FTX Bankruptcy Update: $5 Billion Distribution to Creditors

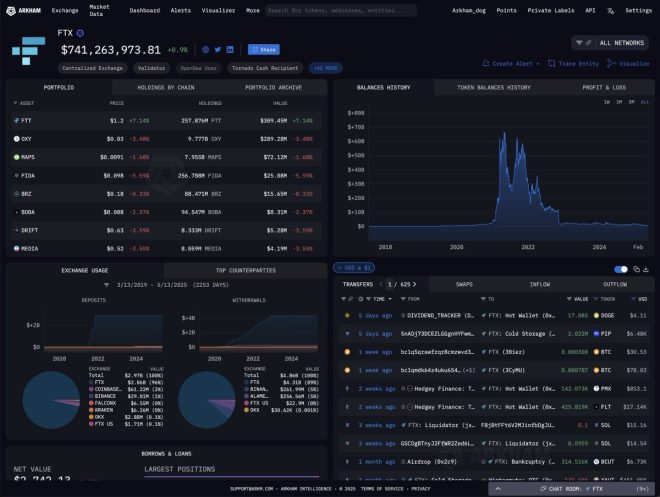

In a significant development in the ongoing FTX bankruptcy saga, the cryptocurrency exchange has announced plans to distribute $5 billion to its creditors on May 30, 2025. This announcement, made via a tweet from Arkham, has generated immense interest and speculation within the cryptocurrency community and beyond. As the date approaches, many are left pondering the implications of this distribution and what it could mean for the future of FTX and its stakeholders.

Understanding the FTX Bankruptcy Case

FTX, once one of the world’s largest cryptocurrency exchanges, filed for bankruptcy in November 2022 amid allegations of mismanagement and fraudulent activities. The collapse of FTX sent shockwaves through the crypto market, leading to significant losses for investors and stakeholders. Following its bankruptcy, FTX has been working on restructuring plans and negotiating with creditors to recover funds.

The announcement of a $5 billion distribution to creditors marks a pivotal moment in this complex legal process. It indicates that FTX has made some progress in liquidating assets and is now in a position to repay a portion of its debts. This distribution will likely be a significant relief for many creditors who have been anxiously awaiting news about their claims.

What Does the $5 Billion Distribution Mean?

The $5 billion distribution is set to be one of the largest repayments in the history of cryptocurrency bankruptcies. It signals a turning point for creditors who have faced uncertainty since FTX’s collapse. The distribution could potentially restore some confidence in the cryptocurrency ecosystem, which has been marred by the fallout from FTX and other similar cases.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

However, the distribution also raises questions about the remaining assets and the recovery process. It is essential to consider how this amount will be allocated among creditors and what portion of their claims it will cover.

Potential Implications for Creditors and the Crypto Market

The decision to distribute $5 billion is likely to have several implications for creditors and the broader cryptocurrency market:

- Creditor Confidence: The distribution may restore some confidence among creditors, many of whom feared they might never see a return on their investments. A successful distribution could pave the way for further recovery efforts and negotiations.

- Market Reaction: The announcement has the potential to positively impact the cryptocurrency market. If creditors begin receiving funds, it may lead to a resurgence in investor confidence, possibly driving up prices in the crypto space.

- Legal Precedents: The FTX case has set important legal precedents regarding the treatment of cryptocurrency assets in bankruptcy proceedings. The successful distribution of funds could influence how future cases are handled, particularly in relation to asset recovery and creditor rights.

- Impact on Other Crypto Entities: Other cryptocurrency exchanges and platforms may take note of FTX’s restructuring and distribution efforts. This could lead to increased transparency and accountability within the industry, as stakeholders demand more robust governance practices.

What Happens Next?

As the date for the distribution approaches, stakeholders are keenly interested in what will unfold. Here are some key considerations:

- Distribution Process: It remains to be seen how FTX will manage the distribution process. Creditors will need clarity on how their claims will be evaluated and what criteria will determine the allocation of the $5 billion.

- Future of FTX: The distribution will likely influence the future trajectory of FTX. Depending on how successfully the company navigates this distribution, it may either emerge from bankruptcy stronger or face further challenges.

- Ongoing Investigations: Investigations into the alleged misconduct surrounding FTX are still ongoing. The distribution of funds does not absolve the company or its executives from legal accountability. Stakeholders should remain aware of potential developments in this area.

- Potential for Further Distributions: If the initial distribution goes smoothly, there may be opportunities for additional distributions in the future. Creditors will be hopeful that further recoveries will follow as FTX continues to work on liquidating assets.

Conclusion

The announcement of a $5 billion distribution to creditors by FTX is a significant step in the ongoing bankruptcy proceedings. It brings hope to many stakeholders who have been affected by the exchange’s collapse while also raising questions about the future of the company and the cryptocurrency market as a whole. As the May 30 deadline approaches, all eyes will be on FTX to see how they execute this distribution and what it means for the broader landscape of cryptocurrency recovery and regulation.

In the coming weeks, industry observers will be closely monitoring developments, as the outcomes of this distribution could have far-reaching implications for the future of cryptocurrency exchanges, investor confidence, and the legal frameworks governing digital assets. Whether this marks the beginning of a new chapter for FTX or another twist in its tumultuous journey remains to be seen, but it is undoubtedly a moment of significant importance in the cryptocurrency world.

