Understanding the Tax Portions of the One, Big, Beautiful Bill

In recent discussions around the One, Big, Beautiful Bill, a significant focus has been placed on its tax implications and how these changes are designed to prioritize American workers. This summary delves into the key aspects of the tax portions of the bill, highlighting its potential impact on the workforce, the economy, and the overall financial landscape for American citizens.

The Foundation of the Bill

The One, Big, Beautiful Bill represents a comprehensive legislative effort aimed at overhauling various aspects of American socioeconomic policy. A central tenet of this bill is its commitment to putting American workers first. The proposed tax reforms are designed to support job creation, stimulate economic growth, and ensure that the benefits of a thriving economy are felt by all citizens.

Key Tax Provisions

The tax portions of the bill introduce several crucial provisions that aim to benefit American workers directly:

1. Tax Credits for Workers

One of the most significant elements of this legislation is the expansion of tax credits aimed at low- and middle-income workers. By increasing the Earned Income Tax Credit (EITC) and introducing new credits for specific sectors, the bill seeks to provide financial relief and incentivize workforce participation. This enhancement is expected to lift many families out of poverty, contributing to a more robust middle class.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

2. Corporate Tax Reform

The bill also addresses corporate taxation, proposing adjustments designed to discourage offshoring and promote domestic investment. By adjusting corporate tax rates and introducing incentives for companies that invest in American jobs, the legislation aims to create a more favorable environment for businesses to thrive while keeping jobs within the country. This shift is expected to encourage companies to reinvest in their operations and workforce, ultimately benefiting American workers.

3. Wealth Tax Considerations

Another critical aspect of the bill is the proposal for a wealth tax on the ultra-wealthy. This tax aims to address income inequality by ensuring that the wealthiest Americans contribute a fairer share to the nation’s revenue. The funds generated from this tax could be redirected towards social programs, education, and infrastructure improvements, which would, in turn, create more opportunities for the workforce.

Economic Implications

The proposed tax reforms are not just about raising revenue; they are a strategic approach to stimulate economic growth. By prioritizing workers, the bill aims to achieve a more equitable distribution of wealth, which is crucial for sustainable economic development.

Job Creation

The emphasis on tax credits and corporate incentives is expected to lead to increased job creation. When workers have more disposable income due to tax credits, they are likely to spend more, driving demand for goods and services. This demand can, in turn, prompt businesses to hire more employees, creating a positive feedback loop that benefits the economy as a whole.

Strengthening the Middle Class

The bill’s focus on supporting low- and middle-income workers is particularly significant in today’s economic climate, where income inequality has become a pressing issue. By providing tax relief and incentives for these demographics, the One, Big, Beautiful Bill aims to strengthen the middle class, which is often seen as the backbone of the American economy.

Social Programs and Infrastructure

The tax revenues generated from the proposed reforms are intended to fund various social programs that directly benefit American workers. This includes investments in education, healthcare, and infrastructure. By improving access to quality education and healthcare, the bill aims to enhance the overall productivity of the workforce, leading to long-term economic benefits.

Education and Workforce Development

Investing in education is paramount for preparing the American workforce for the jobs of the future. The bill outlines plans for increased funding for vocational training and higher education. By equipping workers with the necessary skills, the legislation seeks to address the skills gap that many industries face today. This focus on education is expected to lead to a more competent and competitive workforce.

Infrastructure Investments

Improving infrastructure is another critical area addressed by the bill. By allocating funds for transportation, broadband, and renewable energy projects, the legislation aims to create jobs while enhancing the quality of life for American workers. Improved infrastructure can lead to increased efficiency for businesses and better access to employment opportunities for individuals.

Conclusion

The tax portions of the One, Big, Beautiful Bill represent a transformative approach to American economic policy, with a clear focus on prioritizing workers. By expanding tax credits, reforming corporate taxes, and introducing a wealth tax, the legislation aims to create a fairer economic landscape that benefits all citizens.

Through its emphasis on job creation, support for the middle class, and investments in social programs and infrastructure, the bill seeks to address the pressing issues of income inequality and workforce development. As discussions continue, it is essential for American citizens to stay informed about these changes, as they hold the potential to reshape the economic future of the nation for generations to come.

