Breaking news: $276 Million Bitcoin Long Position Opened

In the ever-evolving world of cryptocurrency, significant movements often capture the attention of investors and enthusiasts alike. Recently, a remarkable event unfolded in the Bitcoin market when a colossal long position valued at $276 million was opened. This bold move has sent ripples through the crypto community, prompting discussions about market trends, potential price movements, and overall investor sentiment.

Understanding Long Positions in Cryptocurrency Trading

Before diving deeper into the implications of this enormous long position, it’s essential to understand what a long position means in trading. A long position is a financial term used to describe a trader’s belief that the price of an asset, in this case, Bitcoin, will rise. By opening a long position, the trader buys Bitcoin with the expectation that they can sell it at a higher price in the future, thus generating a profit.

The Current state of Bitcoin

As of May 17, 2025, Bitcoin continues to dominate the cryptocurrency market, both in terms of value and market capitalization. It has become a staple for investors looking to diversify their portfolios. The decision to open such a large long position suggests a strong bullish sentiment among some investors, indicating confidence in Bitcoin’s future price trajectory.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions to the $276 Million Long Position

The announcement of this significant long position has elicited a variety of reactions across social media and crypto forums. Many traders and analysts are interpreting this move as a sign of growing institutional interest in Bitcoin. With more institutional investors entering the market, Bitcoin’s credibility as a digital asset is further solidified.

Furthermore, the opening of such a large long position could potentially influence Bitcoin’s price in the short term. If the market perceives this move as a bullish signal, it may lead to increased buying activity, driving the price up further. Conversely, if market conditions shift or if the position is seen as overly speculative, it could lead to volatility.

The Impact of Institutional Investors on Bitcoin

The entry of institutional investors into the Bitcoin market has been a game-changer. Institutions bring significant capital and a level of scrutiny that can positively impact the market’s stability and credibility. The recent $276 million long position is a testament to this trend, showcasing that large players are willing to bet big on Bitcoin’s future.

Potential Price Predictions and Market Analysis

Analysts are closely monitoring Bitcoin’s price action following the opening of this large long position. Historical data suggests that significant long positions can lead to bullish trends in the market. However, it’s crucial to consider various factors that influence Bitcoin’s price, including market sentiment, regulatory developments, and macroeconomic conditions.

Conclusion: What This Means for Investors

The opening of a $276 million long position in Bitcoin marks a significant event in the cryptocurrency market. It illustrates the growing confidence among investors and the increasing participation of institutional players in the Bitcoin ecosystem. For individual investors, this may serve as an indication to keep a close watch on market trends and potential price movements in the coming weeks and months.

As the cryptocurrency landscape continues to evolve, staying informed about such developments is essential for making educated investment decisions. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding the implications of large trades like this one can help you navigate the complexities of the market.

Final Thoughts

In summary, the cryptocurrency market is witnessing monumental shifts, with large positions being opened by significant players. The recent $276 million long position in Bitcoin is a strong indicator of bullish sentiment and highlights the increasing institutional interest in the digital asset space. As we move forward, it will be fascinating to see how this impacts Bitcoin’s price and the broader cryptocurrency market dynamics.

Investors should remain vigilant, as the market can be unpredictable. Keeping an eye on significant trades and understanding their implications can provide valuable insights for anyone involved in cryptocurrency trading. As always, conduct thorough research and consider your risk tolerance before making investment decisions.

Stay Updated

For the latest news and insights into Bitcoin and the broader cryptocurrency market, be sure to follow trusted sources and stay informed about market developments. The world of crypto is fast-paced and ever-changing, making it essential to keep your finger on the pulse of the industry. Whether you’re looking to invest or simply stay informed, understanding the significance of large trades like the $276 million long position can help you navigate this exciting and challenging market.

BREAKING

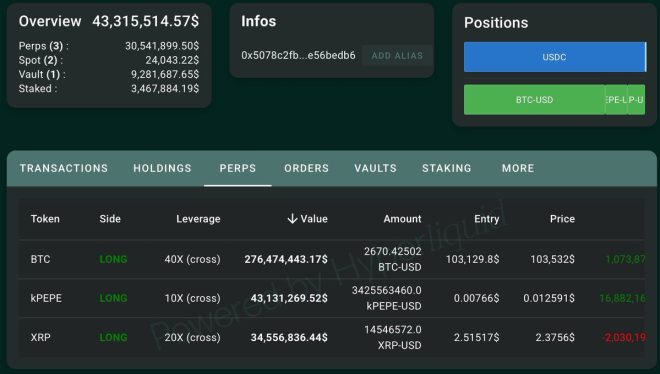

Someone opened a $276M long on #bitcoin pic.twitter.com/74XlUj3H3K

— Crypto Beast (@cryptobeastreal) May 17, 2025

BREAKING

In the ever-evolving world of cryptocurrency, news travels fast, and nothing quite makes waves like massive trades. Recently, a jaw-dropping announcement surfaced — someone opened a $276M long on bitcoin. This staggering figure has sent shockwaves throughout the crypto community and has left many wondering about the implications of such a bold move. If you’re curious about what this means for investors, traders, and the future of Bitcoin, you’re in the right place!

