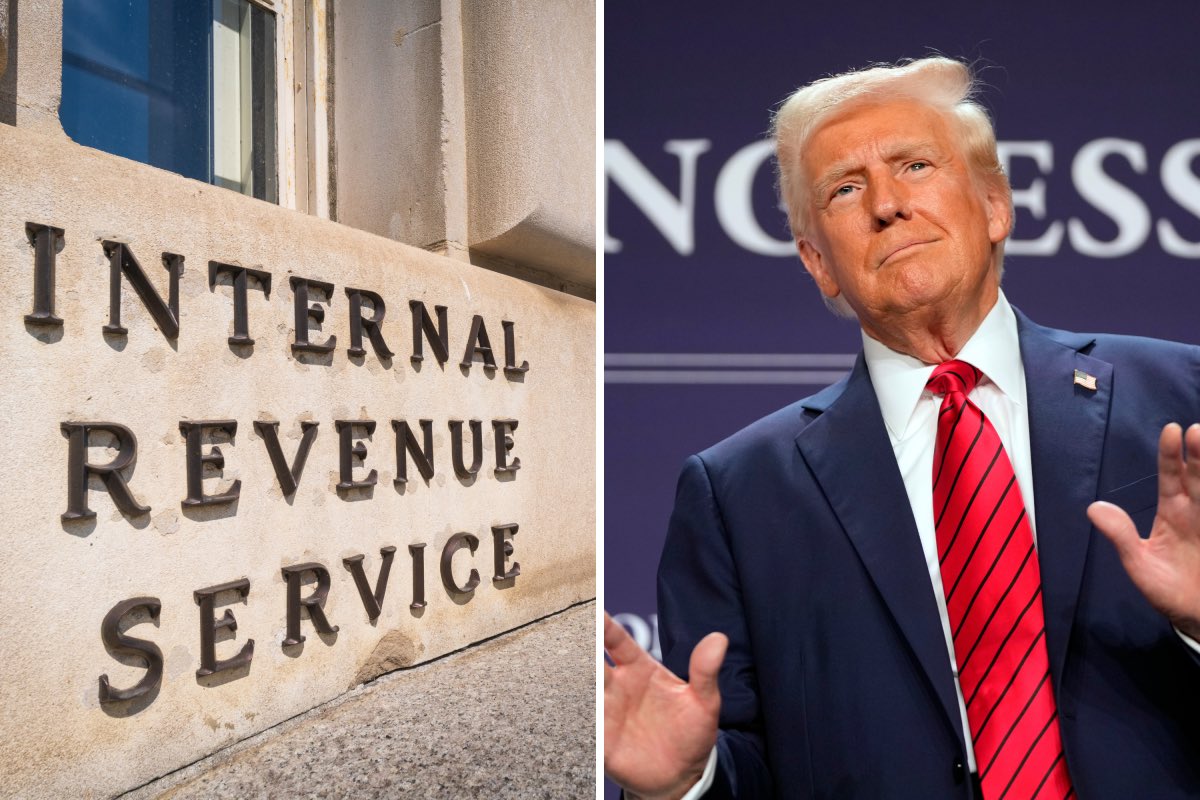

Federal Judge Rules on IRS Data Use to Track Illegal Immigrants: A Game Changer for Immigration Policy

In a groundbreaking development, a federal judge has ruled that President Donald trump is authorized to utilize IRS data to identify illegal immigrants in the United States. This decision is being hailed as a significant shift in immigration policy and enforcement strategies, prompting discussions across various sectors of society.

The Implications of the Ruling

The court’s ruling opens the door for the federal government to access sensitive financial information from the IRS to aid in tracking down individuals residing in the country illegally. This move has sparked a controversial debate regarding privacy rights, governmental authority, and the ethical considerations surrounding such data usage.

Supporters of the ruling argue that utilizing IRS data can enhance the government’s ability to enforce immigration laws effectively. They believe that having access to financial records will provide a clearer picture of illegal immigration patterns and potentially assist in the identification of undocumented individuals who may be engaging in fraudulent activities, such as tax evasion.

