Michael Burry’s Bold Move: A Deep Dive into Market Predictions and Estee Lauder

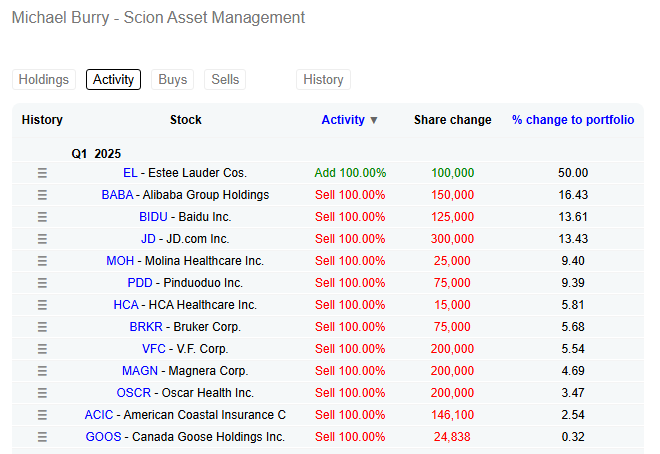

Michael Burry, the renowned investor and hedge fund manager best known for his prescient predictions during the 2008 financial crisis, has once again made headlines with a significant shift in his investment strategy. According to a recent tweet from Barchart, Burry has liquidated his entire stock portfolio, retaining only one investment: Estee Lauder Companies Inc. (NYSE: EL). This decision raises questions about market trends, consumer behavior, and the future of Estee Lauder in a rapidly changing economic landscape.

Understanding Michael Burry’s Investment Philosophy

Burry’s investment philosophy is deeply rooted in fundamental analysis and a thorough understanding of market conditions. Over the years, he has gained a reputation for his ability to foresee market downturns, famously betting against subprime mortgages before the 2008 financial crisis. His track record suggests a keen insight into economic cycles and an ability to identify undervalued assets. By divesting from a majority of his stock holdings, Burry appears to be signaling a bearish outlook on the broader market while placing his confidence solely in Estee Lauder.

Market Sell-offs: Burry’s Predictions

The phrase “predicted 20 of the last 2 market sell-offs” humorously underscores Burry’s reputation for making bold calls that don’t always pan out in the short term. Despite his mixed track record, market participants and analysts closely watch his moves. His decision to sell off most of his portfolio aligns with a growing sentiment among investors who are cautious about economic uncertainties, inflationary pressures, and potential recessionary signals.

Burry’s recent actions highlight a broader trend in the investment community: a flight to quality. With various sectors facing volatility, many investors are seeking stability in established companies with strong fundamentals. Estee Lauder, a leader in the beauty and cosmetics industry, represents such a stable investment, especially in periods of economic unpredictability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Estee Lauder Advantage

Estee Lauder has long been recognized for its robust business model and a diverse portfolio of beauty brands. The company operates in various segments, including skincare, makeup, fragrance, and hair care, which allows it to cater to a wide range of consumer preferences. Estee Lauder’s strong brand equity, coupled with a commitment to innovation, positions it favorably in the marketplace.

Moreover, the beauty industry has shown resilience even during economic downturns. Consumers often prioritize personal care and beauty products, viewing them as essential rather than discretionary. Estee Lauder’s ability to adapt to changing consumer trends, including the rise of e-commerce and demand for sustainable products, further solidifies its standing as a wise investment choice.

Market Reactions to Burry’s Decision

Burry’s divestment has sparked discussions among investors and analysts. Many are interpreting his move as a cautionary stance regarding the overall market. The decision to retain only Estee Lauder suggests that he sees potential for growth in the beauty sector, even amid broader economic challenges. Market reactions to such high-profile investment changes can lead to fluctuations in stock prices, and Estee Lauder may experience increased attention from both retail and institutional investors.

