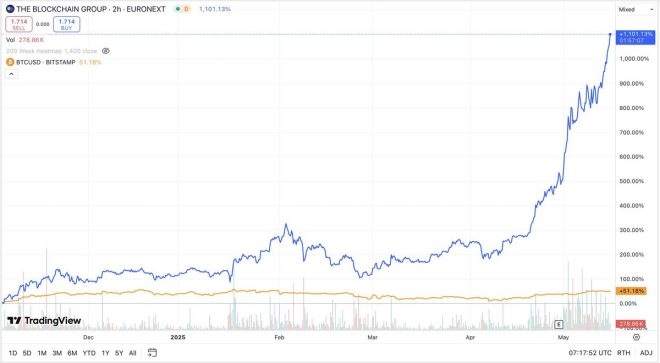

The Blockchain Group’s Incredible Surge: A 1,100% Increase in Six Months

In a remarkable financial development, The Blockchain Group has witnessed an astounding increase of 1,100% over a six-month period, attributed to the launch of their Bitcoin treasury strategy. This surge has sparked significant interest in the cryptocurrency market, particularly among investors keen on capitalizing on the Bitcoin phenomenon. This summary delves into the details of this impressive growth, the implications of the Bitcoin treasury strategy, and the broader context of Bitcoin’s influence on the market.

Understanding the Bitcoin Treasury Strategy

The Bitcoin treasury strategy involves companies or organizations allocating a portion of their treasury reserves into Bitcoin. This strategy has gained traction as more businesses recognize Bitcoin as a viable asset class, particularly in times of economic uncertainty. The Blockchain Group’s decision to adopt this strategy reflects a broader trend among corporations looking to diversify their investment portfolios and hedge against inflation.

By holding Bitcoin, companies can potentially benefit from its appreciation in value, as seen in The Blockchain Group’s extraordinary performance. This strategy not only offers an opportunity for substantial returns but also positions companies at the forefront of the evolving digital asset landscape.

The Impact of Bitcoin on Financial Markets

Bitcoin, often referred to as digital gold, has emerged as a significant player in the financial markets. Its decentralized nature and limited supply make it an attractive option for investors seeking alternative assets. The recent surge in Bitcoin’s value has prompted many companies, including The Blockchain Group, to explore the potential benefits of incorporating Bitcoin into their financial strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Bitcoin effect, as highlighted in the tweet from Bitcoin Magazine, underscores the cryptocurrency’s ability to influence market dynamics. As more organizations adopt Bitcoin treasury strategies, the demand for Bitcoin is likely to increase, further driving its price and solidifying its status as a mainstream asset.

The Role of Market Sentiment

Market sentiment plays a crucial role in the performance of cryptocurrencies. Positive news, such as The Blockchain Group’s impressive growth, can create a ripple effect, encouraging other companies to consider similar strategies. The enthusiasm surrounding Bitcoin can lead to increased investment, resulting in further price appreciation and greater adoption of digital currencies.

Social media platforms, particularly Twitter, have become vital channels for disseminating information and shaping market sentiment in the cryptocurrency space. The tweet from Bitcoin Magazine serves as an example of how quickly information can spread, influencing investor behavior and market trends.

Future Prospects for The Blockchain Group

Given the current trajectory of The Blockchain Group, the future looks promising. The company’s strategic decision to embrace Bitcoin has not only yielded significant returns but has also positioned it as a leader in the cryptocurrency space. As more companies recognize the benefits of Bitcoin treasury strategies, The Blockchain Group may continue to attract attention and investment.

The ongoing evolution of the cryptocurrency market presents both opportunities and challenges. Regulatory developments, technological advancements, and market volatility are factors that The Blockchain Group and other companies must navigate. However, with a solid strategy in place, The Blockchain Group is well-positioned to leverage the growing interest in Bitcoin and digital assets.

The Broader Implications of Bitcoin Adoption

The adoption of Bitcoin and similar cryptocurrencies has far-reaching implications for the global economy. As more companies incorporate digital assets into their financial strategies, traditional financial systems may undergo significant changes. The rise of Bitcoin could lead to increased competition for traditional currencies and investment vehicles, prompting governments and financial institutions to rethink their approaches.

Moreover, the growing acceptance of Bitcoin as a legitimate asset class could pave the way for more institutional investment in cryptocurrencies. This shift could enhance the stability and legitimacy of the cryptocurrency market, attracting even more participants and fostering innovation.

Conclusion: Embracing the Bitcoin Revolution

The Blockchain Group’s impressive 1,100% increase over six months serves as a testament to the transformative potential of Bitcoin and the broader cryptocurrency market. As companies increasingly adopt Bitcoin treasury strategies, the impact of this digital asset on financial markets is likely to grow. The Bitcoin effect, as highlighted by the recent surge in The Blockchain Group’s performance, underscores the significance of staying informed and adaptive in a rapidly changing financial landscape.

Investors and companies alike should pay close attention to the developments in the cryptocurrency space. The Bitcoin revolution is well underway, and those who embrace this change may find themselves at the forefront of a new era in finance. Whether through investment, innovation, or strategic partnerships, the potential for growth and opportunity in the world of Bitcoin and digital assets is immense.

