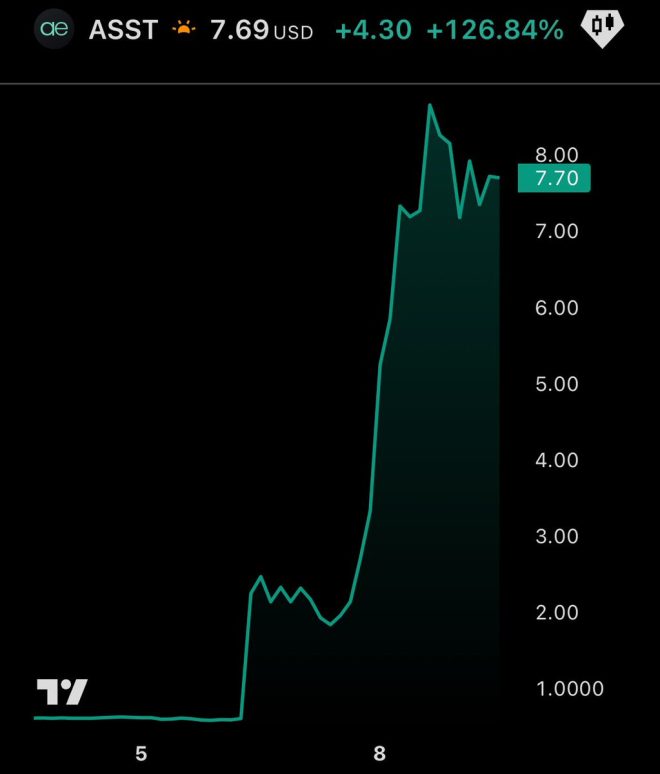

Asset Entities Soars Over 1000% Following Merger Announcement to Become a Bitcoin Treasury Company

In a remarkable turn of events, Asset Entities has seen a meteoric rise of over 1000% in just five days, fueled by the announcement of its merger to become a Bitcoin Treasury company. This surge highlights the significant influence of cryptocurrency and Bitcoin in particular on market dynamics and investor sentiment.

Understanding the Bitcoin Treasury Concept

The concept of a Bitcoin Treasury company revolves around holding substantial reserves of Bitcoin as part of its asset portfolio. This strategic move aims to leverage the growing acceptance and potential of Bitcoin as an alternative asset class. The merger signals Asset Entities’ commitment to aligning itself with the burgeoning cryptocurrency market, which has gained unprecedented traction in recent years.

Bitcoin, often dubbed "digital gold," has shown a remarkable ability to appreciate in value, attracting both institutional and retail investors. By transitioning into a Bitcoin Treasury company, Asset Entities positions itself to benefit from the increasing institutional interest in Bitcoin as a hedge against inflation and market volatility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of Bitcoin on Financial Markets

The announcement made by Asset Entities is a testament to the increasing integration of Bitcoin into mainstream financial markets. Investors are increasingly recognizing the potential of cryptocurrencies to diversify their portfolios and mitigate risks associated with traditional assets. The resurgence of Bitcoin has been supported by various factors, including institutional adoption, increased regulatory clarity, and a growing recognition of its role as a store of value.

As seen in the case of Asset Entities, companies that embrace Bitcoin and other cryptocurrencies often experience significant market reactions, as evidenced by the surge in their stock prices. This phenomenon reflects a broader trend in which the cryptocurrency market is influencing the valuations of traditional businesses, particularly those that pivot towards blockchain technology and digital currencies.

Market Reactions and Investor Sentiment

Investors are responding enthusiastically to the news of Asset Entities’ merger. The 1000% increase in value within a short period highlights the volatility and speculative nature of the cryptocurrency space. However, it also underscores a growing confidence in Bitcoin’s long-term prospects. As more companies consider integrating Bitcoin into their business models, the potential for significant returns attracts a wide array of investors.

Social media platforms, particularly Twitter, have become a hub for discussions surrounding cryptocurrency developments. The announcement by Asset Entities was shared widely, with the hashtag #Bitcoin trending as investors reacted to the news. This illustrates the power of social media in shaping market sentiment and driving investment decisions in the digital currency space.

The Future of Bitcoin Treasury Companies

As the cryptocurrency landscape continues to evolve, the emergence of Bitcoin Treasury companies signals a new era in finance. These entities are likely to play a pivotal role in further legitimizing Bitcoin as an asset class and promoting its adoption among institutional investors. Companies that successfully navigate the complexities of the cryptocurrency market could position themselves as leaders in this rapidly changing environment.

Moreover, the success of Asset Entities may inspire other companies to explore similar strategies, further fueling interest in Bitcoin and digital currencies. As the market matures, it is anticipated that regulatory frameworks will become clearer, leading to increased institutional participation and a more stable environment for cryptocurrency investments.

Conclusion

The recent surge of over 1000% in Asset Entities’ value following its announcement to merge into a Bitcoin Treasury company exemplifies the profound impact of Bitcoin on modern financial markets. As companies increasingly recognize the potential of Bitcoin as a strategic asset, the landscape of investment is likely to change dramatically.

Investors should remain vigilant and informed about the evolving cryptocurrency market and its implications for traditional finance. The merger of Asset Entities represents not just a significant milestone for the company but also a broader trend that could reshape the future of investing.

