Arizona Governor Vetoes Bitcoin Reserve Legislation: An Analysis

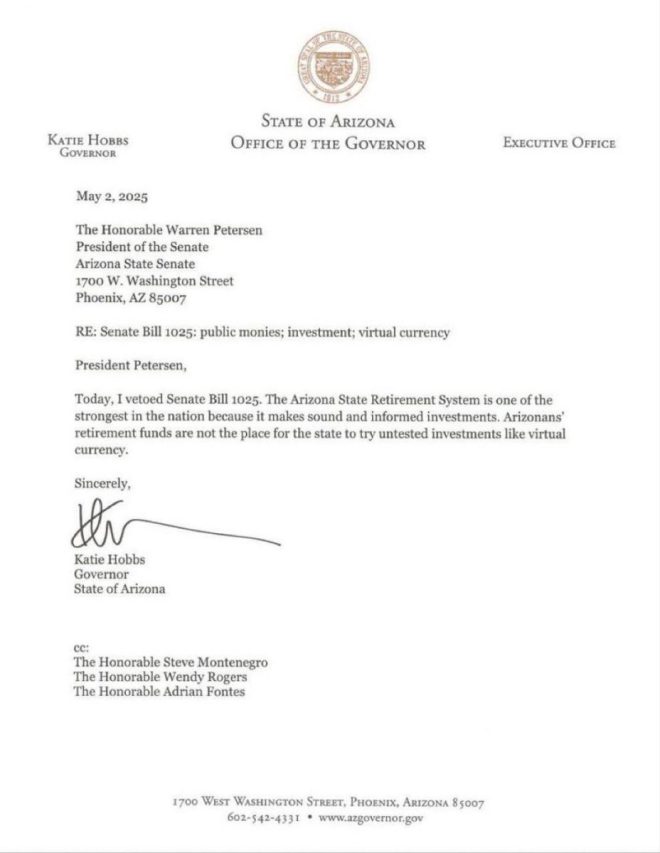

In a significant political move, the Governor of Arizona has vetoed a proposed legislation that sought to create a strategic Bitcoin reserve for the state. This decision has drawn attention from various stakeholders, including cryptocurrency enthusiasts and economic analysts, who are keenly observing the implications of such a policy. The Governor’s stance was framed around the notion of Bitcoin being an "untested investment," signaling concerns about the viability and stability of cryptocurrency as a state asset.

Understanding the Proposal

The legislation aimed to establish a Bitcoin reserve that would allow the state of Arizona to invest in the burgeoning digital currency market. Proponents believed that such a reserve could provide financial benefits and potentially bolster the state’s economy. By holding Bitcoin, Arizona could have positioned itself as a leader in cryptocurrency adoption, potentially attracting tech companies and innovators looking to relocate to a crypto-friendly environment.

The Rationale Behind the Veto

Governor’s veto reflects a cautious approach towards emerging technologies and investment strategies. By labeling Bitcoin as an "untested investment," the Governor is highlighting the inherent risks associated with cryptocurrency, which is known for its volatility and unpredictability. This caution is particularly relevant for state finances, which rely on stability and predictability to ensure public services and infrastructure funding.

Implications for Arizona’s Economy

The rejection of the Bitcoin reserve initiative raises questions about Arizona’s competitive edge in the rapidly evolving digital economy. As other states and countries embrace blockchain technologies and cryptocurrency, Arizona risks falling behind in attracting innovative businesses and investment opportunities. The decision might stifle potential growth in the tech sector, which is increasingly leaning towards digital currencies and assets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Cryptocurrency Landscape

Cryptocurrencies like Bitcoin have gained popularity over the past decade, with many investors viewing them as a hedge against inflation and economic instability. However, the lack of regulatory frameworks and the speculative nature of cryptocurrency investments have made many cautious about embracing it as a legitimate financial instrument. The Governor’s decision can be seen as a reflection of a broader skepticism regarding cryptocurrency at the governmental level.

