Understanding the Impending Student Loan Crisis: Key Insights

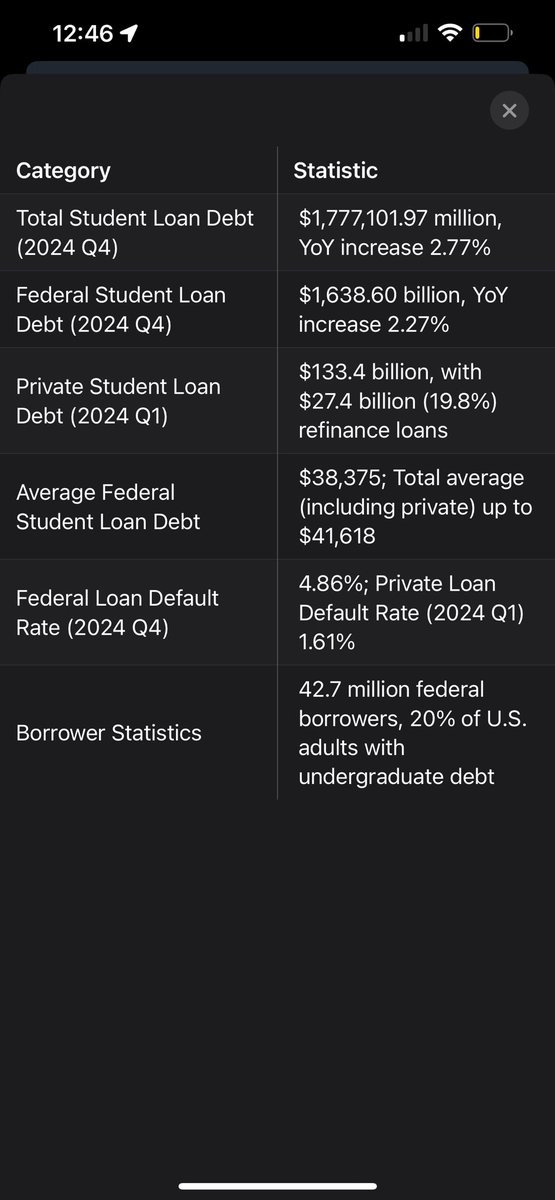

The student loan crisis in the United States is reaching a critical juncture, with alarming statistics indicating that approximately 20% of Americans are currently encumbered by student debt totaling a staggering $1.62 trillion, as reported by the New York Federal Reserve in early 2024. This situation is set against the backdrop of an economy grappling with various challenges, making it imperative for stakeholders to understand the implications of this crisis.

The Burgeoning Student Loan Debt

The student loan bubble has been inflating for years, with rising tuition costs outpacing inflation and wage growth. As education becomes increasingly essential for career advancement, many students are compelled to take on significant debt to finance their degrees. The result is a generation of borrowers struggling under the weight of their loans, leading to broader financial repercussions for both individuals and the economy.

The Statistics Behind the Crisis

The statistics are staggering. Nearly 45 million borrowers owe money on their student loans, a figure that has been steadily increasing. The New York Fed’s 2024 report highlights that 20% of Americans face the burden of this debt, indicating a widespread issue that transcends socioeconomic boundaries. The implications are far-reaching, affecting not only the borrowers themselves but also the housing market, consumer spending, and overall economic growth.

The Impacts on Borrowers

For many borrowers, the burden of student loans leads to delayed milestones such as homeownership, marriage, and starting a family. The financial strain often results in mental health issues, including anxiety and depression, as individuals grapple with their financial futures. Moreover, the inability to repay these loans can lead to default, which can severely damage credit scores and limit future financial opportunities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Government’s Role

The government has a pivotal role in addressing the student loan crisis. Various proposals have been put forth to alleviate the burden on borrowers, ranging from loan forgiveness programs to adjustments in repayment plans. However, the efficacy and feasibility of these initiatives remain hotly debated among policymakers and economists. With the current administration signaling a commitment to reforming student loans, the conversation around potential solutions is more critical than ever.

The Future of Student Loans

As we approach May 5, 2025, the landscape of student loans may be poised for significant changes. Potential reforms could introduce new repayment structures or even widespread loan forgiveness, aimed at alleviating the financial burden on borrowers. However, the effectiveness of these changes will largely depend on their implementation and the broader economic context at that time.

Conclusion: Navigating the Crisis

The impending student loan crisis presents a complex challenge that requires urgent attention. With millions of Americans grappling with significant debt, it is essential for stakeholders, including policymakers, educational institutions, and borrowers themselves, to engage in constructive dialogue and explore viable solutions. As the situation evolves, staying informed and proactive will be crucial for navigating the treacherous waters of student debt.

In summary, the student loan crisis is a multifaceted issue with far-reaching implications for individuals and the economy. Understanding the statistics, impacts, and potential reforms is vital for addressing this crisis effectively. As we move closer to May 2025, the urgency for meaningful solutions becomes increasingly apparent, making it imperative for all involved to come together and seek a path forward.

This is why the student loan bubble is about to burst. I feel bad for this woman—but she freaking nails it.

The student loan crisis is hitting a breaking point—20% of Americans are buried under $1.62T in debt (New York Fed, 2024). Starting May 5, 2025, the… pic.twitter.com/4WZ6ooWuCt

— Purge (@n_y_kickz) April 30, 2025

This is why the student loan bubble is about to burst

If you’ve been keeping an eye on the news lately, you might have noticed a rising tide of concern about the student loan crisis in the United States. The sentiment is palpable; people are frustrated, anxious, and, quite frankly, overwhelmed. The following statement captures this perfectly: “This is why the student loan bubble is about to burst. I feel bad for this woman—but she freaking nails it.” It’s poignant and real, and it reflects the struggles many people face today.

