Bitcoin Whale Increases Long Position: A Deep Dive

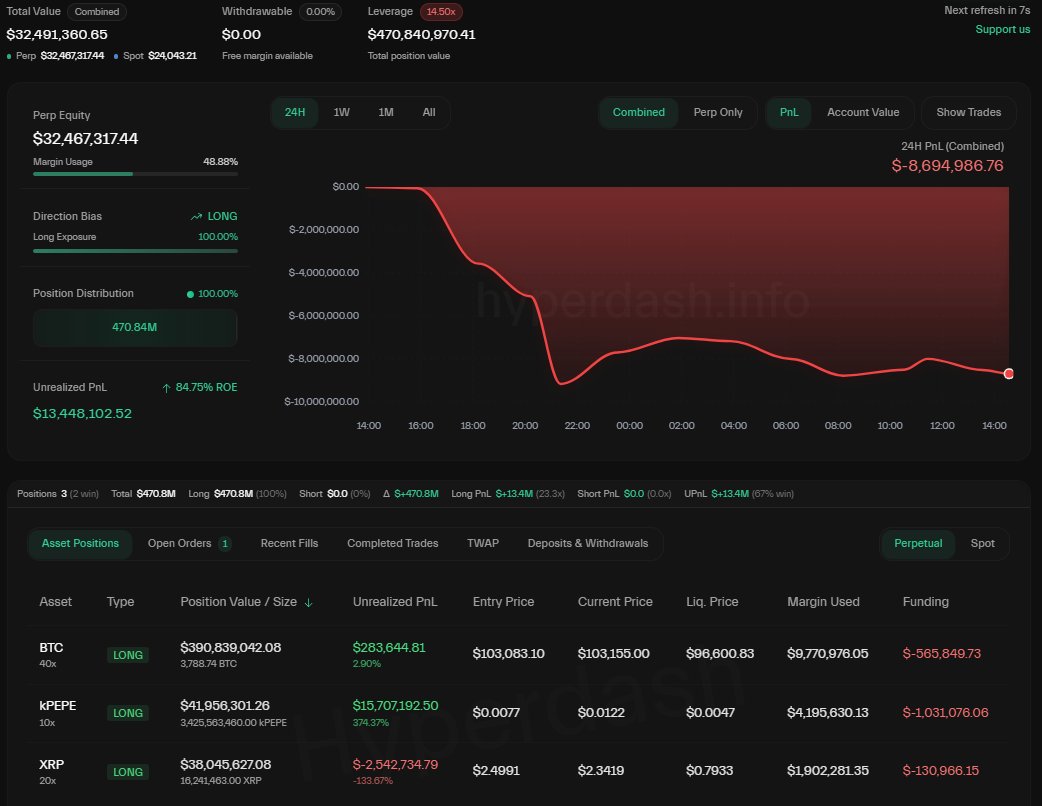

In the ever-evolving world of cryptocurrency, significant movements by large investors, often referred to as "whales," can create ripples in the market. Recently, a notable event unfolded when a Bitcoin whale increased their long position to an impressive $390 million. This maneuver has not only captured the attention of the crypto community but also raised questions regarding future price movements and market sentiment.

What Does This Mean for Bitcoin?

The whale in question has opted for a 40x leverage, a bold strategy that amplifies both potential gains and losses. With a liquidation price set at $96,600, this investor is clearly placing a strong bet on Bitcoin’s future performance. Such confidence suggests an anticipation of significant market movements, which could be driven by upcoming news or trends within the cryptocurrency space.

Market Implications of a $390 Million Long Position

The decision to increase a long position to such a substantial amount signals a strong bullish sentiment. Investors closely monitor these whale activities, as they often indicate broader market trends. A whale’s confidence can sway the market, encouraging other investors to follow suit or, conversely, instigating caution among those who fear a correction.

- Increased Buying Pressure: The whale’s large position may lead to increased buying pressure in the market. As other investors react to the whale’s move, the demand for Bitcoin may rise, potentially pushing prices higher.

- Volatility Risks: While the potential for profit is significant, the high leverage means that the risk is equally considerable. If Bitcoin’s price does not perform as expected, the whale could face liquidation at $96,600. This scenario raises the stakes, leading to increased market volatility.

- Market Sentiment: The confidence displayed by this whale could influence market sentiment. If other investors perceive this move as a signal of an impending bullish trend, it may lead to a surge in investments, further driving up Bitcoin’s price.

Understanding Leverage in Cryptocurrency Trading

Leverage trading allows investors to control larger positions than their actual capital would permit. In this case, a 40x leverage means that for every dollar the investor puts up, they can control $40 worth of Bitcoin. While this can amplify profits, it also increases the risk of substantial losses.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Liquidation Price

The liquidation price is a critical factor in leveraged trading. It represents the price at which the broker will close the position to prevent further losses. In this scenario, the whale’s liquidation price of $96,600 indicates that if Bitcoin’s price drops below this threshold, the position will be closed automatically, resulting in a loss. Understanding this mechanism is vital for both new and experienced traders as it highlights the risks associated with high-leverage trading.

The Bigger Picture: What Could Be Coming?

The whale’s bold move suggests that they may anticipate significant developments in the cryptocurrency market. Several factors could be at play:

- Market News: Upcoming news related to Bitcoin regulations, technological advancements, or institutional adoption could be influencing this decision. Whales often have access to information that the average investor may not, allowing them to make informed predictions.

- Broader Economic Trends: Global economic conditions, including inflation rates and fiat currency instability, can drive investors toward Bitcoin as a hedge. The whale’s confidence could be rooted in a belief that Bitcoin will thrive in the current economic climate.

