Ethereum Gas Fees Drop to $0.03: A Game-Changer for Cryptocurrency Transactions

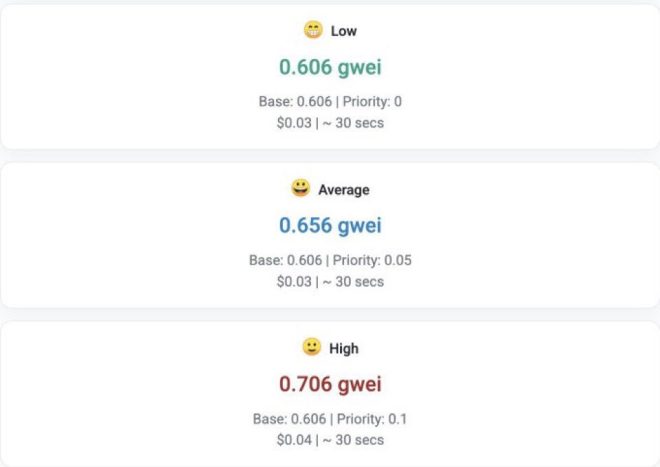

In a surprising turn of events, Ethereum (ETH) gas fees have plummeted to an astonishing low of just $0.03, as reported by prominent crypto influencer Fabri Crypto on Twitter. This significant reduction in transaction costs brings Ethereum’s fees in line with those of Solana (SOL), a blockchain known for its low transaction fees and high throughput. As the crypto community buzzes with excitement over this development, it’s essential to understand the implications it may have for users, investors, and the broader blockchain ecosystem.

Understanding Ethereum Gas Fees

Gas fees are the costs associated with conducting transactions or executing contracts on the Ethereum blockchain. These fees compensate miners for the computational energy required to process and validate transactions. Historically, Ethereum gas fees have been notorious for their volatility, often spiking to exorbitant rates during periods of high network congestion. The recent drop to $0.03 marks a stark contrast to the high fees users have faced in the past, making Ethereum more accessible to a broader audience.

What Does This Mean for Ethereum Users?

- Increased Accessibility: With gas fees at an all-time low, users can now engage in smaller transactions without worrying about prohibitive costs. This newfound affordability could encourage more users to experiment with decentralized applications (dApps) and smart contracts, potentially driving up Ethereum’s user base.

- Enhanced dApp Usage: Developers may find it easier to attract users to their dApps when operating costs are significantly reduced. This could lead to a surge in innovation and creativity within the Ethereum ecosystem, fostering the development of new applications that cater to various needs, from finance to entertainment.

- Competitive Edge Against Other Blockchains: Ethereum has long faced criticism for its high transaction fees compared to competitors like Solana and Binance Smart Chain. The recent reduction in gas fees may help Ethereum regain its competitive edge and retain its position as the leading smart contract platform.

The Impact on Investors

For investors, lower gas fees could signal a resurgence of interest in Ethereum and its associated tokens. With cheaper transaction costs, users are more likely to participate in trading and investing activities, which may positively impact ETH’s market price. Furthermore, a more active network could boost the overall confidence in Ethereum’s long-term viability, attracting institutional investors who may have previously hesitated due to high operational costs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Broader Blockchain Ecosystem

The implications of Ethereum’s low gas fees extend beyond its immediate user base and investors. The entire blockchain ecosystem stands to benefit from increased activity on the Ethereum network. More transactions mean more data, which can enhance the development of analytics tools and services that provide insights into user behavior and market trends.

Moreover, lower gas fees could encourage cross-chain interactions, where users leverage the strengths of multiple blockchains. This interoperability could lead to a more interconnected ecosystem, fostering collaboration and innovation across different platforms.

The Future of Ethereum

While the current drop in gas fees is a positive development, it is essential to consider its sustainability. Ethereum has been undergoing significant upgrades as part of its transition to Ethereum 2.0, which aims to improve scalability, security, and energy efficiency. The introduction of proof-of-stake (PoS) consensus mechanisms and sharding is expected to further reduce congestion and lower fees in the long run.

However, the crypto market is inherently volatile, and external factors such as regulatory developments, market demand, and technological advancements can influence gas fees. Users and investors should remain vigilant and stay informed about ongoing changes in the Ethereum ecosystem.

Conclusion

The recent drop in Ethereum gas fees to $0.03 is a groundbreaking development that could reshape the landscape of cryptocurrency transactions. As Ethereum becomes more accessible to users and developers alike, we may witness a surge in dApp usage and innovation, creating a ripple effect throughout the broader blockchain ecosystem. For investors, this could signify a renewed interest in Ethereum, potentially boosting its market price and reinforcing its position as a leading smart contract platform.

As the Ethereum network continues to evolve with the ongoing upgrades and improvements, it is crucial for participants to stay informed and adapt to the changing dynamics of the blockchain space. With lower transaction costs and increased accessibility, the future of Ethereum looks promising, paving the way for a more inclusive and vibrant cryptocurrency environment.

By keeping an eye on developments in the Ethereum ecosystem and understanding the implications of these changes, users, investors, and developers can make informed decisions that align with their goals in this rapidly evolving digital landscape.

