Major Decline in Toronto Condo Resale Prices: An In-Depth Analysis

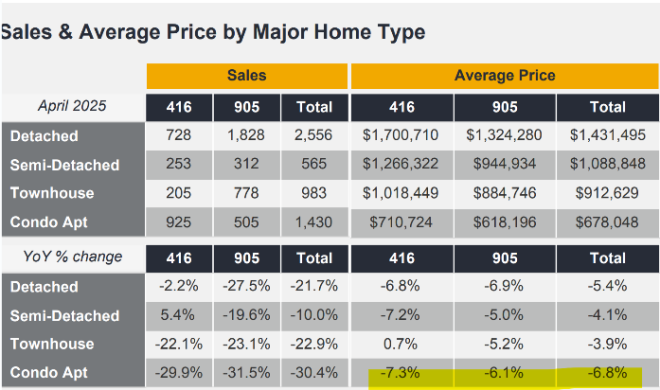

Recent reports from the Toronto Real Estate Association have revealed a significant downturn in the resale prices of condos in Toronto. The data indicates a staggering decline of 7.3% over the past year, a trend that has raised eyebrows among real estate professionals and potential buyers alike. This article explores the implications of this decline, the contributing factors, and what it means for the future of the Toronto housing market.

Understanding the Price Drop

The 7.3% decrease in resale condo prices is a reflection of a broader trend in the Toronto real estate market, characterized by a growing glut of available properties. As more condos flood the market, competition among sellers intensifies, leading to reduced prices. This oversupply, combined with a decrease in demand, has contributed to the current state of the market.

Real estate experts suggest that this decline is not an isolated incident but part of a larger pattern that has been unfolding in recent months. With increasing inventory levels and a slowdown in buyer activity, the market dynamics have shifted dramatically. Potential buyers are becoming more cautious, leading to a decrease in transactions and further exacerbating the price decline.

The Impact of Market Dynamics

One of the most concerning aspects of this price drop is its potential ripple effect on the broader housing market. As resale prices decrease, new condo developments may face challenges in attracting buyers. If resale condos are significantly cheaper, prospective homeowners might opt for these more affordable options rather than investing in new constructions. This trend creates a “death spiral,” where lower resale prices negatively impact new builds, leading to further price declines.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, this situation complicates the financial landscape for developers and investors. Many have invested significant capital into new projects, and a drop in demand could lead to delayed launches, reduced construction, and even cancellations of planned developments. As the market adjusts to these new realities, stakeholders must reevaluate their strategies to navigate the changing landscape.

Factors Contributing to the Price Decline

Several key factors contribute to the current decline in Toronto condo resale prices:

- Increased Inventory: The number of condos available for sale has surged, leading to a buyer’s market where sellers are compelled to lower prices to attract interest.

- Rising Interest Rates: Higher mortgage rates have made financing less affordable for many buyers, reducing their purchasing power and deterring them from entering the market.

- Economic Uncertainty: Broader economic concerns, including inflation and potential job market fluctuations, have made buyers more hesitant to make significant financial commitments, such as purchasing a condo.

- Changing Buyer Preferences: As remote work becomes more prevalent, many buyers are reevaluating their housing needs. There is a growing interest in larger homes or properties in suburban areas, leading to decreased demand for urban condos.

Implications for Buyers and Sellers

For buyers, the current market presents a unique opportunity to capitalize on lower prices. With more options available, buyers can negotiate better deals and find properties that meet their needs without breaking the bank. However, potential buyers should remain cautious, as market conditions can change rapidly.

For sellers, the situation is more challenging. Those looking to sell their condos may need to adjust their expectations regarding pricing and be prepared for a longer selling process. It is crucial for sellers to work with knowledgeable real estate agents who can provide insights into current market trends and help them price their properties competitively.

Future Outlook for the Toronto Condo Market

Looking ahead, the future of the Toronto condo market remains uncertain. While the current decline presents challenges, it may also signal a necessary correction in an overheated market. As prices stabilize, there is potential for renewed interest from buyers who had previously been priced out.

Additionally, if developers can adjust their strategies to meet changing buyer demands, such as focusing on affordable housing or mixed-use developments, they may find opportunities for success even in a challenging environment.

Conclusion

The recent 7.3% drop in Toronto condo resale prices is indicative of a complex interplay of market forces that are reshaping the real estate landscape. While this decline presents challenges for sellers and developers, it also opens up opportunities for buyers seeking affordable housing options. As the market continues to evolve, all stakeholders must remain adaptable and informed to navigate the changing tides effectively.

In summary, understanding the dynamics at play in the Toronto condo market is essential for anyone looking to buy, sell, or invest in real estate. With careful consideration and strategic planning, both buyers and sellers can find paths to success in this fluctuating environment.