On the flip side, opponents of the ruling express serious concerns about privacy violations and the potential for abuse of power. Critics fear that this unprecedented access to personal financial information could lead to unjust targeting and profiling of individuals based solely on their immigration status. There are worries that such actions may disproportionately affect communities of color and marginalized groups.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump’s Immigration Agenda

This ruling aligns closely with President Trump’s broader immigration agenda, which has emphasized stricter enforcement measures and a crackdown on illegal immigration. The President has consistently advocated for policies aimed at reducing the number of undocumented immigrants in the U.S. and has employed various means to achieve these goals.

The authorization to use IRS data is being viewed as a vital tool in this effort. Trump supporters argue that this ruling could lead to more effective immigration enforcement, potentially deterring individuals from entering the country illegally in the first place. The ability to track down illegal immigrants through financial data may also help streamline the deportation process for those who are found to be in violation of immigration laws.

Legal Challenges Ahead

While the ruling has been framed as a victory for the Trump administration, it is not without its legal challenges. Civil rights organizations and advocacy groups are gearing up to contest the decision, arguing that the use of IRS data raises significant constitutional questions. They contend that this could set a dangerous precedent for government surveillance and the erosion of privacy rights.

These organizations are likely to argue that the government’s use of IRS data for immigration enforcement purposes violates individuals’ rights to due process and equal protection under the law. They may also highlight how such practices could lead to increased fear within immigrant communities, discouraging individuals from reporting crimes or seeking essential services.

Public Reaction and Media Coverage

The public reaction to this ruling has been mixed, with strong opinions on both sides of the debate. Social media platforms have become a battleground for discussions surrounding the implications of this decision. Supporters praise the ruling as a necessary step towards enforcing immigration laws, while opponents raise alarm bells about potential abuses and the impact on vulnerable populations.

Media coverage has also intensified following the announcement. news outlets are focusing not only on the implications of the ruling but also on the potential fallout it may have on the upcoming elections. Immigration policy is a critical issue for many voters, and this ruling could play a significant role in shaping public opinion and political discourse in the months to come.

The Future of Immigration Enforcement

As the implications of this ruling unfold, it remains to be seen how the Trump administration will implement these new powers. The use of IRS data for immigration enforcement could lead to a fundamental shift in how illegal immigration is addressed in the U.S. If effectively integrated into existing enforcement strategies, it could enhance the government’s ability to manage immigration issues more comprehensively.

However, the potential for legal challenges and public backlash underscores the need for careful consideration of ethical implications. Balancing effective immigration enforcement with respect for individual rights and privacy will be a significant challenge for policymakers moving forward.

Conclusion

The decision by a federal judge to allow President Trump to use IRS data to track down illegal immigrants represents a pivotal moment in the ongoing immigration debate in the United States. As this ruling sets the stage for potential changes in immigration enforcement strategies, it raises critical questions about privacy rights, governmental authority, and the ethical ramifications of using financial data for immigration purposes.

As the situation develops, stakeholders from various sectors, including legal experts, civil rights advocates, and political analysts, will be closely monitoring the effects of this ruling and its broader implications on immigration policy in the United States. The coming months will likely see heightened discussions and debates as the administration seeks to navigate the complexities of this landmark ruling.

#BREAKING: A federal judge has given President Trump the GREEN LIGHT to use IRS data to track down illegal immigrants

GAME CHANGER! pic.twitter.com/9Uy6oCvySF

— Nick Sortor (@nicksortor) May 12, 2025

BREAKING: A federal judge has given President Trump the GREEN LIGHT to use IRS data to track down illegal immigrants

In a major development, a federal judge has allowed President Trump to utilize IRS data in efforts to track down illegal immigrants. This ruling has sparked a wave of discussions and reactions across various platforms, especially on social media. As the news breaks, many are labeling this decision as a potential game-changer in the ongoing debates surrounding immigration policy and enforcement in the United States.

GAME CHANGER!

