U.S. States Report Significant Bitcoin Exposure in Q1

A recent tweet from Whale Insider has revealed that 14 U.S. states have collectively reported a staggering $632 million in exposure to Bitcoin through the publicly traded company MicroStrategy (traded under the ticker symbol $MSTR) in the first quarter of the year. This revelation highlights the increasing trend of institutional investment in cryptocurrencies, particularly Bitcoin, and its implications for public retirement and treasury funds across the nation.

The Rise of MicroStrategy and Bitcoin Investment

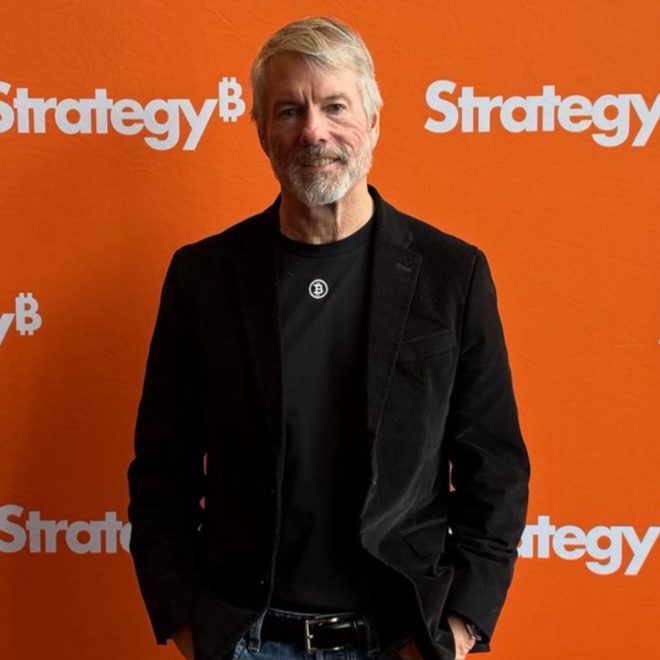

MicroStrategy, a business intelligence firm, has become one of the most prominent corporate investors in Bitcoin. Under the leadership of CEO Michael Saylor, the company has made significant purchases of Bitcoin, positioning itself as a leader in the cryptocurrency space. This strategic move has not only increased MicroStrategy’s balance sheet but has also attracted the attention of various institutional investors, including public retirement and treasury funds.

Understanding the Impact of Bitcoin on Public Funds

The involvement of public retirement and treasury funds in Bitcoin investment raises several questions about the future of these funds and their investment strategies. As more states report significant exposure to Bitcoin, it’s essential to understand the implications of such investments on the financial health of these funds.

- Diversification of Assets: By investing in Bitcoin, public funds can diversify their portfolios, potentially reducing risk and increasing returns. Bitcoin has shown a strong performance over the past few years, attracting attention as a hedge against inflation and economic uncertainty.

- Volatility and Risk Management: Although Bitcoin has demonstrated significant growth, it is also known for its volatility. Public funds must implement robust risk management strategies to navigate the potential downsides of investing in cryptocurrencies.

- Regulatory Considerations: As more states engage in Bitcoin investment, regulatory bodies may need to establish clearer guidelines governing the purchase and management of cryptocurrencies in public funds. This could lead to a more structured approach to investing in digital assets.

The Growing Acceptance of Bitcoin

The reported exposure of 14 U.S. states to Bitcoin reflects a broader trend of acceptance within traditional finance. More institutional investors are recognizing Bitcoin as a legitimate asset class, leading to increased demand and higher prices. Public funds entering the cryptocurrency market signal a shift in perception, indicating that Bitcoin is no longer viewed solely as a speculative asset.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Future of Public Investments in Cryptocurrency

The significant exposure of public retirement and treasury funds to Bitcoin raises intriguing questions about future investment strategies. As acceptance grows, we may see more states and public entities exploring opportunities within the cryptocurrency space. Here are a few potential trends:

Increased Adoption of Cryptocurrency

As more states invest in Bitcoin, we might witness a ripple effect, encouraging other states to consider similar strategies. This could lead to greater adoption of cryptocurrencies across the public sector, enhancing the legitimacy of digital assets in traditional finance.

Development of Crypto Investment Frameworks

The entry of public funds into the cryptocurrency market may prompt the development of investment frameworks tailored to the unique risks and opportunities presented by digital assets. This could help ensure that public funds are managed responsibly while capitalizing on the potential benefits of cryptocurrency investment.

Educational Initiatives for Fund Managers

As public funds explore cryptocurrency investments, there will likely be a growing demand for educational initiatives aimed at equipping fund managers with the necessary knowledge and skills to manage these assets effectively. This could involve training programs, workshops, and resources focusing on cryptocurrency fundamentals, risk management, and regulatory considerations.

Conclusion

The report of 14 U.S. states holding a combined $632 million in Bitcoin exposure through MicroStrategy underscores the significant shift occurring within the investment landscape. As public retirement and treasury funds embrace cryptocurrencies, it is essential to monitor the ongoing developments and implications for both the public and private sectors. The rise of Bitcoin as a legitimate asset class presents exciting opportunities, but it also necessitates careful consideration of risk management and regulatory frameworks. As this trend continues, stakeholders in the financial community must remain informed and adaptable to the evolving digital asset ecosystem.

