Missouri’s Historic Move: The Removal of Capital Gains Tax on Crypto and More

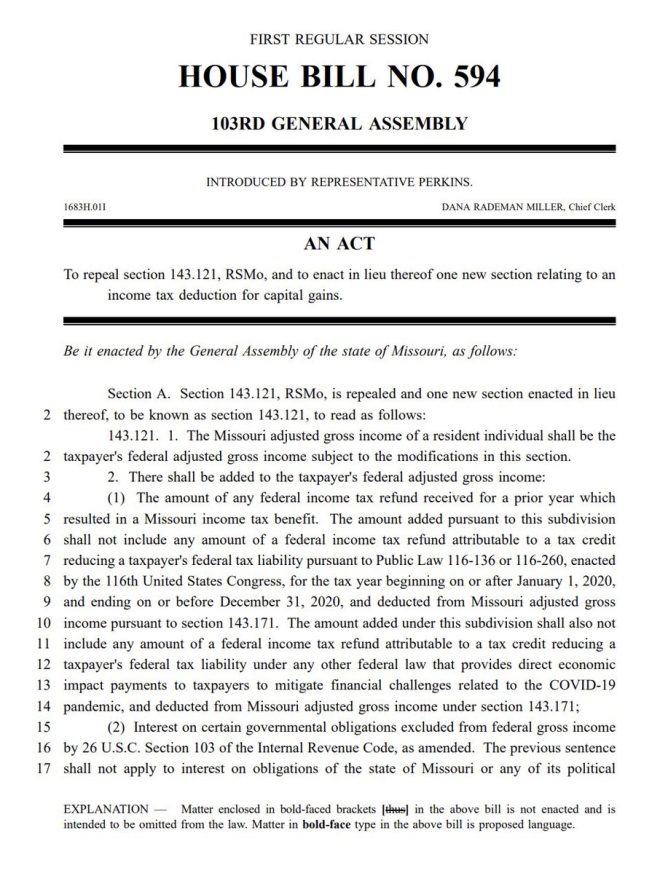

In a groundbreaking decision that is set to change the landscape of investment in the United States, Missouri has officially removed the capital gains tax on Bitcoin (BTC), XRP, stocks, and even real estate. This unprecedented move positions Missouri as the first state in the U.S. to eliminate capital gains taxes on such assets, creating a ripple effect that could influence other states to follow suit. The implications of this policy shift are profound, affecting investors, businesses, and the overall economy.

Understanding Capital Gains Tax

Capital gains tax is a levy on the profit made from the sale of an asset. In most states, this tax applies to various types of investments, including stocks, real estate, and cryptocurrencies. Traditionally, capital gains tax has been a significant consideration for investors when deciding when to sell their assets, as it reduces the overall profit from any investment. By eliminating this tax, Missouri aims to encourage investment, stimulate economic growth, and attract new businesses and residents to the state.

The Impact on Investors

The removal of capital gains tax in Missouri presents a compelling opportunity for investors. Without the burden of taxation on profits from investments, individuals can maximize their returns, making the state an attractive destination for both seasoned and novice investors. This policy change is particularly beneficial for those involved in fast-growing sectors such as cryptocurrency and technology stocks, where price volatility can lead to substantial capital gains.

Boosting the Crypto Market

Cryptocurrencies like Bitcoin and XRP have gained immense popularity in recent years. However, the capital gains tax has often deterred potential investors from entering the market due to concerns about taxation upon selling. With Missouri’s elimination of this tax, the state may see an influx of crypto investors looking to capitalize on the opportunities presented by digital currencies. This could lead to a surge in local crypto-related businesses and innovation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Real Estate Investment Opportunities

The real estate market is another area that stands to benefit significantly from this tax removal. Investors looking to buy and sell properties can now do so without the fear of incurring a hefty tax bill on their capital gains. This change could stimulate the housing market, encouraging more transactions and potentially leading to increased property values in Missouri.

Economic Growth and Job Creation

The decision to eliminate capital gains tax is not just advantageous for investors; it’s also a strategic move to boost Missouri’s economy. By creating a more favorable investment climate, the state is likely to attract new businesses and entrepreneurs, ultimately leading to job creation. As more companies establish themselves in Missouri, the demand for skilled labor will increase, providing more employment opportunities for residents.

Attracting New Residents

Missouri’s progressive tax policy could also make it a more appealing place to live for individuals and families looking to relocate. As people seek out states with lower tax burdens, Missouri’s stance on capital gains tax could draw in new residents, contributing to population growth and a vibrant community. This influx of new residents can further bolster the local economy, leading to increased demand for goods and services.

Potential Challenges and Considerations

While the removal of capital gains tax is seen as a positive step for Missouri, there are potential challenges and considerations to keep in mind. Critics may argue that the loss of tax revenue could impact public services, such as education and infrastructure. It will be essential for state lawmakers to consider how to balance the benefits of attracting investment with the need to fund essential services.

National Implications

Missouri’s bold decision could set a precedent for other states considering similar tax reforms. If the policy proves successful in stimulating economic growth and attracting investment, other states may feel pressured to follow suit to remain competitive. This could lead to a broader national conversation about tax policy and its role in fostering economic development.

Conclusion

Missouri’s removal of capital gains tax on Bitcoin, XRP, stocks, and real estate marks a historic moment in the U.S. investment landscape. By eliminating this tax, the state is positioning itself as a leader in fostering an attractive investment environment, with the potential to boost economic growth, create jobs, and draw in new residents. As investors and businesses alike respond to this policy change, the effects could reverberate far beyond Missouri, influencing tax policies across the nation.