This ruling is not just a minor update; it could significantly alter the landscape of immigration enforcement. The use of IRS data means that the government may have access to a wealth of information regarding individuals who may be in the country illegally. This raises various questions about privacy, ethics, and the implications of such data usage. Are we entering a new era of immigration enforcement that relies heavily on financial records? Let’s dive deeper into what this means for the future.

The Legal Framework Behind the Decision

The decision to allow President Trump to access IRS data comes from a complex legal framework that balances privacy rights with the government’s need to enforce immigration laws. Historically, the IRS has maintained a level of confidentiality regarding taxpayer information. However, the ruling suggests that under certain circumstances, this data can be leveraged for law enforcement purposes, particularly in immigration cases.

Critics argue that using IRS data could violate privacy rights and could lead to racial profiling or unfair targeting of specific communities. On the other hand, proponents believe that having access to this information can enhance the government’s ability to enforce existing immigration laws effectively. The debate continues, and this ruling certainly adds fuel to the fire.

Reactions from Various Stakeholders

The reactions to this ruling have been mixed, with strong opinions on both sides of the aisle. Advocates for stricter immigration enforcement see this as a positive step towards better regulation and oversight. They argue that utilizing IRS data can help identify individuals who may be evading taxes while living and working in the U.S. illegally. This perspective emphasizes the need for accountability and adherence to the law.

Conversely, civil rights organizations and advocates for undocumented immigrants have expressed deep concerns. They argue that this ruling could lead to increased fear and distrust within immigrant communities, discouraging individuals from seeking necessary services or reporting crimes. The fear of being tracked down due to their financial records can create a chilling effect, further marginalizing already vulnerable populations.

The Implications for Immigrant Communities

With the new ruling, immigrant communities are understandably anxious about the potential fallout. Many individuals who may have been living quietly and contributing to society may now feel at risk. The decision raises questions about the future of trust between immigrant communities and government agencies. Will individuals be less likely to file taxes, or will they avoid seeking assistance for fear of being reported?

Moreover, the implications extend beyond just those who are undocumented. Legal immigrants and citizens may also feel the repercussions of increased scrutiny. The fear of being associated with someone who may be in the country illegally could lead to a more extensive chilling effect, where individuals hesitate to engage with government services or report issues for fear of being entangled in immigration enforcement.

The Broader Political Landscape

This ruling comes at a time when immigration is a hot-button issue in U.S. politics. With the upcoming elections, candidates on both sides are likely to leverage this decision to rally support or critique their opponents. The republican party may use it to showcase their commitment to strict immigration enforcement, while Democrats may focus on the potential human rights violations and the negative impact on immigrant communities.

The decision also reflects the broader sentiments in the country regarding immigration. As debates intensify, understanding the multifaceted perspectives surrounding this ruling becomes crucial. It’s not just about data; it’s about the lives and communities affected by these policies.

What’s Next?

As the dust settles from this ruling, the immediate questions revolve around implementation and potential challenges. Critics may seek legal avenues to challenge the decision, arguing that it infringes on privacy rights. Additionally, there will likely be discussions about the ethical implications of using financial data in immigration enforcement. How will this be monitored, and what safeguards will be put in place to prevent misuse?

Furthermore, the government will need to navigate the public relations aspect of this decision carefully. Engaging with communities and addressing concerns transparently will be essential to mitigate fears and rebuild trust. It’s crucial for the administration to provide clear information about how this data will be used and the protections in place for individuals.

Conclusion: A Shifting Paradigm

The ruling allowing President Trump to use IRS data to track down illegal immigrants marks a significant shift in the approach to immigration enforcement in the United States. It opens the door to new strategies but also raises essential questions about privacy, ethics, and community trust. As this story unfolds, it will be vital to stay informed and engaged with the implications of this decision on our society.

Ultimately, this is not just a legal issue; it’s a human issue that affects real lives. The conversations surrounding this ruling will shape the future of immigration policy, community relations, and the very fabric of our society. How we respond now will determine the path forward.

GAME CHANGER!