Bitcoin Market Cap Dominance Hits New High: A 4-Year Milestone

The latest update from Bitcoin Magazine highlights a significant development in the cryptocurrency market: Bitcoin’s market cap dominance has reached a new four-year high. This milestone emphasizes Bitcoin’s position as the undisputed leader in the crypto space, reinforcing the notion that there is currently no close competitor. This summary will explore the implications of Bitcoin’s dominance, the factors contributing to its rise, and the overall impact on the cryptocurrency market.

Understanding Bitcoin Market Cap Dominance

Market cap dominance refers to the percentage of the total cryptocurrency market capitalization that is attributed to Bitcoin. A higher market cap dominance indicates that Bitcoin holds a more substantial portion of the market compared to other cryptocurrencies. This metric is crucial as it reflects investor confidence in Bitcoin relative to altcoins and is often used to gauge the health of the cryptocurrency ecosystem.

The Significance of the New High

Reaching a new four-year high in market cap dominance is a remarkable achievement for Bitcoin. This milestone signifies a growing trust and reliance on Bitcoin, especially amidst the volatility often observed in the cryptocurrency market. As the original and most well-known cryptocurrency, Bitcoin’s dominance serves as a barometer for the overall sentiment in the crypto space.

The phrase "There is no second best" encapsulates the current sentiment in the market, suggesting that while many altcoins exist, none can match Bitcoin’s established reputation and market position. This dominance has critical implications for investors and the future of cryptocurrencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Contributing to Bitcoin’s Dominance

Several factors have contributed to Bitcoin’s increased market cap dominance:

- Institutional Adoption: Over the past few years, there has been a notable increase in institutional investment in Bitcoin. Corporations and investment firms have begun to recognize Bitcoin as a legitimate asset class, leading to significant capital inflows. This trend has bolstered Bitcoin’s price and market cap dominance.

- Limited Supply: Bitcoin’s supply is capped at 21 million coins, a feature that creates scarcity. As demand increases, so does its value, further solidifying its dominance in the market. This limited supply contrasts with many altcoins, which often have inflationary models.

- Network Security: Bitcoin’s robust security infrastructure, derived from its proof-of-work mechanism, has made it a reliable choice for investors. The extensive amount of computational power dedicated to Bitcoin mining provides a level of security that many altcoins cannot match.

- Market Sentiment: Bitcoin often acts as a bellwether for the cryptocurrency market. When Bitcoin’s price rises, it typically leads to positive sentiment across the market, driving investment into Bitcoin and reinforcing its dominance.

- Technological Developments: Continuous improvements and updates to the Bitcoin protocol, such as the Lightning Network for faster transactions, have enhanced its usability. These advancements make Bitcoin more appealing to both new and seasoned investors.

The Impact on the Cryptocurrency Market

Bitcoin’s dominance has far-reaching implications for the cryptocurrency market:

- Investor Confidence: A rising Bitcoin dominance often instills confidence in investors, leading to increased participation in the market. When Bitcoin performs well, it can create a positive feedback loop that encourages investment in other cryptocurrencies.

- Market Trends: Bitcoin often sets the tone for market trends. When Bitcoin experiences a significant price movement, it typically influences the price trajectories of altcoins. As Bitcoin’s dominance rises, altcoins may experience downward pressure, as investors may prefer the perceived stability of Bitcoin.

- Regulatory Attention: As Bitcoin solidifies its position, it may attract increased regulatory scrutiny. Governments and financial institutions are paying closer attention to Bitcoin and the cryptocurrency market as a whole, leading to potential regulatory developments that could impact the entire ecosystem.

Conclusion

Bitcoin’s achievement of a new four-year high in market cap dominance is a significant indicator of its strength and resilience in the cryptocurrency market. As the leading digital currency, Bitcoin continues to capture the interest of investors, institutions, and the general public alike. The factors driving this dominance, including institutional adoption, limited supply, and robust security, underscore Bitcoin’s enduring appeal.

For investors and enthusiasts, this milestone serves as a reminder of Bitcoin’s unique position in the ever-evolving landscape of cryptocurrencies. As Bitcoin continues to lead the charge, its dominance will likely shape the future of digital assets and influence the strategies of both investors and developers in the space.