Reactions from the Community

The announcement of the veto has sparked a wave of reactions from the cryptocurrency community and economic commentators. Many advocates for digital currencies have expressed disappointment, arguing that the state is missing an opportunity to innovate and lead in the financial technology sector. In contrast, critics of the legislation have lauded the veto as a responsible decision that protects the state’s financial integrity.

Future Outlook for Cryptocurrency in Arizona

Despite the setback, the conversation around cryptocurrency and blockchain technology is far from over in Arizona. As public interest in digital currencies continues to grow, there may be future opportunities to revisit this legislation or propose new initiatives that address the concerns raised by the Governor. Stakeholders are encouraged to engage in dialogue to explore how Arizona can safely and effectively incorporate cryptocurrency into its economic strategy.

Conclusion

The veto of the Bitcoin reserve legislation in Arizona reflects a complex interplay between innovation, risk management, and regulatory oversight. While the Governor’s decision prioritizes caution over potential financial rewards, it also highlights the challenges that policymakers face in navigating the rapidly evolving landscape of digital currencies. As conversations continue, the future of cryptocurrency in Arizona remains an intriguing topic for both advocates and skeptics alike.

Call to Action

For those interested in the ongoing developments in Arizona’s cryptocurrency policies, it is crucial to stay informed and engaged. Following updates from state officials, participating in community discussions, and advocating for responsible innovation can contribute to shaping a more favorable environment for cryptocurrency in the state.

BREAKING: The Governor of Arizona has vetoed legislation that would have established a strategic Bitcoin reserve for the state.

Claiming “untested investment”

We got work to do @samuelarmes pic.twitter.com/rWoDhcOqux

— Joshua Jake (@itzjoshuajake) May 3, 2025

BREAKING: The Governor of Arizona has vetoed legislation that would have established a strategic Bitcoin reserve for the state.

In a significant move that has captured the attention of cryptocurrency enthusiasts and investors alike, the Governor of Arizona has vetoed legislation aimed at creating a strategic Bitcoin reserve for the state. This decision has sparked conversations about the future of digital currencies and their potential role in state governance. The Governor’s reasoning? He referred to Bitcoin as an “untested investment.” This phrase alone raises questions about the perceived stability and reliability of cryptocurrencies in the eyes of government officials.

Claiming “untested investment”

The term “untested investment” suggests a level of skepticism surrounding Bitcoin and cryptocurrencies in general. Many investors might argue that Bitcoin has proven its resilience over the years, but for lawmakers, the volatility of the cryptocurrency market can be intimidating. The Governor’s decision reflects a cautious approach, prioritizing the state’s financial stability over the potential benefits of incorporating Bitcoin into its reserves. This stance invites a broader discussion about the balance between innovation and prudence in financial management.

We got work to do @samuelarmes

The tweet from Joshua Jake highlights a collaborative spirit among advocates for cryptocurrency in Arizona. With the veto in place, it’s clear that supporters of the Bitcoin reserve will need to rally together and push for further discussions and potential revisions of the legislation. This situation could serve as a catalyst for more in-depth conversations about the viability of Bitcoin as a state asset. Advocates might need to educate lawmakers about the benefits and risks associated with Bitcoin, perhaps even sharing success stories from other regions that have embraced cryptocurrency.

The Implications of the Veto

The veto has significant implications for Arizona, especially for those who believe in the transformative potential of blockchain technology and cryptocurrencies. Establishing a strategic Bitcoin reserve could have positioned Arizona as a forward-thinking state, attracting tech-savvy businesses and investors. However, the veto sends a clear message: the state is currently not ready to take that leap. This reluctance may hinder Arizona’s ability to compete with other states that are more open to adopting cryptocurrency-friendly policies.

