UnitedHealth Denies DOJ Criminal investigation Claims

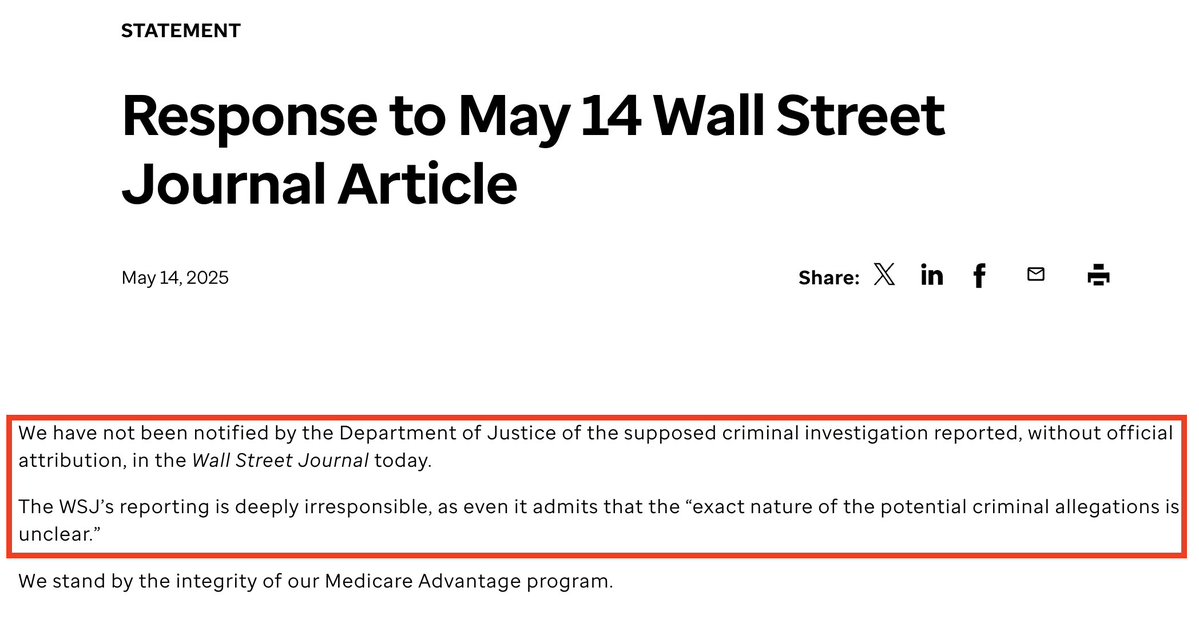

On May 15, 2025, a significant announcement from UnitedHealth Group Inc. (ticker symbol: $UNH) prompted discussions across financial and healthcare news platforms. The company issued a statement addressing claims made in a Wall Street Journal article reporting a "supposed criminal investigation" by the Department of Justice (DOJ). UnitedHealth firmly denied any notification from the DOJ regarding such an investigation, labeling the WSJ’s reporting as "deeply irresponsible" and suggesting that the piece lacked official attribution.

Background on the Allegations

The context of these allegations revolves around ongoing scrutiny into healthcare companies, particularly in light of rising healthcare costs and regulatory concerns. The Wall Street Journal’s report suggested that UnitedHealth was under investigation for potential legal violations, raising eyebrows among investors and stakeholders. This type of news can significantly impact stock prices, investor confidence, and market perception, especially within the healthcare sector, which is already under intense regulatory pressure.

UnitedHealth’s Response

UnitedHealth’s swift response highlights the company’s commitment to transparency and maintaining its reputation. In their statement, they emphasized that they had not received any formal notification from the DOJ concerning the reported investigation. By categorically denying the claims, UnitedHealth aims to mitigate any potential fallout from the WSJ article, reassuring investors and stakeholders of their operational integrity.

The company also criticized the journalistic practices employed in the reporting, pointing out that the article was published "without official attribution." This statement indicates a larger concern regarding the credibility of the sources and the potential for misinformation in the media landscape. UnitedHealth’s decision to publicly address the issue underscores the importance of accurate reporting, particularly for publicly traded companies facing regulatory scrutiny.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investors

The timing of UnitedHealth’s statement is critical for investors, particularly those holding shares in the company. The healthcare sector has experienced volatility due to various factors, including regulatory changes, shifting government policies, and rising operational costs. In this environment, news of a potential investigation could lead to panic selling and a decline in stock prices.

However, with UnitedHealth’s clear denial and assertion of no ongoing DOJ investigation, investors may find reassurance in the company’s stability. This could lead to a rebound in stock prices if investors perceive that the market overreacted to the initial reporting. It serves as a reminder for investors to critically evaluate news sources and not react impulsively to unverified claims.

The Role of Media in Financial Reporting

This incident raises broader questions about the role of media in financial reporting and the ethical responsibilities of journalists. The impact of misinformation can be substantial, affecting not only stock prices but also public perception and corporate reputations. As such, financial news outlets must adhere to strict journalistic standards, ensuring that claims are substantiated and sources are credible.

In an era where news travels quickly, particularly through social media platforms, the potential for misinformation becomes a pressing concern. Investors and the general public are often left to navigate a complex landscape where the lines between fact and speculation can blur. Companies like UnitedHealth may find themselves needing to be more proactive in addressing rumors and clarifying their positions to maintain trust and confidence among stakeholders.