For investors looking for opportunities in a favorable tax environment, Missouri has now become a key player in the evolving economic landscape, signaling a shift toward more progressive tax policies that prioritize growth and innovation.

BREAKING: MISSOURI REMOVES CAPITAL GAINS TAX ON BTC, XRP, STOCKS & REAL ESTATE — FIRST U.S. STATE TO DO IT!

No more capital gains tax on Bitcoin, XRP, stocks — even real estate?!

Missouri just dropped a policy bombshell that could ripple across the U.S. economy — and… pic.twitter.com/uoqv3gQ5fG

— Diana (@InvestWithD) May 9, 2025

BREAKING: MISSOURI REMOVES CAPITAL GAINS TAX ON BTC, XRP, STOCKS & REAL ESTATE — FIRST U.S. STATE TO DO IT!

Big news is hitting the financial world as Missouri makes a groundbreaking move by eliminating the capital gains tax on Bitcoin, XRP, stocks, and even real estate! This historic decision positions Missouri as the first state in the U.S. to take such a bold step, and it could have far-reaching implications for investors and the economy at large. Let’s dive into what this means and why it matters.

No More Capital Gains Tax on Bitcoin, XRP, Stocks — Even Real Estate?!

Imagine a world where your investments in Bitcoin, XRP, stocks, and real estate don’t incur a capital gains tax when you sell them for a profit. Sounds amazing, right? Well, that’s exactly what Missouri is proposing! This policy change means that residents of Missouri will no longer have to pay taxes on the profits they make from selling these assets. It’s a game-changer for investors, making the state an attractive destination for those looking to grow their wealth without the burden of hefty taxes.

Missouri Just Dropped a Policy Bombshell

This move is particularly significant because it signals a shift in how states view cryptocurrency and investment taxes. With the rise of digital currencies like Bitcoin and XRP, many regions are grappling with how to regulate and tax these assets. Missouri’s decision could inspire other states to follow suit, sparking a potential revolution in tax policy across the country.

By removing the capital gains tax, Missouri is not just making it easier for residents to invest; it’s also promoting innovation and attracting new businesses to the area. Investors are often drawn to states with favorable tax policies, and this could lead to an influx of capital and talent into Missouri.

The Economic Ripple Effect

One of the most intriguing aspects of this decision is its potential ripple effect on the broader U.S. economy. When a state takes such a bold stance, it can influence neighboring states and even prompt federal discussions about tax reform. If more states consider eliminating or reducing capital gains taxes, we could see a significant shift in how investments are viewed and taxed nationwide.

Moreover, this move could encourage more people to invest in cryptocurrency and other assets, knowing they won’t be hit with a capital gains tax. This influx of investment could lead to increased market activity, benefiting everyone involved. More trading means more liquidity, and that’s a win-win for investors and businesses alike.

How Does This Impact Investors?

If you’re an investor in Missouri, this change is nothing short of exciting. You can now buy and sell Bitcoin, XRP, stocks, and real estate without worrying about the tax implications eating into your profits. It’s a fantastic incentive for both seasoned investors and those new to the game.

Imagine being able to reinvest your profits without the tax man taking a cut. This could lead to more aggressive investing strategies as individuals feel freer to take risks, knowing that their gains won’t be taxed. It’s an environment that fosters growth and innovation.

The Bigger Picture: Cryptocurrency and Real Estate

This policy change is particularly noteworthy in the context of cryptocurrency. As digital assets continue to gain acceptance and popularity, states that create favorable regulations will likely attract more cryptocurrency enthusiasts and businesses. Missouri is positioning itself as a leader in this space, and it may very well become a hub for blockchain technology and investment.

Real estate investors are also likely to benefit significantly from this policy. With no capital gains tax, property owners can sell their properties without the fear of losing a chunk of their profits to taxes. This could lead to a more dynamic real estate market, with more transactions occurring as investors feel empowered to buy and sell without the tax burden.

The Potential Downside

Of course, no policy change comes without its critics. Some may argue that removing the capital gains tax could lead to an unequal playing field, benefiting wealthy investors while leaving others behind. There’s also the concern that this could impact state revenue. Capital gains taxes contribute to state budgets, and losing this revenue stream may require Missouri to find alternative funding sources.

Additionally, critics may point out that tax incentives can lead to speculative bubbles, particularly in volatile markets like cryptocurrency. As more investors flock to Missouri for its favorable tax treatment, there’s a risk that asset prices could inflate beyond their actual value, leading to potential market corrections down the line.

What’s Next for Missouri?

With this significant policy shift, all eyes will be on Missouri to see how it unfolds. Will other states follow suit? Will we see new businesses and investors flocking to the state to take advantage of these favorable conditions? The answers to these questions could shape the future of investing in the U.S. for years to come.

It’s also worth keeping an eye on how Missouri plans to address the potential revenue shortfall from eliminating the capital gains tax. Will they implement alternative taxes or incentives to balance the budget? As the situation develops, transparency will be key to maintaining public trust and confidence in the state’s financial health.

Conclusion

Missouri has taken a bold step in removing the capital gains tax on Bitcoin, XRP, stocks, and real estate, positioning itself as a potential leader in innovative tax policies. This decision not only benefits investors but could also spark a broader conversation about tax reform across the nation. As we watch how this unfolds, one thing is clear: Missouri is making waves in the world of finance, and the implications could be felt far beyond its borders.

For those interested in the intersection of finance, cryptocurrency, and real estate, Missouri’s move is definitely one to watch. The future looks bright for investors in the Show-Me State, and we can only imagine the opportunities that lie ahead!