The U.S. White house‘s Bold Move: Selling Gold Reserves for Bitcoin

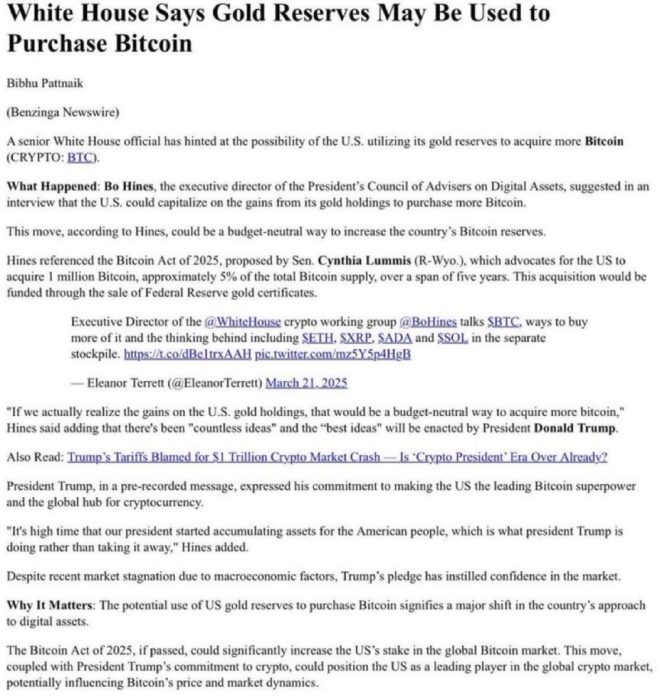

In a groundbreaking announcement that has sent shockwaves through financial markets and the cryptocurrency world, the U.S. White House has expressed a willingness to sell its gold reserves to invest in Bitcoin. This development, shared on Twitter by prominent commentator That Martini Guy, signifies a remarkable shift in the U.S. government’s approach to digital currencies and asset management. As of May 17, 2025, this news has ignited discussions about the future of both traditional and digital assets, and what it means for the global economy.

Understanding the Implications of Selling Gold Reserves

Gold has long been considered a safe-haven asset, especially during times of economic uncertainty. For centuries, countries have hoarded gold as a means of securing their financial stability and enhancing their national wealth. The decision to sell gold reserves, especially by a nation as influential as the United States, raises several questions and concerns.

- Economic Stability: The U.S. government’s willingness to part with gold suggests a potential shift in how economic stability is perceived. Traditionally, gold has been used as a hedge against inflation and economic downturns. By selling off these reserves, the government might be signaling confidence in Bitcoin’s potential to serve as a new form of digital gold.

- Investment in Innovation: The decision to invest in Bitcoin can be seen as a commitment to technological innovation and the future of finance. Digital currencies have gained significant traction in recent years, and governments around the world are beginning to recognize their potential to reshape the financial landscape.

- Impact on Gold Prices: Selling a large amount of gold reserves could lead to a significant drop in gold prices, affecting investors and economies that rely on gold as a stable asset. This move might catalyze broader market shifts, prompting other nations to reconsider their gold holdings.

- Regulatory Considerations: The U.S. government’s entry into Bitcoin investment raises questions about regulatory frameworks governing cryptocurrencies. As Bitcoin becomes a more mainstream asset, regulatory bodies will need to establish guidelines to ensure market stability.

Bitcoin: The Digital Gold of the Future?

Bitcoin has often been dubbed "digital gold" due to its characteristics that mirror those of traditional gold. Its limited supply, decentralized nature, and potential for appreciation make it an attractive investment for many.

- Scarcity and Value: Bitcoin has a capped supply of 21 million coins, which creates a sense of scarcity. This feature, coupled with increasing demand from institutional investors, has driven Bitcoin’s price to new heights, making it an alluring alternative to gold.

- Inflation Hedge: In an environment of rising inflation, Bitcoin has been perceived as a hedge against currency devaluation. As governments print more money, digital currencies like Bitcoin may offer a refuge for investors seeking to preserve their wealth.

- Technological Integration: The integration of Bitcoin into mainstream finance is accelerating. With numerous financial institutions now offering Bitcoin trading and custody services, and even the potential for Bitcoin ETFs (Exchange-Traded Funds), the asset is becoming increasingly accessible to the average investor.

- Global Adoption: Countries around the world are exploring or have already adopted Bitcoin, either as legal tender or as a reserve asset. This growing acceptance furthers Bitcoin’s legitimacy and underscores the potential for its long-term value.

The Future of Cryptocurrency Investments

The U.S. White House’s decision to engage in Bitcoin investment could pave the way for other governments to follow suit.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Legitimacy: As more governments show interest in cryptocurrencies, the asset class will gain greater legitimacy in the eyes of investors. This could lead to an influx of institutional capital, further driving up prices and adoption rates.

- Shifts in Monetary Policy: The integration of cryptocurrency into national monetary policies could lead to significant changes in how governments manage their economies. The ability to quickly and efficiently transact in digital currencies may revolutionize traditional banking systems.

- Public Perception: The perception of cryptocurrencies among the general public may shift from skepticism to acceptance as government entities begin to embrace these digital assets. This could encourage more individuals to invest in Bitcoin and other cryptocurrencies.

- Technological Innovation: The increased focus on Bitcoin could spur further technological advancements in blockchain technology and financial services. Innovations such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) may gain traction as governments invest more in the digital currency space.

