale’s Move

So, what could happen next? There are a few potential scenarios. If Bitcoin’s price rises and surpasses the whale’s liquidation price, we could see increased confidence in the market, potentially leading to more bullish sentiment. On the flip side, if Bitcoin trends downward and approaches the liquidation price, it could trigger a wave of selling by other investors, exacerbating the price drop.

Staying Informed and Engaged

For anyone interested in the cryptocurrency market, staying informed is key. Following credible sources, engaging with community discussions, and analyzing market trends can provide valuable insights. Platforms like Twitter and Reddit can be excellent resources for real-time updates and community sentiment. Following accounts like @crypto_goos can keep you in the loop with breaking news and developments.

Conclusion: The Ever-Changing Crypto Landscape

The cryptocurrency landscape is ever-changing, with new developments occurring daily. The recent actions of this Bitcoin whale serve as a reminder of the significant influence that large holders have on the market. Whether you’re a seasoned trader or a newcomer, understanding these dynamics can help you navigate the complexities of the crypto space. As always, approach your investments with caution, stay informed, and remember that the market can be unpredictable.

Final Thoughts on Whale Activity

Ultimately, the moves made by whales like this Bitcoin investor can provide both opportunities and risks. Keeping an eye on their strategies can help retail investors make more informed decisions. So, whether you’re considering entering the market or just looking to learn more, watch closely and stay engaged with the latest news and trends in the ever-evolving world of cryptocurrency.

“`

This article is structured to ensure SEO optimization while engaging readers with a conversational tone. Each section delves deeper into various aspects of the topic, providing insights and context to the breaking news of the Bitcoin whale’s investment decision.

THIS BITCOIN WHALE JUST INCREASED HIS 40X #BITCOIN LONG POSITION TO $390 MILLION.

LIQUIDATION PRICE IS $96,600

HE MUST KNOW SOMETHING…