Major Bitcoin Acquisition: A Whale Buys $227 Million

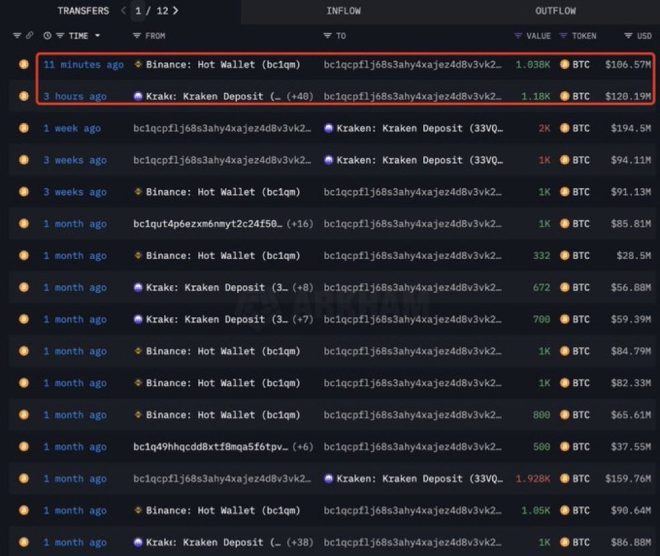

In a stunning development within the cryptocurrency market, a significant player, often referred to as a "whale," has made headlines by acquiring a staggering $227 million worth of Bitcoin. This monumental purchase has sparked discussions among traders, investors, and crypto enthusiasts alike, as it highlights both the volatility and the potential of Bitcoin as an investment.

Understanding the Whale Phenomenon

In cryptocurrency jargon, a "whale" refers to individuals or entities that hold large quantities of cryptocurrency, often influencing market prices with their trading activities. Whales can be early adopters, large institutional investors, or even crypto exchanges with vast reserves. Their transactions can create significant ripples in the market, as evidenced by this recent $227 million Bitcoin purchase.

What Does This Acquisition Mean for Bitcoin?

The acquisition of such a substantial amount of Bitcoin can have several implications:

- Market Confidence: Large purchases by whales often signal confidence in the cryptocurrency’s future value. Investors may interpret this move as a bullish indicator, suggesting that the whale believes Bitcoin will appreciate over time.

- Price Volatility: While a large purchase can boost market sentiment, it can also lead to increased volatility. If the whale decides to sell part of their holdings in the future, it could cause price fluctuations that affect the entire market.

- Increased Institutional Interest: The growing trend of large-scale acquisitions by institutional investors indicates a shift in the perception of Bitcoin from a speculative asset to a viable investment. This could attract more retail investors and institutions into the market.

The Role of Social Media in Cryptocurrency Trends

The announcement of this massive Bitcoin acquisition was shared via Twitter by crypto influencer DustyBC, illustrating the power of social media in shaping market narratives. Platforms like Twitter and Reddit have become critical for real-time updates, discussions, and sentiment analysis in the rapidly evolving crypto landscape.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin’s Performance and Market Trends

Bitcoin has experienced significant fluctuations in price since its inception, reaching an all-time high of nearly $64,000 in April 2021 before facing corrections. The recent acquisition reflects ongoing interest and activity within the market, especially as Bitcoin continues to be viewed as a hedge against inflation and an alternative to traditional assets.

Investor Strategies in Response to Whale Activity

The activity of whales can shape the strategies of regular investors. Here are some common responses:

- HODLing: Many investors may choose to hold onto their Bitcoin, believing that long-term gains will outweigh short-term volatility, especially in light of whale activity.

- Market Timing: Some traders may attempt to time the market based on whale movements, buying in before significant purchases and selling during peaks.

- Increased Due Diligence: Investors may conduct more thorough research into market trends and whale behavior to make informed decisions.

The Future of Bitcoin

Looking ahead, the implications of significant whale purchases like this $227 million acquisition can set the stage for future market developments. Several factors will influence Bitcoin’s trajectory:

- Regulatory Environment: Governments worldwide are increasingly focusing on cryptocurrency regulation. How these regulations develop will impact investor sentiment and market stability.

- Technological Advancements: Innovations in blockchain technology and improvements in Bitcoin’s infrastructure could enhance its usability and security, attracting more users.

- Global Economic Conditions: As economic uncertainty persists, Bitcoin could be perceived as a safe haven, driving more investors towards the asset.