As we move forward, it is essential to remain vigilant and informed about the evolving dynamics of the cryptocurrency market. The rise of Bitcoin and its influence on companies like The Blockchain Group exemplifies the growing importance of digital assets in today’s economy. With the right strategies in place, the future holds limitless possibilities for those willing to explore the world of cryptocurrencies.

JUST IN: The Blockchain Group is up +1,100% over 6 months since the launch of the #Bitcoin treasury strategy.

The Bitcoin effect pic.twitter.com/KCL3UECPCk

— Bitcoin Magazine (@BitcoinMagazine) May 16, 2025

JUST IN: The Blockchain Group is up +1,100% over 6 months since the launch of the #Bitcoin treasury strategy

Did you hear the news? The Blockchain Group has skyrocketed by a staggering 1,100% in just six months following the launch of their new #Bitcoin treasury strategy. This incredible growth has left many in the crypto community buzzing, and rightly so! But what exactly does this mean for the Blockchain Group, and how has the Bitcoin effect played such a significant role in this surge? Let’s break it down.

The Bitcoin Effect

The term “Bitcoin Effect” refers to the phenomenon where businesses or organizations that adopt Bitcoin as part of their financial strategy experience a significant boost in their market performance. The Blockchain Group’s recent performance is a prime example of this. By integrating Bitcoin into their treasury strategy, they have not only increased their assets but have also instilled confidence among investors and stakeholders.

When companies leverage Bitcoin, they tap into a market that has shown unprecedented growth over the past decade. With Bitcoin hitting all-time highs and gaining mainstream acceptance, it’s no surprise that organizations are looking to incorporate this digital currency into their financial practices. The Blockchain Group’s massive increase is a testament to the power and potential of Bitcoin.

Understanding the Treasury Strategy

So, what exactly is a treasury strategy in the context of Bitcoin? Simply put, it’s a financial approach where an organization holds Bitcoin as part of its treasury reserve. This strategy can serve multiple purposes, including hedging against inflation, diversifying assets, and enhancing liquidity. The Blockchain Group recognized the potential of Bitcoin and decided to allocate a portion of their treasury to this cryptocurrency, and the results speak for themselves.

By holding Bitcoin, the Blockchain Group has positioned itself to benefit from any price increases while also providing a buffer against traditional market volatility. It’s a smart move that reflects a growing trend among companies looking to secure their financial future.

The Role of Investor Confidence

One of the most fascinating aspects of this surge is the impact on investor confidence. When companies like the Blockchain Group make bold moves, it often creates a ripple effect throughout the market. Investors are always on the lookout for signs of growth and stability, and the Blockchain Group’s adoption of a Bitcoin treasury strategy sends a clear message: they are forward-thinking and ready to embrace the future of finance.

This increased confidence can lead to more investments, as stakeholders are more likely to support a company that demonstrates a commitment to innovation and adaptation in a rapidly changing market. The Blockchain Group’s 1,100% growth is not just a reflection of their treasury strategy but also an indicator of the trust they have built within the investment community.

Market Reactions and Future Implications

The response from the market following the announcement of the Blockchain Group’s treasury strategy has been overwhelmingly positive. Investors and analysts are taking note of this significant growth, and many are speculating on what it could mean for the future. The success of this strategy could encourage other companies to explore similar paths, potentially leading to a greater acceptance of Bitcoin in the corporate world.

As more organizations consider Bitcoin as a viable asset, we may witness a shift in how businesses approach their financial strategies. The Blockchain Group’s success could pave the way for a new era of corporate finance where Bitcoin plays a central role. This shift would not only affect individual companies but could also have broader implications for the overall economy.

Challenges and Considerations

Of course, it’s essential to recognize that with great opportunity comes great responsibility. Adopting a Bitcoin treasury strategy is not without its challenges. The cryptocurrency market is known for its volatility, and while the Blockchain Group has experienced incredible growth, there is always the risk of market fluctuations impacting their holdings.

Companies considering a similar strategy must be prepared for these challenges and have robust risk management practices in place. It’s crucial to assess one’s risk tolerance and understand the potential downsides of investing in such a volatile asset. However, with careful planning and strategic execution, the rewards can far outweigh the risks.

The Future of Bitcoin in Corporate Strategies

As we look ahead, it’s clear that Bitcoin is here to stay. The Blockchain Group’s impressive growth is just one example of how companies can leverage this digital currency for greater financial success. The trend of integrating Bitcoin into corporate treasury strategies is likely to gain momentum, with more businesses recognizing the benefits it can offer.

In addition to the potential financial gains, adopting Bitcoin may also enhance a company’s reputation as an innovative and forward-thinking organization. This can attract top talent, loyal customers, and investors who are excited about being part of a company that is at the forefront of financial technology.

Wrapping Up

In summary, the Blockchain Group’s remarkable 1,100% growth in just six months since launching their Bitcoin treasury strategy highlights the profound impact that Bitcoin can have on corporate performance. The Bitcoin effect is real, and it serves as a powerful reminder of the opportunities available in the evolving landscape of finance.

As more companies like the Blockchain Group adopt similar strategies, we can expect to see a transformative shift in the way businesses operate, paving the way for a future where Bitcoin is a standard part of financial planning. Whether you’re an investor, a business owner, or simply someone interested in the future of finance, now is the time to pay attention to the incredible potential of Bitcoin and what it can mean for the corporate world.