Understanding Bitcoin and Its Potential

For those who might not be familiar, Bitcoin is a decentralized digital currency that operates on a technology called blockchain. Unlike traditional currencies, Bitcoin is not controlled by a central authority, which is one of its major selling points. Supporters argue that Bitcoin can provide a hedge against inflation and offer diversification for state reserves. However, its volatility and the lack of regulatory framework can make it a risky endeavor for governments to engage with.

The Future of Cryptocurrency in Arizona

The veto raises questions about what the future holds for cryptocurrency legislation in Arizona. With the skepticism displayed by the Governor, it’s likely that any future proposals will face intense scrutiny. Nevertheless, this could also be an opportunity for advocates to refine their strategies and present a more compelling case for the adoption of cryptocurrencies at the state level. Engaging with the public to raise awareness about the benefits of Bitcoin could also play a crucial role in shifting perceptions.

Lessons from Other States

Looking at other states that have embraced cryptocurrency can provide valuable lessons for Arizona. For example, Wyoming has made significant strides in creating a favorable regulatory environment for blockchain and cryptocurrency businesses. Their proactive approach has attracted numerous companies to set up shop in the state, showcasing the economic benefits of supporting this new frontier. Arizona might consider studying these examples to formulate a more informed approach to cryptocurrency legislation.

Engaging the Community

Engagement with the community will be crucial as advocates push for a reconsideration of the veto. Hosting forums, educational seminars, and community discussions can help demystify Bitcoin and cryptocurrency as a whole. By fostering an informed public discourse, supporters can empower citizens to advocate for change, thereby creating a grassroots movement that policymakers cannot ignore.

The Role of Education in Cryptocurrency Adoption

Education is a fundamental component in the conversation about cryptocurrency. Many individuals still harbor misconceptions about Bitcoin and digital currencies. Offering workshops or partnering with local universities to create educational programs could significantly enhance understanding and acceptance of cryptocurrencies. By equipping citizens with knowledge, advocates can encourage a more informed electorate that understands the potential benefits and risks associated with Bitcoin investment.

Potential Economic Benefits of a Bitcoin Reserve

The potential economic benefits of establishing a Bitcoin reserve are worth considering. In a world where traditional investments may yield lower returns, Bitcoin has shown the potential for substantial growth. A strategic reserve could provide Arizona with a unique financial asset that could appreciate over time. Additionally, the ability to engage in innovative financial practices could attract new businesses and investment opportunities to the state, fostering growth and job creation.

Understanding the Risks

While the potential benefits are enticing, it’s essential to recognize the risks associated with Bitcoin as well. The Governor’s concerns about it being an “untested investment” are not unfounded. The cryptocurrency market is known for its volatility, and prices can fluctuate dramatically in a short period. Any legislation surrounding Bitcoin must consider these risks and include provisions for mitigating potential losses.

The Importance of Regulatory Framework

Establishing a regulatory framework is crucial for any state considering the adoption of Bitcoin. Clear regulations can help protect investors and provide guidelines for how public funds can be managed in a cryptocurrency reserve. This framework would not only build confidence among lawmakers but also encourage responsible investment practices among individuals and businesses.

Advocacy and the Path Forward

Advocacy will play a key role in shaping the future of Bitcoin in Arizona. Supporters must come together to address the concerns raised by the Governor and present a unified front in favor of cryptocurrency adoption. Collaborating with financial experts, tech innovators, and community leaders can strengthen the case for establishing a Bitcoin reserve. By showcasing real-world applications and benefits, advocates can shift the narrative surrounding cryptocurrency from one of skepticism to one of opportunity.

Conclusion: The Road Ahead

While the veto of legislation to establish a strategic Bitcoin reserve is a setback, it also presents an opportunity for growth and dialogue. Arizona’s journey into the world of cryptocurrency is just beginning, and with continued advocacy, education, and community engagement, there’s potential for change. As we navigate this evolving landscape, it’s crucial to keep the conversation alive and work towards a future where Bitcoin and other cryptocurrencies can coexist with traditional financial systems.