MAJOR BREAKING

RESALE TORONTO CONDO PRICES FLUSH DOWN -7.3% FROM 1 YEAR AGO, NEW DATA SHOWS

as major glut continues.

As resale gets cheaper, people will be LESS likely to buy new, continuing the death spiral.

-Data: Toronto Real Estate Association pic.twitter.com/ZuN7gETDdW

— Tablesalt (@Tablesalt13) May 6, 2025

MAJOR BREAKING

In a surprising turn of events in the Toronto real estate market, recent data has shown that resale Toronto condo prices have plummeted by -7.3% from last year. This sharp decline is raising eyebrows and sparking discussions about the future of the housing market in one of Canada’s most vibrant cities. The numbers don’t lie—there’s a significant shift happening, and it’s crucial to understand the implications of this trend.

RESALE TORONTO CONDO PRICES FLUSH DOWN -7.3% FROM 1 YEAR AGO, NEW DATA SHOWS

According to the latest report from the Toronto Real Estate Association, the drop in resale prices is attributed to a major glut in the market. With more condos available than buyers looking to purchase, the dynamics of supply and demand are shifting dramatically. This oversupply has resulted in a competitive environment where sellers have to lower their prices to attract buyers, leading to this significant decrease in resale values.

As Major Glut Continues

The concept of a “major glut” might sound alarming, and it is. When there are too many condos on the market, it signals a mismatch between what developers are building and what buyers actually want. This oversaturation can often lead to a vicious cycle where new developments are also impacted. With resale prices dropping, potential buyers may hesitate to invest in new properties, thinking they can find a better deal in the resale market. This hesitance contributes to what some are calling a “death spiral” for new construction.

As Resale Gets Cheaper, People Will Be LESS Likely to Buy New

This is where the situation gets particularly tricky. If resale prices continue to decline, people might opt for the more affordable options available in the resale market instead of looking at new developments. This behavior could stifle the growth of new projects, which in turn affects jobs, construction, and the overall economy. Developers may find themselves in a position where they have to cut back on new builds, which could lead to fewer options in the long run for buyers.

Continuing the Death Spiral

As the trend of declining resale prices continues, the fear is that we may enter a cycle that’s hard to break. Lower resale prices lead to lower demand for new condos, which results in fewer new builds, and the cycle continues. It’s a situation that can seem overwhelming, but understanding the underlying factors is key to navigating this tricky market.

What Does This Mean for Buyers?

If you’re in the market for a condo in Toronto, this news might actually work in your favor. With prices dropping, now could be a great time to buy if you’re looking for a deal. However, it’s essential to approach this situation with caution. While the potential for a bargain is enticing, it’s also crucial to consider the long-term implications of buying in a declining market.

Considerations for Sellers

For those looking to sell their condos, this news isn’t as promising. With resale prices falling, sellers might need to recalibrate their expectations. Pricing your condo realistically is more important than ever. Overpricing in a declining market can lead to longer selling times and ultimately force price reductions. It’s essential to stay informed about market trends and make strategic decisions based on current data.

The Bigger Picture: Economic Implications

The implications of a declining real estate market extend beyond individual buyers and sellers. The Toronto housing market plays a significant role in the broader Canadian economy. A slowdown in real estate can lead to reduced spending in related sectors, such as home improvements, furnishings, and even local businesses that benefit from a thriving housing market. As the Toronto Real Estate Association points out, the ongoing glut and declining prices could pose risks not just for the housing market, but for the overall economic landscape.

What Can We Expect Moving Forward?

Looking ahead, several factors will influence the Toronto real estate market. Interest rates, economic indicators, and demographic shifts all play a role in shaping market dynamics. It’s essential for both buyers and sellers to stay informed and be adaptable in this ever-changing environment. Keeping an eye on market trends and economic forecasts can help you make informed decisions whether you’re looking to buy, sell, or simply stay in the loop.

Advice for Investors

If you’re an investor in the Toronto real estate market, it’s crucial to stay vigilant. The current market conditions may provide unique opportunities for savvy investors, especially those who can spot undervalued properties. However, it’s equally essential to conduct thorough research and consider the potential risks involved. Understanding the factors driving the market will be key to making sound investment decisions.

Final Thoughts

The recent drop in resale Toronto condo prices by -7.3% is a wakeup call for everyone involved in the real estate market. The ongoing glut signals a need for both buyers and sellers to reassess their strategies. Whether you’re looking to buy, sell, or invest, staying informed and adaptable will be critical in navigating this shifting landscape. The Toronto housing market is in a state of flux, and understanding the nuances of these changes can position you for success in the future.

As we continue to monitor these developments, it’s clear that the Toronto real estate market is at a crossroads. How individuals respond to these changes will shape the market for years to come. So, whether you’re planning your next move or just keeping an eye on the market, remember that knowledge is power. Stay informed, stay engaged, and you’ll be better prepared to navigate whatever comes next in the world of Toronto real estate.