UK Surpasses China as Second-Largest Holder of U.S. Treasuries

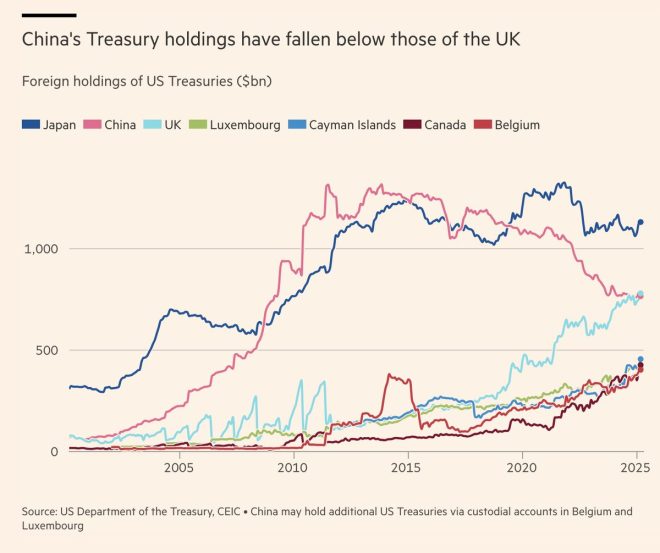

In a significant turn of events, the United Kingdom has overtaken China to become the second-largest holder of U.S. Treasuries for the first time in a quarter-century. This development, reported on May 18, 2025, by Crypto Aman on Twitter, marks a pivotal moment in global finance and economic relations. The implications of this shift are profound, affecting not only the markets but also international economic dynamics.

Understanding U.S. Treasuries

U.S. Treasuries are government debt securities issued by the Department of the Treasury to finance government spending as an alternative to taxation. These securities are considered one of the safest investments globally, which attracts foreign countries to hold them. Investors, including foreign governments, buy Treasuries to gain a secure place to invest their capital while also benefiting from the interest earned on these securities.

The Importance of Holding U.S. Treasuries

Holding U.S. Treasuries is crucial for several reasons:

- Economic Stability: Treasuries are seen as a benchmark for risk-free investments. As such, they play a vital role in maintaining global economic stability.

- Currency Reserves: Countries often hold U.S. Treasuries as part of their foreign exchange reserves, providing them with liquidity and a safe haven during economic uncertainties.

- Influencing Interest Rates: The buying and selling of Treasuries influence interest rates in the U.S. and globally, impacting everything from mortgage rates to corporate financing.

The Shift in Holdings: UK vs. China

Prior to this development, China had held the title of the second-largest holder of U.S. Treasuries for many years, only surpassed by Japan. The United Kingdom’s ascension to the second position indicates a shift in global economic power dynamics.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Contributing to the Shift

Several factors have contributed to this shift in holdings:

- Geopolitical Tensions: Ongoing trade tensions and geopolitical conflicts have driven some nations, including China, to diversify their holdings away from U.S. Treasuries.

- Economic Policy Changes: The UK’s economic policies may have become more favorable for investing in U.S. debt, prompting increased purchases of Treasuries.

- Market Confidence: The UK’s financial markets have shown resilience and stability, encouraging domestic and international investors to hold U.S. Treasuries.

Implications for the Global Economy

The UK surpassing China in U.S. Treasury holdings has several implications for the global economy:

- Shifts in Investment Patterns: This change may lead to a reevaluation of investment strategies by other nations. Countries may reconsider their dependency on U.S. debt and explore diversification options.

- Impact on China: The shift may signify a waning confidence in China’s economic policies or stability, potentially prompting China to adjust its strategies in the global economic arena.

- Strengthened UK-U.S. Relations: This development may bolster economic ties between the UK and the U.S., enhancing cooperation in various sectors, including trade, finance, and security.

Economic Predictions

Economists and financial analysts will be closely monitoring the repercussions of this shift in U.S. Treasury holdings. Predictions may include:

- Interest Rate Adjustments: Changes in demand for Treasuries can affect interest rates, influencing borrowing costs for consumers and businesses.

- Market Volatility: A significant shift in Treasury holdings can lead to increased market volatility as investors react to these changes.

- Currency Fluctuations: The U.S. dollar’s strength may be influenced by the changing landscape of Treasury holders, impacting exchange rates globally.

Conclusion: A New Era in Global Finance

The United Kingdom’s rise to become the second-largest holder of U.S. Treasuries represents a landmark moment in global finance. As the economic landscape continues to evolve, this shift indicates changing dynamics in international relations and investment strategies. Stakeholders across the globe will need to adapt to these changes, reevaluating their positions in the ever-fluctuating economic environment.