Conclusion

The recent whale acquisition of $227 million in Bitcoin signifies a critical moment in the cryptocurrency market. It reflects growing confidence and the potential for future price appreciation, while also highlighting the inherent volatility that accompanies large transactions. As investors and enthusiasts continue to monitor the market, the influence of whale behavior on Bitcoin’s trajectory will remain a focal point for analysis and discussion.

With social media playing a pivotal role in disseminating information and shaping perceptions, the crypto community will be closely watching for subsequent developments. The future of Bitcoin remains uncertain, but significant moves like this serve as a reminder of the asset’s potential to redefine investment strategies and financial landscapes worldwide.

BREAKING

A WHALE JUST SCOOPED UP $227 MILLION IN BITCOIN pic.twitter.com/zRSPAjUsgm

— DustyBC Crypto (@TheDustyBC) May 16, 2025

BREAKING

In the world of cryptocurrencies, news travels fast, especially when a significant transaction occurs. Recently, social media lit up with reports that a whale just scooped up $227 million in Bitcoin. This jaw-dropping transaction has sparked conversations and speculation across the crypto community, leaving many to wonder about the implications of such a massive purchase.

A WHALE JUST SCOOPED UP $227 MILLION IN BITCOIN

What exactly does it mean when we refer to a “whale” in the cryptocurrency space? Simply put, a whale is an individual or entity that holds a substantial amount of cryptocurrency. In this case, the whale’s recent acquisition of Bitcoin has raised eyebrows and prompted discussions about market trends and potential price movements.

The Impact of Whale Transactions

When a whale makes a significant move, it can impact the market dramatically. For instance, the purchase of $227 million in Bitcoin can signal confidence in the asset’s future, potentially encouraging other investors to jump on board. Conversely, it may also raise concerns about market manipulation, as large holders can influence prices significantly. This transaction has the potential to shift sentiment within the crypto sphere.

Understanding the Motivation Behind Large Purchases

So, what could motivate a whale to invest such a colossal amount in Bitcoin? There are several factors at play:

- Market Sentiment: Whales often have access to advanced market analysis and trends. If they believe that Bitcoin is poised for a rally, they might choose to buy in large quantities to profit from the anticipated increase in value.

- Long-Term Investment: Some whales view Bitcoin as a long-term store of value, akin to digital gold. By acquiring large amounts, they may be hedging against inflation or economic uncertainty.

- Diversification: For some, purchasing Bitcoin can be a strategic move to diversify their investment portfolio. By holding a variety of assets, they can mitigate risks associated with market volatility.

Market Reactions to Major Transactions

Following the announcement of the whale’s $227 million Bitcoin purchase, market reactions can vary widely. Traders and investors often analyze the transaction to gauge market sentiment. If they perceive it as a bullish signal, they may rush to buy, driving prices up. Conversely, if they suspect manipulation or fear a market correction, they may choose to sell, leading to a decline in prices.

Social media platforms, especially Twitter, become hotbeds for discussions around such transactions. The tweet from @TheDustyBC highlighted this massive transaction, quickly garnering attention and fueling speculation.

What Does This Mean for the Average Investor?

As an average investor, witnessing a whale scoop up $227 million in Bitcoin can evoke a mix of emotions—excitement, fear, or curiosity. It’s essential to remember that while whales have significant influence, the market is ultimately driven by supply and demand dynamics. Here are a few takeaways for individual investors:

- Stay Informed: Keep an eye on major transactions and market movements. Understanding the landscape can help you make informed decisions.

- Don’t Panic: Just because a whale makes a move doesn’t mean you should react impulsively. Assess your investment strategy and stay the course if you’ve done your research.

- Consider Diversification: Like whales, consider diversifying your portfolio. It can help cushion against market volatility and reduce risk.

The Future of Bitcoin and Whale Activity

As Bitcoin continues to gain traction, the presence of whales in the market is unlikely to diminish. Their activities can provide insights into market trends and investor sentiment. However, it’s crucial to approach these insights with caution. Historical data shows that while whale activity can influence prices, it’s not the only factor at play.

Bitcoin’s future remains uncertain, but one thing is clear: the interest from whales indicates that there is still significant belief in its long-term potential. Whether you’re a seasoned investor or a newcomer, keeping an eye on whale movements can provide valuable context for understanding market dynamics.

Conclusion: Keeping an Eye on the Big Players

The recent news that a whale has scooped up $227 million in Bitcoin serves as a reminder of the complex interplay between large investors and market movements. For those of us navigating the crypto landscape, it’s essential to stay informed and engage thoughtfully with the information available. The actions of whales can be a guiding light, but as always, individual research and strategy are vital for success in this ever-evolving space.

A WHALE JUST SCOOPED UP $227 MILLION IN BITCOIN