Fund Managers Miss Out on Stock Surge: A Deep Dive into Recent Market Trends

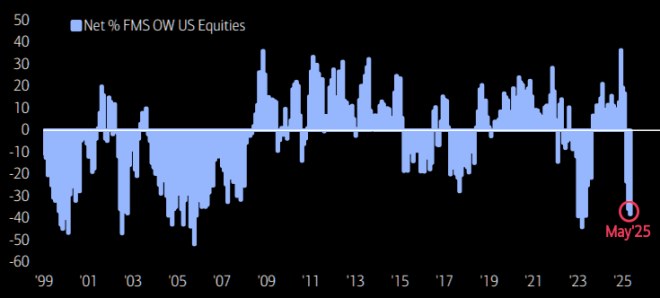

In a shocking twist, recent reports highlight that fund managers have significantly reduced their equity exposure to the lowest levels seen in the past two years. This strategic move comes just as stock prices are experiencing a notable surge, leaving many investors questioning the decisions made by these financial professionals.

Understanding the Current Market Landscape

The stock market has been on an upward trajectory, driven by various factors including strong corporate earnings, favorable economic indicators, and investor optimism. However, many fund managers seem to have missed this critical window of opportunity. According to a tweet from Barchart, fund managers are "Rekt!" after cutting back on their equity holdings, which has resulted in substantial missed gains during this stock surge.

This trend raises important questions about the strategies employed by fund managers and the impact of their decisions on investor portfolios. As the market fluctuates, understanding the rationale behind these choices becomes crucial for both individual and institutional investors.

The Implications of Reduced Equity Exposure

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Risk Aversion: One of the primary reasons fund managers might have opted to reduce their equity exposure is a heightened sense of risk aversion. Given the volatility in markets, many fund managers may have believed that pulling back could protect their portfolios from potential downturns.

- Market Timing Challenges: Timing the market is notoriously difficult, even for seasoned professionals. The recent surge in stock prices may have caught many fund managers off guard, leading them to make decisions that seemed prudent at the time but ultimately resulted in missed opportunities.

- Rebalancing Strategies: Fund managers often engage in rebalancing their portfolios to align with their investment strategies and risk tolerances. However, in the context of a rapidly rising market, this can lead to an undesirable outcome if equity exposure is overly reduced.

- Investor Sentiment: The shift in equity exposure among fund managers may also reflect broader investor sentiment. As confidence in the market fluctuates, fund managers must navigate these sentiments to make informed decisions. Unfortunately, their recent actions indicate a misalignment with the current market dynamics.

The Importance of Staying Informed

For individual investors, the news about fund managers reducing their equity exposure serves as a critical reminder of the importance of staying informed about market trends. Understanding the broader economic landscape and the behaviors of institutional investors can provide valuable insights into investment decisions.

- Diversification: One key takeaway from this situation is the importance of maintaining a diversified portfolio. While fund managers may have reduced their equity exposure, individual investors should consider their risk tolerance and investment goals when making similar decisions.

- Long-Term Perspective: Market fluctuations are inevitable. Maintaining a long-term investment perspective can help mitigate the impact of short-term volatility and ensure that investors are not swayed by temporary market movements.

- Continuous Learning: Keeping abreast of market trends, economic indicators, and the behaviors of institutional investors can empower individual investors to make more informed decisions. This knowledge can help investors identify potential opportunities and risks in the market.

Conclusion: Lessons Learned from Fund Managers

The recent actions of fund managers in reducing their equity exposure to the lowest levels in two years serve as a cautionary tale for both institutional and individual investors. As the stock market continues to surge, the decisions made by these professionals highlight the complexities and challenges of navigating financial markets.

Investors are reminded of the importance of remaining informed, diversifying their portfolios, and maintaining a long-term perspective. While fund managers may have missed out on this recent stock surge, individual investors have the opportunity to learn from these developments and adapt their strategies accordingly.

In a world where market conditions can change rapidly, staying educated and flexible in investment approaches will be crucial in capitalizing on potential gains and mitigating risks. The financial landscape is ever-evolving, and those who remain vigilant and informed will be better positioned to navigate the complexities of investing.

As we continue to monitor market trends and the actions of fund managers, it is essential to remember that investing is not just about timing the market—it’s about understanding it. The recent news serves as a reminder that even the most experienced professionals can make missteps, underscoring the need for continuous learning and adaptation in the world of finance.

BREAKING : Fund Managers

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years Rekt! pic.twitter.com/zagTDCM3Uy

— Barchart (@Barchart) May 13, 2025

BREAKING : Fund Managers

It’s no secret that the stock market can be a wild ride. Just when you think you have a handle on it, the unexpected happens. Recently, we’ve seen a significant stock surge, but there’s a twist: many fund managers have missed out on this opportunity after drastically reducing their equity exposure to its lowest levels in two years. It’s the kind of news that makes you raise an eyebrow and think, “Rekt!” This situation raises some serious questions about market timing, strategy, and the psychology of fund managers.