BREAKING: FTX TO DISTRIBUTE $5B TO CREDITORS ON MAY 30TH

What do you think happens next? pic.twitter.com/NjATSkqaLT

— Arkham (@arkham) May 15, 2025

BREAKING: FTX TO DISTRIBUTE $5B TO CREDITORS ON MAY 30TH

The world of cryptocurrency is a rollercoaster ride, and the latest update from FTX is just another twist in this thrilling saga. Recently, we got news that FTX is set to distribute a staggering $5 billion to its creditors on May 30th. This announcement has everyone buzzing with curiosity and speculation about what could happen next. With so much at stake, let’s dive into the implications of this distribution and what it could mean for the future of FTX and the broader crypto space.

What do you think happens next?

This question is on the lips of many in the crypto community, and it’s a valid one. After being embroiled in one of the biggest scandals in cryptocurrency history, FTX’s move to pay back creditors marks a significant milestone. But what does this distribution mean for the company, its former customers, and the market at large?

First off, it’s essential to understand the context. FTX, once a leading cryptocurrency exchange founded by Sam Bankman-Fried, faced a catastrophic collapse in late 2022. The company filed for bankruptcy after reports surfaced of mismanagement and fraud involving billions of dollars of customer funds. The fallout was immense, leading to investigations, lawsuits, and a significant loss of trust in the cryptocurrency sector. Fast forward to today, and the impending distribution of $5 billion to creditors is a critical step towards rebuilding that trust and restoring some semblance of order in the chaos that followed.

The Impact on Creditors

For the creditors who have been anxiously waiting for news, this distribution could bring some relief. Many individuals and businesses lost significant amounts of money when FTX went under. The fact that they will receive a portion of their funds back is undoubtedly a positive development. It’s like finding a glimmer of hope in a dark tunnel.

However, receiving $5 billion doesn’t mean creditors will be fully compensated. The distribution will likely be a fraction of what they originally lost. Depending on how the total debt is structured and the number of creditors involved, the payout could vary significantly. This uncertainty can lead to mixed feelings among creditors—relief that something is happening, but also frustration at the losses they still face.

Market Reactions

The crypto market is notoriously volatile, so how will this news affect market sentiment? Investors are always on the lookout for signals that could influence the price of cryptocurrencies. FTX’s situation has already had a ripple effect on Bitcoin and other major coins, often leading to heightened sell-offs or mass panic.

That said, a structured distribution plan could instill a sense of confidence among investors. It demonstrates that there is a pathway to accountability and that actions are being taken to address the fallout from the FTX collapse. However, skepticism remains—many might view this as just a band-aid on a much larger wound.

Moreover, if the distribution is handled transparently and efficiently, it could help in regaining trust in the crypto ecosystem, encouraging new investments and potentially stabilizing the market. But if things go south, the repercussions could be detrimental, leading to even more distrust among investors.

The Future of FTX

So, what’s next for FTX itself? While the distribution is a significant step, the company still faces a mountain of challenges ahead. The bankruptcy process is complex, involving numerous legal proceedings and negotiations with various stakeholders. They need to ensure compliance with regulatory bodies and address the concerns of the public and investors.

Additionally, FTX’s management will need to focus on rebuilding its reputation. This won’t happen overnight, and they will have to be transparent about their operations moving forward. The cryptocurrency world is unforgiving, and one misstep could lead to a complete loss of credibility.

Moreover, the ongoing legal battles will likely continue to draw attention. High-profile cases often catch the public eye, and the outcomes can set precedents for future crypto regulations and operations. How FTX navigates these waters will be critical in determining its future.

The Broader Implications for Cryptocurrency Regulation

FTX’s collapse has reignited discussions around the need for stricter regulations in the cryptocurrency space. With this distribution of funds, we might see a push for clearer guidelines on how exchanges should operate and manage customer funds.

Regulators worldwide are watching closely, and many are likely to implement new rules in response to this situation. This could lead to a more secure environment for investors, but it could also stifle innovation in the industry. Striking the right balance will be key to ensuring that the crypto space can grow while protecting consumers.

Community Response

As news spreads about the $5 billion distribution, the crypto community’s response has been varied. Some see it as a beacon of hope, while others remain skeptical. Social media platforms are buzzing with opinions, and the Twitter thread linked to the announcement serves as a microcosm of the broader conversation happening across the internet.

People are sharing their thoughts on how they feel about the distribution and what it could mean for their investments. Some are hopeful that it signals a recovery for the crypto market, while others are cautious, recalling the tumultuous past.

Engagement within the community is crucial. Many are discussing potential strategies for navigating the aftermath of FTX’s collapse, whether that means diversifying their portfolios or exploring new investment opportunities.

Conclusion: Awaiting the May 30th Distribution

As we approach May 30th, all eyes will be on FTX and the $5 billion distribution to creditors. The outcome of this distribution could have lasting effects—not just for the creditors but for the entire cryptocurrency landscape. Will it restore trust in FTX and the market, or will it deepen the skepticism that already exists? Only time will tell.

In the meantime, it’s essential for the crypto community to stay informed and engaged. The developments surrounding FTX are just one chapter in the ongoing story of cryptocurrency, and understanding the implications can help investors make more informed decisions. As we navigate this complex environment, let’s keep the conversation going and share our thoughts on what happens next.

BREAKING: FTX TO DISTRIBUTE $5B TO CREDITORS ON MAY 30TH

What do you think happens next?