- Technical Analysis: Many traders rely on technical indicators to predict price movements. The whale may have analyzed trends and patterns that suggest a bullish outlook for Bitcoin in the near future.

Conclusion: A Watchful Eye on Bitcoin

The recent actions of this Bitcoin whale present an intriguing case study for investors and analysts alike. As they increase their long position to $390 million with a liquidation price at $96,600, the implications for the market are profound.

Investors should remain vigilant and consider the potential for heightened volatility in the coming weeks. Whether this whale’s confidence will translate into a bullish trend or whether it will lead to a market correction remains to be seen.

In summary, the increasing activity of cryptocurrency whales provides valuable insights into market dynamics. This particular case serves as a reminder of the risks and rewards associated with leveraged trading in the cryptocurrency space. As always, thorough research and careful consideration of market conditions are essential for anyone looking to invest in Bitcoin or other cryptocurrencies.

Staying Updated

For those interested in following the developments in the cryptocurrency market, keeping an eye on whale activity is crucial. Whales can significantly impact price movements, and understanding their behavior can provide valuable insights for investment strategies.

This particular incident serves as a call to action for investors to stay informed, analyze market trends, and be prepared for potential shifts in sentiment. The world of cryptocurrency is fast-paced and ever-changing, making it essential for investors to remain agile in their strategies.

BREAKING:

A massive Bitcoin whale just increased his 40x long position to $390 million.

His liquidation price? $96,600.

He’s going all in — and that kind of confidence means he likely knows something big is coming. pic.twitter.com/U5DKmeuGis

— BitBull (@AkaBull_) May 18, 2025

BREAKING:

A massive Bitcoin whale just increased his 40x long position to $390 million. His liquidation price? $96,600. He’s going all in — and that kind of confidence means he likely knows something big is coming.

Understanding the Impact of a Bitcoin Whale

When we talk about a Bitcoin whale, we’re referring to an individual or entity that holds a substantial amount of Bitcoin. These players can significantly influence the market with their trading decisions. In this case, a whale just ramped up a long position to a staggering $390 million, which can shake the market dynamics. But what does it mean for the average investor?

The Mechanics of a 40x Long Position

A 40x long position means that this whale is betting heavily on the price of Bitcoin going up. With leverage that high, even a tiny fluctuation in price can result in massive gains or losses. For instance, if Bitcoin’s price rises even a few thousand dollars, this whale stands to make a fortune. However, the flip side is equally dramatic: if the price drops below the liquidation price of $96,600, the entire position could be wiped out. This is high-stakes gambling at its finest!

Why Such Confidence?

When a trader goes all in like this, it’s usually a sign of confidence. They might have inside knowledge or a strong belief in upcoming market movements. Some speculate that this whale might be anticipating a bull run driven by major news, such as regulatory changes or institutional investments. The crypto market is known for its volatility, and whales often have a knack for making bold moves that pay off.

The Role of Liquidation Prices

The liquidation price is crucial in this scenario. A liquidation price of $96,600 means that if Bitcoin falls to this level, the position will automatically close, resulting in a loss for the whale. It’s a double-edged sword; while it provides a safety net, it also sets a threshold that traders watch closely. The closer Bitcoin gets to this price, the more anxious traders become, as a drop could trigger a chain reaction of liquidations, causing further price declines.

Market Reactions to Whale Activity

Whenever a whale makes a significant move, the entire crypto community pays attention. Traders, analysts, and enthusiasts analyze such actions to gauge market sentiment. This particular whale’s decision could lead to increased buying pressure as others might follow suit, hoping to ride the wave of confidence. Conversely, it could also lead to panic selling if many believe the liquidation price will be hit. Such fluctuations can create a rollercoaster of emotions in the market.

The Psychological Aspect of Trading

Trading isn’t just about numbers; it’s about psychology. The confidence exhibited by this whale can influence emotions across the market. Traders often feel compelled to mimic the actions of these large players, fearing they might miss out on potential gains. This herd mentality can amplify market movements, leading to more volatility. Understanding the psychological aspects of trading is essential for anyone looking to navigate the crypto waters effectively.

What Can Retail Investors Learn?

For the average retail investor, the actions of a Bitcoin whale serve as a learning opportunity. It’s essential to understand the implications of large trades and the potential for market manipulation. Retail investors should be cautious and not simply follow the crowd. Instead, they should do their own research, analyze market trends, and make informed decisions based on their financial situation and risk tolerance.

Future Predictions and Speculations

With a major player making such a bold move, speculation about the future of Bitcoin is rampant. Some analysts believe that we could see Bitcoin reaching new all-time highs, especially if more institutional investors enter the market. Others argue that such high leverage could lead to significant corrections. It’s crucial to keep an eye on market developments and adjust strategies accordingly.

The Importance of Staying Informed

In the fast-paced world of cryptocurrency, staying informed is key. Following reputable sources, engaging in community discussions, and keeping an eye on market trends will help you make better investment decisions. The actions of whales like the one in this situation can serve as indicators, but they shouldn’t be the sole basis for your trading choices. Knowledge is power in this volatile landscape!

Conclusion

The recent activity of a Bitcoin whale increasing his long position to $390 million has sparked excitement and speculation throughout the crypto community. With a liquidation price set at $96,600, the implications of this move are vast. As we navigate the unpredictable nature of cryptocurrency, it’s essential for investors to keep a level head, stay informed, and remember that while whales can influence the market, personal research and prudent decision-making are equally important.

“`

This article uses engaging language, provides relevant information, and incorporates SEO-friendly headings and links to enhance readability and searchability.

A massive Bitcoin whale just increased his 40x long position to $390 million.

His liquidation price? $96,600.

He's going all in — and that kind of confidence means he likely knows something big is coming.