Fund Managers Have Missed Out on the Recent Stock Surge

Imagine sitting on the sidelines while the stock market is busy climbing heights you didn’t anticipate. That’s precisely the scenario for many fund managers right now. As noted in a recent tweet by [Barchart](https://twitter.com/Barchart/status/1922404791411429451?ref_src=twsrc%5Etfw), these managers made a strategic decision to reduce their equity exposure. But instead of safeguarding their portfolios, they have inadvertently positioned themselves to miss out on the recent stock surge.

When fund managers decide to pull back on their investments, it’s often rooted in caution. Economic uncertainty, geopolitical tensions, and fluctuating interest rates can all contribute to a more conservative approach. However, the current market conditions seem to be throwing a curveball. With the stock market climbing, those who hesitated to jump in are left watching from the sidelines, likely scrambling to recalibrate their strategies.

After Recently Reducing Their Equity Exposure

Reducing equity exposure is a common tactic used by fund managers when they sense a downturn or increased volatility in the market. However, this time, their caution may have been misplaced. The recent surge has left many wondering if they were too quick to make adjustments. This highlights a critical aspect of investing: timing is everything.

While it’s easy to critique fund managers for their decisions, it’s essential to recognize the complexities they face. They’re not just reacting to market trends; they’re also trying to balance risk and return for their investors. But as we see now, their conservative strategies have seemingly backfired. The question now is whether they will stick to their guns or pivot in light of the recent surge.

To the Lowest Levels in 2 Years

The decision to reduce equity exposure to its lowest level in two years is a bold move that can signify various underlying factors. For one, it reflects a more cautious outlook on market conditions. Fund managers might have been reacting to macroeconomic indicators, corporate earnings reports, or even global events that hinted at potential instability.

But here’s the kicker: when the market defies expectations and rises, those who’ve taken a defensive stance may find themselves at a disadvantage. The fact that this equity exposure is at its lowest in two years means that fund managers are potentially missing out on significant gains. It’s a classic case of risk management gone awry.

Rekt!

The phrase “Rekt!” perfectly encapsulates the sentiment many are feeling regarding this situation. It’s shorthand for “wrecked,” and it’s often used in the trading community to describe the pain of missing out or making poor decisions. Fund managers are likely feeling a version of this right now.

What does it mean for them going forward? Well, they face a tough choice: do they double down on their conservative strategies, or do they take a leap of faith and re-enter the market? The latter can be particularly tricky; re-entering after a surge often feels like chasing a moving train.

Investors and analysts alike will be watching closely to see how these fund managers respond. Many will be assessing performance metrics and trying to figure out if this was merely a blip or the start of a sustained upward trend.

Understanding Market Trends and Psychology

To truly grasp why fund managers make these decisions, it’s essential to understand market psychology. Investors, including fund managers, often react emotionally to market movements. Fear and greed are two powerful motivators that can dictate buying and selling behaviors.

When markets are volatile, fear can prompt fund managers to pull back, thinking it’s the safest option. However, in a rising market, the emotion of greed can push them to jump back in, even if it means buying at higher prices. This emotional rollercoaster can lead to a cycle of buying high and selling low, often resulting in “rekt” scenarios.

If you’ve ever felt the urge to check your stock portfolio multiple times a day during a bull run, you know what I’m talking about. Fund managers experience this too, but on a much larger scale, with millions of dollars at stake.

The Implications for Future Strategies

So, what does this recent development mean for the future strategies of fund managers? One thing’s for sure: they’ll likely be re-evaluating their approaches. The stock surge serves as a reminder that markets can be unpredictable.

Fund managers may consider employing a more balanced approach moving forward, blending conservative and aggressive strategies. This could involve maintaining a core position in equities while also investing in sectors that show promise or resilience. The goal will be to capture upward momentum without exposing themselves to excessive risk.

Additionally, many fund managers will likely enhance their market analysis techniques. Using advanced data analytics and AI tools can help them better gauge market sentiment and make more informed decisions.

What Can Individual Investors Learn?

If you’re an individual investor, there’s plenty to glean from the current situation of fund managers. First and foremost, it’s a reminder of the importance of staying informed and adaptable. The market is fluid, and being overly cautious can sometimes lead to missed opportunities.

Moreover, it emphasizes the value of diversification. By spreading investments across various asset classes, you can mitigate risk while still enjoying the benefits of market upswings.

Finally, emotional discipline is key. Markets will always have their ups and downs, and reacting impulsively can lead to poor decision-making. Instead of letting fear or greed dictate your investments, focus on a well-researched strategy that aligns with your long-term goals.

Final Thoughts

The recent surge in the stock market has left many fund managers feeling “rekt” as they grapple with the ramifications of their decisions. Their reduced equity exposure has positioned them at a disadvantage during this upward trend, and it raises critical questions about market timing and strategy.

Investors, both large and small, can learn valuable lessons from this scenario. It’s essential to remain adaptable, informed, and disciplined in the ever-changing landscape of the stock market. The next surge may be just around the corner, and being prepared could mean the difference between participating or missing out.

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years Rekt!