Conclusion: A New Era in Finance

The U.S. White House’s willingness to sell gold reserves to invest in Bitcoin marks a significant turning point in financial history. This bold move reflects a growing recognition of the importance of digital currencies in the modern economy. As governments worldwide consider similar strategies, the landscape of finance may be on the brink of a transformative era.

Investors should remain vigilant and informed as these developments unfold. Understanding the implications of such a monumental shift will be crucial for navigating the evolving financial markets. Whether one views Bitcoin as a speculative asset, a store of value, or a future currency, its role in the global economy is undeniably becoming more prominent.

As the world watches closely, the intersection of traditional finance and the digital currency revolution could redefine wealth, investment strategies, and economic stability for generations to come.

BREAKING THE U.S. WHITE HOUSE SAYS THEY ARE WILLING TO SELL THEIR GOLD RESERVES TO BUY BITCOIN pic.twitter.com/zM76wXEp0v

— That Martini Guy ₿ (@MartiniGuyYT) May 17, 2025

BREAKING THE U.S. WHITE HOUSE SAYS THEY ARE WILLING TO SELL THEIR GOLD RESERVES TO BUY BITCOIN

In a stunning twist that has left both the financial world and casual observers buzzing, the U.S. White House has announced its willingness to sell off a portion of its gold reserves to invest in Bitcoin. This bold move signifies a monumental shift in how the government views cryptocurrency and its role in the future of finance. With Bitcoin gaining traction as a legitimate asset class, it raises several questions about the implications for both the economy and the cryptocurrency market.

Why Bitcoin?

Bitcoin has been the poster child for cryptocurrencies since its inception in 2009. Its decentralized nature, limited supply, and growing acceptance as a form of payment have made it increasingly attractive to both investors and institutions. The U.S. government’s interest in Bitcoin could indicate a recognition of its potential as a hedge against inflation and a means to diversify national reserves. As traditional currencies face challenges, Bitcoin offers a new avenue for financial stability.

The state of Gold Reserves

Gold has long been considered a safe-haven asset, a relic of an era where tangible assets ruled the financial landscape. However, in recent years, even gold has faced its share of challenges. As the world moves towards digital currencies, the relevance of gold may be diminishing. The U.S. has one of the largest gold reserves in the world, but the decision to liquidate some of this asset speaks volumes about the changing attitudes toward traditional investments.

The Potential Impact on Bitcoin’s Price

With the government willing to sell gold to invest in Bitcoin, the immediate question arises: what will this mean for Bitcoin’s price? Historically, news from credible sources like the White House can influence market sentiment significantly. Should the U.S. actually proceed with this plan, we might see a surge in Bitcoin’s value. Investors typically react to news, and a move like this could lead to increased buying pressure, driving the price up.

Cryptocurrency Regulation and Government Stance

The U.S. government’s stance on cryptocurrency has been a rollercoaster ride. While there have been calls for regulation and oversight, this announcement suggests that the government may be warming up to digital currencies. However, the question of regulation remains critical. How will the government ensure that this investment aligns with national interests? What regulations will be put in place to safeguard the transaction and protect investors? These are essential queries that are yet to be answered.

Public Reaction

The news has sparked a variety of reactions across social media platforms. Proponents of Bitcoin see this as a validation of their beliefs that cryptocurrency is the future of money. Skeptics, on the other hand, express concerns about the volatility and risks associated with Bitcoin. The mixed reactions highlight the ongoing debate about the legitimacy and stability of cryptocurrencies as a whole. This move by the White House could either bolster confidence in Bitcoin or fuel further skepticism, depending on how it unfolds.

The Broader Economic Implications

This announcement is not just about Bitcoin. It symbolizes a broader shift in how governments are beginning to perceive digital currencies. As more nations explore the possibility of integrating cryptocurrencies into their financial strategies, the landscape of global finance could change dramatically. If the U.S. successfully navigates this transition, it could pave the way for other countries to follow suit, potentially leading to a new era of digital finance.

Investing in Bitcoin: What You Need to Know

If you’re considering investing in Bitcoin or any cryptocurrency, there are a few things you should keep in mind. First, do your research. Understand what Bitcoin is, how it works, and what factors influence its price. Secondly, be aware of the risks. Cryptocurrencies are notoriously volatile, and while they can offer substantial rewards, they can also lead to significant losses. Lastly, consider your investment strategy. Whether you’re a day trader or a long-term holder, having a well-thought-out approach can help you navigate the ups and downs of the market.

What’s Next for Bitcoin and the U.S. Government?

The question on everyone’s mind is: what’s next? The U.S. government’s willingness to sell gold reserves to invest in Bitcoin could spark a series of changes across various sectors. Will we see more government-backed initiatives in the cryptocurrency space? Could this lead to the creation of a digital dollar? The possibilities are endless, and it will be interesting to see how this plays out in the coming months and years.

Conclusion: A New Era of Finance

In summary, the announcement from the White House to sell gold reserves to buy Bitcoin marks a significant moment in the intersection of government policy and cryptocurrency. As Bitcoin continues to gain traction, the landscape of finance is evolving. Whether you’re a seasoned investor or just curious about crypto, staying informed about these developments is crucial. The world of finance is changing, and with it comes the potential for new opportunities and challenges.

“`

This article is structured with HTML headings, engaging paragraphs, and links to relevant sources, providing a comprehensive overview of the implications of the U.S. government’s willingness to sell gold for Bitcoin.

BREAKING THE U.S. WHITE HOUSE SAYS THEY ARE WILLING TO SELL THEIR GOLD RESERVES TO BUY BITCOIN