Missouri Insurers Expected to Provide Full Coverage After Devastating Storms

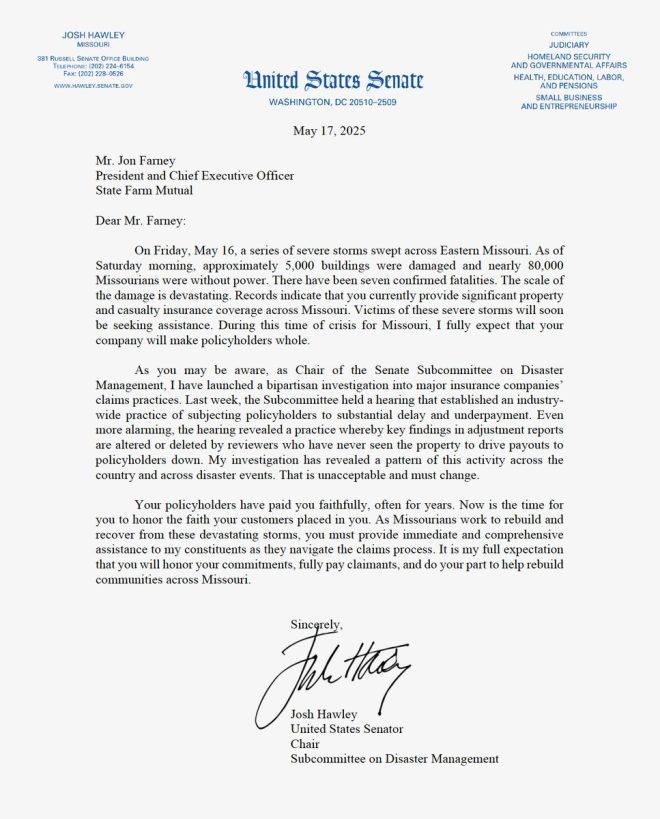

In a recent announcement, U.S. Senator Josh Hawley from Missouri has taken a firm stance regarding the insurance coverage for residents affected by severe storms that devastated parts of the state. On May 17, 2025, Hawley communicated through social media that he has sent letters to all major insurance companies operating in Missouri, urging them to provide full coverage for any damages incurred during the storms. His message emphasizes the importance of insurer accountability in times of crisis and the need for residents to receive the support they deserve.

Background on the Storms

Missouri has faced numerous weather-related challenges, especially during the spring and summer months when severe storms are prevalent. These storms can bring heavy rainfall, strong winds, hail, and tornadoes, leading to substantial property damage and significant disruptions to daily life. After such catastrophic events, residents often rely on their insurance policies to help recover and rebuild. However, the process of insurance claims can sometimes be fraught with challenges, including disputes over coverage limits and the extent of damages.

Senator Hawley’s Commitment to Missouri Residents

In light of the recent storms, Senator Hawley’s proactive approach demonstrates his commitment to ensuring that Missouri residents receive the support they need. By directly addressing the insurance companies, he is advocating for transparency and fairness in the claims process. His statement reflects a broader concern for the welfare of constituents who may be struggling to navigate the aftermath of the storms.

Hawley’s warning that insurers could face subpoenas if they fail to comply with his expectations highlights the seriousness of the situation. It underscores the responsibility that insurance companies have to their policyholders, particularly during times of crisis when individuals and families are most vulnerable.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Full Coverage

Full coverage insurance is crucial for homeowners and business owners alike, as it can significantly ease the financial burden of repairing and replacing damaged property. In the aftermath of a storm, policyholders often find themselves in a race against time to file claims and secure funding for necessary repairs. Delays or disputes in the claims process can exacerbate the challenges they face, making it essential that insurers act swiftly and fairly.

Senator Hawley’s call for full coverage not only seeks to ensure that residents receive the financial assistance they need but also reinforces the expectation that insurance companies uphold their end of the bargain. When policyholders pay their premiums, they do so with the understanding that they will be protected in the event of a disaster.

The Role of Insurers in Crisis Recovery

Insurance companies play a pivotal role in the recovery process following natural disasters. They are tasked with assessing damages, processing claims, and disbursing funds to policyholders. However, the effectiveness of these processes can vary widely between companies. Some insurers may prioritize profit over customer service, leading to frustrations and delays for those in need.

By sending letters to all major insurers in Missouri, Senator Hawley is not only advocating for immediate action but also calling for a reevaluation of how insurance companies operate during crises. His approach suggests a desire for systemic change that prioritizes the needs of consumers and ensures that they receive timely and adequate support during times of distress.

Community Impact and Support

The impact of severe storms extends beyond physical damage; it also affects the emotional and psychological well-being of residents. The stress of dealing with property damage, loss of belongings, and the uncertainty of recovery can take a significant toll on individuals and families. By holding insurers accountable and advocating for full coverage, Senator Hawley aims to alleviate some of the burdens faced by his constituents.

Moreover, his actions may inspire community support and engagement. When leaders take a stand for their constituents, it can galvanize public sentiment and encourage residents to come together to support one another. Community organizations, local businesses, and volunteers often step up to help those impacted by disasters, creating a network of support that can aid in recovery efforts.

Conclusion

Senator Josh Hawley’s recent communication to Missouri’s major insurers serves as a vital reminder of the responsibilities that insurance companies hold towards their policyholders, especially in the wake of devastating storms. By advocating for full coverage and threatening subpoenas for non-compliance, Hawley is taking a significant step to protect the interests of Missouri residents.

As communities begin to recover from the storms, the importance of effective insurance coverage cannot be overstated. Full coverage not only facilitates the physical rebuilding of homes and businesses but also supports the emotional and psychological recovery of individuals and families. It is crucial that insurers respond to this call for accountability and prioritize the needs of their policyholders during these challenging times.

