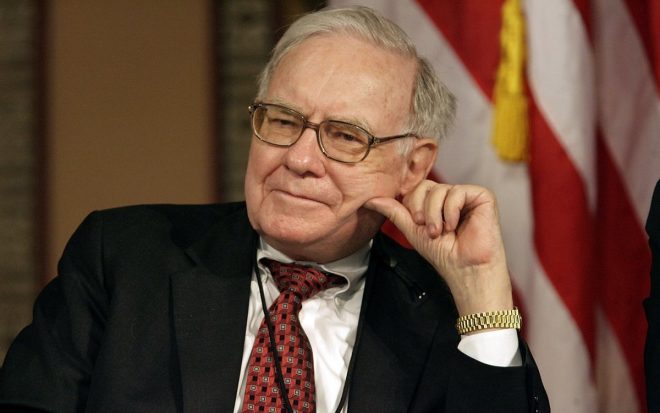

Warren Buffett Advocates for Diversifying Currency Holdings

In a recent statement, renowned investor Warren Buffett suggested that it might be wise for individuals and investors to consider holding a variety of currencies, not just the US Dollar. This statement, shared via Twitter by financial news outlet Watcher.Guru, has sparked discussions among investors and financial analysts alike.

The Context of Buffett’s Statement

Warren Buffett, often referred to as the "Oracle of Omaha," is known for his long-term investment strategies and insights into the financial markets. His latest commentary comes at a time when the global economy is facing various challenges, including inflationary pressures, currency fluctuations, and geopolitical tensions. Investors are increasingly looking for ways to protect their assets and ensure financial stability.

Buffett’s advice to diversify currency holdings suggests a shift in perspective regarding the reliance on the US Dollar, which has traditionally been viewed as a safe haven currency. His recommendation highlights the importance of adapting investment strategies in response to changing economic conditions.

Why Consider Other Currencies?

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Economic Uncertainty: The global economy is currently experiencing fluctuations due to various factors, including supply chain disruptions, ongoing trade tensions, and the impacts of the COVID-19 pandemic. As these factors continue to create uncertainty, relying solely on the US Dollar may expose investors to higher risks.

- Inflationary Pressures: With rising inflation rates being reported in many countries, the purchasing power of the US Dollar may diminish over time. Holding other currencies can provide a hedge against inflation and help preserve wealth.

- Globalization: As the world becomes increasingly interconnected, businesses and investors are engaging with markets beyond their home countries. Diversifying currency holdings allows individuals to tap into opportunities in emerging markets and other economies.

- Interest Rates and Monetary Policy: Central banks around the world are implementing varying monetary policies that affect currency values. By diversifying currency holdings, investors can benefit from interest rate differentials and potentially gain from currency appreciation.

Strategies for Currency Diversification

Investors interested in diversifying their currency holdings can consider several strategies:

- Foreign Currency Accounts: Opening accounts denominated in foreign currencies allows individuals to hold and transact in those currencies directly.

- Currency ETFs: Exchange-Traded Funds (ETFs) that focus on foreign currencies can easily provide exposure to a basket of currencies without the need for direct currency trading.

- Forex Trading: For more experienced investors, participating in the foreign exchange (Forex) market can offer opportunities to profit from currency fluctuations.

- Global Investments: Investing in international stocks and bonds can also provide indirect exposure to foreign currencies while diversifying an investment portfolio.

The Implications of Buffett’s Advice

Buffett’s suggestion to own a variety of currencies resonates with a growing trend of investors seeking to protect their assets against volatility in the financial markets. By embracing a diversified currency strategy, individuals can potentially reduce risk and enhance their overall investment performance.

Furthermore, Buffett’s endorsement of this approach emphasizes the importance of adaptability in investment strategies. As economic landscapes evolve, investors must remain vigilant and responsive to changes that could impact their financial well-being.

Conclusion

Warren Buffett’s recent statement urging investors to consider diversifying their currency holdings beyond the US Dollar is a timely reminder of the importance of strategic investment planning. In an era marked by economic uncertainty and changing global dynamics, diversifying currency assets can serve as a prudent risk management strategy.

Investors should take Buffett’s advice into account as they navigate the complexities of the financial landscape. By exploring opportunities in various currencies, individuals can enhance their portfolios, mitigate risks, and position themselves for long-term success.

Additional Considerations

While diversifying currency holdings may provide several benefits, investors should also be aware of the potential challenges and risks associated with currency investments. Currency markets can be volatile, and fluctuations can occur rapidly based on various factors, including geopolitical events and economic data.

It is essential for investors to conduct thorough research, stay informed about global economic trends, and consider consulting with a financial advisor before making significant changes to their investment strategies. By doing so, investors can make informed decisions that align with their financial goals and risk tolerance.

In summary, Warren Buffett’s insights on currency diversification serve as a valuable reminder for investors to stay adaptive and proactive in managing their portfolios. By exploring opportunities beyond the US Dollar, individuals can better navigate the complexities of the global economy and enhance their financial security.

JUST IN: Warren Buffett says it might be a good idea “to own a lot of other currencies” besides the US Dollar. pic.twitter.com/BSYvRRYTOy

— Watcher.Guru (@WatcherGuru) May 3, 2025

JUST IN: Warren Buffett Says It Might Be a Good Idea “to Own a Lot of Other Currencies” Besides the US Dollar

If you’ve been following the financial news lately, you might have come across an intriguing statement from renowned investor Warren Buffett. He recently suggested that it could be wise to diversify and hold a variety of currencies beyond just the US Dollar. This perspective has sparked discussions among investors and financial analysts alike, prompting many to wonder about the implications of such a strategy. Let’s dive deeper into what this means and why you might want to consider diversifying your currency holdings.

