Surge in US Corporate Bankruptcy Filings in 2025: A 15-Year High

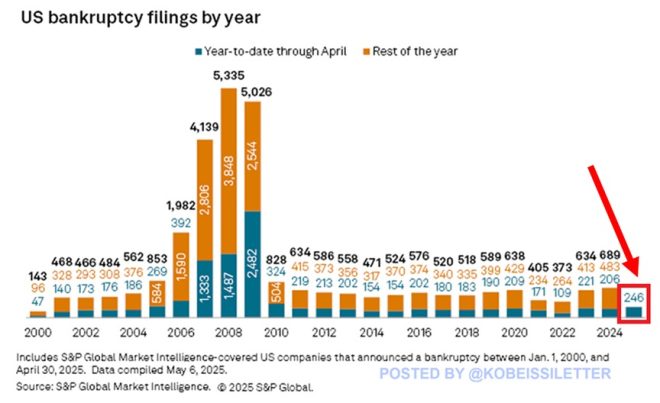

In a significant economic development, a recent report has revealed that 246 large companies in the United States have filed for bankruptcy year-to-date as of May 2025. This figure represents the highest number of bankruptcies observed in the past 15 years, highlighting a troubling trend in the business landscape. In comparison, the previous year saw 206 bankruptcies, indicating a substantial increase in corporate insolvencies this year. Furthermore, this year’s filings have more than doubled the count from the same period in 2022, underscoring the growing financial pressures faced by companies across various sectors.

The Impact of Tariffs on Bankruptcy Rates

In April alone, the United States recorded 59 bankruptcy filings, a surge attributed in part to the escalating tariffs that have been imposed on various goods and services. Tariffs can significantly impact the bottom line of businesses, particularly those that rely heavily on imported materials or goods for their operations. As costs rise due to tariffs, companies may find it increasingly challenging to maintain profitability, leading to financial distress and, ultimately, bankruptcy.

Trends in Corporate Bankruptcies

The ongoing rise in bankruptcies can be linked to several factors, including supply chain disruptions, inflationary pressures, and changing consumer behaviors. Businesses that had previously weathered economic downturns may now be facing insurmountable challenges, prompting them to seek legal protections through bankruptcy filings. With the economic landscape continuing to evolve rapidly, many companies are struggling to adapt, leading to this alarming trend of increased bankruptcies.

Sector-Specific Insights

Different sectors have experienced varying levels of impact from the current economic climate. For instance, industries such as retail and hospitality have been particularly hard-hit due to changing consumer preferences and ongoing market volatility. The rise in online shopping, coupled with the lingering effects of the COVID-19 pandemic, has forced many brick-and-mortar establishments to close their doors permanently. Conversely, some sectors, like technology and e-commerce, may be experiencing growth, but they also face their unique challenges, such as cybersecurity threats and regulatory pressures.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Monitoring Bankruptcy Filings

Monitoring bankruptcy filings is crucial for understanding the health of the economy and the business landscape. An increase in bankruptcies can signal underlying issues within the economy, such as rising unemployment rates, decreased consumer spending, and a slowdown in economic growth. As these factors interconnect, they can create a cycle of financial distress that affects not only individual companies but also the broader economy.

Navigating Economic Challenges

For businesses facing financial challenges, it is essential to take proactive steps to navigate the turbulent economic environment. Strategies may include cost-cutting measures, restructuring operations, renegotiating debts, and exploring new revenue streams. Engaging with financial advisors and legal experts can also provide valuable insights and support for companies considering bankruptcy as a viable option.

Conclusion: The Need for Vigilance

As the trend of rising corporate bankruptcies continues into 2025, it is imperative for stakeholders—including business owners, investors, and policymakers—to remain vigilant. Understanding the factors contributing to this wave of insolvencies can help inform future decisions and strategies aimed at fostering economic resilience. The situation underscores the importance of adaptability and innovation in today’s rapidly changing business environment. By staying informed and proactive, companies can better position themselves to weather the storms ahead and emerge stronger in the future.

Keywords for SEO Optimization

- US corporate bankruptcies 2025

- Bankruptcy filings surge

- Impact of tariffs on businesses

- Economic challenges for companies

- Corporate insolvencies trends

- Sector-specific bankruptcy insights

- Navigating financial distress

- Importance of monitoring bankruptcies

- Strategies for companies facing bankruptcy

- Economic resilience and adaptability

By utilizing these keywords throughout the content, the summary is optimized for search engines, making it easier for readers to find relevant information about the current state of corporate bankruptcies in the US.

BREAKING: 246 US large companies have gone bankrupt year-to-date, the most in 15 years.

This is up from 206 recorded last year and more than DOUBLE during the same period in 2022.