Conclusion

The recent developments surrounding UnitedHealth and the allegations of a DOJ criminal investigation underscore the complexities of operating in the public eye. With the company firmly denying any wrongdoing and criticizing the reporting practices of the Wall Street Journal, it highlights the need for responsible journalism and accurate information dissemination.

For investors, the situation serves as a reminder of the importance of due diligence and the necessity of differentiating between speculation and verified information. As the healthcare landscape continues to evolve, companies like UnitedHealth will need to navigate regulatory challenges while maintaining transparency and trust with their stakeholders. The incident also emphasizes the critical role of media in shaping public perception and financial markets, underscoring the need for integrity in financial journalism.

In summary, UnitedHealth’s denial of the DOJ investigation claims is a significant moment in the ongoing dialogue about corporate responsibility, media ethics, and investor confidence. As the story develops, all eyes will be on how both UnitedHealth and the media address these critical issues moving forward.

BREAKING: UnitedHealth, $UNH, says they have NOT been notified by the DOJ of the “supposed criminal investigation” reported by the Wall Street Journal.

UnitedHealth says this was reported “without official attribution” and the WSJ’s reporting is “deeply irresponsible.”$UNH… pic.twitter.com/Nml0plvfRJ

— The Kobeissi Letter (@KobeissiLetter) May 15, 2025

BREAKING: UnitedHealth Responds to DOJ Investigation Claims

In the fast-paced world of healthcare and finance, news can spread like wildfire. Recently, $UNH (UnitedHealth) made headlines when the Wall Street Journal reported on a supposed criminal investigation by the Department of Justice (DOJ). However, UnitedHealth promptly responded, stating they have NOT been notified by the DOJ regarding any such investigation. This bold statement has certainly captured the attention of investors, analysts, and the general public.

Understanding the Situation

When news outlets like the Wall Street Journal report on sensitive topics like criminal investigations, it can create a ripple effect in the stock market and beyond. UnitedHealth’s assertion that this information was published “without official attribution” raises serious concerns about the reliability of the news source. They went on to describe the reporting as “deeply irresponsible,” a phrase that echoes the frustration many companies feel when faced with unverified claims about their conduct.

The Importance of Accurate Reporting

In the age of information, the accuracy of what we read is paramount. UnitedHealth’s strong reaction highlights a growing issue in journalism—especially in financial reporting. When misleading information circulates, it can lead to unnecessary panic and volatility in stock prices. For instance, in the case of UnitedHealth, the company’s stock could experience dramatic fluctuations based on unverified claims. Investors need reliable information to make sound decisions.

$UNH: A Closer Look at UnitedHealth Group

UnitedHealth Group is one of the largest healthcare companies in the United States. With a vast network of services ranging from health insurance to pharmacy benefits, the company plays a crucial role in the healthcare ecosystem. Their response to the Wall Street Journal’s claims is indicative of their commitment to transparency and accountability. For investors, understanding the fundamentals of UnitedHealth is vital. This includes knowing how the company operates, its financial health, and any potential risks it may face in the market.

What Investors Should Know

The stock market can be unpredictable, especially when news like this breaks. For investors holding $UNH shares, it’s essential to stay informed about the company’s real situation rather than merely reacting to headlines. Monitoring official communications from the company and reputable financial news sources can help investors make more informed decisions. In this case, UnitedHealth’s denial of the DOJ investigation helps to stabilize investor confidence.

Public Perception and Corporate Reputation

Corporate reputation is everything in today’s market. A company like UnitedHealth, which is deeply integrated into the lives of millions of Americans, needs to maintain public trust. The fallout from rumors of a DOJ investigation could tarnish that reputation if not addressed properly. UnitedHealth’s swift response highlights their awareness of the importance of public perception and the potential damage that can arise from misinformation.

The Role of Social Media in Financial News

Social media platforms have revolutionized how news spreads. With just a few clicks, information can reach millions. However, this rapid dissemination can be a double-edged sword. While it allows for immediate communication, it also opens the door for misinformation to spread just as quickly. In the case of UnitedHealth, social media buzz was amplified by the Wall Street Journal’s report, making it crucial for the company to respond promptly and clarify the situation.

How to Navigate Financial News

For those who want to navigate the often-choppy waters of financial news, a few strategies can help. First, always verify information from multiple sources before jumping to conclusions. Second, look for official statements from the company itself, as these are typically the most accurate representations of a situation. Lastly, consider the broader context—how does the news fit into the overall market trends and economic conditions?

Looking Ahead: UnitedHealth’s Future

Despite the recent turmoil, UnitedHealth remains a key player in the healthcare industry. Investors should keep an eye on how the company manages this situation and responds to the market’s reaction. The ability to weather such storms can often indicate a company’s strength and stability. For those considering investing in UnitedHealth, understanding the company’s long-term strategies and market positioning is essential.

Final Thoughts on UnitedHealth

The recent claims concerning UnitedHealth and the DOJ investigation serve as a reminder of how quickly misinformation can spread and the potential consequences it holds for companies and investors alike. UnitedHealth’s quick denial and assertion of the irresponsibility of the reporting are crucial steps in maintaining their reputation and stability in the market. As investors, staying informed and discerning about news sources is more important than ever.

As we watch how this situation unfolds, it’s clear that UnitedHealth will continue to be a focal point in discussions about healthcare and corporate responsibility. The company’s response not only emphasizes the importance of accuracy in reporting but also showcases their commitment to transparency as they navigate the challenges within a complex industry.

UnitedHealth says this was reported "without official attribution" and the WSJ's reporting is "deeply irresponsible."

$UNH