BREAKING #ETHEREUM GAS FEES DROP TO $0.03

IT IS NOW AS LOW AS $SOLANA pic.twitter.com/WffO8J89R1

— Fabri Crypto (@fabriwtfbro) May 17, 2025

BREAKING ETHEREUM GAS FEES DROP TO $0.03

In a remarkable development in the world of cryptocurrency, Ethereum gas fees have recently plummeted to a mere $0.03. This has sent ripples through the crypto community, particularly among investors and users of the Ethereum network. For those who have been following the highs and lows of Ethereum (ETH), you’ll know that gas fees can often be exorbitant, sometimes costing users a small fortune just to complete transactions. But now, with fees dropping to levels comparable to Solana (SOL), many are left wondering what this means for the future of Ethereum.

Understanding Ethereum Gas Fees

To appreciate the significance of this drop in gas fees, it’s essential to understand what these fees represent. Gas fees are payments made by users to compensate for the computing energy required to process transactions on the Ethereum blockchain. Each transaction requires computational power, and as demand increases, so do the fees. Historically, during peak times—like NFT drops or major market movements—gas fees could skyrocket, leaving many users frustrated and unable to transact.

With gas fees now sitting at just $0.03, it opens the floodgates for more users to engage with the Ethereum blockchain without worrying about exorbitant costs. This is particularly vital for smaller transactions or those looking to experiment with decentralized applications (dApps) without the fear of losing a significant amount of money in fees.

Comparing Ethereum and Solana

The comparison between Ethereum and Solana has been a hot topic in crypto circles. Solana has often been praised for its low transaction fees and fast processing times, making it a favorite among developers and users alike. With Ethereum gas fees dropping to $0.03, the competition is heating up.

What does this mean for Ethereum? Many analysts and crypto enthusiasts believe that lower fees could attract a new wave of users to the network, potentially reigniting interest in Ethereum-based projects and applications. As both Ethereum and Solana compete for dominance in the smart contract space, this could lead to innovative developments across both platforms.

Market Reactions to the Fee Drop

The announcement of Ethereum gas fees dropping to such low levels has already begun to influence market dynamics. Traders and investors have expressed cautious optimism, with many seeing this as a potential catalyst for increased trading activity. If users can afford to transact without the burden of high fees, it could lead to a surge in trading volume on decentralized exchanges (DEXs) and other Ethereum-based platforms.

Twitter has been abuzz with reactions from the crypto community. Many users are excited about the prospect of lower fees, with some suggesting that this could lead to a renaissance for Ethereum, especially in the NFT space where high fees have been a deterrent for many potential buyers.

Potential Implications for the Future

So, what are the broader implications of Ethereum gas fees dropping to $0.03? For starters, it could signify a shift in how users interact with the Ethereum network. With lower fees, more people might be inclined to participate in DeFi (decentralized finance) activities, from lending and borrowing to trading and staking.

Moreover, this development could encourage developers to create more dApps, knowing that users are less likely to be deterred by high transaction costs. This influx of new applications could enhance Ethereum’s utility and attractiveness, further solidifying its position as a leading smart contract platform.

There’s also the aspect of scalability to consider. Ethereum has been working on various upgrades, including Ethereum 2.0, to improve transaction speeds and reduce costs. The recent drop in gas fees may be seen as a sign that these upgrades are beginning to take effect, creating a more efficient network for all users.

Community Insights and Feedback

The feedback from the Ethereum community regarding the drop in gas fees has been overwhelmingly positive. Many users have taken to social media platforms to express their excitement about the new opportunities this presents. For instance, on Twitter, discussions around the implications of these low fees have sparked debates about the future of decentralized applications and how users will approach the Ethereum network moving forward.

Crypto influencers and analysts have also chimed in, offering their take on how this could shape the broader market landscape. Some believe that if Ethereum can maintain these low fees, it could attract users away from competitors like Solana, while others caution that the crypto market is notoriously volatile and that fees can fluctuate rapidly.

Investing in Ethereum: What You Need to Know

For investors looking to capitalize on this recent development, it’s crucial to stay informed about market trends and news surrounding Ethereum. The drop in gas fees could be a sign of positive momentum, but as with any investment, it’s important to do thorough research before making any decisions.

Consider monitoring the Ethereum network for any further changes in gas fees or transaction volumes. Additionally, keep an eye on regulatory news and technological advancements, as these can significantly impact the price and usability of Ethereum.

The Broader Crypto Landscape

As Ethereum achieves this milestone, it’s essential to look at the broader crypto landscape. The drop in gas fees not only affects Ethereum but could also have repercussions for other cryptocurrencies. As Ethereum becomes more accessible, it could lead to increased competition among blockchain platforms, prompting other networks to lower fees or improve their own services to attract users.

Furthermore, this event highlights the importance of scalability in blockchain technology. As more users flock to decentralized platforms, the need for efficient transaction processing becomes paramount. The race is on for blockchain networks to innovate and adapt, ensuring they can handle increased demand without compromising on user experience.

Conclusion: A New Era for Ethereum?

The recent drop in Ethereum gas fees to $0.03 is a significant milestone that could usher in a new era for the Ethereum network. With lower transaction costs, more users may feel encouraged to participate in the growing ecosystem of dApps and DeFi projects. As the competition heats up with platforms like Solana, it will be fascinating to see how Ethereum evolves in response to these changes.

For anyone involved in the crypto space, this is a moment to watch closely. Whether you’re an investor, developer, or casual user, the implications of this fee drop could shape the future of Ethereum and the broader blockchain landscape for years to come.

Stay tuned to developments in this space, and who knows? The next big opportunity might just be around the corner!

BREAKING #ETHEREUM GAS FEES DROP TO $0.03

IT IS NOW AS LOW AS $SOLANA