In summary, the actions taken by senator Hawley highlight the critical intersection of government, insurance, and community resilience in the face of natural disasters. By demanding full coverage and holding insurers accountable, he is ensuring that the people of Missouri can begin to rebuild their lives with the support they deserve.

Today I have sent letters to all Missouri’s major insurers: following these devastating storms, I expect they will provide FULL COVERAGE for any and all damage. If they don’t, they will get a subpoena from me pic.twitter.com/84bjCZXqkv

— Josh Hawley (@HawleyMO) May 17, 2025

Understanding the Impact of Recent Storms in Missouri

In the wake of devastating storms that swept through Missouri recently, residents are left grappling with the aftermath. The damage has been extensive, affecting homes, businesses, and infrastructure. Amid this chaos, political figures, including Senator Josh Hawley, have taken a proactive stance to ensure that residents receive the assistance they need. On social media, Hawley announced that he had sent letters to all Missouri’s major insurers, emphasizing the expectation of full coverage for any damage caused by these storms.

This situation raises critical questions about insurance policies and the responsibilities of insurers when disasters strike. Many residents may be wondering what their policies cover and what to expect in terms of compensation. This article will delve into the implications of Senator Hawley’s statements, the role of insurance companies in disaster recovery, and what policyholders should know.

Senator Hawley’s Commitment to Missouri Residents

Senator Hawley has made it clear that he expects major insurers to step up and provide full coverage for the damages caused by the recent storms. His statement, “Today I have sent letters to all Missouri’s major insurers: following these devastating storms, I expect they will provide FULL COVERAGE for any and all damage. If they don’t, they will get a subpoena from me,” reflects a strong commitment to holding insurance companies accountable.

This kind of advocacy is crucial, especially during times of crisis when residents are feeling vulnerable. Hawley’s approach signals to both the insurers and the affected residents that there is an expectation for accountability and support. It’s a reminder that elected officials play a pivotal role in ensuring that the needs of their constituents are met, especially in times of crisis.

What Does Full Coverage Mean for Policyholders?

When Hawley refers to “full coverage,” it’s essential for policyholders to understand what this entails. Full coverage typically means that an insurance policy will pay for damages to a home or property as a result of a covered peril. However, it’s important to note that not all policies are created equal.

For many homeowners in Missouri, their policies may include specific clauses related to storm damage, which can encompass wind, hail, and flooding. Therefore, it’s crucial for policyholders to review their insurance documents to understand their coverage. If you find yourself uncertain about your policy, reaching out to your insurance agent can provide clarity.

Additionally, keeping detailed records of damages and communicating effectively with your insurer can facilitate the claims process. In a post like Hawley’s, residents may feel encouraged to advocate for themselves, ensuring they receive the full benefits owed to them.

The Role of Insurance Companies in Disaster Recovery

Insurance companies play a pivotal role in helping communities recover after disasters. Their ability to process claims efficiently and provide financial support can significantly impact how quickly a community can rebuild. However, following significant events, many insurers face challenges, including an overwhelming number of claims and the need to assess damages thoroughly.

With Senator Hawley’s announcement, it’s clear that there’s an expectation for these companies to rise to the occasion. Insurers must be prepared to handle the influx of claims and provide timely responses to policyholders. This situation emphasizes the importance of having a reliable and accessible insurance policy in place before disaster strikes.

How Residents Can Prepare for Future Storms

The recent storms in Missouri serve as a wake-up call for many residents regarding the importance of being prepared for emergencies. Here are some steps to consider for future storm preparedness:

1. **Review Your Insurance Policy**: Ensure that you understand your policy’s coverage, including exclusions and deductibles.

2. **Document Your Property**: Keep an inventory of your belongings and take photos of your property. This can help expedite the claims process in the event of damage.

3. **Create an Emergency Plan**: Having a clear plan in place for storms can make a significant difference. Know where to go, how to communicate with family members, and what supplies to have on hand.

4. **Stay Informed**: Follow local weather updates and heed warnings from authorities. Being aware of severe weather conditions can help you take necessary precautions.

5. **Connect with Local Resources**: Familiarize yourself with local emergency services and resources available for disaster relief.

The Importance of Advocacy in Insurance Matters

Senator Hawley’s bold stance on holding insurers accountable highlights the critical role advocacy plays in insurance matters. When public figures push for the rights of their constituents, it can lead to meaningful changes in policy and practice. This is especially true in the insurance industry, where pressure from lawmakers can encourage companies to act fairly and promptly.

Residents must also feel empowered to advocate for themselves. If you encounter issues with your insurance claim, don’t hesitate to reach out to your elected officials or consumer protection agencies. They can provide guidance and support in navigating the complexities of insurance claims.

The Bigger Picture: Community Resilience

While individual preparedness is important, the recent storms and the subsequent response from public officials also highlight the need for community resilience. Communities that come together in the face of adversity can often recover more quickly.

Engaging in community preparedness initiatives, participating in local meetings, and supporting local emergency services can enhance overall resilience. When residents work together, they can better support one another during challenging times.

Conclusion: Moving Forward After Disaster

The aftermath of the recent storms in Missouri is a reminder of the importance of preparedness, advocacy, and community support. As Senator Hawley emphasizes the need for full coverage from insurers, residents must also take proactive steps in understanding their policies and preparing for future storms.

By working together and holding each other accountable, communities can emerge stronger from disasters. It’s in these moments that the true spirit of a community shines through, reminding us of the resilience we all possess. As we move forward, let’s ensure that we not only secure our homes but also support one another in rebuilding and recovering.