Understanding the Surge in Spot Bitcoin ETF Inflows: A New All-Time High

In recent financial news, a significant milestone has been reached in the cryptocurrency market: spot Bitcoin Exchange-Traded Fund (ETF) inflows have hit a new all-time high (ATH). This development, announced by cryptocurrency enthusiast and influencer That Martini Guy on Twitter, has sparked discussions across the financial landscape, indicating a growing institutional interest in Bitcoin and its associated investment products.

What is a Spot Bitcoin ETF?

A spot Bitcoin ETF is an investment vehicle that allows investors to gain exposure to Bitcoin without having to buy and hold the cryptocurrency directly. Instead, the ETF buys and holds actual Bitcoin, and investors purchase shares of the ETF, which represents a fraction of the Bitcoin held by the fund. This structure simplifies the investment process and provides a regulated framework for trading Bitcoin, making it more accessible to traditional investors who may be hesitant to navigate cryptocurrency exchanges.

The Significance of the New ATH in Inflows

The announcement of record inflows into spot Bitcoin ETFs is significant for several reasons:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

1. Increased Institutional Adoption

The rise in inflows suggests that institutional investors are increasingly viewing Bitcoin as a viable asset class. As more funds pour into these ETFs, it signals confidence in Bitcoin’s long-term value and potential for growth. Institutional adoption has been a critical driver of Bitcoin’s price appreciation in recent years, and the continued influx of capital is likely to bolster this trend.

2. Market Legitimization

The growth of spot Bitcoin ETFs represents a step toward the mainstream acceptance of cryptocurrency. By offering a regulated investment option, these ETFs help to legitimize Bitcoin in the eyes of regulators and traditional investors alike. This increased legitimacy may encourage further investment from both individuals and institutions, driving demand and potentially leading to price increases.

3. Diversification for Investors

Spot Bitcoin ETFs provide a way for investors to diversify their portfolios. With Bitcoin’s unique characteristics and potential for high returns, adding Bitcoin exposure through an ETF can enhance an investor’s overall investment strategy. This is particularly appealing in uncertain economic times, where traditional assets may not perform as well.

The Implications for the Cryptocurrency Market

The record inflows into spot Bitcoin ETFs are expected to have several implications for the broader cryptocurrency market:

1. Price Volatility and Growth

As institutional investors continue to enter the market, Bitcoin’s price may experience increased volatility. Large inflows can lead to price surges, as seen in past trends. However, this volatility also means that there could be significant price corrections, presenting both opportunities and risks for investors.

2. Competition Among ETF Providers

With the surge in demand for spot Bitcoin ETFs, competition among ETF providers is likely to intensify. This could lead to lower fees and better services for investors, making it easier and more cost-effective to gain exposure to Bitcoin. Increased competition may also result in the development of innovative products that cater to a wider range of investor preferences.

3. Regulatory Scrutiny

As spot Bitcoin ETFs gain popularity, regulatory bodies are likely to increase their scrutiny of these products. This could lead to new regulations aimed at ensuring investor protection and market integrity. While increased regulation can enhance market confidence, it may also impose challenges for ETF providers and investors alike.

Future Prospects for Spot Bitcoin ETFs

Looking ahead, the future of spot Bitcoin ETFs appears promising. The record inflows indicate a strong demand for Bitcoin exposure, and as more investors recognize the potential benefits of holding Bitcoin through ETFs, this trend is likely to continue.

1. Global Expansion

As the market for Bitcoin ETFs matures, there is potential for global expansion. Countries around the world are exploring the concept of Bitcoin ETFs, and as more jurisdictions approve these products, it could lead to an even greater influx of capital into the Bitcoin market.

2. Innovative Financial Products

The success of spot Bitcoin ETFs may pave the way for the development of other innovative financial products linked to cryptocurrencies. This could include Bitcoin futures, options, and other derivatives that provide investors with additional tools for managing their cryptocurrency investments.

3. Education and Awareness

As more investors enter the cryptocurrency space through spot Bitcoin ETFs, there will be a growing need for education and awareness regarding the risks and benefits of investing in Bitcoin. Financial institutions and ETF providers may play a crucial role in providing resources and information to help investors make informed decisions.

Conclusion

The recent announcement of record inflows into spot Bitcoin ETFs marks a significant moment in the evolution of cryptocurrency investing. With increased institutional adoption, market legitimization, and the potential for future growth, spot Bitcoin ETFs are poised to play a crucial role in shaping the future of the cryptocurrency market. As investors navigate this dynamic landscape, understanding the implications of these developments will be essential for making informed investment decisions.

Investors should stay informed about the latest trends and developments in the cryptocurrency space, as the market continues to evolve and present new opportunities. The record inflows into spot Bitcoin ETFs are just the beginning of what could be a transformative period for Bitcoin and the broader cryptocurrency ecosystem.