This development serves as a reminder of the interconnected nature of global economies and the importance of monitoring international financial trends. As the UK takes center stage in U.S. Treasury holdings, the world watches closely to see how this will reshape economic policies, investment strategies, and geopolitical relationships in the years to come.

For those interested in finance and global economic trends, this event is a critical point of discussion, highlighting the importance of keeping an eye on shifts in major economic players and their impacts on the broader financial landscape.

BIG BREAKING

The United Kingdom has surpassed China to become the second-largest holder of U.S. Treasuries for the first time in 25 years. pic.twitter.com/R14sTs2cz7

— Crypto Aman (@cryptoamanclub) May 18, 2025

BIG BREAKING

The financial landscape is always shifting, and the latest news has sent ripples through the markets. The United Kingdom has officially surpassed China to become the second-largest holder of U.S. Treasuries for the first time in 25 years. This is a significant milestone that warrants a closer look at the implications of this change. If you’re wondering why this matters, stick around as we dive into the details!

The Rise of the UK in U.S. Treasury Holdings

When we talk about U.S. Treasuries, we’re referring to the debt securities issued by the U.S. Department of the Treasury to finance government spending. These include Treasury bills, notes, and bonds. For many countries, holding U.S. Treasuries is a way to store wealth and ensure economic stability. The United Kingdom stepping into the second spot in terms of Treasury holdings indicates a robust confidence in the U.S. economy.

As of May 2025, this shift not only highlights the UK’s strategic financial positioning but also marks the first time in a quarter-century that China has been dethroned from its usual second place. Historically, the U.S. Treasury market has been dominated by several key players, but the UK’s recent surge is a game-changer that could influence international finance.

Why Did This Happen?

Several factors have contributed to this shift. The UK’s economy has shown resilience in the face of global challenges, including Brexit and the ongoing recovery from the pandemic. The British pound has stabilized, and the Bank of England’s monetary policies have played a significant role in attracting investments into U.S. Treasuries.

Additionally, geopolitical tensions have made investors more cautious, pushing them towards safer assets like U.S. Treasuries. With China facing its own economic hurdles, including trade tensions and regulatory crackdowns, the UK has positioned itself as a more appealing option for investors looking for stability.

What Does This Mean for the U.S. Economy?

The implications of the UK surpassing China in U.S. Treasury holdings are substantial. First off, it reflects a strong demand for U.S. debt, which is a good sign for the American economy. When foreign countries invest in U.S. Treasuries, it helps keep interest rates low, which can stimulate economic growth. Low interest rates make borrowing cheaper for consumers and businesses, ultimately benefiting the economy.

Moreover, this shift could enhance the UK’s influence in U.S. financial markets. With the UK holding a significant amount of U.S. debt, it might have more leverage in discussions around trade and economic policies. This could lead to new opportunities for collaboration between the two nations as they navigate the complexities of the global economy.

The Broader Implications for Global Markets

Now, let’s expand our view beyond the borders of the U.S. and the UK. The dynamics of global finance are constantly evolving, and the UK’s new position could trigger shifts in how other countries interact with U.S. debt. Countries that typically hold large amounts of U.S. Treasuries may reconsider their strategies in light of this change.

For instance, Japan, which has traditionally been one of the top holders of U.S. Treasuries, may feel pressure to adjust its holdings in response to the UK’s newfound status. This could lead to a ripple effect, impacting currency valuations and international trade agreements. As countries reassess their positions in relation to both the U.S. and the UK, we could witness a reshaping of international alliances and economic partnerships.

The Future of U.S. Treasuries

Looking ahead, what can we expect for U.S. Treasuries? The demand for these securities is likely to persist, especially as central banks globally continue to seek stable, low-risk assets. However, fluctuations in foreign holdings could introduce volatility in the market. If the UK continues to accumulate U.S. Treasuries, it might encourage other nations to follow suit, potentially leading to a more diversified base of investors.

On the other hand, if geopolitical tensions escalate, we could see sudden shifts in how countries allocate their reserves. For example, if China decides to reduce its Treasury holdings in response to economic pressures, it could create a significant impact on bond yields and the broader financial markets.

Conclusion: A New Era in Global Finance

In summary, the United Kingdom’s rise to the position of the second-largest holder of U.S. Treasuries is a noteworthy event that reflects broader economic trends and geopolitical shifts. As we continue to monitor this evolving situation, it’s clear that the financial world is in a state of flux. Investors and analysts alike will be keenly watching how this change influences not just the U.S. economy, but global markets as a whole.

As we move forward, one thing is certain: the relationship between the U.S., the UK, and China will be pivotal in shaping the future of international finance. Make sure to stay updated on these developments, as they could have lasting effects on your investments and the economy at large!

The United Kingdom has surpassed China to become the second-largest holder of U.S. Treasuries for the first time in 25 years.