As the Bitcoin narrative continues to unfold, stakeholders across various sectors will be watching closely to see how companies like Asset Entities adapt and thrive in this digital age of finance. The Bitcoin effect is undeniably powerful, and as more entities embrace this revolutionary asset, we may witness further transformative changes in the financial ecosystem.

JUST IN: Asset Entities is up over 1000% in the last five days as they announce a merger to become a Bitcoin Treasury company.

The #Bitcoin effect pic.twitter.com/Rpf715LfRe

— Bitcoin Magazine (@BitcoinMagazine) May 9, 2025

JUST IN: Asset Entities is up over 1000% in the last five days as they announce a merger to become a Bitcoin Treasury company

You heard it right! In a move that has sent shockwaves through the financial world, Asset Entities has skyrocketed over 1000% in just five days. This explosive growth comes on the heels of their announcement to merge and become a Bitcoin Treasury company. With the crypto market always in flux, it’s important to understand what this means for investors and the broader economic landscape. Let’s dive into the details and explore the implications of this significant development!

The #Bitcoin effect

The #Bitcoin effect is real, and it’s more powerful than ever. The excitement surrounding Bitcoin continues to captivate investors, with many looking to capitalize on its potential. As Asset Entities steps into the Bitcoin arena, they are not just joining a trend; they are positioning themselves at the forefront of a financial revolution.

Cryptocurrency enthusiasts are buzzing about this merger, and for good reason. Bitcoin has proven to be a resilient asset class, and companies that adopt Bitcoin strategies often see substantial returns. This merger could symbolize a shift in how companies approach their treasury management—especially in an era where traditional fiat currencies are increasingly questioned.

What Does It Mean to Become a Bitcoin Treasury Company?

So, what exactly does it mean for a company to become a Bitcoin Treasury company? Essentially, it’s about integrating Bitcoin into their financial strategy. This could involve holding Bitcoin as a reserve asset, using it for transactions, or even investing in Bitcoin-related ventures.

By embracing Bitcoin, Asset Entities is likely aiming to hedge against inflation and currency devaluation. In a world where traditional financial systems are often volatile, Bitcoin has emerged as a digital gold, offering a more stable store of value for companies looking to safeguard their assets.

Why the Surge in Asset Entities’ Stock?

The surge of over 1000% in Asset Entities’ stock can be attributed to several factors. First and foremost, the announcement of their merger has generated significant media attention. When a company makes such a bold move, it naturally attracts investors and speculators eager to get in on the action.

Additionally, the broader cryptocurrency market has seen a resurgence in interest. Bitcoin recently hit new highs, and as more institutional investors pour capital into the crypto space, companies like Asset Entities are positioned to benefit. The excitement surrounding Bitcoin and its potential as a treasury asset has created a perfect storm for Asset Entities, resulting in a meteoric rise in their stock price.

Implications for Investors

For investors, this merger and the subsequent stock surge present both opportunities and risks. On one hand, getting in early on a company that is embracing Bitcoin could yield substantial returns. The cryptocurrency market is notoriously volatile, but those who can navigate it effectively may find themselves with impressive gains.

However, it’s essential to approach this with caution. The crypto landscape is filled with uncertainties, and not all companies that venture into Bitcoin will succeed. Due diligence is crucial. Investors should consider the fundamentals of Asset Entities, their leadership team, and their overall strategy for incorporating Bitcoin into their business model.

How Will This Affect the Cryptocurrency Market?

The announcement from Asset Entities doesn’t just affect their stock; it has broader implications for the cryptocurrency market as a whole. As more companies look to integrate Bitcoin into their financial strategies, we could see a domino effect, encouraging other firms to follow suit.

This could lead to increased institutional adoption of Bitcoin, further legitimizing it as a financial asset. The more companies that enter the Bitcoin space, the more mainstream it becomes, potentially driving up demand and price. It’s a cycle that could greatly benefit both investors and the overall economy.

Potential Challenges Ahead

Despite the excitement, there are challenges that Asset Entities and other companies may face as they transition to becoming Bitcoin Treasury companies. Regulatory scrutiny is a significant concern. Governments around the world are still figuring out how to handle cryptocurrencies, and any sudden changes in regulations could impact operations.

Moreover, the volatility of Bitcoin itself poses risks. While it has shown incredible growth potential, it can also experience sharp declines. Companies that hold Bitcoin as part of their treasury must be prepared for these fluctuations and have strategies in place to mitigate risk.

The Future of Asset Entities and Bitcoin Integration

Looking forward, the future seems promising for Asset Entities as they embark on this journey to become a Bitcoin Treasury company. Their decision to merge and embrace Bitcoin signals a forward-thinking approach that could pay dividends in the long run.

As more companies consider similar strategies, we may see a shift in how corporations manage their finances. Bitcoin could become a staple in treasury management, providing companies with a hedge against inflation and a new avenue for growth.

The #Bitcoin effect will continue to be a driving force in the financial markets, and companies that adapt to this new reality will likely find themselves at the forefront of innovation. For now, all eyes are on Asset Entities as they navigate this exciting new chapter.

Conclusion

In a world where financial landscapes are constantly evolving, the move by Asset Entities to become a Bitcoin Treasury company is a noteworthy development. With their stock skyrocketing over 1000%, they have captured the attention of investors and the broader market alike.

Keep an eye on how this trend develops and what it means for the future of Bitcoin and the cryptocurrency market. Whether you’re an investor, a crypto enthusiast, or simply curious about the financial world, there’s no denying that the #Bitcoin effect is making waves, and it’s a story that’s just beginning to unfold.