Understanding Warren Buffett’s Perspective

Warren Buffett, often referred to as the “Oracle of Omaha,” has built his reputation on a foundation of sound investment principles and a deep understanding of market dynamics. When he speaks, the financial world listens. His recent comments about owning multiple currencies highlight a growing concern over the stability and long-term value of the US Dollar, especially in an increasingly globalized economy.

Buffett’s suggestion to diversify currency holdings isn’t just a random thought; it’s rooted in the reality that economic conditions fluctuate. For instance, geopolitical tensions, inflation rates, and trade balances can all impact the strength of a currency. By diversifying, investors can mitigate risks associated with currency fluctuations.

Why Diversify Your Currency Holdings?

So, why would someone consider holding other currencies? Here are a few compelling reasons:

1. **Protection Against Inflation**: With inflation rates rising in various parts of the world, holding assets in multiple currencies can act as a hedge against devaluation. If the US Dollar weakens, having investments in stronger currencies can help maintain your purchasing power.

2. **Global Investment Opportunities**: Different economies are performing at different levels. For instance, some emerging markets may be experiencing growth that outpaces that of the US. By holding currencies from these regions, you can take advantage of growth potentials that may not be available domestically.

3. **Risk Management**: Diversifying your currency portfolio can reduce overall risk. If one currency depreciates, others may appreciate, balancing out potential losses.

4. **Access to Better Opportunities**: In an interconnected world, many investment opportunities require transactions in foreign currencies. Holding various currencies can make it easier to seize these opportunities without incurring significant exchange fees.

Potential Currencies to Consider

If you’re thinking about diversifying your currency holdings, it’s essential to know which currencies might be worth considering. Here are a few to get you started:

– **Euro (EUR)**: As the second most traded currency in the world, the Euro represents a large economic bloc. Its stability makes it a popular choice for investors.

– **Swiss Franc (CHF)**: Known for its stability, the Swiss Franc is often viewed as a ‘safe haven’ currency, particularly during times of economic uncertainty.

– **Japanese Yen (JPY)**: The Yen is another stable currency that can be beneficial in a diversified currency portfolio, especially in times of global economic turbulence.

– **Chinese Yuan (CNY)**: As China’s economy continues to grow, the Yuan may present unique opportunities for investment, especially considering China’s significant role in global trade.

– **Canadian Dollar (CAD)**: With Canada’s strong natural resource sector, the Canadian Dollar can be a good option, particularly for investors looking to hedge against US Dollar fluctuations.

How to Start Diversifying Your Currency Holdings

If you’re convinced that diversifying your currency holdings is the way to go, here’s how you can start:

1. **Research and Education**: Before making any moves, it’s crucial to educate yourself about the currencies you’re interested in. Understand the economic drivers behind them and the geopolitical factors that might affect their value.

2. **Open a Multi-Currency Account**: Many banks and financial institutions offer multi-currency accounts. These accounts allow you to hold and manage multiple currencies seamlessly, making it easier to transact or invest.

3. **Currency ETFs**: Exchange-Traded Funds (ETFs) focused on foreign currencies can be an excellent way to gain exposure without the hassle of managing multiple currency accounts.

4. **Forex Trading**: For those with a bit more experience, engaging in Forex trading can allow for direct investment in various currencies. However, it’s essential to understand the risks involved, as currency trading can be highly volatile.

5. **Consult with a Financial Advisor**: If you’re unsure about how to proceed, talking to a financial advisor can provide personalized guidance based on your financial goals and risk tolerance.

Challenges of Currency Diversification

While diversifying your currency holdings can provide numerous benefits, there are certainly challenges to consider:

– **Exchange Rate Risk**: Currency values can fluctuate dramatically, and these changes can significantly impact your overall investment returns.

– **Economic and Political Risks**: Different currencies are affected by various economic and political factors. For instance, political instability in a country can lead to a sharp decline in its currency value.

– **Transaction Costs**: Converting currencies can incur fees, which can eat into your profits. It’s essential to factor in these costs when considering currency diversification.

The Future of Currency Diversification

As the global economy continues to evolve, the importance of currency diversification is likely to grow. With technological advancements and the rise of digital currencies, the landscape is changing rapidly. Investors who stay informed and adapt their strategies accordingly can potentially reap significant rewards.

Warren Buffett’s recent commentary on the benefits of owning diverse currencies serves as a reminder that even the most established investors are re-evaluating traditional strategies. The world of finance is ever-changing, and being proactive about your investment approach can make a substantial difference in your financial journey.

In Conclusion

While the idea of diversifying your currency holdings may seem daunting at first, it’s an approach that could yield considerable benefits. Whether you’re looking to hedge against inflation, explore global investment opportunities, or simply manage risk more effectively, considering multiple currencies can be a smart move.

As you navigate this path, remember to stay informed, consult with professionals when needed, and continuously evaluate your strategy. After all, in the world of investing, knowledge is power. So, why not embrace the wisdom of Buffett and explore the world of currency diversification today?

If you want to read more about Warren Buffett’s insights, check out the full tweet from [Watcher.Guru](https://twitter.com/WatcherGuru/status/1918706893012267150?ref_src=twsrc%5Etfw).