As the cryptocurrency market evolves, keeping an eye on Bitcoin’s market cap dominance will be crucial for understanding broader market trends and making informed investment decisions. The landscape remains dynamic, but one thing is clear: Bitcoin’s reign as the king of cryptocurrencies shows no signs of waning. Whether you are a seasoned investor or new to the world of digital assets, recognizing Bitcoin’s pivotal role in the market is essential for navigating the complexities of cryptocurrency investment.

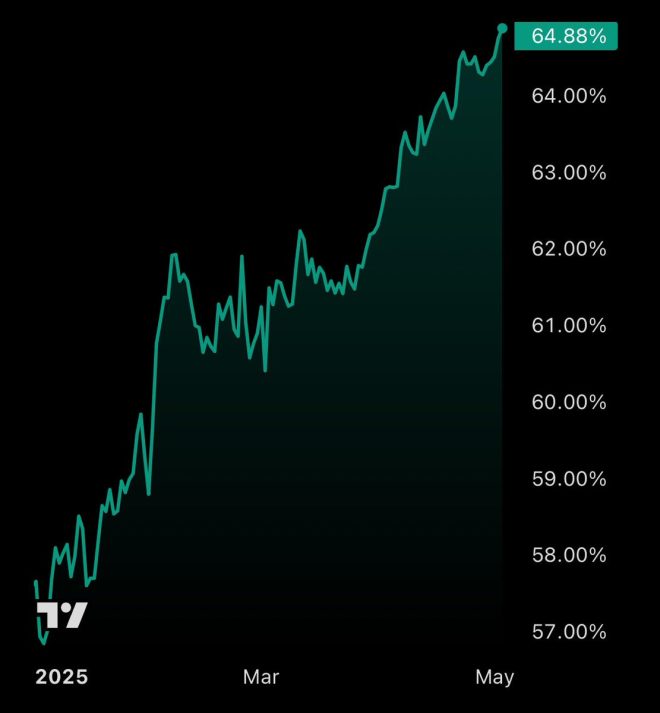

JUST IN: #Bitcoin market cap dominance hits a new 4-year high.

There is no second best pic.twitter.com/DdyJUM0ANg

— Bitcoin Magazine (@BitcoinMagazine) May 2, 2025

JUST IN: #Bitcoin market cap dominance hits a new 4-year high.

Bitcoin continues to dominate the cryptocurrency landscape like a heavyweight champion in the ring. Just recently, we got some exciting news: Bitcoin’s market cap dominance has soared to a new four-year high. This is not just a number; it’s a clear indicator of Bitcoin’s stronghold in the crypto market, showing that it remains the king of cryptocurrencies. As the market evolves and new projects emerge, Bitcoin’s position is like that of a seasoned veteran who refuses to be overshadowed.

What does this dominance mean for investors and casual enthusiasts alike? It’s a sign that Bitcoin is still the go-to option for many, acting as a safe haven in the often turbulent world of crypto. According to a tweet from [Bitcoin Magazine](https://twitter.com/BitcoinMagazine/status/1918255679770394862), the sentiment is clear: “There is no second best.” This statement encapsulates the very essence of Bitcoin’s position in the market.

Understanding Market Cap Dominance

Market cap dominance refers to the percentage of the total cryptocurrency market that is represented by Bitcoin’s market capitalization. A higher dominance percentage indicates that Bitcoin is holding a more significant share of the market compared to other cryptocurrencies. This metric is crucial for gauging Bitcoin’s influence and stability in the ever-changing crypto landscape.

When Bitcoin’s market cap dominance hits a new high, it often indicates a few key things. First, it suggests that Bitcoin is outperforming altcoins (alternative cryptocurrencies) in terms of investment and market confidence. Second, it can be a signal for investors to consider Bitcoin as a more stable investment compared to its more volatile counterparts.

The Implications of High Dominance

So, what does it mean when we see Bitcoin hitting this new four-year high in market cap dominance? There are several implications worth discussing.