In conclusion, the One, Big, Beautiful Bill’s tax reforms are not just a series of adjustments to the tax code; they represent a commitment to building an economy that works for everyone. By putting American workers first, this legislation could pave the way for a more equitable and prosperous future. For more insights and updates, follow the conversation surrounding the bill on platforms like Twitter, where discussions continue to unfold.

Learn more about the tax portions of the One, Big, Beautiful Bill.

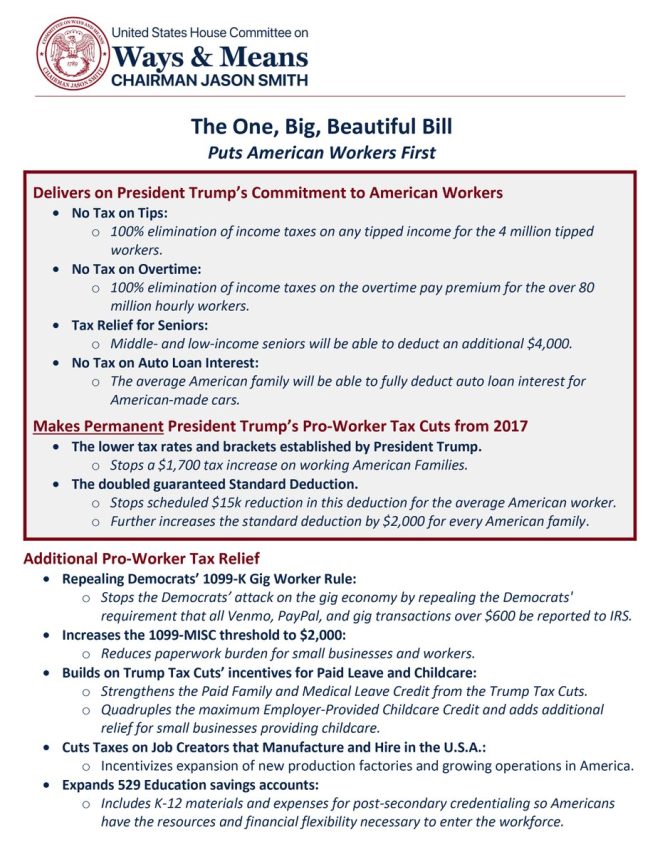

PUTS AMERICAN WORKERS FIRST… pic.twitter.com/8AdNW7zjnD

— Rapid Response 47 (@RapidResponse47) May 12, 2025

Learn more about the tax portions of the One, Big, Beautiful Bill.

PUTS AMERICAN WORKERS FIRST… pic.twitter.com/8AdNW7zjnD

— Rapid Response 47 (@RapidResponse47) May 12, 2025

Understanding the Tax Portions of the One, Big, Beautiful Bill

When it comes to legislation that impacts our wallets, understanding the tax portions of the One, Big, Beautiful Bill is crucial. This bill has generated a lot of buzz, and for good reason! It promises to put American workers first, which is a sentiment that resonates with many of us. But what exactly does that mean, and how do the tax provisions affect you? Let’s dive into the details.

What is the One, Big, Beautiful Bill?

The One, Big, Beautiful Bill is a comprehensive piece of legislation that addresses various economic and social issues facing Americans today. Introduced with the intent to prioritize the needs of American workers, this bill encompasses a range of policies designed to enhance job security, increase wages, and provide better benefits. The tax portions of this bill are particularly significant, as they aim to reshape the financial landscape for individuals and businesses alike.

Learn More About the Tax Portions

If you’re curious about how the tax provisions work, you’re not alone! The tax portions of the One, Big, Beautiful Bill are designed to provide relief to working families while ensuring that corporations contribute their fair share. This balance is crucial for building a sustainable economy that benefits everyone.

The bill proposes several key tax reforms, including increased tax credits for low- and middle-income families, changes to corporate tax rates, and new incentives for businesses that invest in their workforce. These measures are intended to not only support American workers but also stimulate economic growth.