What Does a $276M Long Position Mean?

Before diving deeper, let’s unpack exactly what a long position is. In trading vernacular, when someone “goes long,” they are betting that the price of an asset will rise. In this case, the asset is Bitcoin. By opening a long position worth $276 million, the trader is essentially saying, “I believe Bitcoin’s price will increase, and I want to profit from that.” If the price goes up, the trader stands to gain a significant amount. However, if the price falls, they could face substantial losses.

This kind of financial commitment indicates a strong belief in Bitcoin’s future performance. Many traders are watching this development closely, analyzing market trends and the potential reasons behind such a hefty investment. Could it be a signal of upcoming bullish sentiment in the market? Only time will tell!

The Current State of Bitcoin

As of now, Bitcoin remains the king of cryptocurrencies, often serving as a barometer for the entire crypto market. Its price has experienced wild fluctuations — soaring to new heights and then plummeting dramatically. For instance, during the 2021 bull run, Bitcoin reached an all-time high of nearly $65,000. However, it also faced corrections, with prices dipping below $30,000 at various points.

Understanding Bitcoin’s price dynamics is crucial for interpreting the significance of a $276 million long position. Factors influencing Bitcoin’s price include market sentiment, regulatory news, technological advancements, and macroeconomic trends. The trader’s decision to invest such a massive amount may indicate a belief that the current price is undervalued, or that they foresee a positive catalyst on the horizon.

Market Reactions to Significant Trades

Whenever a substantial trade like this occurs, the market tends to react. Traders and investors often take such announcements as signals to either follow suit or act cautiously. In the past, large positions have led to increased volatility, with many traders jumping on the bandwagon, hoping to ride the wave of potential profits.

Social media platforms, especially Twitter, have become hotspots for discussions around major trades. The announcement of the $276 million long on Bitcoin quickly gained traction, with many speculating who the trader might be and what their motivations are. Influencers and analysts alike have weighed in, providing insights and opinions on this significant move.

Why Go Long on Bitcoin Now?

You might be wondering, why now? What makes this moment the right time to commit such a large sum to Bitcoin? Here are a few factors that could have influenced this decision:

- Market Sentiment: If the overall sentiment surrounding Bitcoin is bullish, it could encourage traders to take larger positions.

- Upcoming Catalysts: Events like regulatory announcements, ETF approvals, or technological upgrades (like the Taproot upgrade) can create optimism in the market.

- Institutional Interest: Increased interest from institutional investors can lead to a more stable price environment, prompting larger trades.

Historical Context: Major Trades in Crypto

Historically, significant trades have often foreshadowed price movements. For example, in 2021, when MicroStrategy announced its purchase of $425 million worth of Bitcoin, it marked a notable shift in institutional adoption. Such actions often encourage retail investors to follow suit, further amplifying market movements.

When someone opens a long position as large as $276 million, it undoubtedly captures the attention of both seasoned investors and newcomers alike. Many will look to see how this trade influences Bitcoin’s price in the short and long term, as well as what it indicates about broader market trends.

The Role of Social Media in Cryptocurrency Trading

In today’s digital age, social media platforms play a crucial role in shaping the perception and trends of cryptocurrencies. Twitter, in particular, has become a go-to source for real-time information regarding significant trades, market analysis, and community sentiment.

The announcement of the $276 million long on Bitcoin quickly spread across Twitter, generating buzz and discussions among traders. Platforms like Twitter allow for rapid dissemination of information, and traders often rely on these updates to make informed decisions. This creates a unique environment where sentiment can shift quickly, impacting market movements.

What This Means for Future Investors

If you’re considering entering the crypto market, the implications of a $276 million long position on Bitcoin are significant. Here are a few key takeaways:

- Understand Risk: While the potential for profit is high, so is the risk. Large trades can lead to increased volatility, so it’s essential to manage your risk accordingly.

- Stay Informed: Keeping up with the latest market trends and news will help you make more informed decisions. Follow credible sources and engage with the community to stay updated.

- Consider Your Strategy: Whether you’re looking to invest long-term or trade short-term, having a clear strategy will help you navigate the complexities of the crypto market.

Final Thoughts on the $276M Long on Bitcoin

The announcement of a $276 million long position on Bitcoin has undoubtedly sparked interest and speculation within the cryptocurrency world. As traders and investors analyze the implications of this move, it’s clear that the crypto market remains as dynamic and unpredictable as ever. Whether you’re a seasoned investor or a newcomer, closely monitoring developments like this can provide valuable insights into Bitcoin’s future performance and the broader market landscape.

As always, exercise caution and ensure you conduct thorough research before making investment decisions. The world of cryptocurrency is exciting, but it also comes with its fair share of risks. Stay informed, stay engaged, and who knows — you might just find yourself riding the next wave of Bitcoin’s journey!

For more details on cryptocurrency trends and trading strategies, be sure to follow reliable sources and stay connected with the ever-growing crypto community.

Someone opened a $276M long on #bitcoin