Furthermore, Burry’s actions could trigger a trend where other investors might follow suit, creating a ripple effect in the market. The beauty and personal care industry has been gaining traction, especially as consumers increasingly seek premium products that promise quality and efficacy. Burry’s confidence in Estee Lauder could encourage others to explore similar opportunities within the sector.

The Future of Estee Lauder and Economic Considerations

As we look ahead, several factors will influence Estee Lauder’s performance. The company’s ability to navigate supply chain challenges, inflationary pressures, and changing consumer habits will be crucial. Estee Lauder has demonstrated agility in adapting its marketing strategies, particularly by leveraging digital platforms to reach consumers directly.

The post-pandemic world has also seen a shift in consumer behaviors, with a growing emphasis on self-care and wellness. Estee Lauder’s focus on skincare and beauty products aligns well with this trend. Additionally, the company’s commitment to sustainability and ethical practices resonates with a more environmentally conscious consumer base.

Conclusion: The Implications of Burry’s Move

Michael Burry’s decision to sell off his stock portfolio, retaining only Estee Lauder, serves as a significant indicator of his market outlook and investment strategy. While his past predictions may have been met with skepticism, his current focus on Estee Lauder underscores the company’s potential for resilience and growth in the beauty sector. Investors will undoubtedly be watching closely to see how this decision plays out in the coming months.

As the market continues to evolve, the implications of Burry’s move extend beyond Estee Lauder. It serves as a reminder of the importance of fundamental analysis and the need for investors to remain vigilant in a dynamic economic landscape. Whether Burry’s confidence in Estee Lauder will yield positive results remains to be seen, but it certainly adds an intriguing layer to the ongoing conversations about market trends and investment strategies.

In summary, Michael Burry’s focus on Estee Lauder amidst widespread portfolio divestment highlights the importance of selecting quality investments in uncertain times. Estee Lauder’s strong market position and adaptability make it a compelling choice for investors seeking stability in a volatile economic landscape.

JUST IN : Michael Burry, the man who has predicted 20 of the last 2 market sell offs, dumped his entire stock portfolio except for one – Estee Lauder $EL pic.twitter.com/Ijz4LFF5Cl

— Barchart (@Barchart) May 16, 2025

JUST IN : Michael Burry, the man who has predicted 20 of the last 2 market sell offs, dumped his entire stock portfolio except for one – Estee Lauder $EL

You might have heard the name Michael Burry floating around the financial news lately, and for good reason. This guy is famous for making some pretty bold predictions about market trends. Recently, he made waves by dumping his entire stock portfolio, keeping only one stock: Estee Lauder ($EL). If you’re wondering what this means for investors and the beauty industry, stick around as we delve into the implications of Burry’s move.

Who is Michael Burry?

Now, let’s talk a little bit about who this guy is. Michael Burry is not just your average investor; he’s the man who famously predicted the 2008 financial crisis. He was portrayed by Christian Bale in the movie *The Big Short*, which gives a glimpse of his analytical genius. Burry has a knack for spotting trends that most people overlook, which is why his recent decision to sell off his portfolio—except for Estee Lauder—has raised eyebrows across the financial world.

His track record is impressive, to say the least. According to reports, he has predicted 20 out of the last 2 market sell-offs. That’s a bold statement, and it suggests that Burry might have an insight into market dynamics that many other investors lack. So when he makes a move, it’s worth paying attention to.

What Does This Move Mean for Investors?

When someone like Burry dumps their entire portfolio, it raises some serious questions. Why would he sell off everything except for Estee Lauder? There are a few angles to consider here.

First, it could signify a broader market correction. Burry has always been cautious about market bubbles, and if he believes that a significant downturn is on the horizon, he might have decided to liquidate most of his holdings to preserve capital. This tactic isn’t uncommon among savvy investors, especially in volatile market conditions.

Second, it highlights his confidence in Estee Lauder as a solid investment. Estee Lauder has been a staple in the beauty industry for decades, and its brand portfolio includes several high-profile names. Burry’s choice to hold onto this stock could indicate that he sees strong growth potential in the company, even in uncertain economic times.