PUTS AMERICAN WORKERS FIRST…

At the heart of this legislation is the commitment to put American workers first. This isn’t just a slogan; it’s a guiding principle that shapes the entire bill. By focusing on the needs of workers, lawmakers aim to create a more equitable economy.

The tax reforms included in the bill reflect this commitment. For instance, the proposed tax credits are meant to alleviate financial burdens on families, making it easier for them to afford essential expenses like housing, healthcare, and education. By investing in the well-being of American workers, the bill seeks to foster a more prosperous future for everyone.

Key Tax Provisions You Should Know

Let’s break down some of the key tax provisions in the One, Big, Beautiful Bill that you should be aware of:

1. **Increased Child Tax Credit**: Families with children will benefit from a more substantial child tax credit, which can significantly reduce tax liability and provide much-needed financial support.

2. **Expanded Earned Income Tax Credit (EITC)**: The EITC is designed to help low- and moderate-income workers. The expansion of this credit means more money in the pockets of those who need it most.

3. **Corporate Tax Rate Adjustments**: To ensure that large corporations pay their fair share, the bill proposes adjustments to corporate tax rates. This move aims to level the playing field for small businesses and promote fair competition.

4. **Investment Incentives for Businesses**: Companies that invest in their workforce, such as through training programs or improved benefits, may receive tax incentives. This encourages businesses to prioritize their employees’ growth and development.

5. **Healthcare Tax Credits**: The legislation also includes provisions for healthcare tax credits, making it easier for individuals and families to afford health insurance. This is particularly important in today’s economy, where healthcare costs can be a significant burden.

The Impact on American Families

So, how do these tax provisions affect American families? The answer is straightforward: they can lead to a better quality of life. By increasing tax credits and providing financial support, the One, Big, Beautiful Bill aims to alleviate some of the economic pressures that many families face.

Imagine being able to afford quality childcare, access to healthcare, or even a little extra savings for vacations or emergencies. These reforms can make a significant difference in the day-to-day lives of ordinary Americans, allowing them to focus on what truly matters—spending time with family, pursuing education, and enjoying life.

Supporting Small Businesses

Small businesses are the backbone of the American economy, and the One, Big, Beautiful Bill recognizes their importance. By providing tax incentives for businesses that invest in their workforce, the bill encourages small business owners to prioritize their employees. This is a win-win situation: employees benefit from better wages and benefits, and businesses benefit from a more motivated and productive workforce.

Moreover, the adjustments to corporate tax rates aim to create a fairer playing field. This means that small businesses can compete more effectively against larger corporations, fostering innovation and growth in local communities.

Why This Matters to You

You might be wondering, “How does this legislation impact me directly?” The answer lies in the details. If you’re a working American, the changes in tax credits and incentives could lead to more disposable income. That’s money you can use for your family, your home, or even that much-needed vacation you’ve been dreaming about.

Moreover, if you’re a small business owner, the new tax provisions can provide opportunities for growth and investment. By understanding how these changes affect you, you can make informed decisions about your finances and future.

Staying Informed

It’s essential to stay informed about the One, Big, Beautiful Bill and its tax portions. Following reliable news sources, such as [Reuters](https://www.reuters.com/) or [NPR](https://www.npr.org/), can help you keep up with the latest developments. Understanding how legislation affects your financial situation is crucial in today’s ever-changing economic landscape.

Additionally, consider reaching out to financial advisors or tax professionals who can help you navigate these changes. They can provide personalized insights and strategies to maximize your benefits from the new tax provisions.

Engaging with Your Community

Lastly, don’t forget the power of community engagement. Discussing how the One, Big, Beautiful Bill affects your community with friends, family, and local leaders can lead to fruitful conversations about how to best utilize the benefits provided. Together, you can advocate for policies that support American workers and push for improvements that benefit everyone.

The One, Big, Beautiful Bill aims to reshape the economic landscape for American workers, and understanding its tax portions is the first step in maximizing its benefits. Whether you’re a worker or a business owner, the changes proposed in this bill could significantly impact your financial future. So, stay informed, engage with your community, and make the most of the opportunities that come your way!

Breaking News, Cause of death, Obituary, Today