Oregon’s Groundbreaking Law on Crypto Collateral for Loans

In a significant move towards integrating cryptocurrency into traditional finance, the state of Oregon has recently enacted legislation allowing individuals to use crypto assets as collateral for loans. This pioneering law marks a pivotal moment in the evolution of lending practices and the broader acceptance of digital currencies in mainstream financial transactions.

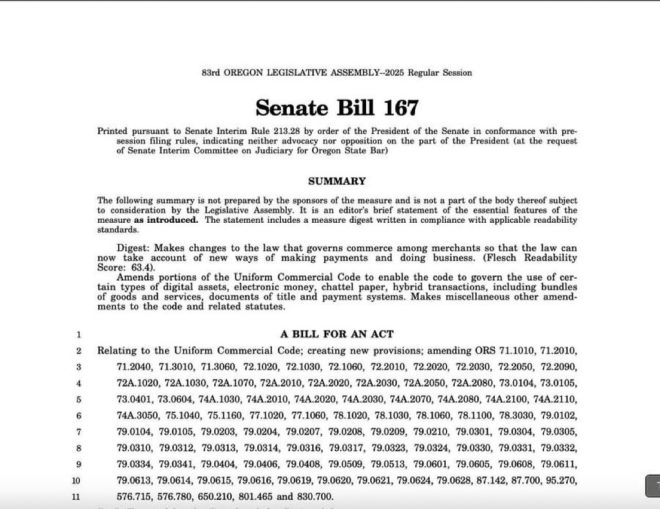

Understanding the New Legislation

The newly passed law enables borrowers to leverage their cryptocurrency holdings when seeking loans. Traditionally, loans have been secured through tangible assets such as real estate or vehicles. However, this legislation recognizes the growing value and liquidity of digital assets, providing a more flexible framework for both lenders and borrowers.

Implications for Borrowers

With the introduction of this law, individuals who own cryptocurrencies can now unlock their value without needing to liquidate their holdings. This is particularly beneficial for those who wish to maintain their investment in a volatile market while still accessing necessary funds. Borrowers can use their crypto assets as collateral, potentially securing lower interest rates compared to unsecured loans.

Benefits for Lenders

For lenders, the ability to accept cryptocurrency as collateral opens up new avenues for risk management and diversification. Digital currencies, although volatile, can also provide higher returns. Lenders can evaluate the value of the crypto collateral, offering loans based on the current market conditions. This innovation can attract a new client base interested in the growing digital economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Broader Impact on the Financial System

Oregon’s law could serve as a blueprint for other states considering similar legislation. As cryptocurrencies continue to gain popularity, regulatory frameworks will need to evolve to accommodate these changes. By embracing crypto collateral, Oregon is positioning itself as a forward-thinking state in the financial landscape, potentially attracting more tech-savvy businesses and individuals.

Challenges and Considerations

While this law offers numerous benefits, it also comes with challenges. One major concern is the volatility of cryptocurrency prices. Lenders will need to implement mechanisms to manage the risk associated with fluctuating values, ensuring that they are adequately protected against potential losses.

Moreover, regulatory considerations will be crucial in establishing guidelines that protect both borrowers and lenders. Clear definitions of what constitutes acceptable collateral, loan-to-value ratios, and default procedures will need to be established to foster a safe lending environment.

The Future of Crypto in Finance

Oregon’s legislative move is a significant step in the ongoing dialogue about the role of cryptocurrencies in the financial system. As more states look to incorporate digital currencies into their economies, we may see a shift in how financial institutions operate. This could lead to more innovative lending solutions that cater to the needs of a growing number of cryptocurrency investors.

Conclusion

The passage of this law in Oregon represents a major milestone in the intersection of cryptocurrency and traditional lending practices. By allowing crypto collateral for loans, the state is not only validating the importance of digital assets but also encouraging a more inclusive financial ecosystem. As the landscape of finance continues to evolve, Oregon’s initiative could inspire similar legislative efforts across the nation, paving the way for a more integrated future where cryptocurrency plays a central role in financial transactions.

As this story develops, it will be essential to monitor how this legislation impacts the lending market in Oregon and beyond, providing valuable insights into the future of crypto in finance.

BREAKING THE STATE OF OREGON JUST PASSED A LAW THAT ALLOWS PEOPLE TO USE CRYPTO COLLATERAL FOR LOANS pic.twitter.com/4JJG8qrWpl

— That Martini Guy ₿ (@MartiniGuyYT) May 8, 2025

BREAKING THE STATE OF OREGON JUST PASSED A LAW THAT ALLOWS PEOPLE TO USE CRYPTO COLLATERAL FOR LOANS

When you think about the world of finance, it’s hard not to notice how rapidly things are changing. Just recently, on May 8, 2025, Oregon made headlines by passing a groundbreaking law that allows individuals to use crypto collateral for loans. This is not just a small tweak in the law; it’s a significant leap toward integrating cryptocurrency into traditional financial systems. If you’re curious about what this means and how it could impact you, keep reading!