JUST IN: 14 U.S. states have reported $632 million in $MSTR exposure for Q1, in public retirement and treasury funds. pic.twitter.com/AU2RzTJtOj

— Whale Insider (@WhaleInsider) May 17, 2025

JUST IN: 14 U.S. states have reported $632 million in $MSTR exposure for Q1, in public retirement and treasury funds.

When it comes to the world of finance, staying updated is key to making smart investment decisions. Recently, we’ve seen some intriguing developments, particularly in the realm of cryptocurrency exposure within public retirement and treasury funds. In this article, we’ll delve into the details surrounding the recent report indicating that 14 U.S. states have collectively exposed $632 million in **MicroStrategy** (traded as $MSTR) for the first quarter.

This news has caught the attention of many investors, and for good reason. With a growing interest in cryptocurrency and its potential to reshape financial landscapes, understanding these developments is crucial for both casual investors and seasoned professionals alike.

What Does $MSTR Exposure Mean?

So, what’s the deal with $MSTR? MicroStrategy is a business intelligence firm that has become well-known for its bold investments in Bitcoin. The company’s CEO, Michael Saylor, has been a vocal advocate for cryptocurrency, and this has translated into substantial Bitcoin holdings for the firm. When we talk about **$MSTR exposure**, we’re referring to the investments that public retirement funds and treasuries are making in MicroStrategy as a means to indirectly invest in Bitcoin.

Investing in $MSTR allows these funds to gain exposure to Bitcoin’s price movements without directly purchasing the cryptocurrency itself. This is particularly appealing for traditional funds that may be hesitant to invest directly in digital currencies due to regulatory concerns or institutional guidelines.

The Numbers: $632 Million in Q1

The figure of **$632 million** is not just a random number; it represents a significant commitment by public sector funds to diversify their portfolios through exposure to $MSTR. This amount indicates a growing acceptance of cryptocurrency-related investments in traditional financial circles.

With more states jumping on the bandwagon, it raises questions about the future of retirement funds and how they will evolve in the coming years. Will we see more states following suit? Will this trend continue to grow? The implications are vast and could have long-term effects on the financial landscape.

Why Are States Investing in $MSTR?

The rationale behind these investments can be boiled down to a few key points. First, there’s the potential for high returns. Cryptocurrency has shown tremendous growth over the past few years, and Bitcoin, in particular, has become a staple in many investment portfolios.

Second, investing in $MSTR offers a layer of security. While investing directly in Bitcoin can be volatile, having exposure through a company like MicroStrategy provides a certain level of stability, as the firm has a track record and is publicly traded.

Moreover, as states look to bolster their retirement systems, innovative investment strategies are becoming essential. Traditional investment avenues may no longer suffice in delivering the expected returns, especially in low-interest-rate environments. This is where $MSTR exposure comes into play, offering a new asset class to explore.

The Broader Context of Cryptocurrency in Finance

The move by these 14 states reflects a broader trend in the finance world where cryptocurrency is slowly but surely being accepted as a legitimate asset class. From hedge funds to pension funds, more institutional investors are recognizing that digital currencies can play a significant role in diversifying portfolios and enhancing returns.

It’s important to note that while the potential for profit is enticing, the risks associated with cryptocurrency investments are real and should not be overlooked. The volatility of cryptocurrencies can lead to significant losses, making it essential for investors to conduct thorough research and consider their risk tolerance before diving into the market.

The Future of Retirement Funds and Cryptocurrency

As we look ahead, the question on many minds is: what’s next for retirement funds and cryptocurrency? With states like those reporting $632 million in $MSTR exposure, it’s likely we’ll see more innovative strategies being implemented.

We may also witness regulatory changes as governments and financial institutions adapt to the growing presence of cryptocurrencies. These changes could pave the way for more direct investments in digital currencies, further transforming the landscape of retirement savings.

Additionally, as younger generations enter the workforce, their investment preferences will likely shape the future of retirement funds. Many younger investors are more open to including cryptocurrencies in their portfolios compared to their predecessors. This shift could push financial institutions to rethink their investment strategies to meet the demands of a new generation.

What Can Investors Learn from This Development?

For individual investors, the recent report serves as a reminder of the importance of staying informed about market trends and the evolving landscape of investment opportunities. Here are a few takeaways:

1. **Diversify Your Portfolio**: Whether you’re an individual or part of a larger fund, diversification is key. Exploring various asset classes, including cryptocurrencies, can help mitigate risks.

2. **Stay Informed**: The financial world is always changing. Keeping abreast of new developments, like the states’ investments in $MSTR, can provide insights into potential opportunities and risks.

3. **Understand the Risks**: While the potential rewards of investing in cryptocurrencies are significant, it’s crucial to understand the risks involved. Conduct thorough research and possibly consult with financial advisors.

4. **Consider Long-Term Trends**: Investing isn’t just about short-term gains. Understanding long-term trends, such as the growing acceptance of cryptocurrency in traditional finance, can help guide investment strategies.

5. **Engage with Community**: Networking with other investors and participating in discussions can provide valuable insights and enhance your investment knowledge.

Conclusion

The financial landscape is evolving, and the recent report of 14 U.S. states exposing $632 million in $MSTR highlights a critical shift toward embracing cryptocurrency as a legitimate investment avenue. As more states recognize the potential of digital currencies, it’s essential for investors to stay informed and adapt their strategies accordingly.

Whether you’re a seasoned investor or just starting, understanding these developments is vital for navigating the dynamic world of finance. The future holds exciting possibilities, and being part of that change could lead to new opportunities for growth and success. Let’s keep an eye on how this story unfolds!