In April alone, the US saw 59 bankruptcy filings as tariffs ramped up.

So far this year, the… pic.twitter.com/Pbhi9W3hTf

— The Kobeissi Letter (@KobeissiLetter) May 16, 2025

BREAKING: 246 US Large Companies Have Gone Bankrupt Year-to-Date, the Most in 15 Years

In a staggering turn of events, 246 US large companies have gone bankrupt so far this year, marking the highest number in 15 years. This figure is a significant jump from the 206 bankruptcies recorded last year, and it’s more than double the amount seen during the same period in 2022. The economic landscape has shifted dramatically, and it’s crucial to understand what’s happening and why.

This Is Up from 206 Recorded Last Year

The increase in bankruptcies isn’t just a statistic; it’s a reflection of the challenges many companies are facing. In 2024, we saw 206 large corporations throw in the towel, but 2025 has already surpassed that number with only a few months gone by. So what’s going on? Factors like rising inflation, supply chain issues, and the ongoing effects of the pandemic have all played a role. Many businesses that barely survived the previous years are now finding it impossible to keep afloat as conditions worsen.

More Than Double During the Same Period in 2022

To put this into perspective, the 246 bankruptcies reported this year are more than double the number from the same period in 2022. Back then, the economy was still recovering from the pandemic, and many companies had started to adapt to new market conditions. However, the rapid rise in bankruptcies we’re witnessing now raises questions about the sustainability of many large corporations. Are they equipped to handle ongoing economic pressures, or are we witnessing the beginning of a larger trend?

In April Alone, the US Saw 59 Bankruptcy Filings as Tariffs Ramped Up

April 2025 was particularly brutal, with 59 bankruptcy filings in just that month. The rise in tariffs has put additional pressure on businesses, especially those that rely on imports. The cost of goods has skyrocketed, leading to tighter margins and, ultimately, the inability of some companies to meet their financial obligations. According to the Kobeissi Letter, the trend indicates that many companies are struggling to adapt to new tariffs and the changing economic climate.

The Impact on the Economy and Job Market

This surge in bankruptcies doesn’t just affect the companies involved; it has wider implications for the economy and the job market. When large companies fold, thousands of jobs can be lost almost overnight. This creates a ripple effect that impacts consumer spending and overall economic growth. As people lose jobs, they have less money to spend, which can lead to further economic decline.

Why Are So Many Companies Failing?

There isn’t a one-size-fits-all answer to why so many companies are going bankrupt. However, several factors contribute to this troubling trend. Increased competition, especially from digital-native companies, has made it challenging for traditional businesses to keep pace. Additionally, rising interest rates have made borrowing more expensive, further straining companies that rely on loans for cash flow.

The Role of Inflation and Supply Chain Issues

Inflation has been a significant factor in the rise of bankruptcies, with prices for essential goods and services continuing to climb. Companies are forced to pass these costs onto consumers, which can lead to decreased sales and revenue. Moreover, supply chain disruptions remain a significant hurdle, making it difficult for businesses to get products to market efficiently.

What This Means for Consumers

For consumers, the increase in bankruptcies can lead to fewer choices and potentially higher prices. As companies close their doors, competition decreases, which can drive prices up. Additionally, loyal customers may find their favorite brands disappearing, leaving them to search for alternatives. This is particularly concerning in sectors like retail and hospitality, where many well-known brands are struggling.

Looking Ahead: What Can Be Done?

So what can be done to reverse this trend? Policymakers and business leaders need to take a comprehensive look at the factors leading to these bankruptcies. Strategies that support small and large businesses alike, such as financial relief programs, might help stabilize the economy. Additionally, addressing supply chain issues and reconsidering tariff policies could ease the burden on struggling companies.

The Importance of Financial Literacy

In times of economic uncertainty, financial literacy becomes even more critical. Business owners must understand their financial health, cash flow management, and the implications of debt. For consumers, knowing how to manage personal finances can help them navigate challenging times. This can mean budgeting wisely, saving for emergencies, and being cautious with credit use.

Final Thoughts

The current landscape of bankruptcies among US large companies paints a concerning picture. With 246 bankruptcies year-to-date, we’re witnessing the most significant wave of corporate failures in 15 years. As we continue into 2025, it will be essential for businesses and consumers alike to stay informed and adaptable. Only by understanding the challenges we face can we hope to navigate this turbulent economic environment successfully.

“`

This HTML formatted content is structured to engage readers while incorporating SEO-friendly keywords and phrases related to the rise in bankruptcies among US large companies.

BREAKING: 246 US large companies have gone bankrupt year-to-date, the most in 15 years.

This is up from 206 recorded last year and more than DOUBLE during the same period in 2022.

In April alone, the US saw 59 bankruptcy filings as tariffs ramped up.

So far this year, the