1. **Investor Confidence**: When Bitcoin’s dominance increases, it often reflects a solidifying confidence among investors. They are likely seeing Bitcoin as the most reliable cryptocurrency, especially during times of market uncertainty. This could lead to more institutions and individual investors allocating their resources into Bitcoin rather than experimenting with riskier altcoins.

2. **Market Trends**: A rise in dominance can indicate shifting market trends. If Bitcoin is gaining market share, it may suggest that investors are moving away from speculative coins and gravitating toward Bitcoin as a safer bet. This trend can create a domino effect, leading to increased adoption and higher prices for Bitcoin.

3. **Impact on Altcoins**: With Bitcoin’s dominance on the rise, altcoins may experience a downturn. Investors often sell off their altcoin holdings to invest in Bitcoin during bullish trends. This dynamic can create volatility in the altcoin market, making it a challenging environment for those invested in other cryptocurrencies.

4. **Long-Term Viability**: Bitcoin’s long-standing market cap dominance signals its potential for long-term viability. As new technologies and cryptocurrencies emerge, Bitcoin has managed to maintain its position. This endurance is a testament to its foundational technology and the trust it has built over the years.

Bitcoin: The Pioneer of Cryptocurrency

Bitcoin is often referred to as the pioneer of cryptocurrency, and for a good reason. It was the first digital currency to utilize blockchain technology, and its introduction has paved the way for thousands of other cryptocurrencies. Despite the influx of new coins, Bitcoin remains the most recognized and valuable cryptocurrency.

The decentralized nature of Bitcoin, combined with its finite supply of 21 million coins, adds to its allure. Investors view Bitcoin as a digital gold, a store of value that can withstand economic fluctuations. This perception is crucial as Bitcoin continues to attract new users and investors seeking financial independence.

The Role of Media in Bitcoin’s Popularity

The role of media cannot be understated when discussing Bitcoin’s rise in market cap dominance. Platforms like Twitter, where news spreads rapidly, have become vital for the crypto community. Tweets from influential accounts such as [Bitcoin Magazine](https://twitter.com/BitcoinMagazine) help shape public perception and inform investors of market trends.

Social media provides a platform for discussions, debates, and the sharing of insights. This engagement keeps the community informed and engaged, making it easier for newcomers to understand Bitcoin’s significance in the financial world. The more people talk about Bitcoin, the more interest it garners, creating a cycle of growth and engagement.

Analyzing the Current Market Landscape

As of now, the cryptocurrency market is in a fascinating phase. With Bitcoin’s market cap dominance reaching a new high, it’s crucial to analyze the current landscape. The market is still relatively young and subject to rapid changes. New projects are constantly being launched, and regulatory frameworks are evolving.

Investors need to stay informed and consider how Bitcoin’s dominance might influence their investment strategies. For many, Bitcoin represents a safe harbor, while others might choose to diversify their portfolios with altcoins. Understanding market dynamics is essential for making well-informed investment decisions.

Future Predictions for Bitcoin

Looking ahead, what can we expect for Bitcoin? While no one can predict the future with certainty, the current trends suggest that Bitcoin will continue to be a dominant force in the cryptocurrency market. As more institutional investors enter the space and regulatory clarity improves, Bitcoin’s appeal is likely to grow.

Moreover, the ongoing development of Bitcoin’s infrastructure, such as the Lightning Network for faster transactions, will enhance its usability and attractiveness to users. The combination of these factors could solidify Bitcoin’s position even further as the leading cryptocurrency.

In Conclusion

Bitcoin’s recent achievement of a new four-year high in market cap dominance is more than just a statistic; it symbolizes the resilience and strength of the cryptocurrency. As we navigate through the complexities of the crypto world, Bitcoin stands tall, proving that it remains the first choice for many investors.

With growing confidence in Bitcoin and the evolution of the cryptocurrency landscape, there’s no denying that Bitcoin is here to stay. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, keeping an eye on Bitcoin’s journey is essential. It’s a thrilling ride, and who knows what the future holds? Just remember, when it comes to cryptocurrencies, there truly seems to be no second best.