As per the latest data from the New York Fed, around 20% of Americans are currently buried under an astonishing **$1.62 trillion** in student loan debt. That’s a staggering figure, right? The weight of that number is compounded by the stark reality that many are struggling to keep up with their payments. Starting May 5, 2025, the situation might reach a breaking point, and it’s essential to understand what that means for borrowers and the economy as a whole.

The Growing Student Loan Crisis

The student loan crisis isn’t just a buzzword; it’s a phenomenon impacting millions of lives. The narrative often focuses on the individuals—the borrowers—who are trying to navigate their financial futures while dealing with the burden of debt. Many people feel trapped in a cycle where they can’t get ahead because they’re constantly paying off loans that seem never-ending.

The impact of this crisis is felt across various sectors, from housing to consumer spending. When individuals are strapped with high loan repayments, they have less disposable income to spend on goods, services, and even saving for their futures. This creates a knock-on effect that can stifle economic growth.

The Numbers Don’t Lie

Let’s dive into some numbers that really illustrate the gravity of the situation. According to the New York Fed, the total student loan debt has skyrocketed over the last couple of decades. In fact, it has more than tripled since 2005. This rapid increase raises serious questions about the sustainability of the current model of higher education financing.

Moreover, consider this: **20% of Americans** are walking around with student loan debt. That’s one in five people. When you think about the ripple effects of this statistic, it becomes clear that we aren’t just talking about individual hardships; we’re talking about a societal issue that needs urgent attention.

Understanding the Burden of Student Loans

So, what does it feel like to be part of this statistic? Imagine graduating from college, filled with hope and dreams, only to be greeted by a mountain of debt. The reality hits hard. Many graduates find themselves in jobs that don’t pay enough to cover their loan payments, let alone their living expenses. The stress can be overwhelming, leading to mental health issues and a sense of hopelessness.

It’s not just about the numbers; it’s about the human experience. People are sharing their stories on social media, and it’s heartbreaking. They express their fears about never being able to pay off their loans, about delaying major life decisions like buying a house or starting a family due to financial constraints. This is a reality that many are living every day.

What’s Next? The Impending Bubble Burst

With the student loan crisis hitting a breaking point, many experts are starting to sound the alarm. The notion that the student loan bubble is about to burst isn’t just a catchy phrase; it’s a reality that could have far-reaching implications.

The impending bubble burst could result in economic fallout, affecting not just borrowers but also lenders and the broader economy. If individuals start defaulting on their loans en masse, it could create a ripple effect that destabilizes financial institutions and impacts job markets.

Some might argue that this crisis could lead to significant reforms in the education system. As more individuals and families become aware of the burdens of student loans, there might be increased demand for alternative education paths, such as vocational training or online learning platforms.

Possible Solutions to the Crisis

Addressing the student loan crisis requires a multifaceted approach. Here are some potential solutions that could help alleviate the burden:

1. **Reforming Loan Structures**: One of the most significant changes that could occur is a reform of loan structures. This could mean lower interest rates or more flexible repayment plans that align better with borrowers’ income levels.

2. **Increased Transparency**: Educational institutions should provide clearer information about the total cost of education, including potential debt outcomes. This transparency can help future students make informed decisions.

3. **Forgiveness Programs**: Expanding student loan forgiveness programs, particularly for those in public service roles, could provide much-needed relief to borrowers.

4. **Promoting Alternative Education Paths**: Encouraging more students to consider vocational training and other non-traditional education options can help reduce reliance on student loans.

5. **Financial Education**: Providing better financial education in high schools could prepare students for the realities of student loans and budgeting.

The Role of Government and Institutions

The government and educational institutions play a crucial role in addressing the student loan crisis. Policies that prioritize affordability and accessibility to education can fundamentally alter the landscape for future generations.

Moreover, institutions need to recognize their responsibility in ensuring students are not left drowning in debt. They should collaborate with financial experts to create sustainable funding models that do not rely heavily on student loans.

Personal Stories: Voices of the Borrowers

In the midst of the statistics and potential solutions, it’s essential to hear from those directly affected by the student loan crisis. Many borrowers have taken to social media to share their stories, and their experiences are eye-opening.

Some express feelings of shame and guilt about their debt. Others share their struggles to find jobs that pay well enough to make their loan payments. These personal narratives add a human element to the numbers, reminding us that behind every statistic is a real person with dreams and aspirations.

As discussions around student loans continue, it’s crucial to keep these stories in mind. They are a reminder of the urgency of the situation and the need for comprehensive solutions that address the systemic issues at play.

Looking Ahead: The Future of Student Loans

As we move closer to May 5, 2025, the date that many are anxiously anticipating, it’s clear that the conversation about student loans is more important than ever. The student loan crisis is hitting a breaking point, and it’s time for all of us—borrowers, policymakers, and educational institutions—to come together and seek solutions.

This isn’t just about economics; it’s about people’s lives and futures. The weight of student loan debt is something that too many Americans are carrying, and it’s time to address this issue head-on.

The path forward may be challenging, but it’s essential for the well-being of individuals and the economy as a whole. With informed discussions, advocacy for change, and a commitment to finding solutions, we can work toward a future where education is accessible and affordable, free from the crushing weight of student debt.

If you’re feeling overwhelmed by your student loans, remember that you’re not alone. There are resources available, and many are advocating for change. Stay informed, share your story, and let’s work together to create a better future for all.