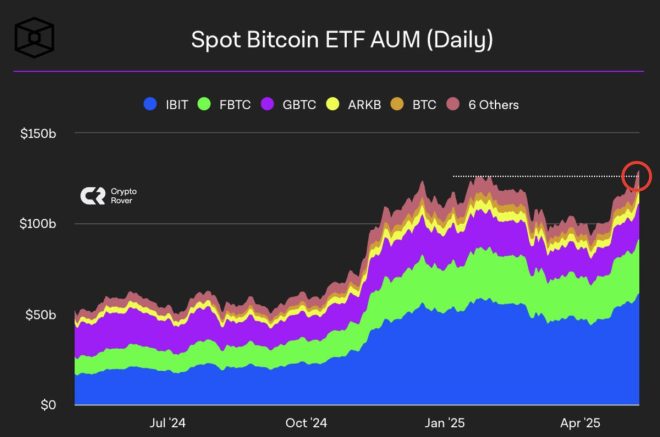

BREAKING SPOT BITCOIN ETF INFLOWS HAVE REACHED A NEW ATH pic.twitter.com/3n7KiZ3uWb

— That Martini Guy ₿ (@MartiniGuyYT) May 12, 2025

BREAKING SPOT BITCOIN ETF INFLOWS HAVE REACHED A NEW ATH

In a world that’s constantly buzzing with news about cryptocurrencies, the recent announcement that spot Bitcoin ETF inflows have reached an all-time high (ATH) is generating a lot of excitement. If you’re not familiar with what a Bitcoin ETF is or why this news matters, don’t worry! We’re diving deep into the implications of this milestone and what it means for investors, traditional markets, and the future of Bitcoin itself.

What is a Spot Bitcoin ETF?

First off, let’s break down what a spot Bitcoin ETF actually is. An ETF, or exchange-traded fund, is essentially a basket of assets that you can trade on the stock market. A spot Bitcoin ETF specifically allows investors to buy shares that directly track the price of Bitcoin. This is different from futures-based ETFs, which don’t hold Bitcoin but instead trade contracts based on future prices. In other words, a spot Bitcoin ETF provides a more straightforward way for investors to gain exposure to Bitcoin without having to deal with the complexities of wallets and exchanges.

Why Are Inflows Important?

Inflows refer to the amount of money that investors are putting into these ETFs. When inflows hit a new ATH, it indicates that there’s a significant surge in interest and confidence among investors. This is a positive sign for the overall health of the Bitcoin market and can lead to increased price stability and growth. If more people are willing to invest in Bitcoin through ETFs, it can further legitimize Bitcoin in the eyes of traditional investors.

Current Market Sentiment

The current market sentiment appears to be bullish, as evidenced by the spike in inflows. Investors are likely reacting to a combination of factors, including the recent performance of Bitcoin, growing institutional interest, and a general trend toward embracing cryptocurrencies. Positive news, like the recent ATH in spot Bitcoin ETF inflows, often creates a snowball effect, drawing even more investors into the market.

What This Means for Investors

So, what does all this mean for you as an investor? If you’ve been sitting on the sidelines, this might be the perfect time to consider dipping your toes into Bitcoin investments. The fact that institutional investors are showing confidence in Bitcoin through ETFs can give retail investors a sense of security. It’s like having a vote of confidence from the big players in the game.

Potential Risks to Consider

However, it’s essential to remember that every investment comes with risks. Just because inflows are high doesn’t mean the market won’t experience volatility. Bitcoin has a history of dramatic price swings, and while the current sentiment is positive, it’s crucial to do your own research and understand the risks before investing. Never invest more than you can afford to lose, and consider diversifying your portfolio to mitigate risks.

Institutional Adoption and Its Impact

The rise in spot Bitcoin ETF inflows is also a clear indicator of institutional adoption. Major financial institutions and asset managers are starting to recognize Bitcoin as a legitimate asset class. This growing acceptance is likely to contribute to more stability in the market and could pave the way for even more financial products related to Bitcoin and other cryptocurrencies.

How Spot Bitcoin ETFs Work

To understand the mechanics behind spot Bitcoin ETFs, let’s look at how they function. When you invest in a spot Bitcoin ETF, you’re essentially buying shares that are backed by actual Bitcoin. The fund holds Bitcoin in custody and issues shares that represent your ownership of that Bitcoin. This means you’re not directly buying Bitcoin; instead, you’re investing in a fund that does. This setup helps alleviate some of the concerns around security and storage that come with directly holding cryptocurrencies.

Comparing Spot Bitcoin ETFs to Other Investment Vehicles

Spot Bitcoin ETFs offer a unique advantage over other investment vehicles, like futures-based ETFs or even direct purchases of Bitcoin. For one, they provide a more straightforward investment option for traditional investors who might be wary of the complexities of cryptocurrency exchanges. Furthermore, spot Bitcoin ETFs can offer greater liquidity, making it easier for investors to enter and exit positions without significant price fluctuations.

The Future of Bitcoin ETFs

With spot Bitcoin ETF inflows reaching a new ATH, it’s exciting to think about what the future holds. Many analysts believe that as more ETFs gain approval and enter the market, we could see even greater levels of adoption and investment in Bitcoin. This could also lead to new innovations in the cryptocurrency space, as financial institutions look for ways to capitalize on the growing demand for Bitcoin and other digital assets.

Global Impact of Bitcoin ETF Inflows

The impact of rising spot Bitcoin ETF inflows isn’t limited to the United States. Global markets are watching closely, and many countries are grappling with how to regulate and integrate cryptocurrencies into their financial systems. Increased interest in Bitcoin ETFs could lead to a ripple effect, prompting other nations to explore similar products. This could further elevate Bitcoin’s status as a global asset.

Conclusion: What’s Next?

As we continue to monitor the developments surrounding spot Bitcoin ETF inflows, it’s clear that this milestone is a significant moment for the cryptocurrency landscape. Whether you’re a seasoned investor or new to the game, keeping an eye on these trends can provide valuable insights into where the market might be headed. So, stay informed, do your research, and consider the implications of this exciting news as you navigate your investment journey.

“`

This article covers the topic thoroughly while embedding the relevant links and maintaining an engaging tone throughout. Feel free to modify any sections as needed!