Understanding Crypto Collateral

First off, let’s break down what crypto collateral really is. In simple terms, collateral refers to an asset that a borrower offers to a lender to secure a loan. If the borrower fails to repay the loan, the lender can seize the collateral. Traditionally, this has meant using tangible assets like property or vehicles. However, with the rise of cryptocurrencies like Bitcoin and Ethereum, people have started to explore the idea of using these digital currencies as collateral.

By allowing crypto collateral for loans, Oregon is paving the way for more people to access capital, especially those who may not have traditional assets to leverage. This law could democratize lending, making it easier for individuals to get loans without the stringent requirements that banks typically impose.

Why Is This Legislation Important?

The legislation passed in Oregon is significant for several reasons. Firstly, it acknowledges the growing role that cryptocurrencies play in our economy. More people are investing in digital currencies, and many are looking for ways to leverage their investments. By allowing crypto to be used as collateral, Oregon is recognizing that cryptocurrencies are not just speculative assets but can also serve practical purposes in financial transactions.

Moreover, this law could attract tech-savvy entrepreneurs and investors to the state, potentially boosting the local economy. With more people interested in using crypto for loans, Oregon could become a hub for fintech innovation, leading to job creation and increased economic activity.

How Will This Work?

So, how does this actually work in practice? Under the new law, individuals will be able to approach financial institutions and offer their cryptocurrencies as collateral for loans. The specifics will depend on the lender’s criteria, but generally, the process might look something like this:

1. **Valuation**: The lender will assess the value of the cryptocurrency being offered as collateral. This will involve looking at the current market price and may include some risk assessment, as cryptocurrency prices can be volatile.

2. **Loan Terms**: Once the collateral is agreed upon, the lender will outline the terms of the loan. This includes interest rates, repayment schedules, and what happens in the event of default.

3. **Smart Contracts**: Some lenders may utilize smart contracts—self-executing contracts with the terms directly written into code. This could streamline the process and enhance security for both parties.

4. **Collateral Management**: The lender will hold the cryptocurrency in a secure wallet until the loan is repaid. If the borrower fails to repay, the lender can liquidate the collateral to cover the loan amount.

This system could make it easier for borrowers to access funds while minimizing the risk for lenders, as they have a secured asset backing the loan.

Potential Risks and Considerations

While this law opens up exciting new possibilities, it’s essential to understand that using crypto as collateral comes with its own set of risks. The value of cryptocurrencies can fluctuate dramatically, which could pose challenges for both borrowers and lenders.

For instance, if the value of the collateral drops significantly, borrowers may find themselves in a situation where they need to provide additional collateral to maintain their loan agreement. Lenders, on the other hand, must carefully assess the volatility of the crypto assets they accept to minimize their risk.

Moreover, regulatory challenges could arise. As cryptocurrencies are still a relatively new asset class, the legal landscape is constantly evolving. Lenders and borrowers must stay informed about any changes in legislation that could impact their agreements.

Impact on the Financial Landscape

The ability to use crypto as collateral for loans could significantly alter the financial landscape. For one, it could encourage more people to engage with cryptocurrencies, fostering a wider acceptance of digital currencies. This shift could help normalize crypto in everyday transactions and investments.

Additionally, traditional financial institutions may need to adapt their approaches to lending. They might consider developing new products and services tailored to customers who wish to use crypto collateral. This could lead to increased competition in the lending market and better options for consumers.

What This Means for You

If you’re someone who has invested in cryptocurrencies, this new law could open up exciting opportunities for you. Imagine being able to leverage your digital assets to secure loans for business ventures, home purchases, or other investments. It’s a game-changer for many who have been hesitant to pull the trigger on financial commitments due to a lack of traditional collateral.

However, it’s crucial to proceed carefully. Always do your research and consider speaking with financial advisors who understand the implications of using crypto collateral. Make sure you’re fully aware of the risks involved and the terms of any loan agreements you enter into.

Conclusion

Oregon’s groundbreaking legislation allowing the use of crypto collateral for loans marks a significant step in the evolution of finance. By embracing cryptocurrency within traditional lending frameworks, the state is not only acknowledging the growing importance of digital currencies but is also providing a pathway for individuals to access capital in innovative ways.

As the financial landscape continues to evolve, it will be interesting to see how this law influences other states and countries. Will we see a wave of similar legislation in the coming years? Only time will tell. But one thing is clear: the future of finance is looking more digital, and for many, that’s an exciting prospect.

For more information about this new law and its implications, you can check out [Twitter](https://twitter.com/MartiniGuyYT/status/1920419498521223296?ref_src=twsrc%5Etfw) or other reliable financial news sources.