An In-Depth Look at Estee Lauder

Estee Lauder ($EL) is a beauty powerhouse that’s known for its high-quality skincare, makeup, and fragrance products. The company has built a reputation for innovation and has a diverse range of brands, including MAC, Clinique, and Aveda. So, what makes Estee Lauder stand out in Burry’s eyes?

1. **Strong Brand Portfolio**: Estee Lauder’s diverse offerings make it resilient in the face of market fluctuations. With brands catering to different demographics and price points, the company has a broad customer base.

2. **E-commerce Growth**: The shift to online shopping has accelerated due to the pandemic, and Estee Lauder has successfully capitalized on this trend. Its investment in e-commerce platforms has helped boost sales, making it a strong contender in the beauty sector.

3. **Global Reach**: Estee Lauder operates in over 150 countries, giving it a significant advantage in terms of market penetration. This global presence allows the company to mitigate risks tied to any single market or region.

4. **Sustainability Initiatives**: Consumers are increasingly leaning toward brands that prioritize sustainability. Estee Lauder has committed to various environmental initiatives, making it more appealing to eco-conscious shoppers.

Market Reactions and Predictions

So, how has the market reacted to Burry’s bold decision? Financial analysts and investors are buzzing with speculation. Some believe that Burry’s endorsement of Estee Lauder could lead to a surge in its stock price, while others are cautious, reminding us that even the best investors can be wrong.

Market sentiment is often influenced by high-profile moves like this one. As Burry’s reputation for market predictions precedes him, investors may flock to Estee Lauder, hoping to capitalize on its potential growth. However, it’s essential to remember that stock prices can be volatile, and past performance does not guarantee future results.

Understanding Market Sell-Offs

To fully appreciate the weight of Burry’s actions, it’s crucial to understand what a market sell-off entails. A sell-off occurs when a significant number of investors begin to sell their stocks, leading to a rapid decline in stock prices. This can be triggered by various factors, including economic indicators, political events, or even analyst downgrades.

Burry’s history of predicting sell-offs means that his recent actions could be a signal for others. If he believes a sell-off is imminent, he might be trying to preserve his capital by holding onto a stock he trusts.

Should You Follow Michael Burry’s Lead?

The million-dollar question is whether you should follow Burry’s lead and invest in Estee Lauder. While Burry is undoubtedly a savvy investor, it’s essential to conduct your own research and consider your financial situation before making investment decisions.

1. **Evaluate Your Investment Goals**: Are you looking for short-term gains or long-term growth? Estee Lauder may be a solid long-term investment, but if you’re seeking quick profits, you might want to explore other options.

2. **Analyze Market Conditions**: Keep an eye on broader market trends. If a recession is on the horizon, even strong companies can face challenges.

3. **Diversification**: It’s crucial to have a diversified portfolio. While Estee Lauder might be a good investment, putting all your eggs in one basket can be risky.

4. **Stay Informed**: Follow the latest news and analysis regarding Estee Lauder and the beauty industry. Market dynamics can change rapidly, and staying informed will help you make better decisions.

Conclusion: The Future of Estee Lauder in a Post-COVID World

As we navigate through an uncertain economic landscape, Michael Burry’s recent decision to dump his stock portfolio—except for Estee Lauder—has certainly caught the attention of investors and analysts alike. Estee Lauder, with its rich history and robust brand portfolio, seems to be the shining star in Burry’s strategy.

If you’re considering investing in Estee Lauder, remember to do your homework. The beauty industry is evolving, and companies that adapt to changing consumer preferences will thrive. Whether you choose to follow Burry’s lead or carve your own path, understanding the market and staying informed is key to making sound investment decisions.

So, what are your thoughts on Burry’s investment in Estee Lauder? Does it inspire confidence, or are you cautious about jumping on the bandwagon? Share your thoughts and let’s keep the conversation going!